Digestive Health Products Market Outlook:

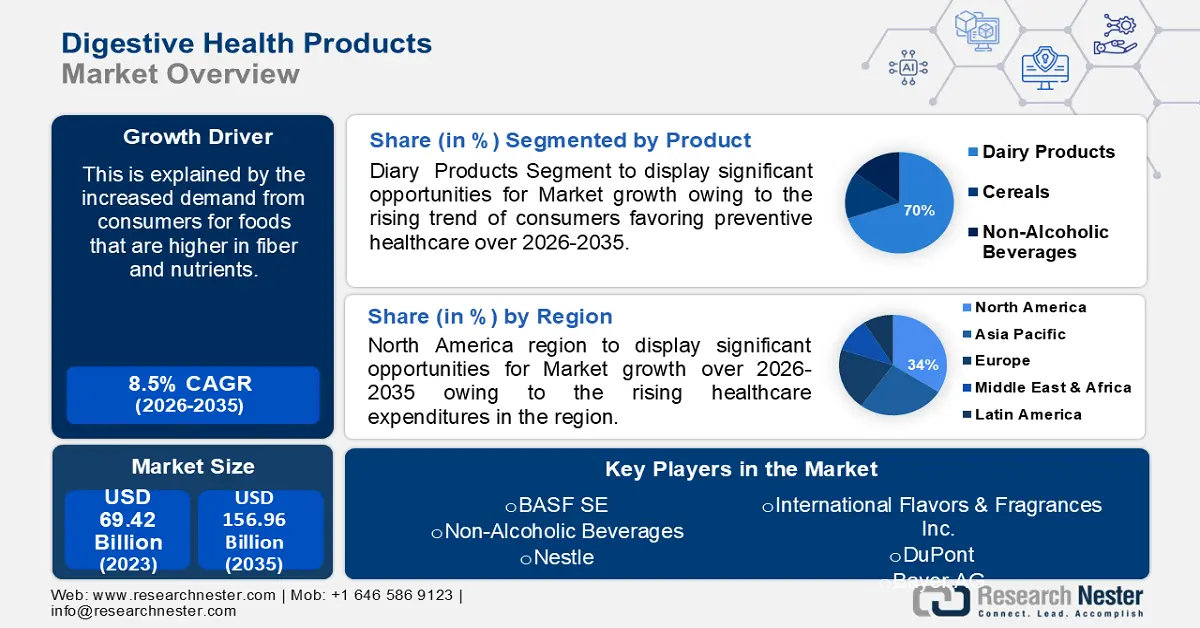

Digestive Health Products Market size was valued at USD 69.42 billion in 2025 and is set to exceed USD 156.96 billion by 2035, registering over 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of digestive health products is estimated at USD 74.73 billion.

Producers are introducing more and more probiotics, prebiotics, and enzymes into their food and drink items. This is explained by the increased demand from consumers for foods that are higher in fiber and nutrients. In the last 30 days, 4 million adults in the United States (1.6%) reported using probiotics or prebiotics.

Key Digestive Health Products Market Insights Summary:

Regional Highlights:

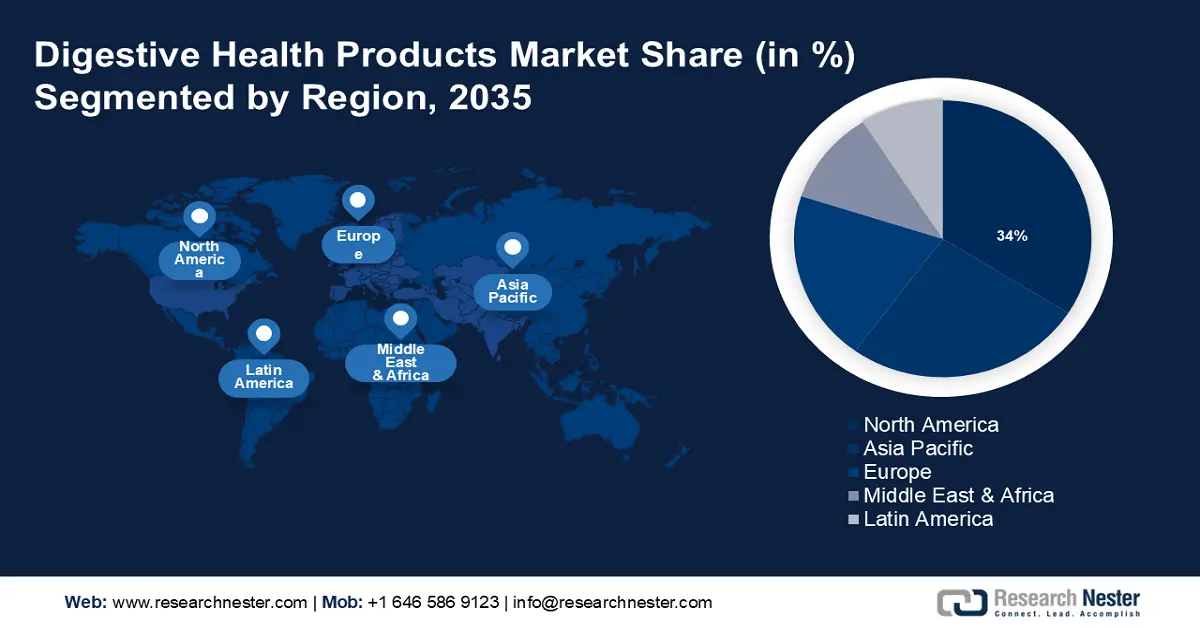

- North America digestive health products market will account for 34% share by 2035, driven by rising healthcare expenditures and growing interest in wellness through diet.

- Asia Pacific market will achieve the fastest CAGR during 2026-2035, driven by rapid urbanization and rising affluence leading to demand for digestive health products.

Segment Insights:

- The dairy products segment in the digestive health products market is expected to achieve substantial growth till 2035, attributed to the rising consumer preference for probiotic dairy products.

- The probiotics segment in the digestive health products market is projected to capture the largest share by 2035, driven by growing awareness of probiotics' health benefits.

Key Growth Trends:

- People's awareness of health issues is growing

- Growth will be promoted by increasing demand for digestive health products

Major Challenges:

- Tight rules and updated tax structure to restrict market expansion

- Restricted coverage for reimbursement

Key Players: Novozymes A/S, Nestle, International Flavors & Fragrances Inc., DuPont, Bayer AG, Danone, Herbalife International of America, Inc., Sanofi, Cargill, Incorporated.

Global Digestive Health Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 69.42 billion

- 2026 Market Size: USD 74.73 billion

- Projected Market Size: USD 156.96 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Digestive Health Products Market Growth Drivers and Challenges:

Growth Drivers

- People's awareness of health issues is growing – Among the products that are gaining popularity among western customers who approach health holistically are probiotics, which are crucial for maintaining a healthy gut flora. Therefore, as consumer awareness of gut health grows, it is anticipated that demand for digestive health products market would expand during the forecast period.

The country's need for digestive health products is expected to rise as a result of bad eating habits and a high intake of fast food, high-sodium, and ready-to-eat meals. Per capita income in 2024 is projected to be US$76.49, based on population totals.

- Growth will be promoted by increasing demand for digestive health products – The pandemic has placed logistical and other financial constraints on the world, yet the market for gut health products is predicted to expand quickly despite these obstacles. With the coronavirus ravaging the world, the major businesses in the industry made sure that everyone could stay healthy without any obstacles.

For example, Yakult U.S.A. Inc.'s annual report states that in their overseas food and beverage industry, average daily sales increased by 1.6% in 2020 to 31,624 bottles from the previous year. In addition, a lot of people are aware of the necessity of probiotics and other products in maintaining good health during this severe viral pandemic.

- Growing R&D efforts by industry participants to promote development – Recent years have seen an increase in consumer awareness over gut health, which has sped up research and development of products for digestive health. For instance, a comprehensive global research study carried out in 2020 found that over 40% of individuals globally suffer from functional gastrointestinal diseases, which have an impact on healthcare utilization and quality of life.

As a result, there is a rising need among consumers for safe and natural products. Because of this, industry participants are making significant investments in R&D to create innovative products that will meet the growing demand.

Challenges

- Tight rules and updated tax structure to restrict market expansion – The digestive health products market is expanding due to a number of variables, but there are also certain obstacles in the way. One of these factors is the strict rules that makers of vitamins and supplements must deal with prior to the launch of their products.

The Dietary Supplement Health and Education Act became operative in 1994. As per this legislation, it is the responsibility of a company to ascertain that the dietary supplements it produces or supplies are safe and that any statements or guarantees made on the product are accurate. Additionally, before creating or marketing supplements, firms must register with the FDA in accordance with the Bioterrorism Act. Therefore, all of this postpones the release of a product.

- Restricted coverage for reimbursement – Reimbursement coverage for interventions and treatments related to digestive health may be restricted in certain healthcare systems. In cases of chronic digestive diseases in particular, this may have an impact on a patient's ability to access specialized healthcare experts, therapies, and diagnostic testing. The affordability of services and products related to digestive health might also be impacted by limited reimbursement.

Digestive Health Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 69.42 billion |

|

Forecast Year Market Size (2035) |

USD 156.96 billion |

|

Regional Scope |

|

Digestive Health Products Market Segmentation:

Product Segment Analysis

Dairy products segment is set to capture over 70% digestive health products market share by 2035. The market is driven by the rising trend of consumers favoring preventive healthcare and the creation of effective probiotic strains for dairy products that reduce inflammation in the intestines and boost immunity and gut health.

Over the next ten years, it is anticipated that the global per capita consumption of fresh dairy products will rise by 1.0% annual rate. Because of their distinct flavors and health advantages, functional drinks such as kombucha, sports drinks, and relaxation drinks have become much more popular. Prebiotics and probiotics are two examples of functional ingredients that are anticipated to be added to non–alcoholic beverages, which is anticipated to help the digestive health products market expand.

Ingredients Segment Analysis

The probiotics is estimated to gain the largest market share during the forecast period. The rising public knowledge of probiotics' potential health advantages, including their ability to enhance immune function, improve digestive health, reduce inflammation, and promote mental health, has led to a rise in the popularity of these substances in nutritious foods and nutritional supplements.

This trend is partially fueled by rising interest in natural and healthful food options as well as increased concerns about wellbeing and health. The rising demand for the ingredient is prompting a number of industry participants to introduce new goods, which is fueling the market's expansion.

For instance, in March 2023, Good Culture and the biggest dairy cooperative in the United States worked together to launch a new product named Good Culture Probiotic Milk. The product is called Bacillus coagulants GBI–30, 6086, and it is a lactose–free, long–life milk that contains the probiotic BC30. The milk is a nutritious choice that helps enhance digestion and support gut health because it contains BC30 probiotic.

Our in–depth analysis of the digestive health products market includes the following segments:

|

Ingredients |

|

|

Distribution Channel |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Digestive Health Products Market Regional Analysis:

North America Market Insights

North America industry is estimated to account for largest revenue share of 34% by 2035. The region's future growth will be aided by rising healthcare expenditures, evolving food regulations that impact product claims and labels, swift advancements in science and processing technologies, an aging population, and growing interest in achieving wellness through diet. In 2020, the number of senior Americans reached 55.8 million, or 16.8% of the total population of the US.

To obtain a competitive advantage, market participants in the United States are implementing a range of tactics, including partnerships and diversifying their product offerings. For instance, Kerry announced in November 2020 that it was purchasing Bio–K Plus, a Canadian company that makes probiotic drinks and supplements. Kerry's plan to enhance its capabilities and solidify its position as the industry leader in the probiotics sector aligned with this acquisition.

APAC Market Insights

APAC region in digestive health products market is set to register fastest growth through 2035. Rapid urbanization and rising affluence have led to a shift in consumer preferences toward processed and fast food, which has resulted in gastrointestinal problems such constipation, acid reflux, and irritable bowel syndrome treatment. Products that enhance digestive health and treat these issues are now in demand as a result. 12.0% was the combined prevalence of constipation.

Factor contributing to the Chinese market's expansion in the area is the rising incidence of digestive issues there. In China, 10.75% of all illnesses among patients hospitalized to public hospitals were digestive in nature.

The Japan's growing demand for digestive health goods. In Japan, Yakult Honsha Co., Ltd., for example, sells 9,540 probiotic drink bottles every day.

The proliferation of e-commerce platforms and online shops in Korea has facilitated consumers' access to a vast array of products sourced both domestically and internationally. Domestic internet sales increased from USD 168.5 billion in 2021 to USD 180.4 billion in 2022.

Digestive Health Products Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novozymes A/S

- Nestle

- International Flavors & Fragrances Inc.

- DuPont

- Bayer AG

- Danone

- Herbalife International of America, Inc.

- Sanofi

- Cargill, Incorporated.

The existence of multiple participants in the worldwide market is predicted to result in fierce competition amongst enterprises. Because there is a target consumer base in Southeast Asia, major firms are concentrating on this market.

Recent Developments

- BASF and Cargill (Provimi) partnered for the development and distribution of feed enzymes in South Korea was enlarged. With the help of Cargill's broad market coverage and application experience and BASF's strengths in enzyme R&D, the partners want to create a collaborative innovation pipeline for South Korean animal protein producers.

- Herbalife launched Herbalife V, a new range of plant–based supplements, in response to the increasing demand from consumers for plant–based goods, including supplements. USDA Organic, confirmed non–GMO, kosher, plant–based, and vegan certifications from FoodChain ID are just a few of the certifications these goods have earned.

- Report ID: 6227

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Digestive Health Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.