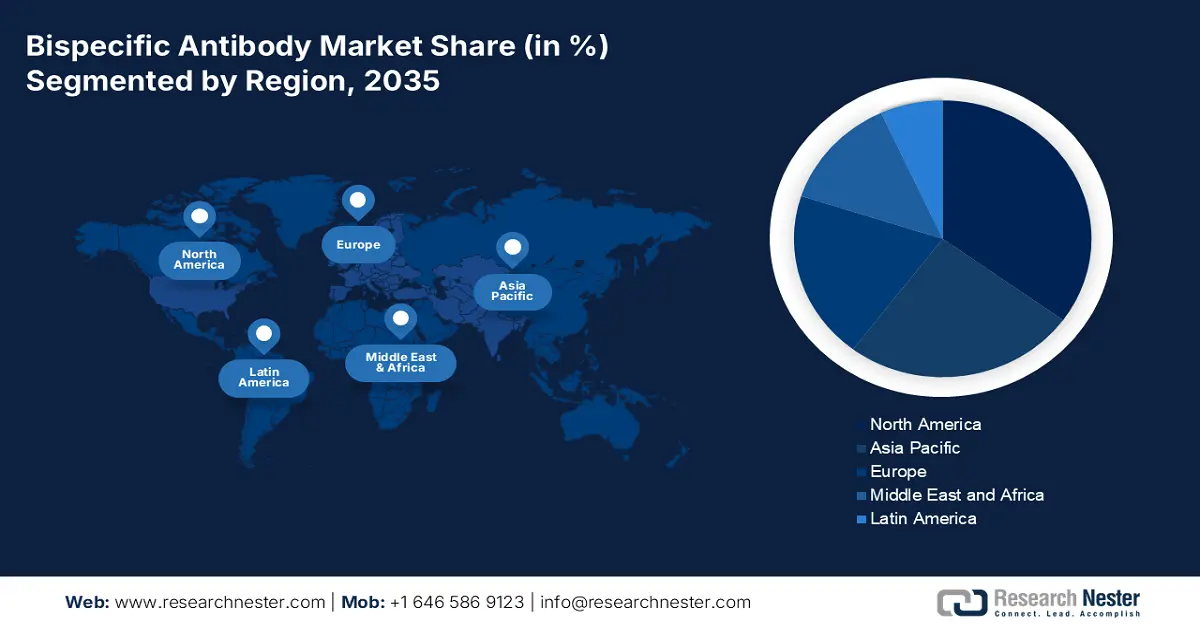

Bispecific Antibody Market Regional Analysis:

North American Market Insights

North America is projected to hold over 35% share of the global bispecific antibody market throughout the analyzed period. The rising demand and regulatory allowance for targeted and tailored therapies are ensuring the region’s proprietorship in coming years. According to the report from the Personalized Medicine Coalition (PMC), in 2022, over 34.0% of the newly approved drugs in the U.S. were personalized therapeutics, designed to address the needs of patients with distinguished biological characteristics. It also highlighted that this category accounted for a 25.0% of the total FDA approvals till 2023 from 2015. Hence, it indicates the presence of a continuously advancing and supportive trading atmosphere for this sector.

The U.S. presents a large consumer base and reliable distribution channel for the market, empowered by its established healthcare infrastructure and improved public access to advanced cancer care. The estimated count of leukemia, lymphoma or myeloma in this country registered to be 187,740 in 2024, accounting for 9.4% of the total new cancer diagnoses, as per the Leukemia & Lymphoma Society. On the other hand, the nationwide frequent and strong commercial operations of global pioneers testify to the easy accessibility of required therapeutics, including BsAbs. On this note, in March 2025, Canopy signed a multi-year partnership with Texas Oncology to offer proactive care for patients across the nation.

APAC Market Insights

The Asia Pacific bispecific antibody market is estimated to be the 2nd largest by exhibiting a remarkable CAGR by 2035. Rising government initiatives to spread awareness about rare diseases and provide economic support to R&D cohorts is propelling the region’s pace of growth. For instance, in 2021, the government of India implemented the National Policy for Rare Disease, which allocated financial assistance up to USD 58532.8 per patient. This subsidy is effective for people, who are undergoing treatment in selected 12 Centers of Excellence (CoEs) around the country. Such initiatives focused on improving patient access to advanced treatments, coupled with improving insurance and reimbursement coverages, are ensuring wide adoption in this field.

China is increasingly becoming a hub of drug discovery and manufacturing for the market. With an unmatched production capacity and strong emphasis on clinical trials, the country is fostering a progressive environment for both domestic and international companies in this field. For instance, by the end of 2024 fiscal year, Akeso Biopharma, which specializes in BsAbs innovation, secured a commercial sale of USD 273.5 million, augmenting a 25.0% year-over-year growth. The company also achieved success in enlisting its breakthrough bispecifics, cadonilimab and ivonescimab, in the National Reimbursement Drug List (NRDL). Such accomplishments further inspire other pioneers to invest in this sector.