Aerospace Insurance Market Outlook:

Aerospace Insurance Market size was over USD 1.03 billion in 2025 and is projected to reach USD 1.55 billion by 2035, growing at around 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace insurance is assessed at USD 1.07 billion.

The aerospace insurance market is predicted to witness significant growth, on account of various factors such as the increasing number of passengers, who prefer to travel by aircraft, from all over the world. According to a report published by the International Air Transport Association (IATA) in May 2024, over 12.5 million people are transported through 128,000 flights between more than 21,000 distinguished city pairs daily. This is generating plenty of opportunities for global leaders in this sector, depending on the subsidies available in individual operational air transport facilities. Furthermore, the requirement for maintenance of associated airports and aircraft is driving demand for adequate reimbursement and insurance policies.

The future propagation of the market is also attributable to the rapid expansion of the airline industry and increased international activities. As global air connectivity becomes more efficient and accessible, the cash flow in this field is increasingly magnifying. On this note, IATA predicted the amount of global-scale profit generation from the airline industry to be USD 25.7 billion in 2024. It also calculated the air passenger revenue to be valued at USD 642

billion during the same timeline. These figures indicate a lucrative future and great possibilities for this field, attracting more pioneers and financial ventures to invest and participate.

Key Aerospace Insurance Market Insights Summary:

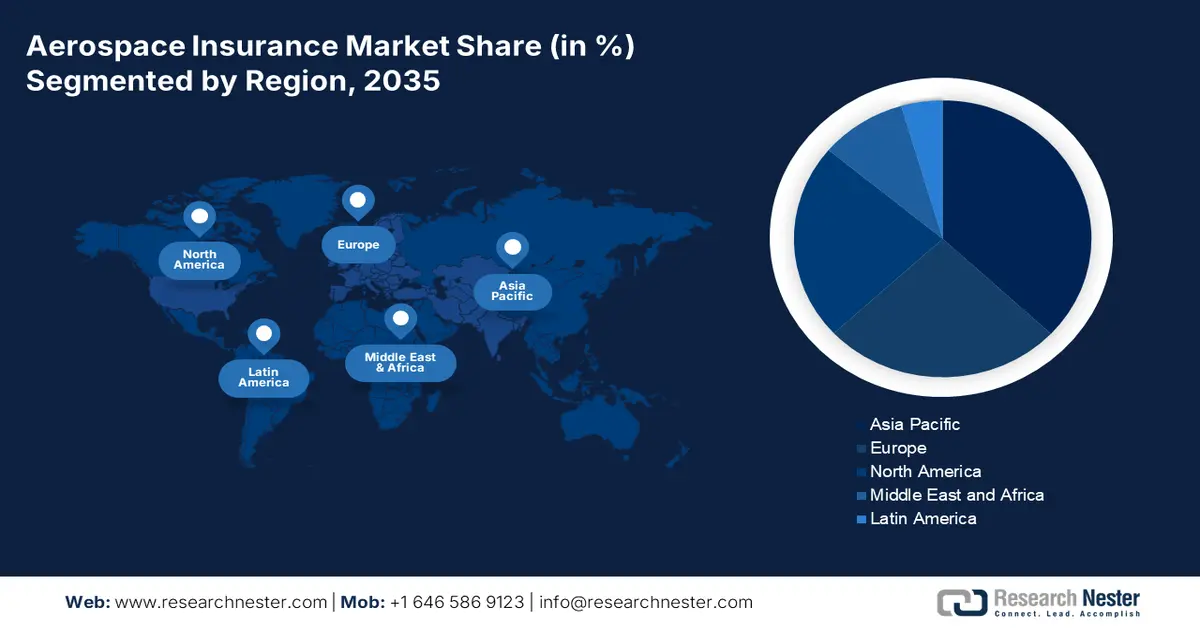

Regional Highlights:

- Asia Pacific aerospace insurance market is poised to capture 37% share by 2035, driven by a rising number of commercial airports, high air passenger traffic growth, and expanding aviation fleets.

- North America market will exhibit notable growth during the forecast timeline, driven by economic stability, industrial globalization, and increasing air passenger traffic.

Segment Insights:

- The airport operators segment in the aerospace insurance market is projected to hold a significant share by 2035, fueled by the rise in commercial airports and tourism-related investments.

- The public liability insurance segment in the aerospace insurance market is projected to hold a significant share by 2035, driven by simplified international reimbursement processes in aviation incidents.

Key Growth Trends:

- Fleet expansion to cope with the passenger traffic

- Accelerated urbanization and air mobility

Major Challenges:

- Systematic, international, and financial volatilities

Key Players: Marsh & McLennan Companies, Inc., American International Group, Inc., Global Aerospace, Inc., Allianz SE, Arthur J Gallagher & Co., Axa SA, Old Republic Aerospace, Inc., Willis Towers Watson PLC, Hallmark Financial Services, Inc., Hiscox Limited, Rokstone Group, Ryanair.

Global Aerospace Insurance Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.03 billion

- 2026 Market Size: USD 1.07 billion

- Projected Market Size: USD 1.55 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, China, France

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 8 September, 2025

Aerospace Insurance Market Growth Drivers and Challenges:

Growth Drivers

- Fleet expansion to cope with the passenger traffic: According to the Civil Aviation Authority, the number of operational aircraft in the world is projected to increase from 28,400 in 2024 to 36,400 by 2035, causing a 28% expansion in commercial aviation fleets. Considering various chances of risk occurrences such as air accidents, natural disasters, and others, a majority of such business fleets are opting for a reliable financial backup availed by the aerospace insurance market. Both of these factors are accumulatively causing inflation in capital influx and extension in the consumer base.

- Accelerated urbanization and air mobility: In June 2024, the United Nations Population Fund reported that over 5 billion people around the globe are expected to live in urban areas by 2030. This implies continuous urban infrastructure development, including air transport. In addition, several private and governing bodies are showing interest in investing in building smart cities, filled with adequate accommodations, which is creating new business opportunities for the aerospace insurance market. Furthermore, the emergence of eVTOLS and drone-based delivery systems in this landscape is constructing lucrative avenues for global leaders in this sector.

Challenges

- Systematic, international, and financial volatilities: The aerospace insurance market is subjected to various limitations such as low levels of awareness and client dissatisfaction, which may develop a disinterest and lack of trust in choosing accommodations for selected air transportation. The insurance claims are processed at a leisurely pace, as they pass through various public departments for getting processed in foreign nations, which often dissuades investors. Furthermore, the worldwide airline sector is becoming surrounded by uncertainty and unpredictability due to several geopolitical and economic disruptions, creating inconsistency in the rate of new subscriptions and registrations from service providers and operators.

Aerospace Insurance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 1.03 billion |

|

Forecast Year Market Size (2035) |

USD 1.55 billion |

|

Regional Scope |

|

Aerospace Insurance Market Segmentation:

End user Segment Analysis

The airport operators segment is anticipated to occupy a significant aerospace insurance market share over the assessed timeline. The rising number of commercial airports across several regions of the world is securing a leading position for this category of consumer base. In addition, the direct association of airport operators with the management and financial output of aircraft makes insurance coverage necessary for them. Particularly, the emergence of countries with higher rates of tourism, such as Malaysia, Thailand, China, Japan, India, Saudi Arabia, and Others, is emphasizing the need for investment in this field.

Insurance Type Segment Analysis

The public liability insurance segment is projected to capture a significant share of the aerospace insurance market by 2035. This sub-type is intended to cover aircraft-caused damage of third-party individuals or entities, such as property, people on the ground, and other aircraft. The complications faced by both parties from different regions or nations during a collision most often become the worst due to the differences in public law enforcement policies. On the other hand, public liability coverage simplifies the whole process of reimbursement and damage compensation, which makes it a priority segment for operators, particularly from international divisions. Additionally, the financial output of such flights is significantly higher than domestic ones, which ensures a greater revenue generation in this segment.

Our in-depth analysis of the global aerospace insurance market includes the following segments:

|

End user |

|

|

Insurance Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Insurance Market Regional Analysis:

APAC Market Insights

The aerospace insurance market in Asia Pacific is anticipated to register the highest share of 37% throughout the discussed timeframe. The heightened number of commercial airports and general accessibility are positioning this region at the forefront of the global landscape. Particularly in emerging economies, such as China and India, are significantly contributing to the region’s leadership. On this note, the Civil Aviation Authority reported that the volume of commercial aviation fleets in India is predicted to enlarge its volume by 2.5 times by 2035, that of 600 planes in 2024. In addition, the air passenger traffic in APAC registered the highest growth of 18.5% among other regions in the world till October 2024 (IATA).

According to IATA, the domestic revenue passenger kilometers (RPK) in China witnessed a year-on-year growth of 17.6% and 35.1% in March and February 2024, respectively. Additionally, rapid urbanization and global business expansion are accumulatively contributing to the country’s enlarging consumer base for the aerospace insurance market. On the other hand, the nation’s economic progress and increasing disposal income are pushing citizens to invest in personal requirements, including traveling and business trips. For instance, the per capita disposable income in China was USD 1,624.5 in 2024, which further increased by 5.5% and accounted for USD 1,688 in 2025 (The State Council Information Office).

North America Market Insights

North America is poised to register a notable pace of growth in the aerospace insurance market by the end of 2035. Economic stability and industrial globalization are a few of the major growth drivers in this landscape. Additionally, the remarkable financial output of this category is making it a priority field of investment. In this regard, the North America Airport Council International revealed that employment & GDP contributions of airports in the U.S. and Canada were 11.5 million & USD 1.4 trillion and 405,000 & USD 25.3 billion in 2024. Additionally, the growing demand for both outbound and inbound passenger traffic is also fueling the region’s proprietorship and attracting global pioneers to participate in this landscape.

In 2022, annual air passenger traffic in the U.S. increased by 89% from 2019, accounting for 937 million, showcasing one of the most significant recoveries from the pandemic situations in the world (ScienceDirect). This, coupled with the overseas business expansion, is resulting in higher traffic in air transportation spread across the country, fueling the aerospace insurance market. The country’s lucrative engagement can also be testified by frequent service upgrades. For instance, in August 2024, Skyward Specialty Insurance Group allied with Acceleration Aviation Underwriters to create comprehensive coverage solutions for every aviation-related business. The coverage includes: commercial and general aviation aircraft, fixed-based operators, flight schools, public and private airports, and other aviation enterprises.

Aerospace Insurance Market Players:

- Marsh & McLennan Companies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American International Group, Inc.

- Global Aerospace, Inc.

- Allianz SE

- Arthur J Gallagher & Co.

- Axa SA

- Old Republic Aerospace, Inc.

- Willis Towers Watson PLC

- Hallmark Financial Services, Inc.

- Hiscox Limited

- Rokstone Group

- Ryanair

Key players in the aerospace insurance market are continuously expanding their territory and field of operation overseas to garner greater revenue. Their efforts to establish a strong network of capital resources and cash inflows are further increasing activity and engagement in this sector. For instance, in December 2024, Redline Underwriting, in collaboration with Allianz Commercial, unveiled its General Aviation Insurance solution for the marketplaces in Latin America and the Caribbean. The new pipeline offers coverage for private, pleasure, and business fixed and rotor wing aircraft, extending the company’s distribution network while addressing the unmet needs of small and medium aircraft operators. Such key players are:

Recent Developments

- In March 2025, Rokstone announced its plans to launch a new mid-market aviation program by April to offer access to Lloyd’s capacity for brokers. This new insurance model is crafted to expand the company’s aviation underwriting capabilities in the U.S., covering hull capacity and liability up to USD 10 million and USD 50 million, respectively.

- In March 2025, Ryanair introduced an annual USD 85 subscription service, prime, for reserved seating, insurance, and access to monthly seat sales. Its pilot phase allowed a maximum of 250,000 memberships, which is expected to generate USD 22.3 million in revenue for the company each year.

- Report ID: 2207

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerospace Insurance Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.