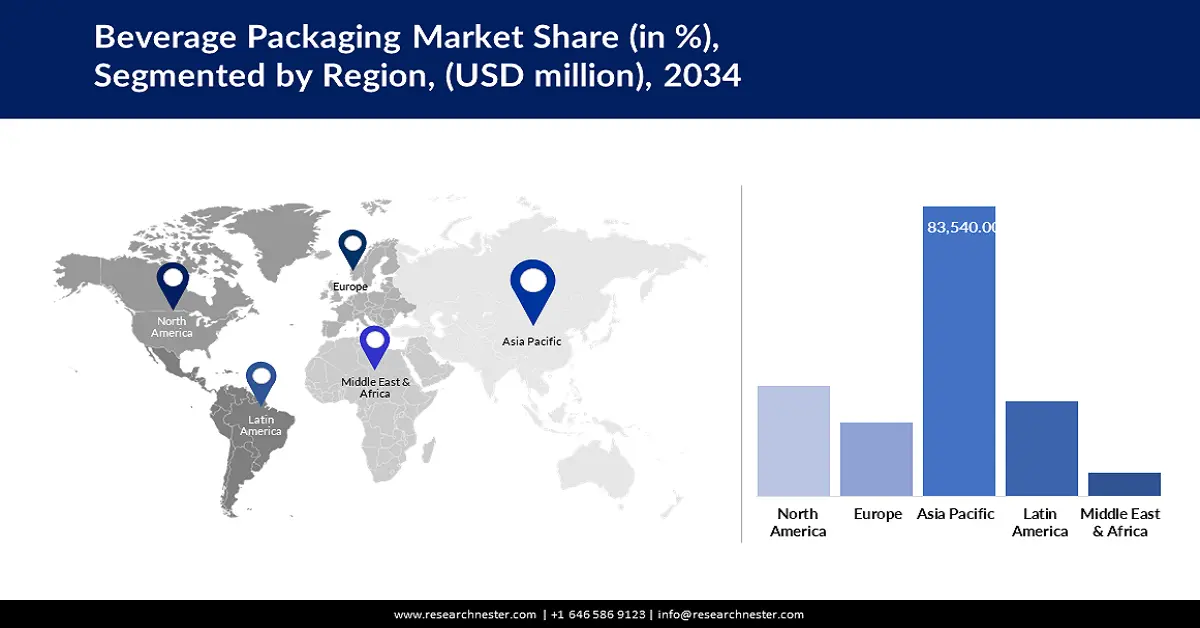

Beverage Packaging Market - Regional Analysis

APAC Market Insights

Asia Pacific beverage packaging maket is likely to account for a 35.5% market share during the forecast period, with the influence of urbanization, rising disposable income, and government regulations toward sustainability. The region is also seeing a shift towards lighter, recyclable PET bottles, as seen with the expansion by Bisleri and Kinley in April 2024 in India. In addition, Government subsidies and EPR policy are propelling the use of recycled and biodegradable materials.

China beverage packaging market is expanding at a rapid rate due to innovation in aseptic and intelligent packaging. In May 2024, the sales of Tetra Pak China's aseptic packaging increased, reflecting consumer trends toward safety and extended shelf life. Chinese brands are investing in material recyclability and lightweight design, with government policies encouraging the use of post-consumer materials. The market focus on quality, safety, and sustainability is driving the take-up of cutting-edge packaging technology.

India beverage packaging market is expanding rapidly due to regulatory requirements and customer demand for sustainable packaging. India made plastic waste management compulsory with Extended Producer Responsibility in July 2024, pushing beverage companies to increase rPET usage and reach higher recycling rates. Furthermore, companies such as Bisleri and Paper Boat are gearing up for green and lighter packaging, and the government is offering incentives for green manufacturing.

North America Market Insights

North America is anticipated to rise at a 5.8% CAGR from 2025 to 2034, driven by regulatory mandates, consumer demand for sustainability, and innovation in packaging. In January 2024, California's minimum requirement of 15% PCR content in plastic beverage cans set the standard for other states, with targets leaping to 50% by 2030. Mergers and acquisitions are also dominating the market, as seen in Sonoco's December 2024 $3.8 billion acquisition of Eviosys and its subsequent expansion into metal packaging.

The U.S. beverage packaging market is witnessing the considerable adoption of sustainable and functional packaging, with top beverage brands launching innovative designs and materials. The industry is also benefiting from packaging redesigns, such as 7UP's August 2024 redesign and Coca-Cola's regulation-free Sprite bottles piloted in early 2024. These innovations are enhancing recyclability and shelf appeal, making the U.S. a leader in packaging innovation.

Canada beverage packaging market is advancing with a focus on sustainable materials and regulatory compliance. In December 2024, Novolex, backed by Apollo Global, acquired Pactiv Evergreen for $6.7 billion to strengthen its regional food service and carton packaging businesses. Canadian brands are also investing in packaging that is recyclable and compostable, with government policies encouraging the incorporation of post-consumer material. Moreover, the market is experiencing growth in smart and functional packaging, driven by consumer demand, fueling innovation in safety and convenience attributes.

Europe Market Insights

Europe is estimated to garner significant growth between 2025 and 2034, with strong regulatory regimes and a shift towards circular economy models. In October 2024, Mondi acquired Western European assets of Schumacher Packaging for €634 million, strengthening its dominance in e-commerce and consumer goods packaging. The region is also witnessing expansion in paper-based and recyclable packaging, with Smurfit Kappa and WestRock merging in July 2024 to form a global leader in paper packaging. Governments across Europe are setting ambitious PCR content and recycling requirements, driving market innovation.

Germany beverage packaging market is expanding steadily, driven by demand for premium, sustainable, and functional packaging. In January 2025, International Paper acquired DS Smith for $7.2 billion, expanding its European presence for fiber-based solutions. German brands are adopting light aluminum cans and smart glass bottles, while pressure on recycling and material reduction from the regulatory climate is impacting product design. The market's emphasis on quality, safety, and sustainability is opening avenues for innovation and expansion.

The UK beverage packaging market is embracing packaging sustainability and innovation, with companies experimenting with new materials and formats in response to evolving consumer and regulatory requirements. During January–March 2024, Coca-Cola piloted labelless Sprite bottles in selected UK stores, streamlining recyclability and supporting the World Without Waste strategy. UK companies are investing in paper-based and compostable packaging, with government policy requiring ambitious recycling levels. The market is benefiting from increasing consumer awareness and appetite for simple, eco-friendly packaging.