Building-integrated Photovoltaics Market Outlook:

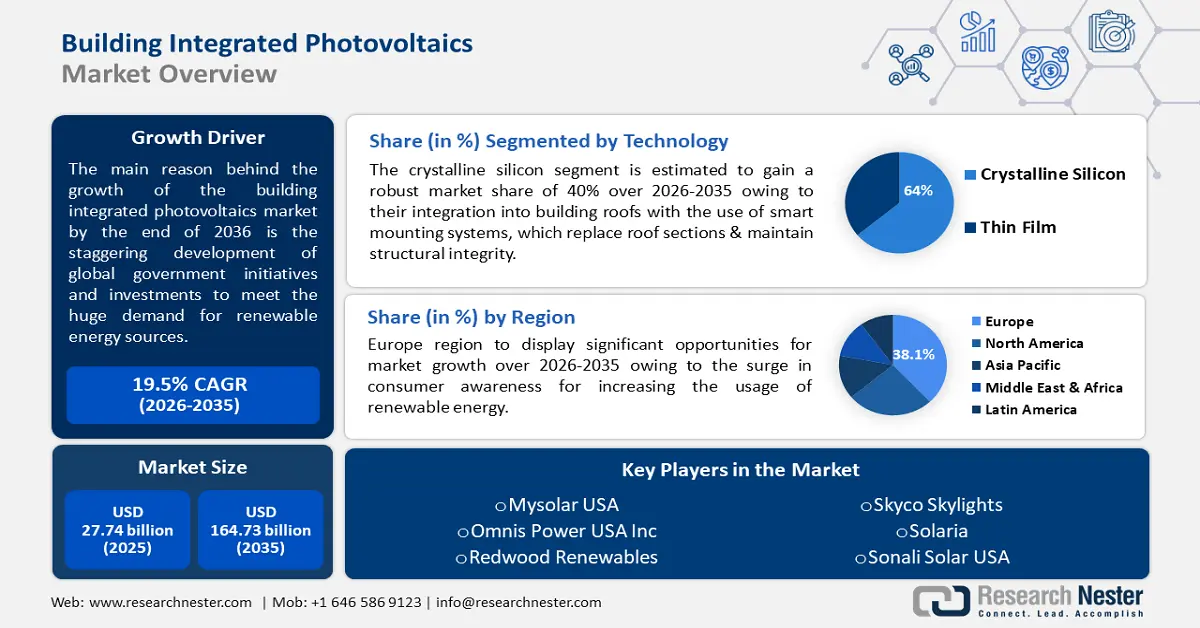

Building-integrated Photovoltaics Market size was over USD 27.74 billion in 2025 and is anticipated to cross USD 164.73 billion by 2035, growing at more than 19.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of building-integrated photovoltaics is estimated at USD 32.61 billion.

The market expansion is attributed to staggering development of global government initiatives and investments to meet the huge demand for renewable energy sources. Governments from across the world are providing financial subsidies, tax credits, or rebates to reduce the upfront costs of installing BIPV systems. These incentives make BIPV more financially viable for building owners and developers.

Additionally, governments allocate funds for research and development in solar photovoltaic (PV) technology. This investment supports innovation, efficiency improvements, and cost reductions in integrated PV systems. The World Energy Investment 2023 report by the International Energy Agency (IEA) stated that USD 2.8 trillion was invested in energy. More than USD 1.7 trillion was allocated to clean energy, which includes renewable power, nuclear, grids, storage, low-emission fuels, efficiency improvements, end-use renewables, and electrification.

Key Building-integrated Photovoltaics (BIPV) Market Insights Summary:

Regional Highlights:

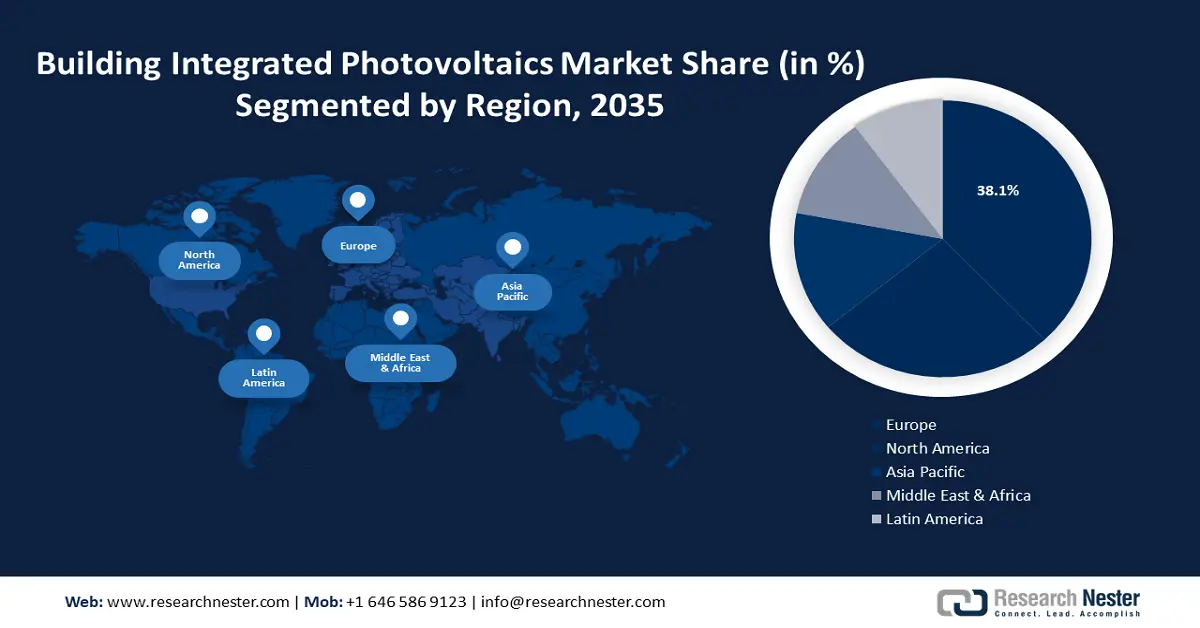

- Europe building-integrated photovoltaics market will dominate over 38.10% share by 2035, attributed to growing awareness of renewable energy benefits and supportive policies for sustainable building practices.

- North America market will exhibit massive growth during the forecast timeline, fueled by the growing demand for accessible and reliable clean energy sources amid population growth.

Segment Insights:

- The roof segment in the building-integrated photovoltaics market is projected to capture a 61.10% share by 2035, driven by the availability of larger panel installation areas for BIPV.

- The commercial segment in the building-integrated photovoltaics market is expected to exhibit a massive CAGR over 2026-2035, fueled by commercial end-users aligning with sustainability goals and cost savings.

Key Growth Trends:

- Surge for zero-emission buildings

- Technological advancements

Major Challenges:

- High initial cost

- Complex installation and integration

Key Players: Merck KGaA, The Dow Chemical Company, AGC Inc., Changzhou Almaden Co. Ltd, Heliatek GmbH, Carmanah Technologies Corporation, Dyesol Ltd., Ertex solartechnik GmbH, ISSOL SA, Tesla Inc.

Global Building-integrated Photovoltaics (BIPV) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.74 billion

- 2026 Market Size: USD 32.61 billion

- Projected Market Size: USD 164.73 billion by 2035

- Growth Forecasts: 19.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (38.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, Spain

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 8 September, 2025

Building-integrated Photovoltaics Market Growth Drivers and Challenges:

Growth Drivers

- High demand for solar energy - To meet consumer demand, more solar energy solutions are being integrated into commercial infrastructures to enhance design and save energy. According to the IEA, the global renewable energy capacity added to energy systems surpassed 50% in 2023. Furthermore, growing concerns about the depletion of nonrenewable power resources such as coal and oil are boosting demand for solar power generation, including the rise of the solar PV sector.

- Surge for zero-emission buildings - Demand for green or zero-emission buildings has increased as a result of the building industry's rapid modernization and increasing focus on clean energy. Based on a report by the IEA in 2023, buildings contribute about 30% to global energy consumption, and they emit more than 25% of global energy. Moreover, BIPV systems not only contribute to reducing greenhouse gas emissions but also enhance the overall energy performance of buildings by offsetting electricity consumption from the grid.

- Technological advancements - BIPV have seen significant technological advancements over the years, enhancing their efficiency, aesthetics, and overall integration into building designs. Many solar industries are trying to innovate more aesthetically appealing BIPV products into the market. For instance, LONGi, one of the world's top solar PV producers, has unveiled a new generation of BIPV products based on HPBC cell technology. It claims the device can provide an output of 580 W, with an efficiency of up to 22.6%.

Challenges

- High initial cost - BIPV systems typically involve higher upfront costs compared to traditional solar PV systems. These costs include not only the price of solar panels, but also expenses related to specialized integration into building components, additional structural support, and customized design requirements.

- Complex installation and integration - Integrating BIPV systems into building designs requires collaborative efforts by architects, builders, and solar installers. Complexities in design, customization, and compatibility with existing building structures can increase installation time and costs limiting market growth.

Building-integrated Photovoltaics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.5% |

|

Base Year Market Size (2025) |

USD 27.74 billion |

|

Forecast Year Market Size (2035) |

USD 164.73 billion |

|

Regional Scope |

|

Building-integrated Photovoltaics Market Segmentation:

Technology Segment Analysis

Crystalline silicon segment is set to dominate the building-integrated photovoltaics market share by the end of 2035. The segment growth is augmented by their integration into building roofs with the use of smart mounting systems, which replace roof sections while maintaining the structural integrity of the building. It is predicted that by 2025, about 57% of homes in the U.S. will have a smart home device. Additionally, this kind of integration offers great efficiency without requiring major investments. Using crystalline silicon cells in place of roof tiles is another integration option.

Application Segment Analysis

Roof segment is estimated to hold more than 61.1% building-integrated photovoltaics market share by 2035, attributed to availability of a larger panel installation area for BIPV. This optimization of space is designed for building owners and developers who aim to increase energy production while reducing adverse environmental impacts. Roof-mounted BIPV systems are increasingly adopted in residential, commercial, and industrial buildings worldwide. For instance, according to a 2023 report from the Solar Energy Industries Association, the U.S. installed 7 GW of residential solar in 2023.

End User Segment Analysis

The commercial segment is set to register massive CAGR in the building-integrated photovoltaics market till 2035. Commercial end-users may align their operational goals with sustainability objectives, understand cost savings, improve property values, and establish themselves as leaders in corporate responsibility and sustainability by making smart investments in green infrastructure. A 2023 report published by the Private Infrastructure Advisory Facility (PPIAF) program, housed and managed by the World Bank Group, stated that private investments globally in green infrastructure are increasing and accounted for 60% of their total private investment in 2021.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Building-integrated Photovoltaics Market Regional Analysis:

Europe Market Insights

Europe in building-integrated photovoltaics market is anticipated to account for more than 38.1% revenue share by the end of 2035. The market expansion is attributed to the growing awareness among consumers, businesses, and governments about the benefits of renewable energy and sustainable building practices. This increasing demand for green buildings and energy-efficient solutions supports the growth of the BIPV market in the region. European Environment Agency published a report in 2024, stating that the greenhouse gas emissions in the EU slowed down since 1990 while achieving their renewable energy target of 20% in 2020. Furthermore, in 2022, about 22.5% of the consumed energy was credited to renewable resources.

Germany has a long-standing commitment to renewable energy and sustainability, backed by policies such as the Renewable Energy Sources Act (EEG) and the Energy Efficiency Strategy for Buildings. These policies provide incentives, feed-in tariffs, and subsidies for BIPV installations, driving market growth. The EEG 2023 aims to make renewable energy account for at least 80% of total power consumption by 2030.

The United Kingdom government has set targets for reducing greenhouse gas emissions and increasing renewable energy generation. For instance, the Clean Growth Strategy, published in 2017, states that the UK government expects to meet its target of cutting emissions by 80% by 2050.

North America Market Insights

North America building-integrated photovoltaics market is expected to grow at massive CAGR through 2035, owing to the growing demand for accessible and reliable power generation, driven by population growth, and a shift toward the use of clean energy. According to a report by the U.S. Energy Information Administration, in 2022 the usage of natural gas was about 33% of the whole energy consumption.

In the United States, there has been an increase in government campaigns and investments aimed at raising awareness about the use of renewable energy. According to a survey conducted in 2023, it was revealed that more than 66% of U.S. adults prioritize using an alternative energy source like solar, hydrogen, and wind power.

Canada is predicted to have a high electricity demand which is further encouraging collaboration with the energy & power sector. Hence, this factor is estimated to impact the overall growth of the building-integrated photovoltaics industry in Canada. According to a report in 2023, the energy consumption in Canada tremendously increased to 8585 petajoules from 2022 to 2021.

Building-integrated Photovoltaics Market Players:

- Meyer burger

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ArcelorMittal

- First Solar Inc.

- D2solar

- Mysolar USA

- Omnis Power USA Inc

- Redwood Renewables

- Skyco Skylights

- Solaria

- Sonali Solar USA

Several key players are playing crucial roles in the expansion of the building-integrated photovoltaics market globally. These companies are leading in innovation, technology development, market penetration, and strategic partnerships.

Recent Developments

- In April 2023, ArcelorMittal announced its partnership with BP2 to supply low-carbon-emission steel for BP2's new product, the integrated photovoltaic roof known as SOLROOF. With a minimum of 75% scrap steel, XCarb recycled and renewable steel will likely be the only material used in the production of BP2's integrated photovoltaic FIT VOLT panels, which will generate 100% renewable electricity.

- In July 2021, Meyer Burger - A Swiss manufacturer of PV modules, acquired the rights to extend its business portfolio into integrated photovoltaic systems. The company agenda includes the installation of solar systems on roofs.

- Report ID: 3370

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Building-integrated Photovoltaics (BIPV) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.