Bispecific Antibody Market Outlook:

Bispecific Antibody Market size was over USD 15.27 billion in 2025 and is poised to exceed USD 426.17 billion by 2035, growing at over 39.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of bispecific antibody is estimated at USD 20.7 billion.

The bispecific antibody market is primarily driven by a rise in the occurrence of cancer afflictions, such as hematological and other hard-to-treat malignancies, around the globe. According to the American Cancer Society, the number of new and death cases of cancer in the world accounted for 20.0 million and 9.7 million in 2022, respectively. It also predicted the count habitats affected by this condition to surpass 35.0 million by 2050. On the other hand, the Journal of Global Health revealed that the incidence and deaths due to multiple myeloma is poised to reach 2,15,313.3 and 1,58,095.1 by 2030. This demography signifies the increasing worldwide need for highly effective and tailored therapeutics, where bispecific antibodies (BsAbs) has shown promising results in targeting and treating carcinoma cells.

The recent boom in the immunotherapy industry is evolving the approach toward cancer care by introducing comparatively affordable payers’ pricing and less harsh alternatives. Simultaneously, several clinical evidence are identifying BsAbs to be one of the most suitable options to serve the same purpose. On this note, in October 2024, a Leukemia Research paper was published by ScienceDirect, demonstrating 99.0% probability of blinatumomab being cost-effective in treating children with B‑precursor acute lymphoblastic leukemia in Mexico. This therapy helped residents with high-risk first-relapse achieve 5.1 years of lifetime at an incremental cost of USD 31691.5, in comparison to standard consolidation chemotherapy. Currently, more explorations in the market are being conducted to discover wider applications.

Key Bispecific Antibody Market Insights Summary:

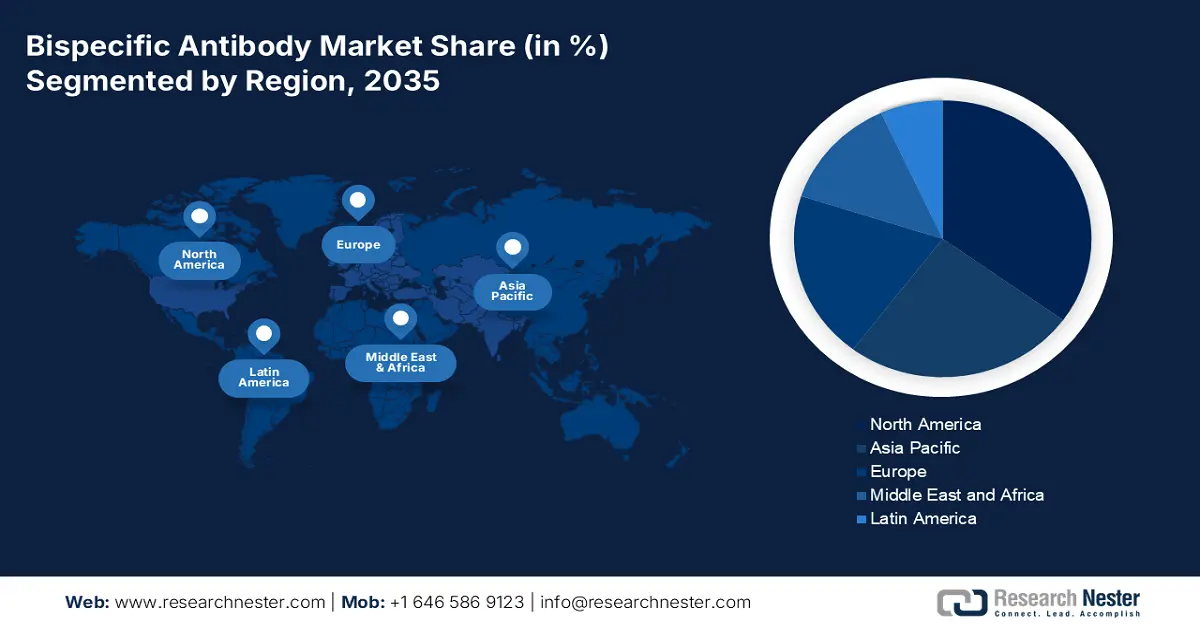

Regional Highlights:

- The North America bispecific antibody market is projected to capture a 35% share by 2035, driven by rising adoption of targeted therapies and favorable regulatory support.

- The Asia Pacific market is anticipated to experience remarkable growth from 2026 to 2035, attributed to government subsidies and expanding rare disease treatment initiatives.

Segment Insights:

- The oncology segment in the bispecific antibody market is expected to achieve a 65% share by 2035, driven by increasing demand for targeted therapies and precision oncology.

- The hospitals segment in the bispecific antibody market is anticipated to capture a 46% share by 2035, driven by the clinical effectiveness and specialized care provided by hospitals.

Key Growth Trends:

- Widening pipeline and indications

- Significant advances in protein engineering

Major Challenges:

- Financial hurdles in drug development

Key Players: F. Hoffmann-La Roche Ltd., Innovent Biologics, Ltd., Affimed GmbH, Pieris Pharmaceuticals, Inc., Mereo BioPharma Group plc, TG Therapeutics, Inc., MacroGenics, Inc., Pfizer Inc., GlaxoSmithKline plc, AbbVie, Inc.

Global Bispecific Antibody Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.27 billion

- 2026 Market Size: USD 20.7 billion

- Projected Market Size: USD 426.17 billion by 2035

- Growth Forecasts: 39.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 11 September, 2025

Bispecific Antibody Market Growth Drivers and Challenges:

Growth Drivers

-

Widening pipeline and indications: The rising research and development is escalating the efficacy of the products from the market. The enhanced therapeutic benefits of these therapies compared to traditional medications are further encouraging pioneers to explore more disease categories beyond oncology. On this note, a study published by NLM in June 2024 revealed a notable decline in multidrug-resistant rheumatoid arthritis with the use of bispecific T cell engager (BiTE), blinatumomab. It further indicated improved synovitis in ultrasound and FAPI-PET-CT and reduced autoantibodies with no signs of clinically relevant cytokine-release syndrome. Similarly, lupus, HIV, and COVID-19 are also being tested for such positive response.

- Significant advances in protein engineering: Technological advancements in binding the two different proteins enables the ability for modulation of protein-protein interactions, opening new possibilities for therapeutic interventions and functional kinetics of BsAbs medications. In this regard, in January 2024, WuXi Biologics gained approval for the patent application for its highly flexible bispecific antibody engineering platform, WuXiBody, from the U.S. Patent and Trademark Office.

Challenges

-

Financial hurdles in drug development: The initial stage of crafting related medicines involve extensive research and discovery efforts, including target identification, compound screening, and preclinical testing. These activities require significant investment in scientific expertise, laboratory facilities, and equipment. This may become expensive for new entrants, discouraging them in further operations. Thus, high R&D costs, which account for a substantial portion of the overall expenses in drug development, limits engagement in the market. Additionally, the inadequate supply and economic barrier in access to advanced healthcare may restrict worldwide adoption of these sector’s offerings.

Bispecific Antibody Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

39.5% |

|

Base Year Market Size (2025) |

USD 15.27 billion |

|

Forecast Year Market Size (2035) |

USD 426.17 billion |

|

Regional Scope |

|

Bispecific Antibody Market Segmentation:

Indication Segment Analysis

The oncology segment in the bispecific antibody market is poised to have the largest revenue share of about 65% till 2035. The advances and worldwide acceptance for targeted medicine to combat cancer is expected to drive the segment’s gain. By simultaneously targeting tumor cells and specific signaling pathways or growth factor receptors, BsAbs drugs in combination with other targeted agents can enhance the anti-cancer activity and overcome resistance mechanisms, improving treatment outcomes. This makes this type of therapeutic one of the most desired medications for malignancy treatment.

End user Segment Analysis

The hospital segment in the bispecific antibody market is anticipated to accumulate a significant portion of around 46% over the assessed timeline. The administration of associated therapies in these organizations have been clinically proven to be most effective, making them the first point-of-care for a majority of the patients. Additionally, the presence of specialized professionals and pharmaceutical supply contribute to the hospitals being the primary medical setting. Moreover, the predominant captivity on government subsidies and steady capital influx, is securing the segment’s leading position in this sector.

Our in-depth analysis of the global bispecific antibody market includes the following segments:

|

Drugs |

|

|

Indication |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bispecific Antibody Market Regional Analysis:

North American Market Insights

North America is projected to hold over 35% share of the global bispecific antibody market throughout the analyzed period. The rising demand and regulatory allowance for targeted and tailored therapies are ensuring the region’s proprietorship in coming years. According to the report from the Personalized Medicine Coalition (PMC), in 2022, over 34.0% of the newly approved drugs in the U.S. were personalized therapeutics, designed to address the needs of patients with distinguished biological characteristics. It also highlighted that this category accounted for a 25.0% of the total FDA approvals till 2023 from 2015. Hence, it indicates the presence of a continuously advancing and supportive trading atmosphere for this sector.

The U.S. presents a large consumer base and reliable distribution channel for the market, empowered by its established healthcare infrastructure and improved public access to advanced cancer care. The estimated count of leukemia, lymphoma or myeloma in this country registered to be 187,740 in 2024, accounting for 9.4% of the total new cancer diagnoses, as per the Leukemia & Lymphoma Society. On the other hand, the nationwide frequent and strong commercial operations of global pioneers testify to the easy accessibility of required therapeutics, including BsAbs. On this note, in March 2025, Canopy signed a multi-year partnership with Texas Oncology to offer proactive care for patients across the nation.

APAC Market Insights

The Asia Pacific bispecific antibody market is estimated to be the 2nd largest by exhibiting a remarkable CAGR by 2035. Rising government initiatives to spread awareness about rare diseases and provide economic support to R&D cohorts is propelling the region’s pace of growth. For instance, in 2021, the government of India implemented the National Policy for Rare Disease, which allocated financial assistance up to USD 58532.8 per patient. This subsidy is effective for people, who are undergoing treatment in selected 12 Centers of Excellence (CoEs) around the country. Such initiatives focused on improving patient access to advanced treatments, coupled with improving insurance and reimbursement coverages, are ensuring wide adoption in this field.

China is increasingly becoming a hub of drug discovery and manufacturing for the market. With an unmatched production capacity and strong emphasis on clinical trials, the country is fostering a progressive environment for both domestic and international companies in this field. For instance, by the end of 2024 fiscal year, Akeso Biopharma, which specializes in BsAbs innovation, secured a commercial sale of USD 273.5 million, augmenting a 25.0% year-over-year growth. The company also achieved success in enlisting its breakthrough bispecifics, cadonilimab and ivonescimab, in the National Reimbursement Drug List (NRDL). Such accomplishments further inspire other pioneers to invest in this sector.

Bispecific Antibody Market Players:

- F. Hoffmann-La Roche Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Innovent Biologics, Ltd.

- Affimed GmbH

- Pieris Pharmaceuticals, Inc.

- Mereo BioPharma Group plc

- TG Therapeutics, Inc.

- MacroGenics, Inc.

- Pfizer Inc.

- GlaxoSmithKline plc

- AbbVie, Inc.

- Roche

- Sanyou Biopharmaceuticals Co., Ltd.

- Orion Corporation

- Amgen Inc.

The presence of research-based key pharma developers is expanding the pipeline of the market. They are competitively innovating new therapeutics and identifying extended indications to solidify their leadership. For instance, in May 2024, Amgen attained FDA approval for its Imdelltra (tarlatamab-dlle) in treating extensive stage small cell lung cancer with disease progression on or after platinum-based chemotherapy. In the same timeframe, Regeneron Pharmaceuticals achieved positive endpoints phase 1/2 trial on its first-in-class costimulatory bispecific antibody, REGN7075 (EGFRxCD28), in combination with Libtayo (cemiplimab) for treating patients with advanced solid tumors. This cohort of pioneers includes:

Recent Developments

- In April 2025, Roche received clearance from the European Commission for its Columvi (glofitamab) to be used in combination with gemcitabine and oxaliplatin. The combined bispecific antibody therapy is intended to treat diffuse large B-cell lymphoma patients, who are ineligible for autologous stem cell transplant.

- In March 2025, Sanyou Biopharmaceuticals announced the commercial launch of 73 whole-series bispecific antibody reference products. The new product pipeline was dedicated to provide robust support and mitigate critical challenges for associated drug developers.

- In January 2025, Orion Corporation partnered with Invenra to develop innovative bispecific antibody cancer therapeutics. This research collaboration agreed to utilize Invenra’s B-Body platform to serve the purpose by leveraging it from monoclonal antibody discovery to optimized panels of bispecific leads.

- Report ID: 5042

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bispecific Antibody Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.