Bile Duct Cancer Market Outlook:

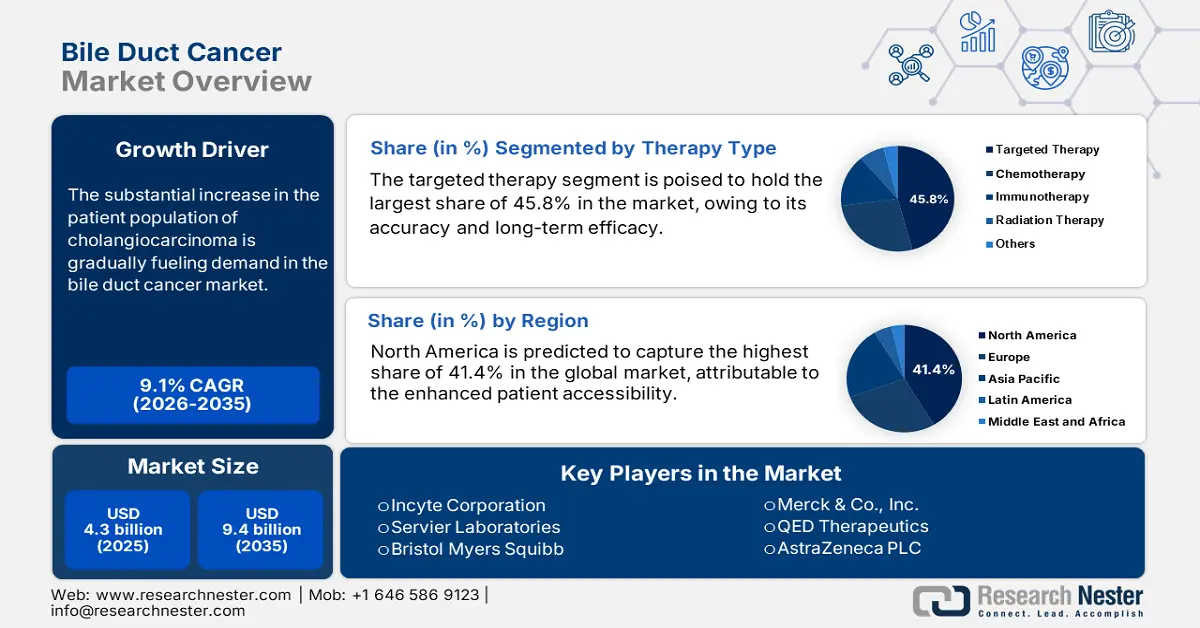

Bile Duct Cancer Market size was over USD 4.3 billion in 2025 and is estimated to reach USD 9.4 billion by the end of 2035, expanding at a CAGR of 9.1% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of bile duct cancer is estimated at USD 4.6 billion.

The substantial increase in the patient population of cholangiocarcinoma is becoming a global health crisis, which is the primary growth factor of the market. According to the Global Cancer Statistics report, approximately 122,462 new cases of BTC were registered from across the globe in 2022 alone. Another NLM study unveiled that the worldwide age-standardized incidence and mortality rates of gallbladder and biliary tract cancers (BTC) are estimated to reach 2.2 and 1.9 per 100,000 people, respectively, by 2030. These demographic trends, coupled with the rapidly aging societies, indicate a slow but steady expansion of the consumer base in this sector.

In the bile duct cancer market, the dynamics of payers’ pricing are stimulated by several key elements, including the rarity and severity of the disease, the availability of approved therapies, and the cost of R&D. Besides, the ultimate product pricing also depends on the evaluation thresholds of the clinical benefit and cost-effectiveness of new treatments for reimbursement coverage. However, the rising economic burden due to the resistance or recurrence of the associated ailments often forces patients to discontinue treatment, limiting widespread use and long-term cash inflow. Evidencing the same, a study published by the NLM in August 2024 revealed that the average monthly cost for each patient of BTC in the U.S. rose from USD 19,589 to USD 33,534 from 1st line to 3rd line treatment.

Key Bile Duct Cancer Market Insights Summary:

Regional Insights:

- North America is projected to secure a 41.4% share by 2035 in the Bile Duct Cancer Market, underpinned by advanced healthcare infrastructure, superior diagnostic capabilities, and strong R&D-driven pharmaceutical presence.

- Asia Pacific is anticipated to witness the fastest growth by 2035, owing to high disease prevalence, expanding high-risk populations, and rapid healthcare infrastructure development.

Segment Insights:

- The targeted therapy segment in the Bile Duct Cancer Market is projected to command a 45.8% share by 2035, propelled by its precision-based mechanisms and long-term efficacy in addressing genetic mutations prevalent in bile duct malignancies.

- The intrahepatic cholangiocarcinoma (iCCA) sub-segment is anticipated to account for a 40.5% share by 2035, supported by rising incidence rates and intensified R&D investments focusing on its well-defined mutational structure.

Key Growth Trends:

- Enhanced access to advanced diagnostics

- Improvement in therapeutic efficacy

Major Challenges:

- Complex and fragmented reimbursement landscapes

- Limited patient pool and diagnostic challenges

Key Players:Incyte Corporation, Servier Laboratories, Bristol Myers Squibb, Merck & Co., Inc., QED Therapeutics, AstraZeneca PLC, F. Hoffmann-La Roche AG, Pfizer Inc., Novartis AG, Bayer AG, Helsinn Group, Teva Pharmaceutical, Sun Pharmaceutical, Celltrion Inc., CSL Limited, Hikma Pharmaceuticals, Biocon Ltd., Pharmaniaga Berhad, Jazz Pharmaceuticals plc.

Global Bile Duct Cancer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 4.6 billion

- Projected Market Size: USD 9.4 billion by 2035

- Growth Forecasts: 9.1%% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Singapore

Last updated on : 16 September, 2025

Bile Duct Cancer Market - Growth Drivers and Challenges

Growth Drivers

- Enhanced access to advanced diagnostics: As the field of oncology detection introduces more accurate and faster solutions, the market gains traction. Particularly, the revolutionary discoveries through molecular profiling are enabling greater precision in the identification of actionable genetic mutations, creating scope for capitalization on large-scale screening programs. These advances are ultimately accelerating the development of novel therapies, which offer improved outcomes over traditional treatments. Moreover, the adoption of next-generation sequencing (NGS) in clinical practice is cultivating profitable precision medicine approaches in this sector.

- Improvement in therapeutic efficacy: With remarkable progress in the global biopharmaceutical industry, the pipeline of the bile duct cancer market is continuously expanding. Several R&D-based public and private organizations are developing less-harsh alternatives to radiotherapies, which can deliver better progression-free survival among patients. Besides, the elimination or minimization of adverse reactions through targeted and immune therapies is reducing the overall cost of treatment, influencing more afflicted individuals to invest in this category. Furthermore, recent developments in combination treatments are also securing wide utilization, even for chemotherapy.

- Increasing activities in extensive R&D: The amplifying volume of ongoing clinical trials focused on advances in the bile duct cancer market is being observed around the world. This creates extended pipelines for novel drug classes, combination regimens, and new delivery mechanisms. For instance, in December 2023, RenovoRx announced the expansion of its clinical development portfolio to prepare for starting a second Phase III trial on RenovoGem. It is a potentially effective combination drug-device product that delivers gemcitabine directly to a tumor without harming healthy neighboring tissues in cases of hard-to-treat bile duct cancers.

Historic Trends in the Patient Pool of the Market

Global Shift in Gallbladder and Biliary Tract Cancer (GBTC) Demography

(1990-2021)

|

Incidence |

Deaths |

Region |

||

|

1990 number |

2021 number |

1990 number |

2021 number |

|

|

9069.2 |

14 132.4 |

5047 |

5981.4 |

High‐income North America |

|

21 787.9 |

25 453.6 |

18 469.5 |

16112 |

Western Europe |

|

3406.4 |

5362.9 |

3561.5 |

5318.3 |

Central Latin America |

|

2205.6 |

5941.6 |

2273.5 |

5586 |

North Africa and the Middle East |

|

17 801 |

53 483.3 |

17 920.8 |

39221 |

East Asia |

|

4093.1 |

12 035.1 |

4182.6 |

11163.5 |

Southeast Asia |

|

747.6 |

1482.5 |

783.2 |

1555.3 |

Eastern Sub‐Saharan Africa |

Source: NLM

Trends in Therapeutic Innovations in the Bile Duct Cancer Market

Current Trials on Potential Drugs for BTC Treatment

|

Trial Name / Drug |

Trial Status / Results |

Indication |

Sponsor |

Study Timeline |

|

SAFIR-ABC10 |

Recruiting |

Advanced biliary tract cancer, gallbladder |

UCL and UCLH |

2025 |

|

Lynparza (Olaparib) |

Phase 2, recruiting |

Metastatic biliary tract cancer (DNA repair) |

Academic and Community Cancer Research United |

2020-2025 |

|

Bintrafusp alfa + Radiotherapy |

Phase 1, recruiting |

Advanced cholangiocarcinoma |

MD Anderson Cancer Center |

2021-2027 |

|

Tecentriq + Cotellic + Varlilumab |

Phase 2, recruiting |

Advanced biliary tract cancer |

ASCO |

2025-2028 |

|

TC-210 (mesothelin TCR) |

Phase 1/2, recruiting |

Mesothelin-expressing advanced solid tumors |

TCR2 Therapeutics |

2019-2028 |

|

AZD8205 (B7-H4 ADC) |

Phase 1/2, recruiting |

Advanced biliary tract cancer |

AstraZeneca |

2021-2027 |

|

Zanidatamab + chemo (+/- IO) |

Phase 3, recruiting |

HER2+ biliary tract cancer, first-line |

Jazz Pharmaceuticals |

2024-2030 |

|

Tinengotinib |

Phase 3, recruiting |

FGFR2-mutant advanced cholangiocarcinoma |

TransThera Sciences (Nanjing), Inc. |

2023-2026 |

|

Rilvegostomig + chemo |

Phase 3, recruiting |

Adjuvant BTC after resection |

AstraZeneca |

2023-2030 |

Source: UCL, MD Anderson Cancer Center, ASCO, and Clinicaltrials.gov

Challenges

- Complex and fragmented reimbursement landscapes: The bile duct cancer market often presents a distinct challenge through non-unified payer systems worldwide. The differences between individual public insurance policies may restrict coverage even for most approved drugs, as the approval criterion varies notably by framework. Besides, these payers prohibit themselves from reimbursing for premium-priced treatments despite the increasing occurrence of eligibility among BTC-affected patients, creating inequitable access in this field.

- Limited patient pool and diagnostic challenges: Although there are indications about future expansion in the demography, the current volume of the epidemiology related to the market is still low. This ultimately leads to less awareness and availability of the required diagnostic and therapeutic solutions. Such a scenario also discourages pioneers in this field from investing in extensive R&D projects, limiting the scope of progress for the merchandise in the upcoming years due to a lack of sustainable return-on-investment (ROI).

Bile Duct Cancer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 9.4 billion |

|

Regional Scope |

|

Bile Duct Cancer Market Segmentation:

Therapy Type Segment Analysis

The targeted therapy segment is poised to hold the largest share of 45.8% in the bile duct cancer market by the end of 2035. The leadership primarily originates from the accuracy and long-term efficacy of these therapies, which target specific genetic mutations that are prevalent in these malignancies. As a result, this leads to enhanced outcomes and safety profiles over conventional chemotherapy, justifying their premium pricing and rapid adoption into clinical guidelines. Exemplifying the same, in April 2024, the FDA gave fast-track clearance for CTX-009 in combination with Paclitaxel for metastatic or locally advanced biliary tract tumors that did not respond to previous treatments.

Cancer Type Segment Analysis

The intrahepatic cholangiocarcinoma (iCCA) sub-segment is estimated to lead the bile duct cancer market with a 40.5% share over the analyzed tenure. The continuously increasing incidence rates of this subtype, particularly in Western countries, are becoming a global health concern. This also attracted clinical focus and R&D investments predominantly on iCCA. Besides, this cancer has a more clearly defined mutational structure, which is highly amenable to targeted drug development compared to other anatomical kinds. Thus, more pharma and MedTech pioneers from this field are engaging their maximum resources in discovering eligible therapeutic candidates for the segment.

Distribution Channel Segment Analysis

Hospital pharmacies are expected to dominate the bile duct cancer market throughout the assessed timeframe, while accounting for a 60.5% share. Their contribution to the highest revenue generation can be defined and justified by the complex nature of BTC treatments, which mostly require well-equipped facilities, such as hospitals. Moreover, the involvement of intravenous chemotherapy, targeted therapies, and immunotherapies makes real-time administration and monitoring a necessity, which is only availed by these specialized clinical settings. Furthermore, the stockpiling tendency of in-house pharmacies creates a substantial surge in this sector from hospitals.

Our in-depth analysis of the bile duct cancer market includes the following segments:

| Segment | Subsegment |

|

Therapy Type |

|

|

Drug Type |

|

|

Diagnosis |

|

|

Cancer Type |

|

|

Distribution Channel |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bile Duct Cancer Market - Regional Analysis

North America Market Insights

North America is predicted to capture the highest share of 41.4% in the global bile duct cancer market over the discussed period. The enhanced accessibility through a well-established medical system, advanced diagnostic capabilities, and R&D-based pharmaceutical companies are solidifying the region’s forefront position in this sector. The heightening awareness about early detection and intervention also fosters steady cash inflow in the field in support of greater adoption of diagnostic services and treatments. Besides, favorable reimbursement and standardization policies create a lucrative business environment for the merchandise.

According to a report from the National Cancer Institute (NCI), the number of people in the U.S. living with liver and intrahepatic bile duct cancer reached 113,557 in 2022 alone. It also recorded the annual rates of new and death cases of this carcinoma to surpass 9.4 and 6.6 per 100,000 men and women during the same timeline. These figures signify the substantial nature of the demand base for timely detection and effective therapeutics spread across the country, benefiting the market. Besides, the nation’s growing abilities in molecular diagnostics enable personalized treatment approaches, further fueling the market.

Canada plays a prominent role in the North America bile duct cancer market on account of its publicly funded healthcare system and increasing innovation in advanced cancer therapies. Although the incidence of BTC remains relatively low, oncologists practicing in the country are actively promoting early utilization of precision medicine to prevent the potential epidemic. On the other hand, public payers of Canada are enabling a less expensive compliance processes for both domestic and foreign drug developers, which inspires them to expand their territory in the country.

APAC Market Insights

Asia Pacific is anticipated to become the fastest-growing region in the global bile duct cancer market by the end of 2035. Massive disease occurrence, enlarging high-risk populations, and rapid infrastructural development are the major growth factors behind the region’s escalated pace of progress in this field. Particularly, the increasing cases of liver fluke infections and hepatitis are evidently expanding the demography, and hence creating an inflated demand for advanced diagnostics and treatments. For instance, a 2024 NLM article recorded a notable 10% occurrence rate of HBV in East Asia. It also mentioned that approximately 49.3-64.0 million adults in Asia were anti-HCV positive during the timeline.

China is a key landscape of expansion for the Asia Pacific bile duct cancer market, owing to its large patient population and high incidence rates of liver diseases and parasitic infections. As a result, the country is witnessing a notable surge in diagnostic capabilities and a gradual increase in the availability of targeted therapies and immunotherapies. Besides, the nation’s growing emphasis on discovering new precision medicine candidates is also securing a steady domestic supply in this category. Furthermore, government initiatives, such as Healthy China 2030, are improving cancer care infrastructure by implementing subsidiary policies.

India is establishing itself as an emerging investment opportunity for the APAC bile duct cancer market expansion. The enlarging HBV-afflicted patient group and a lack of timely treatment are expanding the primary epidemiology of this sector. Massive developments in the national medical system and diagnostic network are also enabling high-throughput detection and disease management, prompting patients to invest more in this sector. Moreover, the exceptional growth in the biopharmaceutical industry is helping India cultivate localized supply chains of affordable and effective therapeutics.

Country-wise Hepatitis B Virus Epidemiology (2024)

|

Country |

Prevalence Rates of Chronic HBV (in %) |

|

India |

3 |

|

China |

3 |

|

Bangladesh |

5 |

|

Pakistan |

6 |

|

Nepal |

1 |

Source: NLM

Europe Market Insights

Europe is estimated to remain the second-largest shareholder in the global bile duct cancer market during the tenure between 2026 and 2035. The strong emphasis on cancer research and innovation is the major growth factor for the region in this sector. Besides, the widespread access to advanced diagnostics and targeted therapies, particularly in Western Europe countries, ensures continuation of the field’s expansion. On the other hand, the regulatory frameworks are also evolving with current pharmacology trends, making the landscape a golden opportunity for pioneers seeking globalization for their innovative pipelines.

The UK is portraying momentum in the market by facilitating accelerated regulatory approval and reimbursement of new treatments. The National Health Service (NHS) policies further accelerate the incorporation of next-generation disease-detection technologies and therapies into mainstream clinical practice. Evidencing such a favorable environment, in November 2023, the National Institute for Health and Care Excellence (NICE) enacted new guidelines promoting durvalumab as the first choice for treating BTC across England and Scotland, while providing access for 700 patients in England.

Germany is considered to be the growth engine for the Europe bile duct cancer market, which is shaped by its advanced healthcare infrastructure and strong emphasis on cancer treatment innovation. The country also benefits from high-quality diagnostic capabilities and early adoption of targeted therapies and immunotherapies among eligible patients. Furthermore, the nation’s well-established reimbursement system is boosting the rate of adoption in this sector by enabling adequate financial backing.

Country-wise BTC Incidence and Mortality Rates (2025)

|

Country |

BTC Incidence (per 100,000 person-years) |

BTC Mortality (per 100,000 person-years) |

|

France |

2.4 |

3.1 |

|

Germany |

2.5 |

3.8 |

|

Italy |

3.2 |

4.2 |

|

Spain |

2.5 |

3.5 |

|

UK |

1.6 |

3.2 |

Source: E-JLC

Key Bile Duct Cancer Market Players:

- Incyte Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Servier Laboratories

- Bristol Myers Squibb

- Merck & Co., Inc.

- QED Therapeutics

- AstraZeneca PLC

- F. Hoffmann-La Roche AG

- Pfizer Inc.

- Novartis AG

- Bayer AG

- Helsinn Group

- Teva Pharmaceutical

- Sun Pharmaceutical

- Celltrion Inc.

- CSL Limited

- Hikma Pharmaceuticals

- Biocon Ltd.

- Pharmaniaga Berhad

- Jazz Pharmaceuticals plc

The competitive dynamics of the bile duct cancer market are gaining traction under the leadership of global pharma innovators, including AstraZeneca, Pfizer, Novartis, and Eisai. This can be exemplified by AstraZeneca's acquisition of FDA approval for Imfinzi (durvalumab) plus chemotherapy in the U.S. for treating advanced BTC in September 2022. Further, in December of the same year, its dual immunotherapy, Imjudo (tremelimumab) plus Imfinzi, also attained clearance in Japan for the same indication. These commercial accomplishments underscore the sector’s rapid shift toward immunotherapy-based treatments while intensifying innovation in this category.

Such key players are:

Recent Developments

- In November 2024, Jazz Pharmaceuticals attained fast-tracked approval for its Ziihera (zanidatamab-hrii) 50mg/mL Injection from the FDA for intravenous use for the treatment of adults with previously treated, unresectable, or metastatic HER2-positive (IHC 3+) biliary tract cancer.

- In April 2024, AstraZeneca announced promising results from the TOPAZ-1 Phase III trial on its Imfinzi (durvalumab), in combination with standard-of-care chemotherapy, in treating BTC. The novel therapeutic mixture doubled the overall survival rate at three years for patients with advanced-stage cancer.

- Report ID: 8105

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bile Duct Cancer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.