Calcium Glycerophosphate Market Outlook:

Calcium Glycerophosphate Market size was valued at USD 75.41 million in 2025 and is expected to reach USD 110.56 million by 2035, expanding at around 3.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcium glycerophosphate is evaluated at USD 78.06 million.

The growth of the market can be attributed primarily to the widespread consumption of soft drinks and beverages containing low pH levels which requires a higher amount of glycerophosphate to remove harmful properties from the liquid. For instance, a wide range of ready-to-drink (RTD) products, such as Cold Brew Coffee (which has a pH level of 5), have grown by 20% in 2017 and by 2022, the growth is expected to increase to 68% of all such products introduced.

Calcium glycerophosphate is a fine and white powder composed of calcium salts of glycerophosphoric acid. In addition to serving as a protective agent against tooth decay, it is also used to neutralize acidic foods after being consumed. Furthermore, the increasing expenditure on consumer products coupled with the rise in per capita income is expected to fuel the global calcium glycerophosphate market growth during the forecast period. It was observed that, in January 2022, spending on consumer goods in the United States increased from approximately 7.5, compared to a decline of around 6.5% in December 2021.

Key Calcium Glycerophosphate Market Insights Summary:

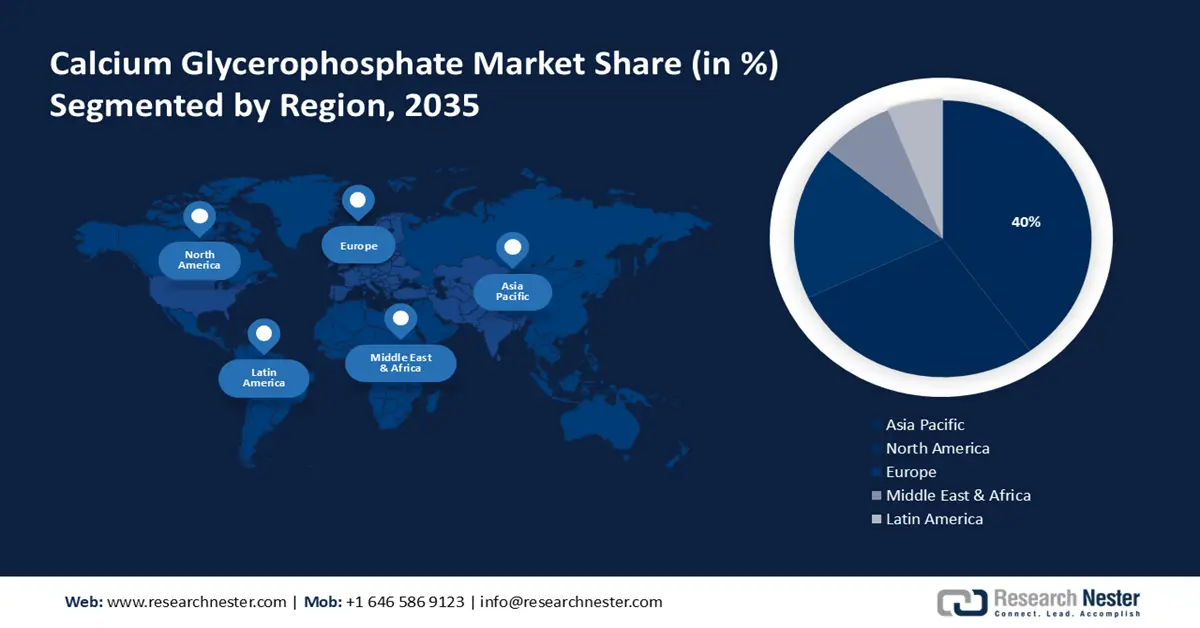

Regional Highlights:

- Asia Pacific is projected to command a 40% revenue share by 2035 in the Calcium Glycerophosphate Market, supported by rising awareness of oral hygiene and increasing dental care visits.

Segment Insights:

- The pharmaceutical segment is anticipated to secure a dominant share by 2035, underpinned by its extensive utilization in medications for IBS, heartburn, and gastrointestinal disorders along with growing exports of oral and dental hygiene products.

Key Growth Trends:

- Growing Demand for Dietary Supplements Among People

- Increasing Exports of Dentifrices Including Toothpowder and Toothpaste

Major Challenges:

- Availability of Alternatives of Calcium Glycerophosphate

- High Production Costs Associated with the Product

Key Players: Global Calcium PVT. LTD., Sri Vyjayanthi Labs Pvt. Ltd., Penta Manufacturing Company, LLC., Seppic SA, NITIKA CHEMICALS PHARMACEUTICAL SPECIALITIES PVT. LTD., Anmol Chemicals Group, Chempol, American Elements, Isaltis Inc.

Global Calcium Glycerophosphate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 75.41 million

- 2026 Market Size: USD 78.06 million

- Projected Market Size: USD 110.56 million by 2035

- Growth Forecasts: 3.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 19 November, 2025

Calcium Glycerophosphate Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Demand for Dietary Supplements Among People- In a survey in 2019, it was found that nearly 75% of American adults take dietary supplements on a daily basis. This included approximately 80% of female adults and 75% of male adults.

-

In addition, the rising awareness about health concerns, coupled with the growing demand for dietary supplements, is anticipated to enlarge the global calcium glycerophosphate market size over the forecast period. Calcium glycerophosphate is used as an active compound in calcium glycerylphosphate. Taking it in the form of supplements or as a dietary mineral component, it helps in maintaining the level of calcium in bodies. It improves bone mineral density and treats calcium deficiency.

- Increasing Exports of Dentifrices Including Toothpowder and Toothpaste- According to the statistics by the International Trade Center (Trademap), the value of exports of Dentifrices in China in the year 2021 was recorded to be USD 453,125 thousand, which was an increase from USD 414,924 thousand in the previous year.

- Product Approval by Government Organization Such as FDA (Food and Drug Administration)- In accordance with FDA standards, calcium glycerophosphate is approved as a generally recognized safe (GRAS) food ingredient for use as a nutrient supplement, a source of calcium or phosphorus, as well as an ingredient used in food products such as gelatin, ice cream, and sauces.

- Prevalence of Heartburn and Gastroesophageal Reflux Disease (GERD) Among Individuals- Calcium glycerophosphate is widely used in medicines to treat heartburn, irritable bowel syndrome, and other gastroesophageal problems. It was observed that Gastroesophageal reflux disease (GERD) is one of the most prevalent digestive disorders in the United States with a prevalence of about 22%.

- Growing Periodontal Disease Incidence Among Individuals- According to the Centers for Disease Control and Prevention, 47.2% of adults aged 30 and over are affected by some form of periodontal disease. 70.1% of people aged over 65 years are suffering from this disease.

Challenges

- Availability of Alternatives of Calcium Glycerophosphate

- High Production Costs Associated with the Product

- Concern about Side Effects Due to Excessive Intake of Calcium Glycerophosphate

- People might hesitate to consume

Calcium Glycerophosphate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.9% |

|

Base Year Market Size (2025) |

USD 75.41 million |

|

Forecast Year Market Size (2035) |

USD 110.56 million |

|

Regional Scope |

|

Calcium Glycerophosphate Market Segmentation:

Application Segment Analysis

The global calcium glycerophosphate market is segmented and analyzed for demand and supply by application into pharmaceutical, and food & beverage. Among these segments, the pharmaceutical segment captured the largest market share by 66% in the year 2022 backed by the extensive use of calcium glycerophosphate in the manufacturing of pharmaceutical medications such as treating IBS, heartburn, and gastrointestinal problems. Furthermore, the increasing exports of oral and dental hygiene products and production in pharma industries are expected to drive segment growth over the forecast period. Statistics provided by the International Trade Center (Trademap) indicate that in 2021, the global export value of oral and dental hygiene products in the United States was USD 1,872,494 thousand, an increase of USD 1,651,373 thousand from the previous year.

Our in-depth analysis of the global calcium glycerophosphate market includes the following segments:

|

By Product Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcium Glycerophosphate Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is likely to hold largest revenue share of 40% by 2035, The growth of market can be ascribed to the growing awareness among the population of the importance of dental cleanliness and general oral health coupled with an increase in dental care visits is expected to drive the regional market growth during the forecast period. Furthermore, the adoption of innovative dental care products and rising disposable income are projected to drive calcium glycerophosphate market growth in Asia Pacific during the forecast period.

Calcium Glycerophosphate Market Players:

- Global Calcium PVT. LTD.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sri Vyjayanthi Labs Pvt. Ltd.

- Penta Manufacturing Company, LLC.

- Seppic SA

- NITIKA CHEMICALS PHARMACEUTICAL SPECIALITIES PVT. LTD.

- Anmol Chemicals Group

- Chempol

- American Elements

- Isaltis Inc.

Recent Developments

-

Isaltis Inc. announced that it Macco Organiques Canada, which specializes in mineral salts for the food and pharmaceutical markets, with calcium and magnesium chlorides of pharmaceutical grade as its main products has taken control of Isaltis to create a global leader in high purity mineral salts.

-

Seppic SA has entered into a partnership agreement with Bioactor B.V. This strategic agreement will not only expand the portfolio of Seppic Inc., but also address major trends in the dietary supplements sector, such as beauty, vitality, mood, memory, sport nutrition, bone and gut health.

- Report ID: 917

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcium Glycerophosphate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.