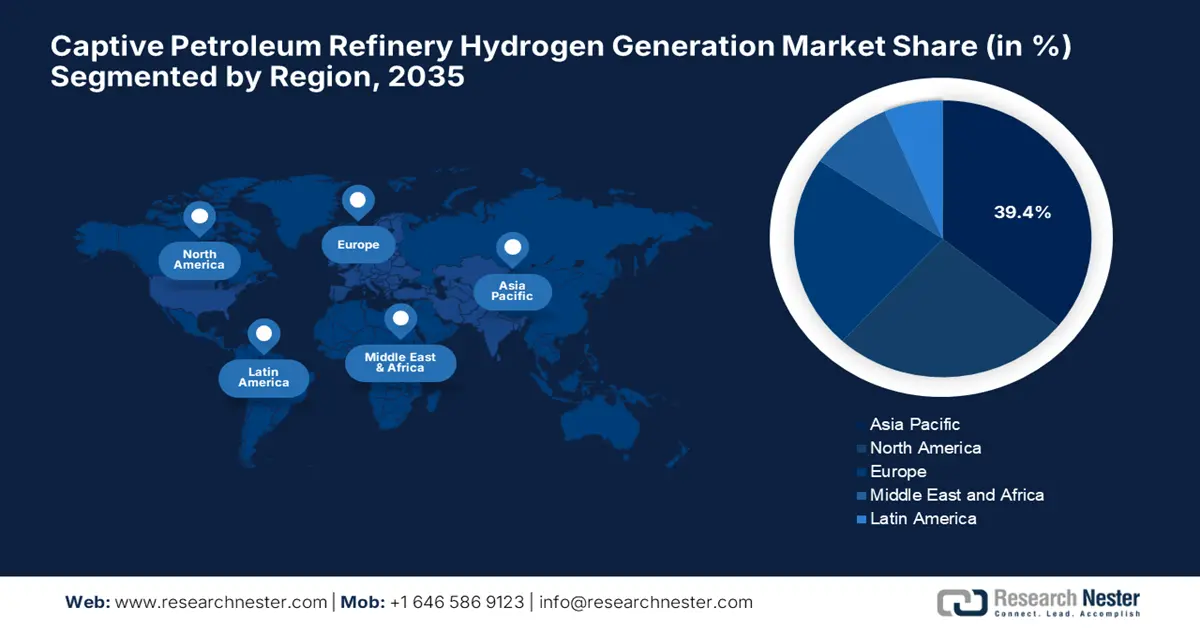

Captive Petroleum Refinery Hydrogen Generation Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific is estimated to capture 39.4% of the revenue share through 2035 owing to the strong presence of refinery plants. The rapid growth in economic activities and increasing consumption of hydrogen power in the industrial sector including, petroleum is positively influencing the overall market growth. China, India, Japan, South Korea, Indonesia, Thailand, and Australia are some of the dominant crude oil production countries in the region, driving high demand for hydrogen production technologies.

China is the top producer of crude oil in Asia Pacific and accounted for a record 14.8 million barrels per day in 2023. The huge presence of refinery capacity in the country is augmenting the demand for captive hydrogen generation technologies. The rapid expansion of the petrochemical industry is driving strategic collaborations between domestic and international companies to boost hydrogen production capabilities.

India’s rapidly increasing population and economic growth are fuelling the demand for refined fuels, prompting refineries to enhance hydrogen production for cleaner outputs. The rising investments in the refining capacities and associated hydrogen production are also pushing the market growth in India. Jamnagar Refinery is the world’s largest oil refinery and de facto petroleum hub. With more than 1.2 million barrels per day of nominal crude processing capacity Jamnagar Refinery is significantly influencing the demand for advanced hydrogen processing technologies.

North America Market Statistics

The North America market is driven by the increasing investments in natural gas infrastructure and the strong presence of regulatory organizations such as the Environmental Protection Agency and Energy Information Administration. The technological advancements in hydrogen production technologies such as steam methane reforming and autothermal reforming are enhancing operational efficiency and lowering costs.

The U.S. captive petroleum refinery hydrogen refinery generation market is expanding due to ongoing refinery upgrades to meet strict environmental regulations and rising investments in hydrogen fuel cell vehicles for transportation. For instance, according to the Energy Information Administration, the U.S. refinery hydrogen production capacity accounted for 2,913 million cubic feet per day in January 2024.

Canada’s commitment to achieve net-zero emissions by 2050 is pushing high investments in the development of advanced hydrogen production infrastructure, pushing the overall market growth. Canada is the world’s top producer of hydrogen owing to the rich availability of feedstocks and the strong presence of renewable energy sources.