Breast Pump Market Outlook:

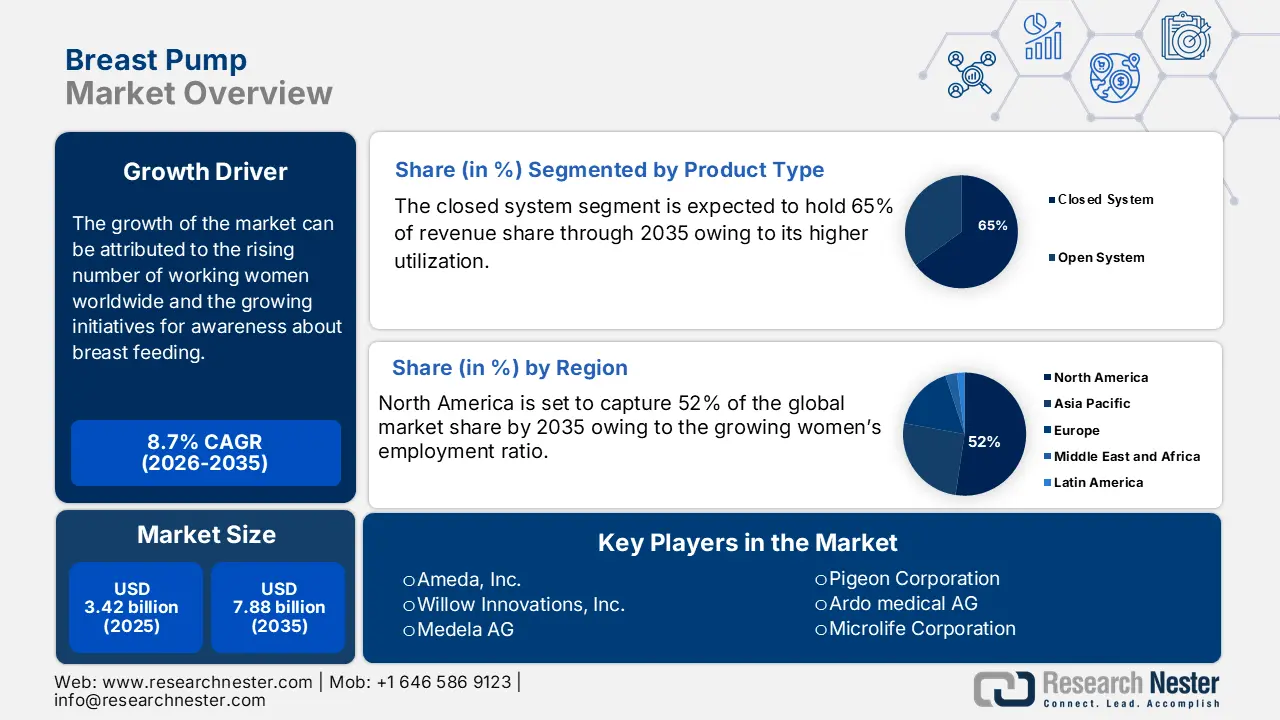

Breast Pump Market size was valued at USD 3.42 billion in 2025 and is expected to reach USD 7.88 billion by 2035, registering around 8.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of breast pump is evaluated at USD 3.69 billion.

The growth of the market is primarily attributed to the rising number of working women worldwide. As per the data released by the World Bank, the total labor force of working women across the globe has reached to 39.2% by 2020.

A breast pump is a mechanical tool used to extract milk from the breast. It enables the user to store breast milk in bags or storage bottles to use it later. Breast pump are mainly used to alleviate breast pain and to produce breast milk to infants who are not able to suck milk on their own. As breastfeeding is highly important to promotes healthy infant growth and encompasses all of the vitamins and nutrients that a baby requires. For instance, breast milk, which contains lactose around (7%), fat (3%), proteins (1%), and water (86%), is regarded as an essential source of nutrients. Both lactose and fat account for 41 and 50% of the total energy found in milk. It also has a lot of vitamins and minerals, including calcium, magnesium, phosphorus, potassium, sodium, and others.

Key Breast Pump Market Insights Summary:

Regional Highlights:

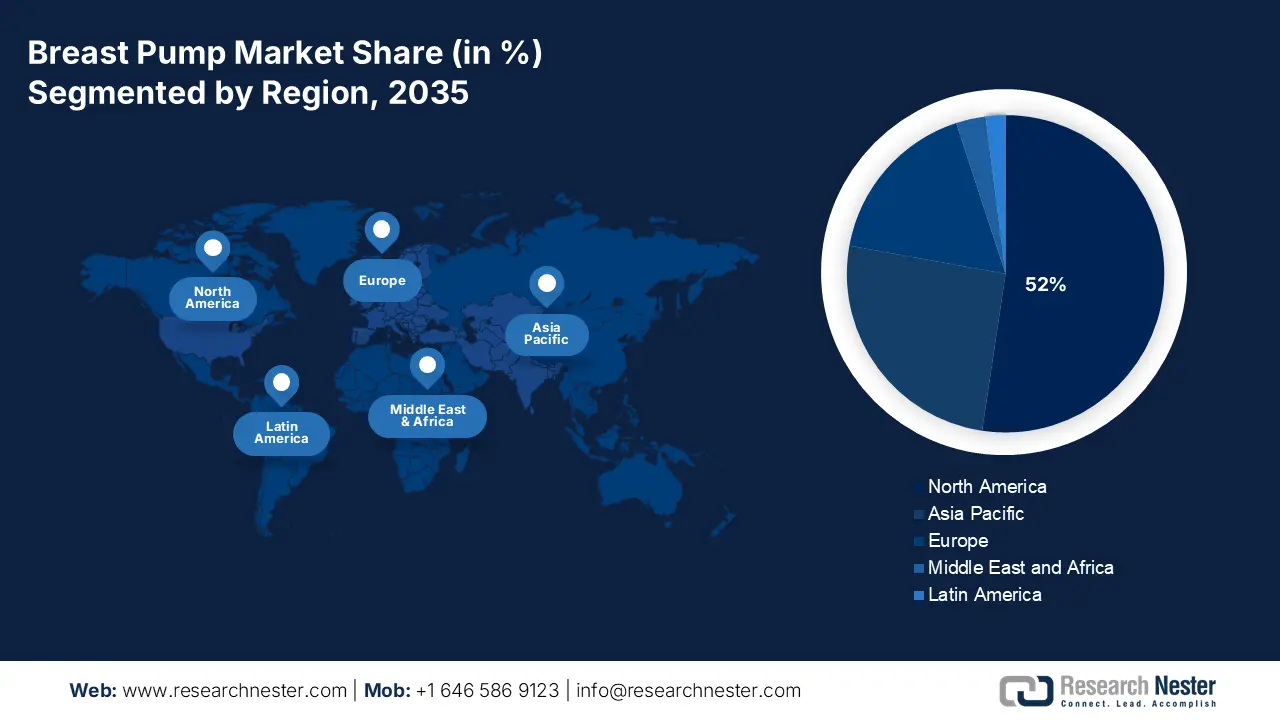

- North America breast pump market achieves a 52% share by 2035, driven by a spike in women’s employment, high healthcare expenditure, and strong healthcare infrastructure.

Segment Insights:

- The hospitals segment in the breast pump market is expected to achieve a noteworthy share by 2035, influenced by growing cases of lactation issues among new mothers.

- The closed system segment in the breast pump market is forecasted to secure the largest share by 2035, driven by higher utilization and demand in breast pump applications.

Key Growth Trends:

- Government Initiatives for Awareness About Breast Feeding

- Globally Improving Healthcare Expenditure

Major Challenges:

- High Cost of Breast Pump

- Risk of Contamination of Milk

Key Players: Medela AG, Pigeon Corporation, Ardo medical AG, Ameda, Inc., Willow Innovations, Inc., Evenflo Feeding, Inc., Beldico, Linco Baby Merchandise Work’s Co., Ltd., BelleMa Co., Microlife Corporation, Albert Manufacturing USA.

Global Breast Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.42 billion

- 2026 Market Size: USD 3.69 billion

- Projected Market Size: USD 7.88 billion by 2035

- Growth Forecasts: 8.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Breast Pump Market Growth Drivers and Challenges:

Growth Drivers

-

Government Initiatives for Awareness About Breast Feeding – Government of various nations are concerned to improve the good growth ratio in infants and children; therefore, many health-related initiatives have been introduced to raise awareness amongst people regarding breast feeding. As per the World Health Organization (WHO), by 2018, approximately 54% of all infants in the South-East Asia region had been fully breastfed up to the age of 6 months, which was up from 47% in 2015 and exceeding the global target of confirming that at least 50% of newborns are breastfed for the first 6 months of life by 2025.

- Globally Improving Healthcare Expenditure – As per the data released by the World Bank, in 2019, the global health expenditure was reached to 9.83%, which was up from 9.7% in 2018.

- Increasing Birth Rate across the World– Worldwide increasing ratio of newborns is also hitting the demand for breast pump. For instance, every year, approximately 140 million babies are born worldwide. That's over than 4 births each second of every day.

- Upsurge in Human Milk Banks – To reduce infant sickness and mortality rate, the trend of human milk bank has gained much popularity across the globe. For instance, in 2020, there were approximately 760 human milk banks in 68 countries.

- Growing Per Capita Income – As per the data provide by the World Bank, in 2021, the worldwide annual per capita income was increased by 4.8% as compared to 1.5% annual per capita income in 2019.

Challenges

-

High Cost of Breast Pump

-

Risk of Contamination of Milk

-

Accessibility of Medicines to Boost Lactation

Breast Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.7% |

|

Base Year Market Size (2025) |

USD 3.42 billion |

|

Forecast Year Market Size (2035) |

USD 7.88 billion |

|

Regional Scope |

|

Breast Pump Market Segmentation:

Product Type Segment Analysis

The global breast pump market is segmented and analyzed for demand and supply by product type into open system, and closed system, out of which, the closed system segment holds largest market share, owing to its higher utilization. Moreover, by end-user, the market is bifurcated into personal use, maternity centers, and hospitals. Out of these segments, the hospital segment is projected to obtain a noteworthy share on account of the rising number of mothers who have lactation, and medical issues in the early stage of motherhood. For instance, globally, around 12 to 17% of mothers face the problem of low lactation in the early postpartum stage.

Major Macro-Economic Indicators Impacting the Market Growth

According to the statistics by the World Health Organization, the global per capita healthcare expenditure amounted to USD 1,064.741 in the year 2017. The worldwide healthcare expenditure per person grew from USD 864.313 in 2008 to USD 1,110.841 in 2018, where the U.S. is the top country that amounted to healthcare expenditure of USD 10, 623.85 per capita in 2018. As of 2018, the domestic general government healthcare spending in the U.S. was USD 5355.79, which grew from USD 3515.82 in 2008. These are some of the factors responsible for market growth over the past few years. Moreover, as per the projections by the Centers for Medicare & Medicaid Services (CMS), the estimated average annual percent change related to National Health Expenditures (NHE) in the U.S. was 5.2% in 2020 as compared to 2019 (4.5%). Furthermore, the National Health Expenditures are projected to reach USD 6,192.5 Billion in 2028, where the per capita expenditure is estimated to touch USD 17,611 in the same year. These are notable indicators that are anticipated to create lucrative business opportunities in upcoming years.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Technology |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Breast Pump Market Regional Analysis:

Regionally, the global breast pump market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in North America will hold around 52% revenue share by 2035, backed by spike in women’s employment ratio, high healthcare expenditure, and good healthcare infrastructure. For instance, in the United States, the ratio of employment in women reached around 54% by the end of 2021.

Breast Pump Market Players:

- Medela AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pigeon Corporation

- Ardo medical AG

- Ameda, Inc.

- Willow Innovations, Inc.

- Evenflo Feeding, Inc.

- Beldico

- Linco Baby Merchandise Work’s Co., Ltd

- BelleMa Co.

- Microlife Corporation

- Albert Manufacturing USA

Recent Developments

-

Willow Innovations, Inc. announced the launch of their newest and most innovative wearable breast pump model, Willow Go, which offers moms the freedom, flexibility, and benefits of cordless, fully in-bra wearable pumps with hospital-grade suction.

-

Medela AG has introduced the Solo electric breast pump, which has a quick charge solution, long-lasting battery, and 2-Phase Expression Technology that offers more milk with less hassle.

- Report ID: 4209

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Breast Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.