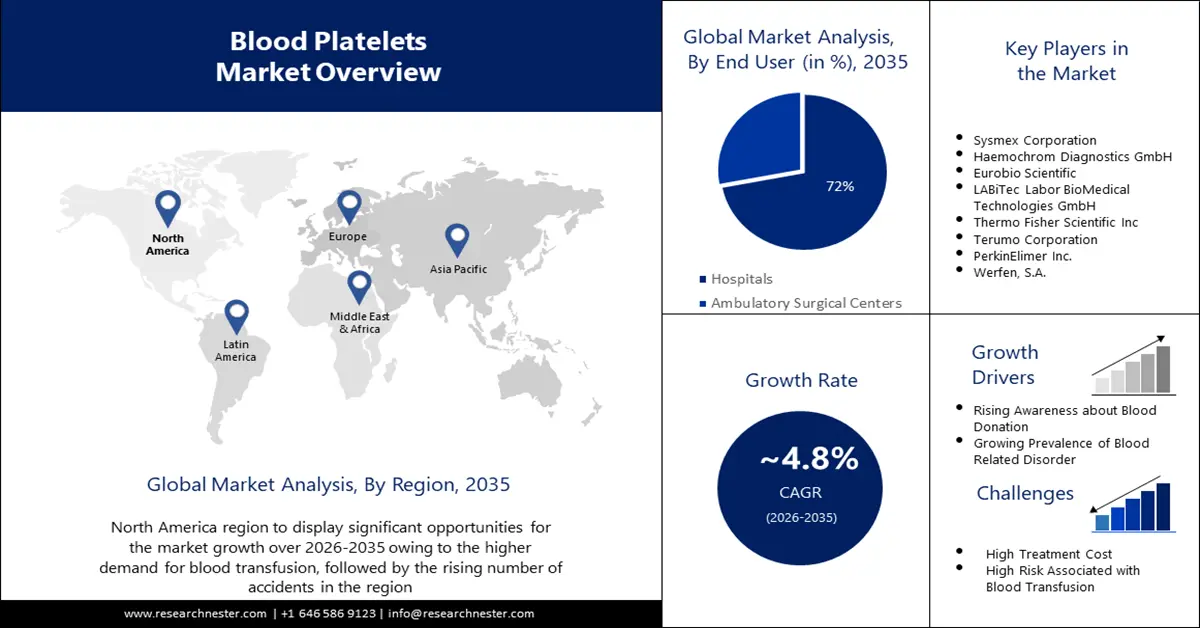

Blood Platelets Market Outlook:

Blood Platelets Market size was over USD 5.71 billion in 2025 and is poised to exceed USD 9.13 billion by 2035, growing at over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blood platelets is estimated at USD 5.96 billion.

The growth of this market is primarily driven by the increasing awareness about the importance of blood donation and the need for platelets has led to an increase in voluntary blood donations. The government, healthcare firms, and non-profit organizations across the globe are carrying out several initiatives to encourage blood and platelet donations.

Moreover, the increasing demand for blood transfusion is giving rise to the global blood platelets market growth. The blood transfusion demand has been significantly growing on account of growing acceptance by the US FDA regarding blood transfusion products consisting of blood platelets and advanced technologies aiding blood donation and storage. The blood to be transfused is first analyzed with the help of blood transfusion diagnostics.

Key Blood Platelets Market Insights Summary:

Regional Highlights:

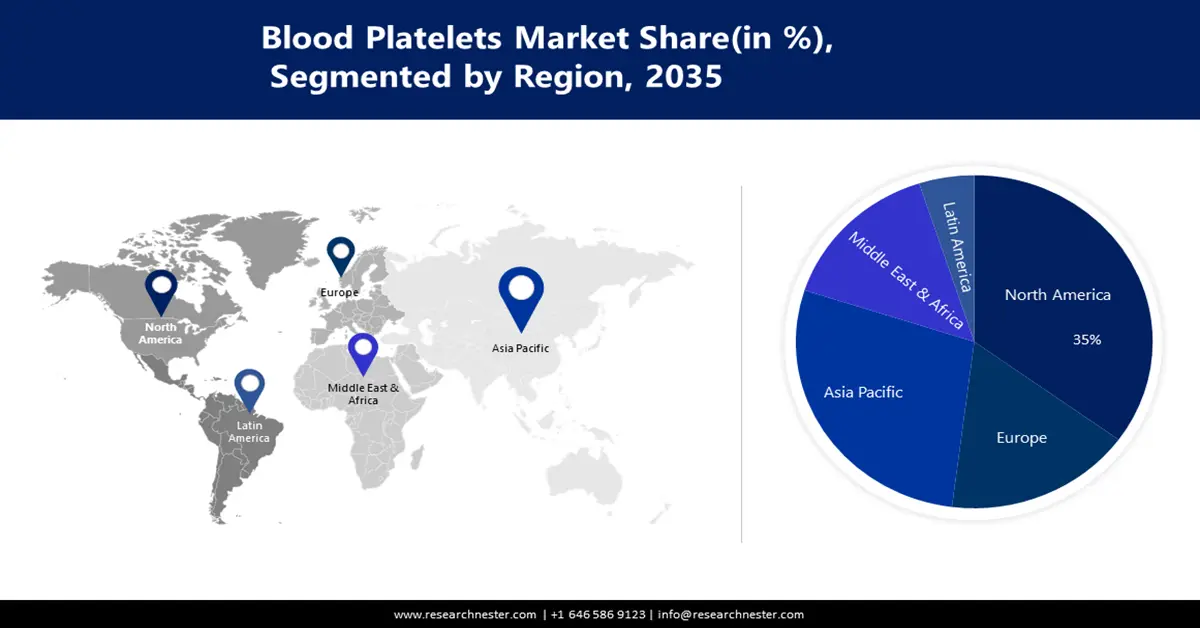

- North America blood platelets market will hold over 35% share by 2035, driven by increased demand for blood transfusion, rising number of accidents, and economic growth boosting healthcare spending.

- Asia Pacific market will capture a 28% share by 2035, driven by high prevalence of bleeding disorders, rising trauma cases, and advancements in healthcare infrastructure raising blood donation awareness.

Segment Insights:

- The hospitals segment in the blood platelets market is projected to hold a 72% share by 2035, fueled by increasing hospital admissions, surgeries, and better availability of blood platelets.

- The platelet function disorder segment in the blood platelets market is projected to secure a 51% share by 2035, driven by the rising cancer cases leading to acquired platelet dysfunction and transfusion needs.

Key Growth Trends:

- Increasing Geriatric Population

- Growing Prevalence of Blood-Related Disorder

Major Challenges:

- High Risk Related to the Transmission of Infections

- High Treatment Cost Associated

Key Players: Aggredyne Inc., Sysmex Corporation, Haemochrom Diagnostics GmbH, Eurobio Scientific, LABiTec Labor BioMedical Technologies GmbH, Thermo Fisher Scientific Inc., PerkinElimer Inc., Werfen, S.A., F. Hoffmann-La Roche Ltd., Terumo Corporation.

Global Blood Platelets Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.71 billion

- 2026 Market Size: USD 5.96 billion

- Projected Market Size: USD 9.13 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Blood Platelets Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Geriatric Population – The aging population is more prone to conditions requiring platelet transfusion such as cancer, cardiovascular disease, and chronic liver disease. As the global population ages, the demand for blood platelets is anticipated to grow due to the high prevalence of age-related health issues.

- Growing Prevalence of Blood-Related Disorder - With the growing prevalence of chronic blood disorders such as hemophilia, myelofibrosis, and thrombocytopenia, the demand for platelets is growing. As these conditions demand regular platelet transfusion to manage bleeding episodes. Around 324,648 out of 5.5 billion people worldwide have an identified bleeding disorder, reported as by the World Federation of Hemophilia's 2019 annual global survey.

- Surge in Number of Surgical Procedures - The increasing number of surgical procedures worldwide also contributes to the increased need for blood platelets. The increase in orthopedic and cardiac surgeries has increased the need for platelets in hospitals. In addition, increased organ transplantation such as kidney, corneal implants, and others has increased the demand for platelets. Recorded by World Observatory on Donations and Transplants, 153,863 organs were transplanted annually in 2019, which is an increase of 4.8% from 2018.

Challenges

- High Risk Related to the Transmission of Infections - Blood transfusions comprise significant health risks. Among these, transmission of infectious organisms remains one of the most concerning complications. Hepatitis B used to be the biggest transfusion risk. Also, there may be a chance of wrong blood group typing while transferring the blood to the patients. However, unnecessary blood transfusions should be avoided to reduce the risk of infection and other complications.

- High Treatment Cost Associated

- Shortage of Blood Donors

Blood Platelets Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 5.71 billion |

|

Forecast Year Market Size (2035) |

USD 9.13 billion |

|

Regional Scope |

|

Blood Platelets Market Segmentation:

Application

The platelet function disorder segment is assumed to dominate the blood platelets market with a revenue of 51% by the end of 2035. The growth of this market is majorly driven by the growing prevalence of cancer among the population. Chronic myelogenous leukemia and various myeloma cancers result in the development of acquired platelet dysfunction in some cancer patients. Therefore, cancer patients often have to receive platelet transfusions. In addition, chronic platelet dysfunction increases the need for platelet transfusions. The incidence of myeloma in the UK is projected to increase by 11% between 2014 and 2035, reported as by Cancer Research UK Statistics 2021. These figures indicate an increasing demand for platelet transfusions in the treatment of cancer patients. Therefore, platelets are often given to such patients to reduce the need for red blood cells, surgical blood loss, and complications such as reoperation due to bleeding.

End Users

The hospital segment is predicted to witness the largest share of 72% during the time period. The expansion of the segment can be attributed on the back of the accessibility of talented experts in the hospitals. The blood platelets market is expanding as a result of an increase in hospital admissions for patients with cancer, hemophilia, and other severe platelet disorders. Furthermore, higher accessibility of blood parts in hospitals brings about expanded use of blood platelets, bringing about expanded reception. Also, blood platelets are in high demand in hospitals as a result of an increase in the number of surgeries and severe injuries that necessitate blood transfusions. Additionally, promotive reimbursement policies have resulted in high demand for blood platelets in the hospital segment.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Platelets |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Platelets Market Regional Analysis:

North American Market Insights

North America industry is anticipated to hold largest revenue share of 35% by 2035. The growth of the market in this region is primarily driven by the increased demand for blood transfusion, followed by the rising number of accidents. As per the U.S. Department of Transportation, the number of people who died in motor vehicle traffic crashes increased to 9,560 in the first quarter of 2022. Furthermore, in the North America region, several countries have been experiencing economic growth which is expected to contribute to the increased healthcare spending and demand for advanced medical treatments.

APAC Market Insights

The Asia Pacific region market for blood platelets is estimated to experience significant market expansion with a revenue of 28 percent by the end of the predicted period. The growth of this sector is driven on the back of several factors such as a high number of the presence of bleeding disorder, especially in emerging economies such as India and China. Besides, the growing number of trauma cases and advancement in healthcare infrastructure in the region are raising awareness related to blood donation in the Asia Pacific region. Blood donation in China grew by more than 40 percent between 1998 and 2020 due to growing awareness.

Blood Platelets Market Players:

- Aggredyne Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sysmex Corporation

- Haemochrom Diagnostics GmbH

- Eurobio Scientific

- LABiTec Labor BioMedical Technologies GmbH

- Thermo Fisher Scientific Inc.

- PerkinElimer Inc.

- Werfen, S.A.

- F. Hoffmann-La Roche Ltd.

- Terumo Corporation

Recent Developments

- Aggredyne, Inc. announced the AND Drug Administration approval for its AggreGuide A-100 ADP Assay testing cartridge, an in vitro diagnostic tool. It is used to assess the effects of antiplatelet drugs that target the platelet P2Y12 receptor. The clearance enables the company to market products across the United States and broadens the range of additional tests that may be performed using the A-100 equipment.

- Terumo Blood and Cell Technologies officially launched MUGARD WB Platelet Pooling Set after receiving clearance from U.S. Food and Drug Administration clearance. It is the first platelet pooling set in the US to receive approval for seven-day storage and can be really helpful at times platelet storage.

- Report ID: 4719

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Platelets Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.