Calcium Formate Market Outlook:

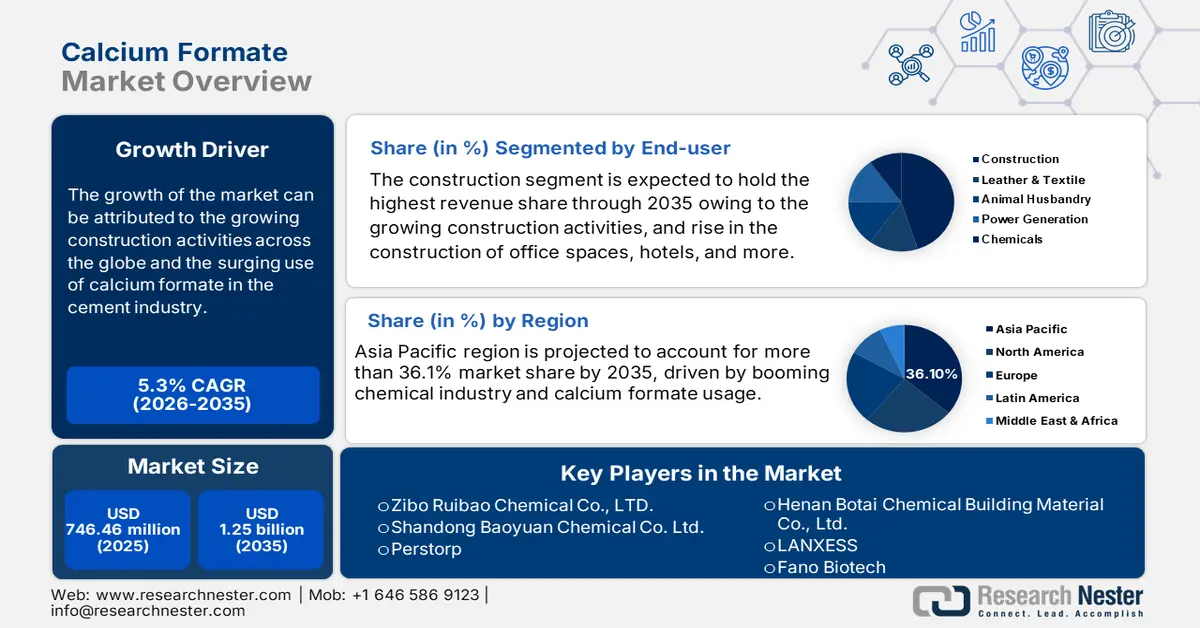

Calcium Formate Market size was valued at USD 746.46 million in 2025 and is set to exceed USD 1.25 billion by 2035, registering over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of calcium formate is estimated at USD 782.07 million.

The growth of the market can be attributed to growing construction activities across the globe, followed by the surging use of calcium formate in the cement industry. Calcium formate increases the hydration level of tricalcium silicate in the cement, and it is expected to boost the market’s growth in the upcoming years. As of 2022, there were approximately 3,784,290 construction companies in the US, a about 4% rise from 2021. Calcium formate is a component of cement additives, concrete accelerators, tile adhesives, and cement-based mortars. The increased use of cement in the building industry has increased the demand for calcium formate. Moreover, it is a cement additive used in the construction industry to shorten the setting time and toughen cement products. Along with other things, cement is also used to create concrete, slabs, sheets, adhesives, bricks, and blocks. Inhibitors, PH regulators, corrosion protection for construction and infrastructure substrates, and cementing for oil drilling are further uses for calcium formate. China, one of the world's top manufacturers and consumers of cement, uses it mostly in the production of concrete. As a result, the growing demand for cement in the building industry is what is driving the global market for calcium formate.

The demand for calcium formate as a feed additive is anticipated to soar in the next few years as governments throughout the world implement regulations on health enhancers used in animal feed. Utilizing nutrient-dense feed improves the digestive health of the animals. To ensure healthy animal growth, this has affected the usage of chemicals and preservatives. Studies predict that sales of calcium formate in the animal feed and sillage treatment businesses would grow at a significant amount in the forecast period. Additionally, the demand for meat and poultry has increased, which offers opportunities for producers of calcium formate.

Key Calcium Formate Market Insights Summary:

Regional Highlights:

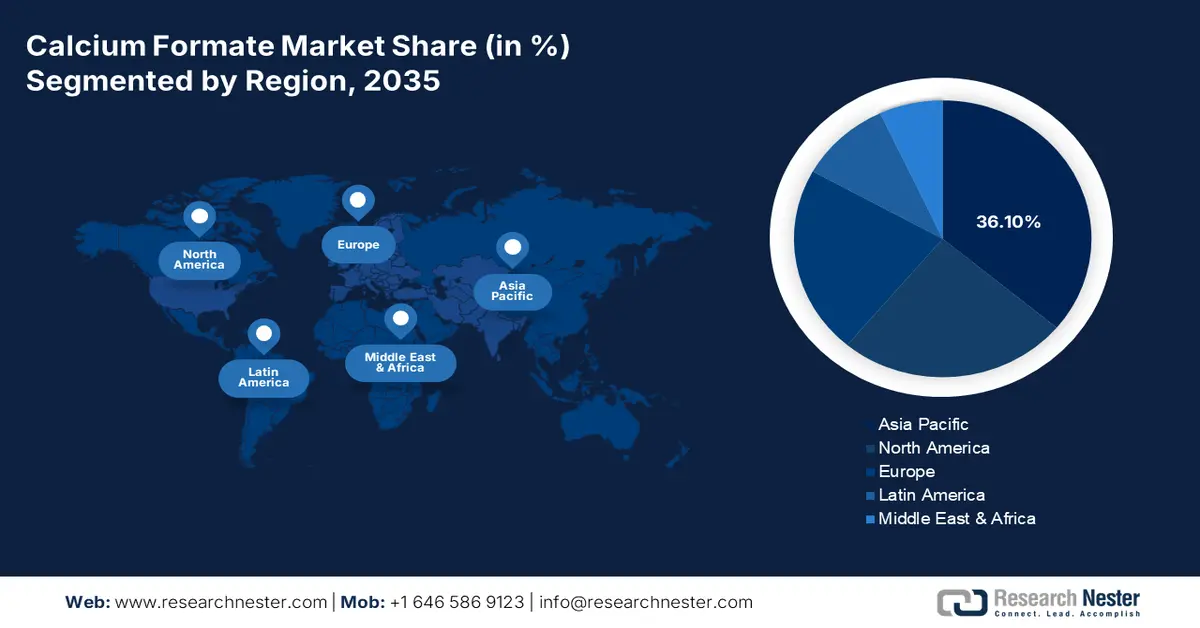

- The Asia Pacific calcium formate market will dominate over 36.1% share by 2035, driven by booming chemical industry and calcium formate usage.

- The Europe market will achieve significant growth from 2026 to 2035, driven by growth in animal feed, leather, and construction sectors.

Segment Insights:

- The feed grade segment in the calcium formate market is expected to spur market expansion from 2026-2035, attributed to rising use of calcium formate in feed and demand for high-quality animal feed.

- The construction segment in the calcium formate market is projected to hold the largest share by 2035, driven by growing construction activities and increased office space and hotel construction.

Key Growth Trends:

- Growth in Construction of Buildings All Around the Globe

- Growing Risk of Pathogenic Bacteria in Animals

Major Challenges:

- Price volatility for raw materials

- Stringent Government Regulations

Key Players: Perstorp, GEO Specialty Chemicals, Inc., Chongqing Chuandong Chemical (Group) Co, Ltd, Command Chemical Corporation, Inc., LANXESS, Zibo Ruibao Chemical Co., Ltd., Changzhou Jintan Hengxin Chemical Co., Ltd., Fano Biotech, Henan Botai Chemical Building Material Co., Ltd., Shandong BaoYuan Chemical Co., Ltd.

Global Calcium Formate Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 746.46 million

- 2026 Market Size: USD 782.07 million

- Projected Market Size: USD 1.25 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Calcium Formate Market Growth Drivers and Challenges:

Growth Drivers

-

Growth in Construction of Buildings All Around the Globe Tile adhesives, cement-based mortars, and calcium formate are used as cement additives and concrete accelerators. The increase in cement usage by the building sector is anticipated to have a significant positive impact on the global calcium formate market's demand. To speed up setting and increase the hardness of cement products, calcium formate is used as an additive in the construction sector. Concrete, adhesives, slabs, sheets, and bricks are just a few of the goods that can be made from cement. As an inhibitor, PH regulator, corrosion protection for building and infrastructure substrates, and for cementing oil drilling, calcium formate is also utilized. According to an estimate, around 3500 buildings are expected to build every day by contractors across the globe.

-

Growing Risk of Pathogenic Bacteria in Animals- Worldwide, rabies accounts for about 59,000 death each year. Dog rabies is still a common disease in many nations, and exposure to rabid dogs still accounts for over 90% of human exposures to rabies and 99% of all human rabies deaths globally, despite evidence to the contrary.

-

Growing Urban Population - Around 4.4 billion people, or 56% of the world's population, reside in cities. By 2050, approximately 7 out of 10 people are expected to live in cities, with the urban population predicted to more than double its current level.

-

Surge in Demand for Crop Growth Fertilizers - Fertilizers are supplemental materials that are given to the crops to boost productivity. Farmers use them regularly to improve crop yields. These chemical fertilizers include nitrogen, potassium, and phosphorus, which are crucial elements needed by plants. They also increase the soil's fertility and its capacity to retain water. Thus, the rising use and demand for fertilizers is also a significant factor that is estimated to spur the growth of the market in the coming years. For instance, six crops account for two-thirds of the world's fertilizer demand, with corn, wheat, and soybeans making up roughly around 35% of that total.

Challenges

- Price volatility for raw materials - The two main raw ingredients that go into making calcium formate are formic acid and calcium carbonate. The market for calcium formate has significant difficulties as a result of the fluctuating cost of these raw ingredients. Additionally, increased production costs are a result of inadequate process efficiency and high energy usage. Therefore, in order to reduce production costs and increase profit margins, makers of calcium formate frequently seek out efficient substitutes that is anticipated to hamper the market’s growth.

- High Initial Capital Investment for Calcium Formate – The manufacturing process requires sufficient capital investment owing to the process that is energy-intensive. Moreover, this further increases the cost of production of the compound and reduces the profit margin. Hence, this factor is expected to hinder the growth of the market.

- Stringent Government Regulations

Calcium Formate Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 746.46 million |

|

Forecast Year Market Size (2035) |

USD 1.25 billion |

|

Regional Scope |

|

Calcium Formate Market Segmentation:

End-user Segment Analysis

The construction segment is expected to garner the largest calcium formate market revenue by the end of 2035, backed by growing construction activities. Also, there has been a rise in the construction of office spaces, hotels, and more, which is also expected to boost the segment's growth. The major six cities in India saw a net absorption of about 30 million square feet of office space in 2020.

Type Segment Analysis

The feed grade segment is anticipated to spur market expansion owing to the rising use of calcium formate in feed, followed by rising demand for high-quality animal feed that is predicted to boost the segment's growth in the market. The 2019 Alltech Global Feed Survey found that, compared to 2018, the world's feed production rose by 3% in 2019.

Our in-depth analysis of the global market includes the following segments:

| Type |

|

| Application |

|

| End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Calcium Formate Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 36.1% market share by 2035, driven by booming chemical industry and calcium formate usage. In the Asia Pacific region, small and medium-sized businesses in the domestic chemicals sector were anticipated to post more than 15% revenue growth in FY22 as a result of improved domestic demand and increased realization owing to high chemical prices. Asia Pacific is one of the most significant markets for the global calcium formate market. The Asia Pacific region accounted for the biggest market share for calcium formate in 2020. The rapidly expanding usage of calcium formate as a cement additive, coupled with radically growing usage as a major substance in various kinds of putties, adhesives and sealants, and so on is estimated to drive the growth of the calcium formate market in the region during the forecast period. Moreover, the surge in chemical, leather, textile, and animal husbandry sectors in countries such as India, Japan, China, and South Korea has also boosted demand for the substance in the Asia Pacific region.

Europe Market Insights

Furthermore, the Europe region is expected to witness significant growth in the upcoming years owing to increased disposable income and the presence of major market participants in the region's nations. Furthermore, the animal feed industry's consistent growth and an increase in new construction projects, are further expected to contribute to the market’s growth. The significant use of calcium formate in the leather tanning industry is another factor driving market expansion in Europe.

Calcium Formate Market Players:

- Perstorp

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GEO Specialty Chemicals, Inc.

- Chongqing Chuandong Chemical (Group) Co, Ltd

- Command Chemical Corporation, Inc.

- LANXESS

- Zibo Ruibao Chemical Co., Ltd.

- Changzhou Jintan Hengxin Chemical Co., Ltd.

- Fano Biotech

- Henan Botai Chemical Building Material Co., Ltd.

- Shandong BaoYuan Chemical Co., Ltd.

Recent Developments

-

The French Theseo group, a top producer of animal health and biosecurity products, was acquired by the specialty chemicals business LANXESS. On February 9, 2021, LANXESS and the seller agreed to a binding acquisition agreement, and in the middle of March, the necessary antitrust authorities the deal.

-

Leading manufacturer of specialized chemicals Perstorp intends to start producing carboxylic acids in 2024 with an additional capacity of roughly 70,000 tonnes/year. With the investment, Perstorp will be able to dramatically boost output while also solidifying its position as a source of sustainable solutions. In high-value applications such as non-phthalate plasticizers for PVC, engineered fluids for uses like refrigeration lubricants, various propionates used in food preservation, and carboxylic acids used in animal feed gut health and preservation products, capacity will be increased to keep up with growing demand. The majority of the output will be utilized in downstream production run by Perstorp.

- Report ID: 4536

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Calcium Formate Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.