Blood Collection Tubes Market Outlook:

Blood Collection Tubes market size was valued at USD 6.2 billion in 2025 and is projected to reach USD 10.8 billion by the end of 2035, growing at a CAGR of 5.8% during the forecast period, i.e., between 2026-2035. In 2026, the industry size of blood collection tubes is estimated at USD 6.5 billion.

The heightened demand for laboratory diagnostics and the escalation in chronic diseases, requiring frequent blood-based testing, are the key factors behind the extensive growth of the market. Therefore, the report by the World Health Organization in November 2024 revealed that diabetes cases accounted for 830 million cases in 2022, and the occurrence has been rising continuously in low and middle-income countries, thereby positively influencing market growth.

Furthermore, the rise of point-of-care testing and home-based sampling solutions is expanding both access and convenience, hence accelerating adoption in decentralized healthcare settings. In this regard, the article published by AJLM in April 2025 researched four brands called VACUCARE, VACUETTE, VACUTEST, and V-TUBE, using samples from 300 volunteers. VACUCARE tube was the best out of all further, underscoring the importance of analysis of the tubes, especially during shortages, to ensure accurate care.

Key Blood Collection Tubes Market Insights Summary:

Regional Highlights:

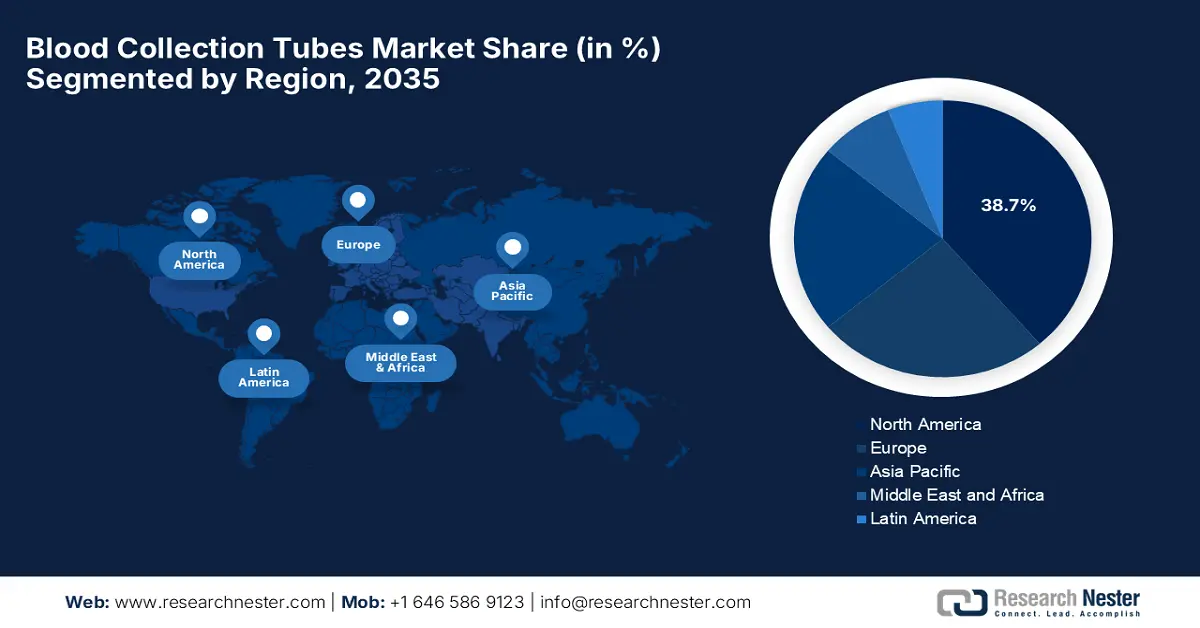

- North America is predicted to hold the largest revenue share of 38.7% by 2035, driven by increasing investments in the sector and a growing focus on early disease diagnosis and preventive care.

- Asia Pacific is expected to be the fastest-growing region over the forecast period, owing to advancements in diagnostic technologies and rising healthcare investments.

Segment Insights:

- The plastic tubes segment is predicted to garner the largest share of 58.6% by 2035, propelled by the rising demand for safer, more durable collection devices in hospitals and diagnostic laboratories.

- The vacuum blood collection tubes segment is projected to capture 45.7% share by 2035, owing to increasing preference for safer, faster, and highly efficient blood collection technologies.

Key Growth Trends:

- Escalating patient pool

- Expanding healthcare infrastructure

Major Challenges:

- Supply chain disruptions

- Stringent administrative procedures

Key Players: BD (Becton, Dickinson, and Company), Greiner Bio-One International GmbH, Sarstedt AG & Co. KG, Quest Diagnostics Incorporated, Cardinal Health, Inc., F.L. Medical S.r.l., Improve Medical Instruments Co., Ltd., Hongyu Medical, Medtronic plc, Haemonetics Corporation, AB Medical, Inc., Hindustan Syringes & Medical Devices Ltd., SPC Co. Ltd, Intervac Medical, B. Medical Sdn. Bhd.

Global Blood Collection Tubes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: 6.2 billion

- 2026 Market Size: USD 6.5 billion

- Projected Market Size: USD 10.8 billion by 2035

- Growth Forecasts: 5.8%% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 11 September, 2025

Blood Collection Tubes Market - Growth Drivers and Challenges

Growth Drivers

- Escalating patient pool: The ever-increasing occurrence of chronic & infectious diseases such as cardiovascular diseases, cancer, and metabolic syndromes is the primary fueling factor for this landscape. Meanwhile, there has been a growing prevalence of HIV, hepatitis, tuberculosis, and COVID-19, which creates a constant surge in the demand for blood sampling systems. As per a WHO article, around 40.8 million individuals were affected by HIV in 2024, out of which 1.4 million are children and 39.4 million adults, further creating a huge necessity for the blood collection tubes.

- Expanding healthcare infrastructure: The rapid expansion of the medical ecosystem across developing economies such as China, Brazil, and India remarkably uplifts the market growth. For instance, in May 2025, the Unified Health Interface (UHI) introduced a new feature that enables blood bank discovery through integration with C-DAC’s e-RaktKosh. Also, citizens in India can easily locate nearby blood banks and access real-time blood stock availability from over 4,000 government and private facilities.

- Automated solutions & emerging technologies: The continued advances in blood collection technologies, such as vacuum-assisted systems, anti-coagulant and gel-separator tubes, are readily blistering growth in the market. In July 2025, OraSure Technologies, Inc. introduced HEMAcollect●PROTEIN, which is an advanced blood collection tube designed specifically for proteomic research. The product is developed by its subsidiary DNA Genotek, and contains a proprietary stabilizing liquid that preserves plasma proteins in whole blood for up to seven days at ambient temperature.

Global Diabetes Statistics and Projections (2024-2050)

|

Statistic |

Value/Description |

|

Adult population (20-79 years) living with diabetes (2025) |

11.1% (1 in 9 adults) |

|

Number of adults living with diabetes (2024) |

Approximately 589 million |

|

Number of adults projected to live with diabetes (2050) |

Approximately 853 million (46% increase from 2024) |

|

Percentage with Type 2 diabetes |

Over 90% |

|

Percentage of adults with diabetes in low- and middle-income countries |

Over 81% (4 in 5 adults) |

Source: IDF

G7 GDP Trends and Their Influence on the Blood Collection Tubes Market Growth

|

Country |

2022 (Trillion USD) |

2023 (Trillion USD) |

2024 (Trillion USD) |

|

U.S. |

25.8 |

27.0 |

28.8 |

|

Japan |

4.3 |

4.2 |

4.2 |

|

Germany |

4.3 |

4.3 |

4.3 |

|

U.K. |

3.3 |

3.4 |

3.5 |

|

France |

3.0 |

3.1 |

3.1 |

|

Canada |

2.3 |

2.4 |

2.5 |

|

Italy |

2.1 |

2.1 |

2.1 |

Source: WEF

Challenges

- Supply chain disruptions: One of the primary challenges in the market is the shortage of raw materials and supply chain disruptions. Also, there has been a shortage of plastic polymers coupled with fluctuations in raw material costs, which have resulted in increased manufacturing costs, making it challenging for suppliers to maintain steady production. Besides the supply chain disruptions caused by the geographical tensions, logistical delays have created a strain on the availability of these components.

- Stringent administrative procedures: The market faces considerable hurdles caused by the strict governing bodies. These tubes are often classified as medical devices since they directly impact patient safety and diagnostic accuracy. Therefore, manufacturers must adhere to the safety standards, which are actually both time and finance-consuming, making it challenging for firms from developing nations, hence creating a barrier to market expansion.

Blood Collection Tubes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 6.2 billion |

|

Forecast Year Market Size (2035) |

USD 10.8 billion |

|

Regional Scope |

|

Blood Collection Tubes Market Segmentation:

Type Segment Analysis

Based on the type plastic tubes segment is predicted to garner the largest share of 58.6% in the market during the forecast period. The dominance of the segment is effectively attributable to the increased demand for safer, more durable collection devices in hospitals and diagnostic labs. In December 2022, ASP Global acquired Nashville-based RAM Scientific, which is a leader in 100% plastic capillary blood collection devices, and this move enhances ASP Global’s supply chain capabilities and expands its portfolio with RAM’s proprietary SAFE-T-FILL technology, which offers safe, glass-free blood collection tubes.

Technology Segment Analysis

In terms of technology vacuum blood collection tubes segment is projected to grab a share of 45.7% in the market by the end of 2035. The growth in the subtype originates from the escalating preference due to their safer, faster, and highly efficient blood collection. In October 2024, Loop Medical reported that it had developed Maxflow, a compact, high-volume blood collection device compatible with common vacuum blood collection systems like BD Vacutainer and Sarstedt S-Monovette. The company also stated that Maxflow can collect up to 4 ml of blood, suitable for various diagnostic tests, while minimizing patient discomfort.

End user Segment Analysis

Based on end user hospitals segment is anticipated to capture a significant share of 40.6% in the market during the discussed time frame. The growing patient inflow and expansion of healthcare infrastructure are the key factors behind this leadership. Besides, the increasing burden of chronic diseases also necessitates frequent blood tests, followed by the government healthcare programs improving diagnostic services, hence denoting a positive segment outlook.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Technology |

|

|

End user |

|

|

Trade |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blood Collection Tubes Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 38.7% in the market by the end of 2035. The dominance of the region is attributable to the increasing investments in this field and a growing focus on early disease diagnosis and preventive care. AIC reported that private equity has invested USD 280 billion over the last decade across more than 1,800 life sciences and medical device companies in the U.S. It also stated that it helped Helix conduct over 10 million COVID-19 tests and for Anthos Therapeutics to develop late-stage blood clot treatments, thus benefiting overall market growth.

The U.S. is augmenting its leadership over the regional market on account of its large patient population and widespread adoption of modern diagnostic technologies. The country also benefits from the presence of numerous leading manufacturers and distributors, which support continuous market expansion. In 2022, Thermo Fisher Scientific reported a total of USD 59 million expansion of its clinical research facility in Campbell County, Kentucky, which will add 43,000 square feet to the existing lab space, thereby effectively boosting pharmaceutical product testing capabilities in the country.

Canada is gaining enhanced momentum in the market owing to the rising healthcare expenditure and public health systems that emphasize quality diagnostics. In this context, the Toronto Memory Program became the first clinic to offer the PrecivityAD2 blood test from C2N Diagnostics in January 2025, enabling non-invasive detection of Alzheimer’s disease through a simple blood draw. The company further noted that this test addresses long diagnostic delays caused by limited access to costly PET scans and specialists, improving early diagnosis in the country.

Historic Influencers in the U.S. Impacting the Blood Collection Tubes Market

|

Key Market Driver |

Supporting Data |

|

Growth in Medical R&D |

U.S. medical and health R&D reached $245.1 billion in 2020, up 11.1% from 2019. |

|

Expansion of the Biopharmaceutical Sector |

Biopharma invested $122.2 billion in 2020, a 36.65% increase since 2016. |

|

Federal Funding by NIH |

NIH funding totaled $48.9 billion in 2020. |

|

Increased BARDA Funding |

BARDA funding rose from $562 million in 2019 to $4.06 billion in 2020. |

|

Growth in Diagnostic & Healthcare Services |

R&D in healthcare services grew 182.93% between 2016 and 2020. |

|

Investment by Academic & Research Institutions |

Academic R&D investment totaled $16.8 billion in 2020. |

Source: Research America

APAC Market Insights

Asia Pacific is predicted to be recognized as the fastest-growing region in the blood collection tubes market over the analyzed time frame. Key factors propelling growth in the region include advancements in diagnostic technologies and increasing healthcare investments. Besides, the central countries such as China and India are displaying notable developments in manufacturing capabilities, such as the installation of integrated blood collection tube production systems, enhancing local supply and reducing dependency on imports, hence making it suitable for standard market growth.

China is reinforcing its dominance over the regional landscape of the blood collection tubes market due to the heightened demand for diagnostic services and a huge focus on enhancing manufacturing capabilities. In January 2025, Terumo Blood and Cell Technologies stated that it had signed an MoU with the Shandong Institute of Medical Devices and Pharmaceutical Packaging Inspection in Hangzhou, China, to integrate production, research, academia, and application to drive innovation in the medical device sector, hence a positive market outlook.

India is also demonstrating strong growth in the Asia Pacific’s market, primarily fueled by advancements in manufacturing technologies and increasing healthcare investments. In May 2023, CML Biotech reported that it had inaugurated the world’s first integrated blood collection tube manufacturing machine, ICHOR, supplied by Husky, Canada. The company further underscored that the machine has the capacity to produce 800,000 tubes per day, marking a remarkable advancement in blood collection tube manufacturing technology.

India Blood Centre Registrations and Blood Collection Data (2021-2024)

|

Year |

Total Registered Blood Centres |

Total Blood Collection (January-December) |

Total Collection via Camp (January-December) |

|

2021 |

3337 |

4,588,541 |

1,691,098 |

|

2022 |

3811 |

8,028,781 |

3,637,394 |

|

2023 |

4029 |

12,695,363 |

5,005,770 |

|

2024 (October) |

4263 |

11,710,951 (Jan-Oct) |

4,235,629 (Jan-Oct) |

Source: DGHS

Europe Market Insights

Europe is expected to grow steadily in the regional blood collection tubes market during the timeline between 2026 to 2035. The sector is progressing due to the notable shift toward automation and plastic products, as healthcare providers increasingly prioritize safety, efficiency, and sustainability. In September 2024, Sysmex Netherlands and Belgium together announced the upcoming launch of CapitainerSEP10, a device that enables accurate, room-temperature-stable, plasma-like sample collection.

The U.K. is also strongly propagating in Europe’s blood collection tubes market, efficiently backed by the growing burden of chronic diseases and increasing blood donation rates. In August 2025, Tasso, Inc. and SheMed together declared that they had launched an at-home blood testing program in the country to support safer, personalized GLP-1 weight loss treatments for women. The initiative uses the Tasso+ device to enable comprehensive lab screening without clinic visits, which has benefited thousands of women in the country.

Germany is also expanding in the regional blood collection tubes market owing to the widespread utilization of serum-separating tubes and advancements in automation, and a shift towards sustainable materials. In April 2025, DF Group declared that it was entering the blood plasma market through its new subsidiary, called Deutsche Blutplasma HP GmbH. Besides, the company also signed an agreement to acquire assets from the insolvent Ruhr-Plasma-Zentrum Bochum GmbH, marking a strategic move in the pharmaceutical sector.

Key Blood Collection Tubes Market Players:

- BD (Becton, Dickinson, and Company)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Greiner Bio-One International GmbH

- Sarstedt AG & Co. KG

- Quest Diagnostics Incorporated

- Cardinal Health, Inc.

- F.L. Medical S.r.l.

- Improve Medical Instruments Co., Ltd.

- Hongyu Medical

- Medtronic plc

- Haemonetics Corporation

- AB Medical, Inc.

- Hindustan Syringes & Medical Devices Ltd.

- SPC Co. Ltd

- Intervac Medical

- B. Medical Sdn. Bhd.

The global market is extremely consolidated, wherein the top five players, i.e, BD, Greiner Bio-One, Terumo, Nipro, and Sarstedt, captured the command over the maximum market share. This dominance became possible with their extensive product portfolios, robust global distribution networks, and strong brand recognition. Furthermore, leading players are readily expanding their presence in emerging markets through strategic acquisitions, partnerships, and domestic manufacturing units.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In March 2025, Becton, Dickinson and Company and Babson Diagnostics together notified the study results using BD MiniDraw Capillary Blood Collection technology, which demonstrated that blood tests are accurate when using several drops of blood collected from a finger prick, as when the sample is taken from a vein.

- In January 2024, Abacus Dx reported that it had launched the RNA Complete BCT, which is a specialized tube designed for advanced molecular and genetic testing applications. It preserves cell-free RNA (cfRNA) stability for up to seven days at room temperature.

- Report ID: 8094

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blood Collection Tubes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.