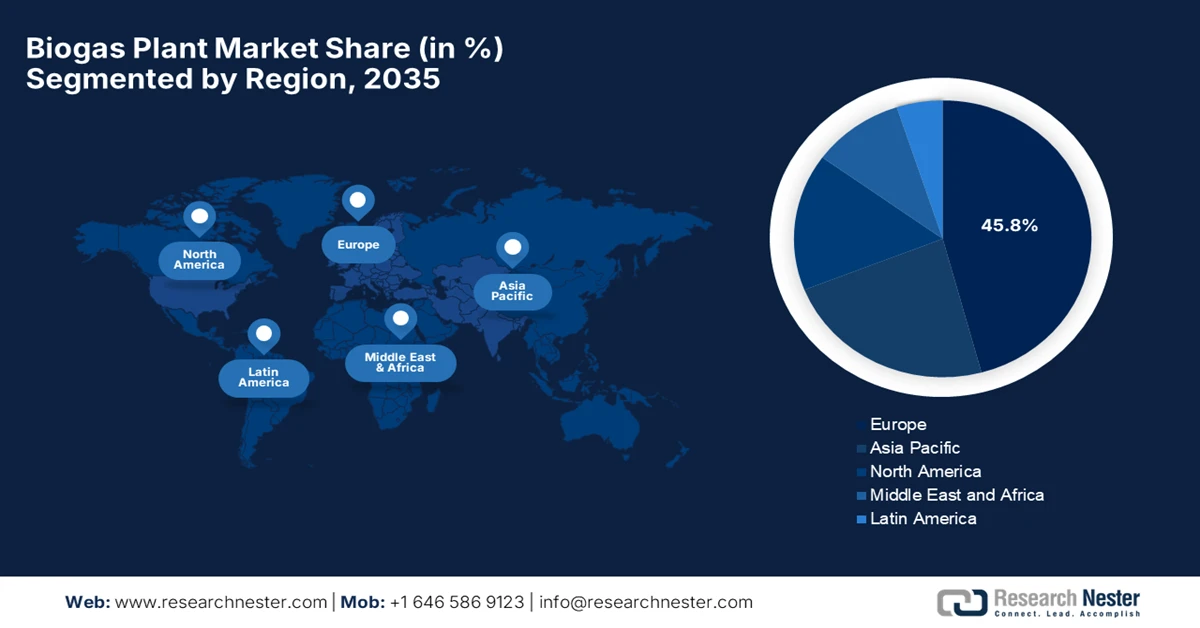

Biogas Plant Market - Regional Analysis

Europe Market Insights

Europe market is expected to lead the overall international landscape with the largest revenue share of 45.8% by the end of 2035. The dominance is mainly driven by the strong integration of biogas plants with the region’s renewable energy initiatives and circular economy frameworks. For instance, in October 2025, Wärtsilä Gas Solutions reported that it achieved a contract for upgrading a biogas plant in Bigadan AS, Denmark, which is capable of processing 6,000 Nm³ of raw biogas per hour. The plant is expected to be fully operational by the third quarter of 2026, and it supports Denmark’s green transition by enhancing biogas utilization. Hence, such instances will accelerate the market growth by increasing the supply of grid-quality biogas and demonstrating scalable, efficient technology. It also encourages investment in terms of renewable gas infrastructure, accelerating adoption across Europe.

Germany biogas plant market is steadily progressing owing to its long-standing experience in anaerobic digestion and strong technological expertise. The country’s market also benefits from research-driven innovation and funding grants, which continue to support improvements in plant efficiency and operational reliability. In this context, Clean Energy Wire in September 2025 officially reported that the country is continuously advancing in the biogas sector, leveraging a 7.9-billion-euro (USD 8.6 billion) support package approved by the EU, which is aimed at promoting climate-friendly electricity and heating. It also mentioned that this funding offers proper investment security for around 2,500 plants and incentivizes flexible operation to align with electricity generation. Hence, such instances promote growth by reducing financial risk for plant operators, fostering newer investments, modernization of existing facilities, and adoption of flexible technologies, which attracts more players to operate in the country.

The UK biogas plant market is also significantly growing, driven by decarbonization goals and a shift towards upgradation to biomethane for grid injection. Integration of biogas plants with municipal waste systems and commercial food supply chains is also a major driving factor for the country’s market. In October 2025, Kanadevia Inova reported that it had acquired the Lower Drayton and Wardley biogas plants in the country, which expanded its portfolio to 17 operational facilities. Both facilities are credited under the Renewable Heat Incentive scheme of the UK government and supply biomethane to the national gas grid, supporting decarbonisation and circular economy practices. Such strategic steps by key players enhance the country’s market exposure by increasing biomethane supply, encouraging investment in low-carbon infrastructure, and demonstrating high-quality biogas operations.

APAC Market Insights

The Asia Pacific market is expected to register the fastest growth owing to the heightened energy demand, suitable government incentives, and the extensive need to manage both agricultural and organic waste. Nations across the region are focused on launching and promoting suitable biogas technologies with a prime focus on addressing energy deficits and rural electrification. For instance, in February 2022, WELTEC BIOPOWER reported that it successfully commissioned its fourth biogas plant in Saitama Prefecture, Japan, which is equipped with a 450-kW cogeneration system that processes about 12,000 tons of organic waste and cattle manure annually. The plant consists of stainless-steel digesters that are especially designed to withstand seismic risks and utilizes technology to separate and dry digestate for use as compost and fertilizer, hence such instances significantly attract investments and accelerate market expansion in the years ahead.

China biogas plant market is growing on account of the government’s priority for renewable energy and the continued expansion of rural biogas plants. Domestic firms are unveiling large biogas projects with growing use of automated monitoring and control systems. As stated by SCIO Peoples Republic of China, in June 2025, the country is turning agricultural and organic waste into clean energy, with biomass power plants such as those in Xuzhou converting straw, kitchen waste, and forestry residues into electricity, biogas, and fuel pellets, reducing coal use and cutting carbon emissions. It also mentions the pilot projects in Shanghai and Anhui, which are advancing biomass-derived green fuels and liquefied bio-natural gas, whereas the centralized monitoring systems enhance efficiency and grid integration. Therefore, such advancements strengthen the market by creating new revenue streams from waste-to-energy solutions, driving the adoption of renewable energy infrastructure.

India shows significant growth in the biogas plant market, mainly driven by government support through various schemes and initiatives. The country is home to millions of operational household-level plants, along with numerous large-scale and industrial CBG facilities. For example, in July 2024, Maruti Suzuki India Ltd. announced the launch of a pilot biogas plant at its Manesar facility in Haryana, where biogas is generated from Napier grass and canteen food waste. The purified gas is used for cooking and manufacturing, while the residue is used as organic fertilizer, producing about 0.2 tons of biogas daily and reducing roughly 190 tons of CO₂ annually. Therefore, such pilot projects and government backing promote wider adoption of biogas technologies in India, strengthening the renewable energy sector in the coming years.

Top 10 States by Number of Biogas Plants Installed (Last 10 Years)

|

State |

Biogas Plants (Nos) |

|

Maharashtra |

71,653 |

|

Karnataka |

34,657 |

|

Madhya Pradesh |

32,120 |

|

Andhra Pradesh |

28,505 |

|

Punjab |

19,288 |

|

Telangana |

11,159 |

|

Chhattisgarh |

11,030 |

|

Kerala |

9,639 |

|

Uttarakhand |

8,362 |

|

Gujarat |

5,427 |

Source: Ministry of New and Renewable Energy, December 2025

North America Market Insights

The increasing emphasis on sustainable waste management and renewable energy integration across agricultural, municipal, and industrial sectors is efficiently driving business in the North America biogas plant market. The region also benefits from advanced anaerobic digestion technologies and rising adoption of biogas upgrading for pipeline injection as well as transportation fuel use. In July 2024, PlanET Biogas USA Inc. reported that in the past 12 months, completed 12 new anaerobic digestion (AD) plants across the U.S., 10 of which include PlanET STATERON RNG upgrading technology. It also mentioned that these facilities capture greenhouse gases, manage manure efficiently, and will effectively generate additional revenue for rural communities, whereas PlanET provides full engineering, operational, and technical support. Thus, such advanced AD technologies and biogas upgrading from major pioneers create new revenue streams and promote wider adoption, driving market growth in the upcoming years.

In the U.S., the biogas plant market is mainly fueled by the large-scale deployment of projects across livestock farms, landfills, and wastewater treatment facilities. The country is witnessing participation from both the public and private entities, which has accelerated the commercialization of renewable natural gas. The Environmental Protection Agency provides a Biogas Toolkit that serves as a resource hub for stakeholders who are involved in biogas projects, by offering guidance across project phases, sectors, and technical, financial, and regulatory aspects. It compiles tools, handbooks, and best practices from programs like AgSTAR, LMOP, and the Global Methane Initiative to support anaerobic digestion, landfill gas, and renewable natural gas projects. The presence of increased government support is enabling efficient biogas project development, boosting renewable energy adoption, and reducing greenhouse gas emissions in the country.

The increasing focus on organic waste management and sustainable farming practices is the key factor driving the biogas plant market in Canada. The integration of biogas with district heating and combined heat and power systems is also facilitating a favorable business ecosystem in the country. NGIF Accelerator in November 2023 reported that it has awarded USD 365,900 to Hydron Energy for its innovative INTRUPTor system, which upgrades biogas to renewable natural gas, thereby offering lower costs and improved efficiency when compared to conventional technologies. This funding supports field testing in Alberta and Ontario and aims to advance clean energy commercialization in Canada. Moreover, through its Industry Grants program, NGIF collaborates with federal and provincial governments to de-risk pre-commercial technologies and increase the adoption of low-carbon solutions in the natural gas sector. Hence, these initiatives are strengthening the country’s market by promoting technological innovation and improving economic viability.