Biodegradable Packaging Market Outlook:

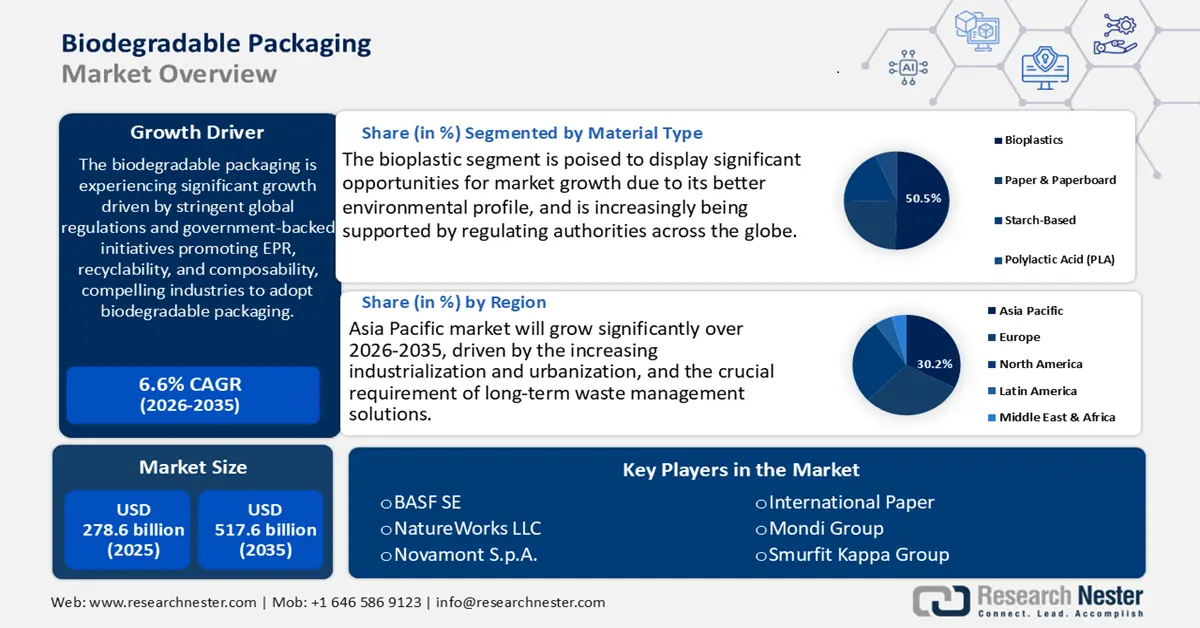

Biodegradable Packaging Market size was valued at approximately USD 278.6 billion in 2025 and is projected to reach around USD 517.6 billion by the end of 2035, rising at a CAGR of about 6.6% during the forecast period, from 2026 to 2035. In 2026, the industry size of biodegradable packaging is estimated at USD 342.4 billion.

The global biodegradable packaging market is expected to grow significantly over the projected years by 2035, primarily driven by the increasing adoption of regulatory measures to reduce single-use plastics. Under proposed federal policies such as the Break Free from Plastic Pollution Act and the CLEAN Future Act, both of which support EPR and standardized labeling for compostables, analysts anticipate increased demand for compostable and biodegradable packaging through 2030. In addition, about 40 countries have Extended Producer Responsibility (EPR) programs as of 2024. UNEP has also helped 12 countries create EPR policies and given technical assistance to over 30 countries to help them reduce plastic pollution through better product design, regulations, reuse, and recycling systems.

In addition to UNEP's Secretariat helping 53 countries under the Basel, Rotterdam, and Stockholm conventions improve plastic-waste management through the establishment of waste management hubs, regional policy guidance, and environmental education initiatives, the initiative has already involved over 45,000 businesses. Such policies are compelling producers, distributors, and purchasing departments to re-arrange their packaging plans with the help of compliant biodegradable materials. This is especially remarkable in the European Union, where the Circular Economy Action Plan implies complete recyclability or composability of all packaging in 2030. The overlap of environmental regulation, governmental policy requirements, and government-supported compliance mandates is defining a long-term structural change to scalable use of biodegradable packaging in all industries.

The biodegradable chain of packaging is growing quickly, together with a further shift towards agro-industrial residues and specialized biomass as feedstocks. The replacement of 500 tons of virgin polymer with 1 million tons of rice straw into cellulose-based packaging may save around 25% (USD 900 versus USD 1200 per ton), and remove an extra 2500 tonnes of raw material costs. The world bioplastics production capacity is projected to double significantly from 2.42 million tons in the year 2021 up to 7.59 million tons in the year 2026 due to regulatory mandates to contain plastic waste. Packaging-grade biopolymers flows are also growing, and regions such as Asia are producing to take over the export markets. Similarly, significant investments are being made in R&D and deployment, as the University of Tennessee, Knoxville, and Oak Ridge National Laboratory received USD 1 million to develop advanced lignin extraction and processing technologies for bio-derived packaging. These projects help shift raw food to processing channels and make trade-ready and industrial utilization of biodegradable packaging solutions.

Key Biodegradable Packaging Market Insights Summary:

Regional Highlights:

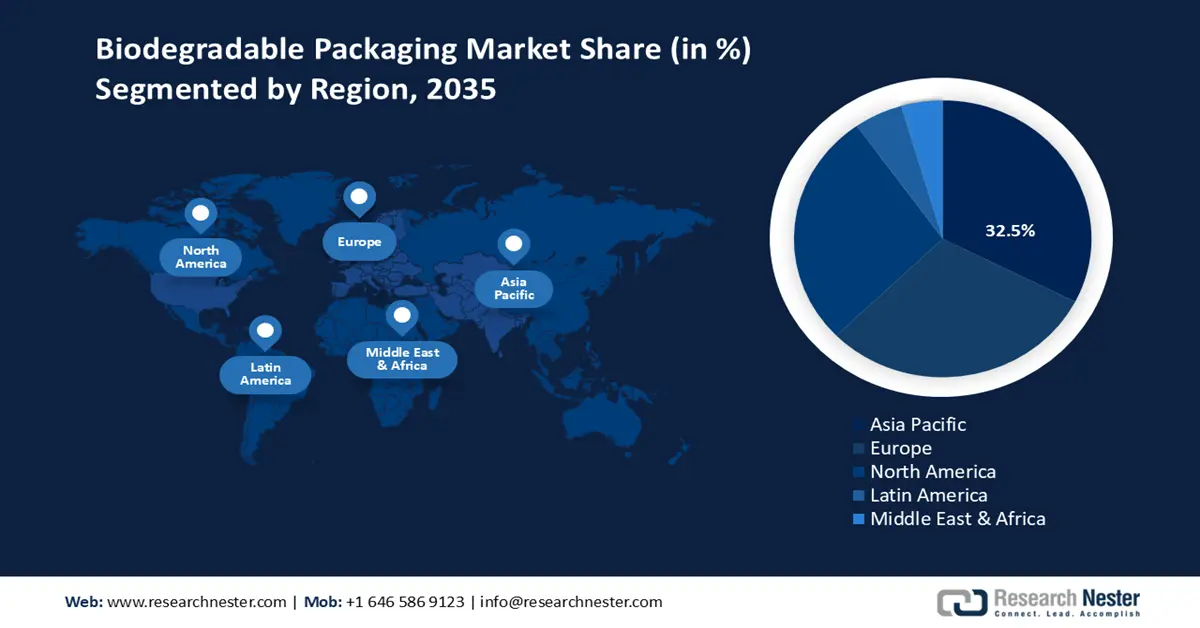

- The Asia Pacific biodegradable packaging market is expected to hold the largest 32.5% share by 2035, supported by increasing industrialization, urbanization, and expanding circular economy initiatives.

- Europe is anticipated to account for 30.2% share by 2035, owing to stringent environmental regulations, robust recycling infrastructure, and high consumer preference for sustainable packaging.

Segment Insights:

- The bioplastics segment in the biodegradable packaging market is projected to account for a dominant 50.5% share by 2035, propelled by regulatory support and advancements in biopolymer chemistry.

- The food and beverage segment is estimated to hold a significant 47.2% share during 2026–2035, driven by rising sustainability mandates and the demand for eco-friendly food packaging solutions.

Key Growth Trends:

- Technological innovations in polymer chemistry

- Plastic waste reduction

Major Challenges:

- Infrastructure restrictions for composting and waste management

- Inadequate R&D and long-term manufacturing

Key Players: BASF SE, NatureWorks LLC, Novamont S.p.A., International Paper, Mondi Group, Smurfit Kappa Group, Stora Enso Oyj, Amcor plc, Tetra Pak International S.A., Sealed Air Corporation, Uflex Ltd., Futamura Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, Kuraray Co., Ltd., DIC Corporation

Global Biodegradable Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 278.6 billion

- 2026 Market Size: USD 342.4 billion

- Projected Market Size: USD 517.6 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 1 October, 2025

Biodegradable Packaging Market - Growth Drivers and Challenges

Growth Drivers

- Consumer preference towards sustainable packaging: Customers' preference to have environmentally friendly products is a significant growth driver of biodegradable packaging. According to the 2024 Voice of Consumer Survey, consumers are willing to pay an average premium of 9.7% for products that are sustainably produced or responsibly sourced. Amid rising economic pressures, there is a growing shift in consumer sentiment toward sustainable packaging solutions, reflecting increased awareness and demand for environmentally conscious choices across the value chain. Millennials and Gen Z especially tend to pay more attention to eco-conscious brands, particularly in the food and beverage, personal care, and retail industries. Therefore, manufacturers are resorting to more biodegradable materials in a bid to live up to consumer expectations and gain market share. This indicates that the biodegradable packaging market is projected to increase notably, due to the increased consumer demand, which has contributed to the adaptation of the industry to changing consumer buying trends.

- Technological innovations in polymer chemistry: Technological breakthroughs of polymer chemistry to advance the biodegradability of the polymer packaging output, in terms of both cost and functionality. Developments including enzymatic additives and bio-based monomers have enhanced the polymer biodegradability, without compromising required strength and barrier properties. This is also supported by more recent progress in catalytic polymerization, which has resulted in increased production efficiency by approximately 20%, thereby scaling and lowering costs. With these kinds of improvements, the biodegradable packaging can easily match the traditional plastics in terms of cost and performance. Improved material characteristics increase the usage in all kinds of industries such as food packaging, medical devices, and consumer goods. This technological development is being propelled by continuous R&D investment financed by government grants and by the industry, thereby supporting the growth trend of biodegradable packaging market.

- Plastic waste reduction: Global efforts to use more energy and reduce plastic waste are escalating the demand for biodegradable package systems. A total of over 120 countries have already banned or imposed restrictions on the usage of single-use plastic materials by the year 2023, accelerating the transition to the use of more sustainable packaging materials, according to the United Nations Environment Programme (UNEP). The European Union is introducing a single-use plastics Directive that will aim not only to halve the amount of plastic waste by the year 2030 but also push companies to adhere to the new standards by using biodegradable substances instead of plastics. These policies not only reduce the usage of traditional plastics but also allow us to be creative and invest in environmentally-friendly alternative materials. The ever-growing interest in the values of a circular economy globally, combined with the need to reduce the use of plastic waste, is shaping a favourable regulatory environment, facilitating the evolution of the market and motivating businesses to adhere to the principles of sustainability.

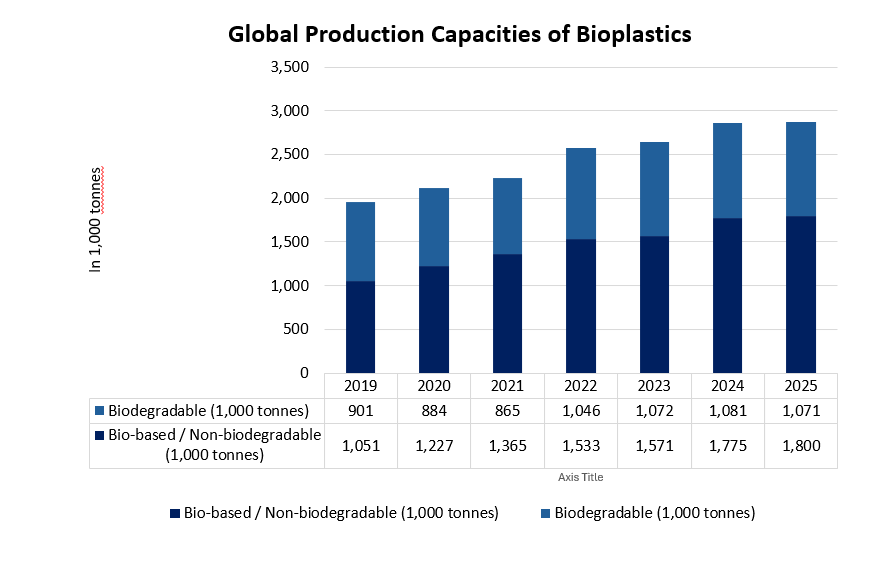

Global Bioplastics production capacity

The production of bioplastics is expected to have been increasing across the globe gradually, from around 2.1 million tons in 2020 to 2.8 million tons by 2025. Such growth is mainly driven by biodegradable plastics, produced as polyhydroxyalkanoates (PHA) and polylactic acid (PLA), representing almost 60% of bioplastics production capacity. This application growth speaks volumes about the ever-increasing nature of the biodegradable packaging materials due to their eco-friendly nature, and also because of their encouragement from the government. The growing production capacity indicates a shift within the industry towards more sustainable packaging applications that combine technical performance with environmental aspects. Asia Pacific is still the major player in terms of production, while Europe is witnessing an increasing drive in investment to develop local production of bioplastics.

(Source: european-bioplastics.org)

Challenges

- Infrastructure restrictions for composting and waste management: To a large degree, the successful use of biodegradable packaging depends on the accessibility to industrial composting infrastructure. Large gaps exist in composting plants to handle biodegradable waste material, especially in the U.S. and in some parts of the Asia-Pacific region. The U.S Environmental Protection Agency (EPA) notes that only about 4.1% of the municipal waste in the U.S. is currently composted, with a limitation to disposal alternatives of biodegradable packaging products. This lack of infrastructure undermines the environmental advantages of biodegradable packaging because the materials could be sent to landfills, where they will hardly be biodegraded. Absence of effective waste management systems stunts market expansion, elevates expenses on waste sorting, and raises manufacturers' trepidation to invest in biodegradable solutions in localities lacking well-developed composting infrastructure.

- Inadequate R&D and long-term manufacturing: RDD of biodegradable packaging technologies has restricted investment, regardless of the increasing demand and value. These comprise limited investment in green and sustainable chemistry innovations, largely due to high upfront costs, uncertain regulatory frameworks, and the complexity of transitioning to more sustainable production methods. Such underinvestment inhibits the progress of production efficiency and material performance, as well as the penetration of biodegradable alternatives into the market. The issue is balancing the expenditure on the RDD with the current profitability of a company, particularly small and mid-sized manufacturing enterprises, which do not have the resources to finance long-term technological development, to allow its wider appeal both within national and worldwide markets.

Biodegradable Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 278.6 billion |

|

Forecast Year Market Size (2035) |

USD 517.6 billion |

|

Regional Scope |

|

Biodegradable Packaging Market Segmentation:

Material Type Segment Analysis

The bioplastics segment is expected to grow with the highest revenue biodegradable packaging market share of 50.5% during the projected years, owing to its better environmental profile, and is increasingly being supported by regulating authorities across the globe. The U.S Environmental Protection Agency (EPA) estimates that bioplastics are at least 70% less greenhouse gas than typical plastics and are currently gaining popularity because of renewable feedstocks. There are also government policies and rules to use bio-based products, like the Circular Economy Action Plan, which has encouraged the use of bio-based products in the EU, dramatically increasing the need for bioplastics. Moreover, with developments in biopolymer chemistry, mechanical properties have been enhanced, allowing bioplastics to be used in a wider range of packaging technologies.

Polyhydroxyalkanoates (PHA) are characterized by 100% biodegradation in the oceans and on land, and a carbon-reduction effect of up to 70% compared to traditional plastics, reported by the U.S. Environmental Protection Agency. Meanwhile, Polybutylene Succinate (PBS) is also a preferred choice due to its outstanding thermal and mechanical characteristics, making it a suitable material to use in flexible packaging and films. Market research suggests that through higher use in food packaging and agricultural uses, the PBS demand will increase by 2035. These biopolymers combine to meet both high environmental laws and high green positioning desired by consumers, making the growth of the biodegradable packaging segment very high.

Application Segment Analysis

The food and beverage segment is projected to grow at a significant biodegradable packaging market share of 47.2% from 2026 to 2035, driving the development of sustainable food packaging solutions that guarantee food safety and shelf life. The Food and Agriculture Organization (FAO) reports that the world is increasing its food packaging needs by 3-5% per year, and that sustainability issues are now of paramount concern following intensified packaging waste regulations in Europe and North America. Biodegradable packaging provides biodegradable and compostable food packaging options complying with regulatory measures, including but not limited to the EU Single-Use Plastics Directive, which induces biodegradable packaging uptake within this sector.

Ready-to-Eat Packaging is escalating quickly because consumers are seeking the convenience and sustainability provided by this method of packaging, with the number of sales professionally expanding in worldwide dealings by 7% each year through the year 2035. This sub-segment has the advantage of using biodegradable films and wraps that help in prolonging shelf life, besides cutting back on plastic waste. With growing awareness of food safety and freshness, Fresh Produce Packaging is also gaining momentum with biodegradable solutions that are assisting Fresh Packaging in eliminating post-harvest losses, as noted by the Food and Agriculture Organization (FAO).

Product Format Segment Analysis

The film & wraps segment is expected to rise at a steady pace with the biodegradable packaging market share of 42.6% by 2035, owing to their wide use in the packaging of foods, such as cling films and flexible wraps, because they are light, ensure product freshness, and reduce plastic waste. Additionally, bioplastic film production technology and its related development on cellulose and PLA films have enhanced pressure benefits and composability, which propel its use in the food and beverage industry. This trend is in line with growing regulatory pressure against single-use plastics, specifically in the EU and North America, which drives growth in that sub-segment.

Our in-depth analysis of the biodegradable packaging market includes the following segments:

| Segment | Subsegment |

|

Material Type |

|

|

Product Format |

|

|

Processing Technique |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Biodegradable Packaging Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific biodegradable packaging market is anticipated to grow with the largest revenue share of 32.5% over the forecast period, by 2035. This growth is attributed to the increasing industrialization and urbanization, and the crucial requirement of long-term waste management solutions. The region already consumes about 63% of the total material utilization globally, resulting in the efficient utilization of resources, which can have a vast influence. Circular economy policies, including green public procurement programs, are becoming more common and promote sustainability initiatives such as biodegradable packaging in procurement systems. Additionally, the Sustainable Consumption and Production Roadmap, released by UNEP, highlights the importance of collaborative policy creation, capacity-building, and eco-labeling as key tools for achieving the adoption of biodegradable substances in all fields. Together with the increased environmental awareness, these efforts are supporting biodegradable packaging solutions that minimize the plastic footprint and enable regional sustainability targets.

The biodegradable packaging market in China is projected to dominate the Asia Pacific region from 2026 to 2035, primarily due to vigorous policy backing and massive demand in e-commerce logistics. By 2023, the biodegradable plastic demanded by the country had more or less 935,300 tons, more than 30% higher than it had been in 2009, and approximately 436,400 tons of such plastics had been consumed by the first half of 2024 alone. In addition, the market size of China's degradable plastic has maintained a steady growth, exceeding 17.2 billion yuan in 2023. Local statutes, including a ban on non-biodegradable plastics in Hainan since 2020, have also encouraged extensive use of PBAT and PLA-based express packaging: in 2020 alone, nearly 13 million fully degraded bags were sold, and more than 40 million biodegraded bags were used before 2021 by large carriers. These programs are improving market penetration, elevating environmental viability, and creating awareness of the people serving the urban and rural supply chains.

India’s biodegradable packaging market is expected to grow at a steady pace during the forecast years, attributed to policy provision and increasing consumption. The Indian packaging industry is one of the most rapidly growing industries in the world, with a CAGR of 22% to 25% Per capita packaging growth from FY2010-2020 has increased from 4.3kg to 8.6kg. National efforts like the single-use plastic ban and profit-linked tax incentives for food packaging further encourage bioplastic innovation. By using guar gum available in the country, research agencies such as BARC have come up with a biodegradable film that provides mechanical strength equivalent to conventional plastics. India, together with the National Packaging Program and new packaging innovation, is transitioning smartly to sustainable packaging, reducing dependence on imported polymers and achieving other environmental targets.

Europe Market Insights

By 2035, the European market is likely to expand with a substantial revenue share of 30.2%, driven by strict environmental rules & regulations and well-established recycling systems, as well as the high interest of citizens in sustainability. The key legislative pillars that have been established by the European Union, ensuring minimum plastic waste and promoting compostable and recyclable options, such as the Single-Use Plastics Directive and the Circular Economy Action Plan. This has led to increased demand for biodegradable substances, including paper and paperboard, and bioplastics such as PLA and PHA in the food and beverage, personal care, and pharmaceutical industries. The market is also being influenced by consumer approaches, as more than 60% of EU citizens favor sustainable packaging even at a premium cost, which drives the development of bio-based solutions.

Germany is the biggest market in the region with considerable funds on R&D, a circular economy roadmap, and robust industrial uptake of green packaging solutions. The UK, since Brexit, has remained consistent with EU standards and continues to actively fund the early stages of biodegradable materials using environmental grants and partnerships with the private sector. As EU-wide projects such as Horizon Europe invest in sustainable chemical innovation (totaling €1.8 billion), the region is projected to generate long-term growth, which will see it rise to achieve a market value of more than USD 6.4 billion by 2035, with an average CAGR of 6.7%.

North America Market Insights

The North American market is projected to capture about 27.5% revenue share with a CAGR of 7.6% between 2026 and 2035. This growth is driven mainly by the strong regulatory framework and the increase in environmental consciousness within food and beverages, pharmaceuticals, and personal care industries. The industry is further supported by the growth in the area through stringent and internationally recognized environmental regulations, such as those issued by the Occupational Safety and Health Administration (OSHA) and the National Institute of Standards and Technology (NIST), which provide safety and various standards in the chemical production industry. Sustainable practices in the industry are actively popularized by industry bodies like the American Chemistry Council (ACC) and certification and partnerships through Responsible Care. Moreover, manufacturers of biodegradable packaging would have access to incentives through government programs such as the Safer Choice program of the EPA, which encourages the use of safer chemicals. All these factors make the biodegradable packaging market in North America have sustainable growth with the support of policies and corporate sustainability pledges.

The U.S. biodegradable packaging market is likely to dominate the North American region with the largest share over the forecast period, due to state environmental policies and the trend toward consumption of environmentally sustainable products. The Green Chemistry Program by the Environmental Protection Agency (EPA) has proved highly beneficial, highlighting various green chemical processes since 2021, which has led to the reduction of Greenhouse emissions by 50%. In 2022, the Department of Energy dedicated almost USD 3 billion to clean energy and sustainable production of chemicals, which is 25% higher than in 2020. In addition, other countries, such as California, have also created stringent rules covering packaging waste that is driving the uptake of biodegradable packaging. With the increased attention paid to decreasing plastic waste and the development of bio-based materials, the market is likely to expand rapidly, which will put the U.S. right at the forefront of sustainable packaging over the next decade.

The biodegradable packaging market in Canada is predicted to grow substantially over the forecast years, owing to strong government policies and enormous investments in green technologies. The Canadian government has committed USD 800 million towards freshwater, clean energy, and sustainable chemicals production in 2023, 20% more than in 2020. The Zero Plastic Waste Strategy in Canada also promotes the use of biodegradable products, as it intends to reduce the use of single-use plastics by the year 2030. British Columbia and Ontario offer incentives to manufacturers of environmentally friendly packaging in the form of tax credits and grants. Besides, industry associations and government agencies, including Environment and Climate Change Canada (ECCC), enhance research activities to develop biodegradable polymers to aid in market growth. These efforts, together with the increased consumer awareness, are the basis behind the gradual market expansion of biodegradable packaging throughout Canada.

Key Biodegradable Packaging Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NatureWorks LLC

- Novamont S.p.A.

- International Paper

- Mondi Group

- Smurfit Kappa Group

- Stora Enso Oyj

- Amcor plc

- Tetra Pak International S.A.

- Sealed Air Corporation

- Uflex Ltd.

- Futamura Chemical Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Kuraray Co., Ltd.

- DIC Corporation

The global biodegradable packaging market is highly competitive, with a combination of large chemical players already established and numerous new specialized players. Key incumbents BASF SE and NatureWorks take the lead through R&D, good distribution, and extensive biodegradable portfolios. European companies such as Novamont and Mondi focus on local integration of the circular economy by using biorefineries and solutions based on compost-related products. Japanese players such as Futamura, Mitsubishi Chemical, Kuraray, and DIC—leverage technical material innovation, especially in PLA and cellulose films. The India-based firms like Uflex are making inroads with the help of cheap bio-based polymers. Sustainable material development, collaboration with brands working towards achieving ESG, and investing in a modern production capacity to address rising demand in the market are among the strategic endeavors across the board.

Top Global Biodegradable Packaging Manufacturers

Recent Developments

- In August 2025, Amcor made major improvements to its plastics recycling plant in Heanor, Derbyshire, UK, and achieved a larger upgrade of its wash plant and safety equipment with a view to improving the quality of recycles. The above improvements will see the plant generate an extra 2,800 tonnes of recyclate to be used in creating flexible packaging each year. It now incorporates an entirely in-house method, including sorting, washing, and reprocessing, and allows the practice of water recycling, as well as waste-to-energy. This investment reinforces the recycling network across Europe, which is utilized by Amcor, and is in line with the Plastic Packaging Tax used in the UK, as well as the Packaging and Packaging Waste regulation used in the EU.

- In April 2025, Amcor partnered with Riverside Natural Foods to roll out the MadeGood Trail Mix with AmFiber paper-based wrappers that would be curbside-recycled in the paper stream. This category-first innovation has been introduced using FSC-certified fiber, reducing by 77% virgin plastic in traditional bar wraps and increasing repulpability to meet the Western Michigan University standards. Independent in-home usage testing showed that 79% of consumers rated the paper-based wrapper as slightly or markedly superior to conventional plastic options, and they would let the packaging factor into their decision to buy.

- Report ID: 1187

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Biodegradable Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.