Bicycle Lights Market Outlook:

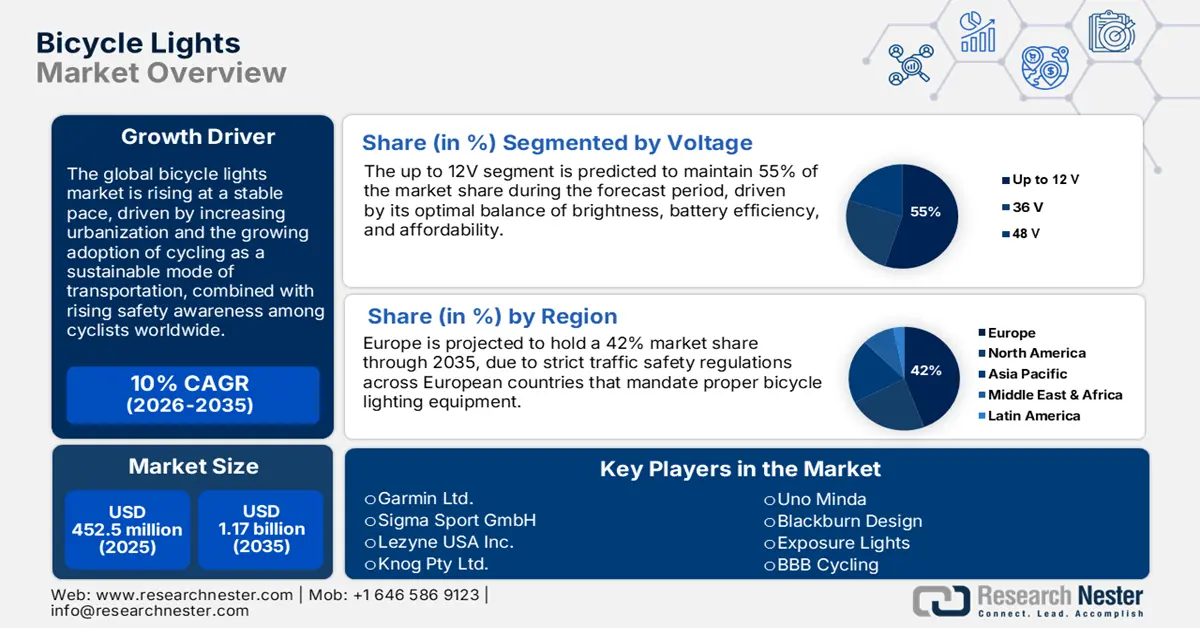

Bicycle Lights Market size is valued at USD 452.5 million in 2025 and is projected to reach a valuation of USD 1.17 billion by the end of 2035, rising at a CAGR of 10% during the forecast period, i.e., 2026-2035. In 2026, the industry size of bicycle lights is assessed at USD 497.7 million.

The global bicycle lights market is expanding at a stable rate, driven by the convergence of urban mobility transformation, safety consciousness, and advances in LED and battery technologies. Government policies worldwide are creating a favorable policy environment in support of safety for cyclists via infrastructure investment and legislation. The urgency is evident in the significant funding allocations, notably the U.S. Department of Transportation's continued support through Active Transportation programs, including $120 billion for highway formula funding and $1.2 trillion provided in 2023 for infrastructure modernization under the Bipartisan Infrastructure Law Implementation Team. The massive programs create demand for premium lighting technologies and provide the foundation for connected transport systems.

Some lucrative growth opportunities for manufacturers in the sector include developing high-end, high-technology lighting systems that are compliant with regulatory needs and enhance rider visibility in increasingly congested urban environments. Some companies are addressing this with technologically advanced products like BBB Cycling's NanoStrike 400, released in October 2023, that produces 400 lumens using high-airflow cooling and memory functions in day- as well as night-time modes. The product is a sign of the sector's focus on addressing real-world cycling challenges with designed heat management and rider-oriented design qualities.

Key Bicycle Lights Market Insights Summary:

Regional Highlights:

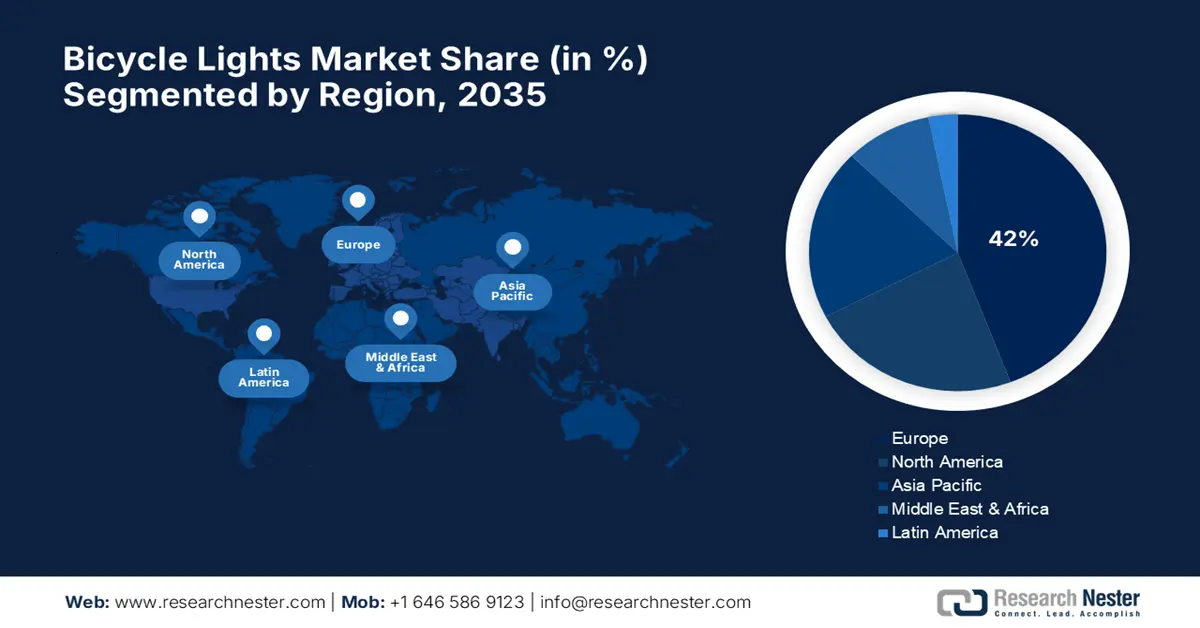

- Europe region is projected to capture over 41.6% share of the bicycle lights market by 2035, impelled by its mature cycling culture, rigorous safety regulations, and widespread e-bike usage.

- The North America market is poised for steady expansion from 2026 to 2035, owing to federal initiatives for active mobility and significant infrastructure investments enhancing cyclist safety and visibility.

Segment Insights:

- The up to 12V segment is projected to command a 55% share by 2035 in the bicycle lights market, propelled by its balance of performance, safety, and compatibility with universal USB charging infrastructure.

- The conventional bicycle segment is expected to retain about 80% share by 2035, driven by the vast global base of non-electric bicycles and consistent demand for after-sales lighting solutions across diverse cycling applications.

Key Growth Trends:

- Growing focus on vulnerable road user safety

- Revolutionary advances in smart lighting technology

Major Challenges:

- Rising safety concerns over lithium-ion battery systems

- Market fragmentation through non-compliant and sub-standard products

Key Players: Garmin Ltd., Sigma Sport GmbH, Lezyne U.S. Inc., Knog Pty Ltd., Uno Minda, Blackburn Design, Exposure Lights, BBB Cycling, NiteRider Technical Lighting Systems, Globetronics Technology Bhd, Lupine Lighting Systems, Samsung Electronics.

Global Bicycle Lights Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 452.5 million

- 2026 Market Size: USD 497.7 million

- Projected Market Size: USD 1.17 billion by 2035

- Growth Forecasts: 10% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, China, United Kingdom, Japan

- Emerging Countries: Germany, United States, China, United Kingdom, Japan

Last updated on : 5 September, 2025

Bicycle Lights Market - Growth Drivers and Challenges

Growth Drivers

- Growing focus on vulnerable road user safety: Greater emphasis on VRU protection is inspiring record investment in cyclist safety and visibility infrastructure, driving long-term demand for high-performance bicycle light systems. Government funding programs targeted specifically at reducing cyclist fatalities through increased visibility and improved infrastructure are being introduced by the government agencies. In 2023, the U.S. Federal Highway Administration implemented the Vulnerable Road User Safety Special Rule, requiring states with 15% or more VRU fatalities to spend at least 15% of Highway Safety Improvement Program funds on pedestrian and bicyclist safety projects. Pennsylvania demonstrated its commitment by implementing the rule to install 779 pedestrian countdown signals, with completion expected by September 2025.

- Revolutionary advances in smart lighting technology: The bicycle lights market is experiencing a technology resurgence with the integration of intelligent features such as radar detection, adaptive brightness, and automatic response systems that enhance safety and customer experience. These innovations represent a huge shift from traditional static lighting to dynamic responsive systems that adapt based on riding conditions and traffic scenarios. In November 2024, CYCLAMI introduced its revolutionary CY300T smart light system with radar-integrated brake detection and a dual-circle front light of 300 lumens and a rear module with an adaptive flash feature. The configuration includes automatic deceleration signals that enhance visibility upon speed reduction, particularly effective in case of heavy traffic situations, with IPX-rated waterproof protection for optimizing issues in practical performance.

- Rapid e-bike market and integrated systems growth: The swift growth in electric bikes is giving rise to new market opportunities for focused lighting systems that are able to harness the power infrastructure of the e-bike without compromising on higher performance demands for speed and visibility. E-bike cyclists ride faster and longer distances than standard cyclists, necessitating more powerful and heavier-duty lighting solutions integrated into the vehicle electrical system. In June 2025, Samsung launched its E-Cycle in the India market, featuring a full LED lighting system alongside disc brakes, an anti-theft lock, and an LCD screen for battery indication. The 145-kilometer range of the e-cycle, combined with the down payment facility, indicates that lighting systems are becoming a standard safety feature, rather than an aftermarket upgrade.

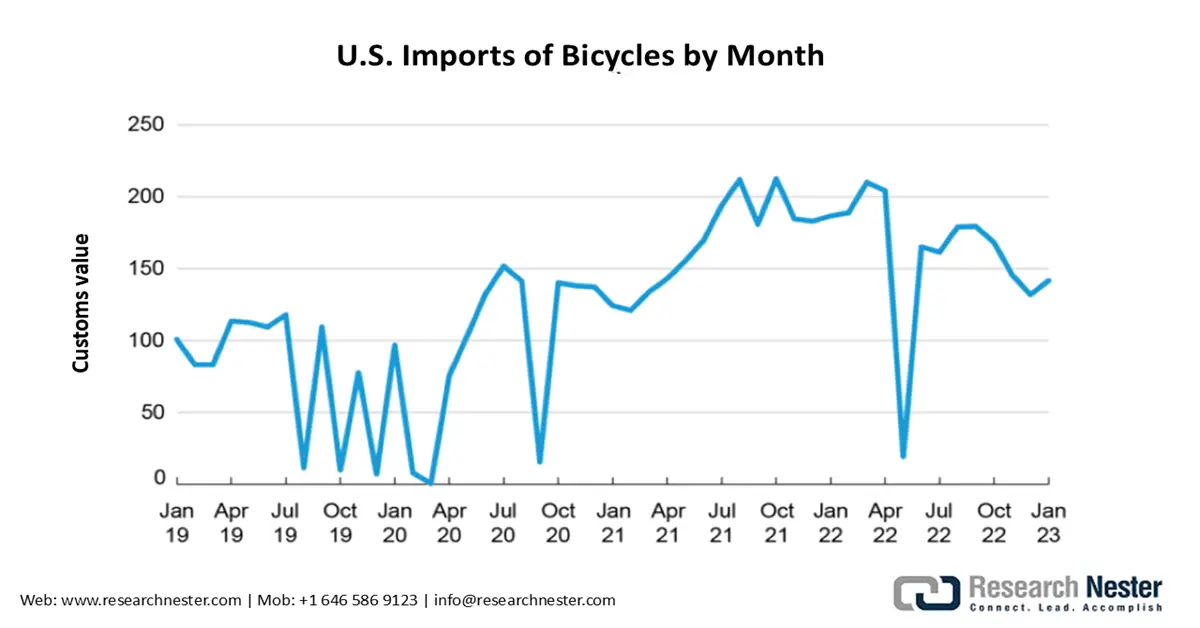

Rising Bicycle Imports Propel Growth in the Bicycle Light Industry

The significant increase in bicycle imports, with values soaring over 1,000% from 2020 to 2023, translates to a significant growth in the bicycle light industry. This influx of millions of new bicycles leads to a rise in demand for important safety accessories. Each new bike means a possible sale, as new cyclists, who make up a large part of this growth, need to equip their bikes with the required and critical lighting systems for safety. As a result, this trend offers a major and immediate growth opportunity for light manufacturers, retailers, and innovators. It boosts the industry's sales baseline and opens up both volume and opportunities for upgraded, premium products. For instance, the total number of non-motorized bicycle imports from the U.S. increased from 0.5 million in March 2020 to 1.0 billion in February 2023.

Source: U.S. BTS

Challenges

- Rising safety concerns over lithium-ion battery systems: The bicycle lights market faces growing pressure to address battery safety issues, particularly with lithium-ion technology, which, if not handled responsibly by consumers, can lead to fires and safety hazards. Regulatory bodies are responding with tighter rules and enforcement measures that impact product design deadlines and compliance costs. In January 2025, the UK Office for Product Safety and Standards published regulatory activity notices of just under 200 e-bike, e-scooter, and lithium-ion battery product fires that resulted in 10 fatalities in the UK throughout 2023. The research greatly improved policy-making data and targeted regulatory efforts, as well as encouraged consumer awareness of hazards.

- Market fragmentation through non-compliant and sub-standard products: The bicycle lights market faces a severe threat from the spread of poor-quality, non-compliant products that don't meet safety standards but undermine authentic manufacturers using undercutting or predatory pricing strategies. Online platforms act as gateways to such low-quality products, creating regulatory enforcement issues and consumer safety risks. In May 2025, a comprehensive E-bike Action Plan for Government was published by the UK Bicycle Association, calling for urgent action, taking obvious, clear action beyond technical action. The plan requires multiple government departments to collaborate in regulating online marketplaces and gig economy food delivery operators, who must take responsibility for unsafe products supplied through their platforms. This emphasizes the need to distinguish legitimate products from throttle-controlled high-speed vehicles that cause safety incidents.

Bicycle Lights Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10% |

|

Base Year Market Size (2025) |

USD 452.5 million |

|

Forecast Year Market Size (2035) |

USD 1.17 billion |

|

Regional Scope |

|

Bicycle Lights Market Segmentation:

Voltage Segment Analysis

The up to 12V segment is anticipated to maintain a commanding 55% share during the forecast period as it enjoys optimal performance, safety, and compatibility with the standard-use USB charging infrastructure most consumers expect. The voltage range provides sufficient power for high-lumen output with compatibility with common charging systems and global market regulatory safety standards. Control of the segment was further entrenched by breakthroughs like Lezyne's August 2023 launch of its redesigned LED product line, which features waterproof USB-C charging ports, cutting-edge heat dissipation technology, and aluminum bodies with integrated cooling fins that maximize performance within the 12V boundary while offering long-term reliability.

Technology Segment Analysis

The conventional bicycle segment is forecasted to retain around 80% bicycle lights market share by 2035 on the back of the massive installed base of non-electric traditional bicycles worldwide and stable demand for after-sales lighting systems for different applications of cycling. The segment encompasses all from urban commuting bikes to high-performance road and mountain bikes, all requiring adjustable, removable lighting systems that can be optimized to specific riding conditions and user preferences. The dominance of this segment was established by Knog's March 2023 launch of new Blinder Integrated front lights, incorporating strong aluminum CNC quality, beam shapes optimized to the next level, and high-power output levels ranging from 600 to 1300 lumens, crafted out of industrial-grade aluminum.

Sales Point Segment Analysis

The online sales channel segment is projected to hold 52% market share through 2035, driven by the needs of consumers for thorough product research, low prices, and convenient purchase simplicity for thorough comparisons of technical features and customer reviews. Online retailing enables manufacturers to tap global markets efficiently and provide detailed product information, facilitating customers' smart purchases based on key factors such as lumen output, burning duration, mounting fit, and regulatory conformity. This was reflected in Knog's July 2023 strategic alliance with Bikecorp as its Australian distribution partner, specifically targeting the realization of the company's aggressive five-year growth strategy that is dependent on robust online sales platforms to tap diverse cycling audiences.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Voltage |

|

|

Mounting Type |

|

|

Sales Point |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Bicycle Lights Market - Regional Analysis

Europe Market Insights

Europe region is expected to account for more than 41.6% market share by 2035, driven by the region's developed cycle culture, stringent safety norms, and high penetration of e-bikes, generating demand for aftermarket and integrated lighting solutions. The region benefits from sophisticated regulatory frameworks and principal industry events that drive innovation and establish global standards for lighting performance and safety. Europe market is anticipated to set product quality and regulatory standards, which the world uses as a benchmark to guide global industry development.

Germany is known for having strict StVZO regulations that impose specific technical requirements on bicycle lights and therefore create a strong demand for high-quality, compliant products. The German regulatory environment shapes global product development and creates potential opportunities for manufacturers with the ability to qualify for these rigorous standards. This influence was demonstrated by the March 2024 launch of Sigma Sport's Infinity USB rear light, boasting a remarkable 16-hour burn time yet retaining unqualified StVZO approval for German market suitability. The compact 25-gram device boasts advanced features including two-stage battery indication and rapid USB charging, demonstrating how German regulatory requirements drive innovation suitable for world markets.

The UK market comprises a complex system of regulation where promotion of safety is struggling with trade policy considerations affecting the availability and prices of the product. The public authorities are systematically striving towards the alleviation of safety problems with the introduction of trade measures affecting supply chain economics and product availability. In April 2025, the UK extended countervailing duty on electric bicycles for a period of five years to January 18, 2029, as per the Trade Remedies Authority recommendation. This measure maintains safeguarding responsibilities while adjusting application to folding e-bikes specifically, demonstrating where safety regulation converges with trade policy and drives market forces and priorities of product innovation.

North America Market Insights

The North America market is set to expand steadily between 2026 and 2035, supported by long-term federal agendas for active transport as well as heavy infrastructure investment that takes cyclists' safety and visibility into account. The market is buoyed by strong regulatory frameworks and sizable funding programs that fuel demand for new light technologies while supporting the overall transition to cleaner transport options. Governmental dedication is evident in ambitious objectives and huge capital investment in infrastructure upgrades, having a direct effect on the safety of cycling and the adoption of light technologies.

In the U.S. market, robust federal leadership plays a crucial role in safeguarding vulnerable road users. This is primarily achieved through dedicated financing programs and the ongoing development of infrastructure. Policy regimes propel demand for safety equipment over the long term while introducing technical standards transparency to guide product innovation. The U.S. Manual on Uniform Traffic Control Devices, 11th Edition, was released in December 2023. This complete document sets standards used by highway managers nationwide for traffic control devices on highways, roads, pedestrian, and bicycle facilities. Thus, providing a system of uniformity that ensures safer construction of the roadways and provides easier U.S.ge of lighting and visibility augmentation devices in various cycling applications.

Canada market approach focuses on evidence-based policy-making and comprehensive safety systems that encompass lighting requirements as a constituent part of transport systems. Its evidence-based transport planning creates market opportunities for new generation lighting technology that meets stringent performance and safety criteria. The Canadian Urban Transit Research and Innovation Consortium published comprehensive reports in 2024 on the implementation of smart vehicle shuttle technology in several large Canadian cities, including Calgary, Surrey, Brampton, Edmonton, Vancouver, York Region, Montréal, and Quebec City.

APAC Market Insights

Asia Pacific bicycle lights market is anticipated to expand at a robust CAGR of 11.5% from 2026 to 2035, driven by heightened urbanization, rising e-bike penetration, and government policies supporting sustainable modes of transport across economic and regulatory profiles. The region is a significant market for electric and traditional bicycles, creating historic levels of demand for light systems that meet varied regulatory requirements and acceptability. Sensitivity to safety and regulatory systems establishes minimum performance standards for lighting equipment and fuel market growth.

China market is shaped by widespread regulatory reform and enforcement measures designed to raise product safety and standardize industry practice. The proactive policy of the government in the area of safety regulation is creating huge demand for safety-compliant lighting systems and forcing sub-standard products out of business. In July 2025, China unveiled new enforcement rules for obligatory national safety standards for electric bicycles across authorities such as the Ministry of Industry and Information Technology and the National Fire and Rescue Administration. The precise guidelines necessitate closer control from production to sales to ensure safety against substandard quality e-bikes.

India's rapidly rising market offers significant business potential for bicycle lighting firms, driven by increasing urban mobility needs and the growing adoption of electric two-wheelers across various economic classes. Domestic manufacturing initiatives and strategic partnerships among global tech companies and local manufacturers help the market by providing innovative, value-based solutions for cost-sensitive buyers. During the Auto Expo Components Show in January 2025, Uno Minda showcased innovative lighting solutions like networked pixel-based digital tail lamps and adaptive lighting technologies as part of its end-to-end mobility innovation initiative. This demonstrates how local producers are developing sophisticated lighting technologies for the domestic market.

Key Bicycle Lights Market Players:

- Garmin Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sigma Sport GmbH

- Lezyne U.S. Inc.

- Knog Pty Ltd.

- Uno Minda

- Blackburn Design

- Exposure Lights

- BBB Cycling

- NiteRider Technical Lighting Systems

- Globetronics Technology Bhd

- Lupine Lighting Systems

- Samsung Electronics

The bicycle lights market landscape features a diverse range of niche lighting manufacturers, mass-producer cycling component companies, and diversified electronics companies competing across various technology segments and price points. The market is increasingly characterized by strategic partnership deals in channel distribution and international expansion activities as companies attempt to take advantage of increased demand in different regional markets with unique regulatory requirements. Successful market penetration requires sophisticated channel strategies that blend direct-to-consumer capabilities with current distributor relationships to reach cycling communities effectively. In February 2023, Madison announced its appointment as the sole UK and Republic of Ireland distributor of the innovative Australian brand Knog, effective immediately, following the brand's global expansion to over 45 countries.

Here are some leading companies in the bicycle lights market:

Recent Developments

-

Lezyne, USA Inc., - announced its partnership with UCI WorldTour team, Team DSM. Working towards the goal of promoting rider safety and visibility, Lezyne joins the Dutch-based international team with a multi-year deal as the team’s official sponsor of LED lights.

-

Fenixlight Limited - introduced Fenix BC26R, an ultra-bright rechargeable bicycle light that offers up to 1,600 lumens and features 65 hours maximum runtime (50 lumens), for high-intensity and long-distance cycling users.

- Report ID: 4420

- Published Date: Sep 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Bicycle Lights Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.