Car Insurance Market Outlook:

Car Insurance Market size was valued at USD 949.2 million in 2025 and is projected to reach USD 3.51 billion by the end of 2035, rising at a CAGR of 14% during the forecast period, i.e., 2026-2035. In 2026, the industry size of car insurance is estimated at USD 1.08 billion.

The car insurance market is experiencing significant growth with rising road accidents, EV adoption, and increasing consumer awareness. According to the Insurance Information Institute data in February 2025, the annual expenditure on auto insurance was USD 1,127 per policyholder in 2022, with a rise of 6.1% from 2021. The rise is mainly propelled by the increasing claim costs and increasing vehicle repair costs. Further, the inflation and higher car prices, which include the electronic components and repair costs, have contributed to a 17.8% rise in motor vehicle insurance costs in 2024. The industry is further experiencing a technology shift with the adoption of AI and data analytics for the underwriting and rate-setting process.

Consumer Price Index for the Motor Vehicle Insurance

|

Year |

Percentage Change |

|

2015 |

5.4 |

|

2016 |

6.2 |

|

2017 |

7.7 |

|

2018 |

7.4 |

|

2019 |

0.9 |

|

2020 |

-4.6 |

|

2021 |

3.8 |

|

2022 |

7.9 |

|

2023 |

17.4 |

|

2024 |

17.8 |

Source: Insurance Information Institute February 2025

Further, the key trends are redefining the core operation and product structures. The advanced driver assistance systems and electric vehicles are transforming the claim landscape. The Insurance Institute for Highway Safety has highlighted the effectiveness of various car crash avoidance features, with the high cost of regulating these systems post-repair presents a new cost pressure. Moreover, the regulatory priorities, such as the increased examination of pricing algorithms and claims settlement practices, require continuous compliance investment. On the other hand, these factors together drive the focus on digital transformation to enhance risk selection accuracy, claims handling, and manage combined ratios in the competitive ecosystem.

Key Car Insurance Market Insights Summary:

Regional Highlights:

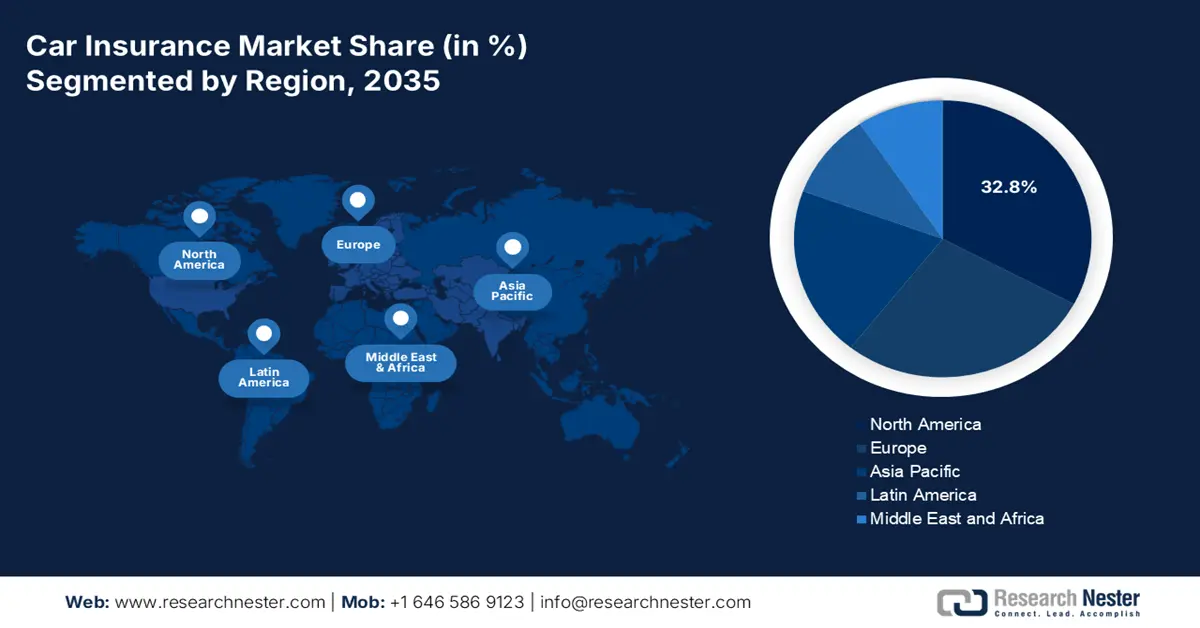

- North America in the car insurance market is expected to secure a 32.8% share by 2035, attributed to elevated vehicle ownership levels, stringent minimum coverage mandates, and rising repair costs that encourage rapid adoption of data-driven insurance models.

- Asia Pacific is projected to expand at a 6.9% CAGR through 2035, propelled by accelerating digitalization, increasing insurance awareness, and the surge of EV adoption alongside usage-based and pay-per-kilometer offerings.

Segment Insights:

- The annual policies segment in the car insurance market is anticipated to command an 88.3% share by 2035, supported by insurers’ enhanced ability to evaluate long-term risk and offer loyalty-linked incentives.

- The passenger vehicles segment is set to remain dominant by 2035, encouraged by expanding private car ownership and compulsory third-party liability norms that sustain recurring policy demand.

Key Growth Trends:

- Regulatory mandates for compulsory coverage

- Rising production of electric vehicles

Major Challenges:

- Data privacy and usage restrictions for telematics

- High frequency of claims and fraud

Key Players: State Farm (USA), Berkshire Hathaway (GEICO) (USA), Progressive (USA), Allstate (USA), Ping An (China), AXA (France), Allianz (Germany), Generali (Italy), Zurich Insurance Group (Switzerland), Aviva (United Kingdom), Tokio Marine (Japan), Sompo Japan (Japan), MS&AD Insurance (Japan), Samsung Fire & Marine (South Korea), DB Insurance (South Korea), ICICI Lombard (India), Bajaj Allianz (India), IAG (Insurance Australia Group) (Australia), Suncorp (Australia), Etiqa (Malaysia)

Global Car Insurance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 949.2 million

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 3.51 billion by 2035

- Growth Forecasts: 14% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Indonesia, Brazil, Mexico, South Korea

Last updated on : 5 November, 2025

Car Insurance Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory mandates for compulsory coverage: Government legislation is the key driver demanding and making the third-party liability a legal prerequisite for vehicle registration and operation in most countries. These create a non-discretionary market, for example, the European Union’s Motor Insurance Directive has ensured a minimum level of civil liability coverage across the states. These regulations guarantee a consistent flow of policies, forming the market’s foundation. Additionally, this demand is directly impacted and maintained by government spending on enforcement and regulatory infrastructure, guaranteeing almost universal penetration among registered car owners.

- Rising production of electric vehicles: The world is on the shift to EVs, which is supported by government subsidies and regulations, creating a new risk landscape. EVs usually have a high purchase price and require costly, specialized parts, mainly batteries, which leads to higher comprehensive and collision premiums. The RMI data in June 2025 depicts that nearly 17 million electric cars were sold in 2024, and 20% of these cars were purchased. This creates a demand for the insurers to make a new actuarial model and coverage option to meet the loss and repair of EVs.

- Demographic and urbanization shifts: The rising population trends drive the driving habits of younger generations, influencing the long-term demand of the car insurance market. The WHO states that the rapid growth of cities is related to the changes in vehicle usage patterns, congestion, and accident types. In some developed markets, generational shifts towards ride-sharing moderate the demand growth. Further, rising vehicle ownership in developing markets is presenting a major growth frontier requiring insurers to adapt products for new customer segments.

Challenges

- Data privacy and usage restrictions for telematics: The adoption of usage-based insurance relies on collecting the data of the driver, which clashes with data privacy laws. Regulators are analyzing the process of data collection, utilization, and storage from telematics devices or smartphone apps. Further, insurers must shift from the complex consent process and ensure data anonymity, increasing compliance costs and technology complexity. This reduces the ability to create highly personalized risk-based premiums, which is key for innovation for new entrants seeking to transform traditional pricing models.

- High frequency of claims and fraud: The World Health Organization report in December 2023 has provided evidence stating that 1.19 million road traffic deaths occur yearly. Moreover, millions of people have non-fatal injuries, each representing a potential insurance claim. This high frequency of claims is coupled with rampant soft fraud, which directly impacts the loss ratio. The National Insurance Crime Bureau in the U.S. reports that fraud costs are in the billions annually. Startups in this industry must invest heavily in advanced claim investigation and anti-fraud technology from the start to remain viable, which is a significant operational challenge.

Car Insurance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14% |

|

Base Year Market Size (2025) |

USD 949.2 million |

|

Forecast Year Market Size (2035) |

USD 3.51 billion |

|

Regional Scope |

|

Car Insurance Market Segmentation:

Policy Duration Segment Analysis

Annual policies dominate the policy duration segment and are likely to capture the share value of 88.3% by 2035. This duration gives insurers the opportunity to access the risk profiles and extend loyalty incentives. For the policyholders, an annual term means manageable payment cycles, opportunities to switch or renegotiate with providers. Further, the growing adoption of insurance is also supported by the digital renewal reminders and auto-renewal feature. In industries such as auto or health insurance, annual policies are mandatory, hence reinforcing the dominance. This structure helps both the customers and insurers by aligning coverage with evolving needs and market conditions.

Vehicle Type Segment Analysis

Passenger vehicles is leading the vehicle type segment and are driven by the rising private car ownership in both developed and developing nations. Strong government mandates for third-party liability insurance for every individual in a car create a non-discretionary and recurring demand. As per the Bureau of Transportation Statistics data, nearly 1,563K passenger cars were sold in 2021, highlighting the rise in car insurance demand. The high adoption of collision coverage on newer and more valuable passenger cars, often required by auto financiers, boosts this segment further.

Application Segment Analysis

Under the application segment, the personal sub-segment dominates the car insurance market and is driven by the rising volume of private passenger vehicles globally. This demand is due to the consumer preference for individual coverage customized to personal assets and liabilities. The surge of the segment is fueled by the awareness of financial protection and the adoption of digital platforms that simplify policy access. Personal insurance products such as health, home, and auto are rising the convenience and cost efficiency. Insurers are using advanced technologies such as AI to customize the offering and enhance customer retention. this indicates the shift from traditional policies to custom-made policies by individuals to control over their insurance decisions and coverage.

Our in-depth analysis of the car insurance market includes the following segments:

|

Segment |

Subsegments |

|

Coverage Type |

|

|

Distribution Channel |

|

|

Vehicle Age |

|

|

Application |

|

|

Vehicle Type |

|

|

Policy Duration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Car Insurance Market - Regional Analysis

North America Market Insights

North America is dominating the car insurance market and is poised to hold a market share of 32.8% by 2035. The market is driven by high vehicle ownership, robust regulatory mandates for minimum coverage, and rising vehicle repair costs. The key trend is the quick adoption of usage-based insurance that uses the data from smartphones and dongles to personalize premiums. Further, these insurers are now actively investing more in AI to streamline claim processing and combat fraud. On the other hand, the rise in EV vehicles is reshaping the risk model and making high repair costs for EVs pressure premiums upwards. This creates new opportunities for the market.

The U.S. care insurance market is dominating the North America market and is characterized by the rapid adoption of telematics and rising road accidents. The CDC data in November 2024 depicts that nearly 120 people are killed every day due to vehicle crashes in 2022. The incorporation of AI-enabled crash detection and real-time driving activity analytics is reshaping underwriting and claims automation. Insurance providers are offering various updated models to support safer driving habits. Further, the rising consumer preference for digitally enabled services and app-based policies boosts the shift towards tech-driven, personalized auto insurance solutions in the U.S. market.

Canada’s car insurance market is defined by the rising motor accident cases and a strong regulatory focus on affordability. Rising accident cases drive the insurance demand, enhancements in safer driving technology, premium adjustments, and claim innovations. According to the Government of Canada data in May 2024, the number of motor vehicle fatalities in 2022 was 1,931, which is a rise of 6.0% from 2021. Moreover, the rise in concerns about road safety is pushing the insurers to invest in digital risk assessment tools and telematics-based policies for real-time monitoring. Further, various factors are affecting the motor vehicle accidents that are accelerating the rise and demand for car insurance market.

Factors Contributing to the Motor Vehicle Fatal Collisions in Canada

|

Contributing Factor |

2018 |

2019 |

2020 |

2021 |

2022 |

|

Distraction |

20.8% |

20.6% |

20.1% |

22.2% |

19.9% |

|

Speed / Driving too Fast |

24.0% |

23.5% |

25.1% |

26.2% |

21.9% |

|

Impaired / Under the Influence |

27.2% |

23.2% |

25.5% |

24.7% |

23.0% |

|

Fatigue |

3.4% |

4.0% |

2.5% |

3.4% |

2.8% |

|

Other Human Factor |

65.3% |

66.4% |

62.4% |

68.3% |

67.0% |

|

Environmental Factor |

23.4% |

22.3% |

20.0% |

21.0% |

21.9% |

|

Vehicle Factor |

3.2% |

4.6% |

4.1% |

3.2% |

3.5% |

|

No Contributing Factors |

24.2% |

25.4% |

22.4% |

28.8% |

25.2% |

Source: Government of Canada, May 2024

APAC Market Insights

Asia Pacific in the car insurance market is expected to witness the fastest growth during the forecast period at a CAGR of 6.9%. The market is propelled by the rapid digitalization and high awareness among consumers of insurance. The primary driver is the rising adoption of the EV vehicles, the launch of usage-based insurance (UBI), and on-demand pay-per-kilometer policies. China and India are driving the market due to the rising road accidents. According to the Asia Pacific Road Safety Observatory data in 2025, nearly 2000 people every day lose their lives due to road crashes. Moreover, supportive government regulations mandating motor insurance and promoting road safety initiatives are accelerating insurance penetration across the region.

China’s car insurance market is the largest in the world and is dominated by the state-backed giant players. The most significant trend is the development of custom insurance products for New Energy Vehicles. The International Council on Clean Transportation article in June 2021 has stated that China is set to put 4.92 million NEVs (New Energy Vehicles) on the road. This highlights the rising adoption of EV vehicles and, on the other hand, surges the demand for insurers to develop specialized policies for EVs, battery coverage, and charging-related risks, and adjust premiums reflecting EV repair costs and driving patterns. Further, the regulatory focus is stabilizing the market, and controlling the claim ratio is a key influence on industry profitability.

The car insurance market is highly dynamic in India and is propelled by the rising middle class and mandatory third-party liability. The main trend is the rapid digitization of the insurance value chain from online policy sales to the use of AI for claims settlement. The Insurance Regulatory and Development Authority of India data in 2022-2023 depicts that the motor segment rises year on year with 15.40% in premiums, accounting for Rs. 81,280 crores in 2022-2023. This data clearly highlights the expansion in the motor or car insurance market, which is driven by higher vehicle sales, rising premiums, and increasing insurance penetration.

Europe Market Insights

Europe car insurance market is characterized by heavy competition and a strong regulatory framework. The growth is mainly driven by the rising sales of new vehicles, including the EVs that require special insurance products due to their huge repair costs and advanced technology. As per the European Insurance and Occupational Pensions Authority data, the motor insurance segment is the largest non-life line of business by premium volume. Europe is actively investing in digital transformation and combat rising claims inflation in the insurance sector. Moreover, key players are approaching strategic initiatives such as mergers and acquisition, for example, AXA in August 2025 announced the acquisition of Prima, which is the leading direct insurance player in Italy with Euro 1.2 billion of premiums in 2024.

Germany’s car insurance market is fueled by the quick adoption of connected and electric vehicles. The country’s strong regulatory framework ensures for a stable market. The German Insurance Association data in January 2024 states that premium motor insurance has risen by 6.7% to EUR 84.5 billion. The claim expenditure increased rapidly by 12.7%. This rise is defined by the threat to the repair cost, and as a result the premiums are expected to grow in this area. The trend towards personalized, telematics-based policies is strong, with insurers leveraging data to accurately price risks associated with new vehicle technologies, which are being adopted faster in Germany than in many other European nations.

The car insurance market in the UK is mature and very competitive, highlighted by the strong regulatory policy focusing on price transparency and customer fairness. The market is fueled by the ensuring a consistent baseline of demand from vehicle owners. Significant developments in the sector, such as rising adoption of telematics and usage-based insurance, are leading to premiums that are more customized and further the adoption of digital tools and data analytics, making claims, improving customer service, and managing risk meet the changes in the industry.

Key Car Insurance Market Players:

- State Farm (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Berkshire Hathaway (GEICO) (USA)

- Progressive (USA)

- Allstate (USA)

- Ping An (China)

- AXA (France)

- Allianz (Germany)

- Generali (Italy)

- Zurich Insurance Group (Switzerland)

- Aviva (United Kingdom)

- Tokio Marine (Japan)

- Sompo Japan (Japan)

- MS&AD Insurance (Japan)

- Samsung Fire & Marine (South Korea)

- DB Insurance (South Korea)

- ICICI Lombard (India)

- Bajaj Allianz (India)

- IAG (Insurance Australia Group) (Australia)

- Suncorp (Australia)

- Etiqa (Malaysia)

- In the car insurance market, State Farm uses its vast network and customer base to promote various strategies. The main advancement is the investment in the Drive Safe and Save program that uses telematics data to monitor the behavior of driving, such as braking, mileage, and speed. This usage-based insurance model allows insurers to offer personalized premiums, rewarding safe drivers with various discounts to boost marketing and sales and customer loyalty via personalization and moving beyond traditional risk models.

- GEICO is a dominant player in the car insurance market and is primarily fueled by its strategic focus on direct-to-consumer sales and massive advertising that ensures low acquisition costs and high brand recognition. A significant advancement is the rollout of its telematic program, GEICO DriveEasy. This app-based technology uses smartphone sensors to track driving habits and provide the necessary feedback. GEICO’s admitted assets as of June 2025 are 85,879,185,174.

- Progressive is the leading car insurance market and has transformed the industry with its Snapshot telematics program. This program is a major advancement in usage-based insurance. By collecting and analyzing the real-time data of driving that is gathered directly from the vehicle, Progressive can accurately and instantly price policies based on the individual behavior rather than the broad demographic factors. The net premium earned by the company during the financial year 2024 was USD 70.8 billion.

- Allstate is the pioneer in the car insurance market and has strategically shifted towards a protection-centric company. The main advancement is the Drivewise program, where the telematics program tracks driving and provides feedback for safety behavior. The data collected by the program not only enables personalized discounts but also feeds into Allstate’s broader analytics to enhance the claims forecasting and risk modeling, hence improving the profitability and customer engagement via proactive safety tools.

- Ping An has redefined its position in the car insurance market via its finance and technology strategy. The advancement is the creation of its proprietary auto ecosystem that integrates insurance with the real-time data from the connected vehicles, smart highways and Goof Driver app. The integration provides a continuous stream of vehicle health data and driving behavior, enabling personalized pricing and proactive risk management, and value-added services such as emergency assistance, data-driven, and creating a seamless experience.

Here is a list of key players operating in the car insurance market:

The global car insurance market is very competitive and is defined by the presence of both specialized non-life insurers and diversified financial conglomerates. Top players of the market are actively pursuing growth via technological innovation and strategic partnerships. For example, Zurich has acquired a 70% stake in Kotak General Insurance to build a general insurer for India. Further, the company is the first foreign insurer to enter India. Consolidation via mergers and acquisitions is significant in the developed markets, while expansion is emerging in developing economies. On the other hand, telematics and AI adoption create a usage-based insurance model that allows for personalized premiums and improved risk assessment.

Corporate Landscape of the Car Insurance Market:

Recent Developments

- In July 2025, Honda launched a new insurance business to provide competitive and convenient insurance options for Acura and Honda customers. Honda Insurance Solutions provides competitive pricing and coverage options for autos, motorcycles, homes, and more.

- In June 2025, Zuno launched India’s first car insurance with built-in crash detection and auto claims trigger. The real-time crash detection capability in the app can sense accidents and automatically alert the insurance team for support and claim processing.

- Report ID: 8221

- Published Date: Nov 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Car Insurance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.