Beta Testing Software Market Outlook:

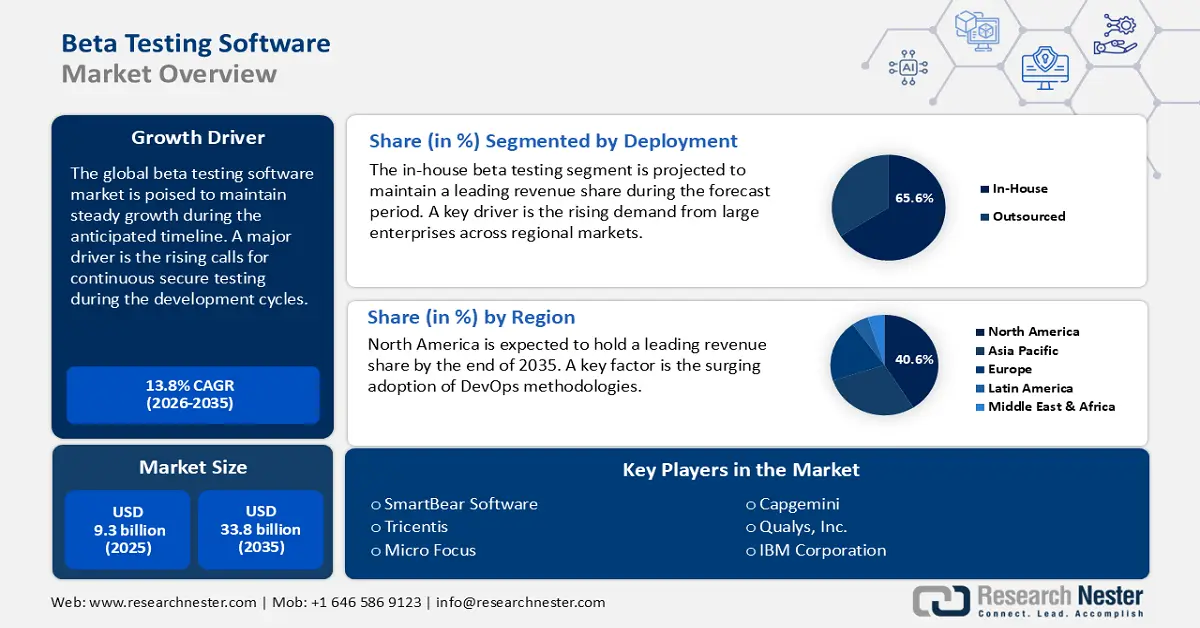

Beta Testing Software Market size was valued at USD 9.3 billion in 2025 and is projected to reach USD 33.8 billion by the end of 2035, rising at a CAGR of 13.8% during the forecast period, i.e., between 2026 and 2035. In 2026, the industry size of beta testing software is evaluated at USD 10.5 billion.

The global beta testing software sector operates within a dynamic supply chain that encompasses software development, testing, deployment, and feedback integration. Additionally, changes in the Producer Price Index (PPI) and Consumer Price Index (CPI) highlight the costs incurred by producers and consumers. In May 2025, the PPI for final demand rose by 0.1% in comparison to the previous month, reflecting a modest rise in the prices received by producers for their goods and services.

The rising cost of software bugs and poor software quality also necessitates the need for beta testing software solutions. Poor software quality has large economic costs, which pushes demand for better testing, including beta testing. For example, a U.S. federal study by the National Institute of Standards and Technology (NIST) estimated that software bugs cost the U.S. economy US$59.5 billion annually in the early 2000s. They also estimated that improved testing, i.e., finding more defects earlier, could reduce this cost by about $22.2 billion.

Moreover, the Consortium for Information & Software Quality (CISQ) published that the cost of poor software quality in the U.S. in 2022 has grown to USD 2.41 trillion, including losses caused by exposure, technical debt, and many more. These large cost figures incentivize companies to invest in mechanisms like beta testing earlier in the development cycle to catch defects and U.S.bility issues before wider expansion. With data privacy, cybersecurity, and accessibility standards becoming more stringent, software must be robust. Beta testing helps discover security vulnerabilities, compliance, performance under various edge conditions, and accessibility issues under real U.S.ge.

Key Beta Testing Software Market Insights Summary:

Regional Insights:

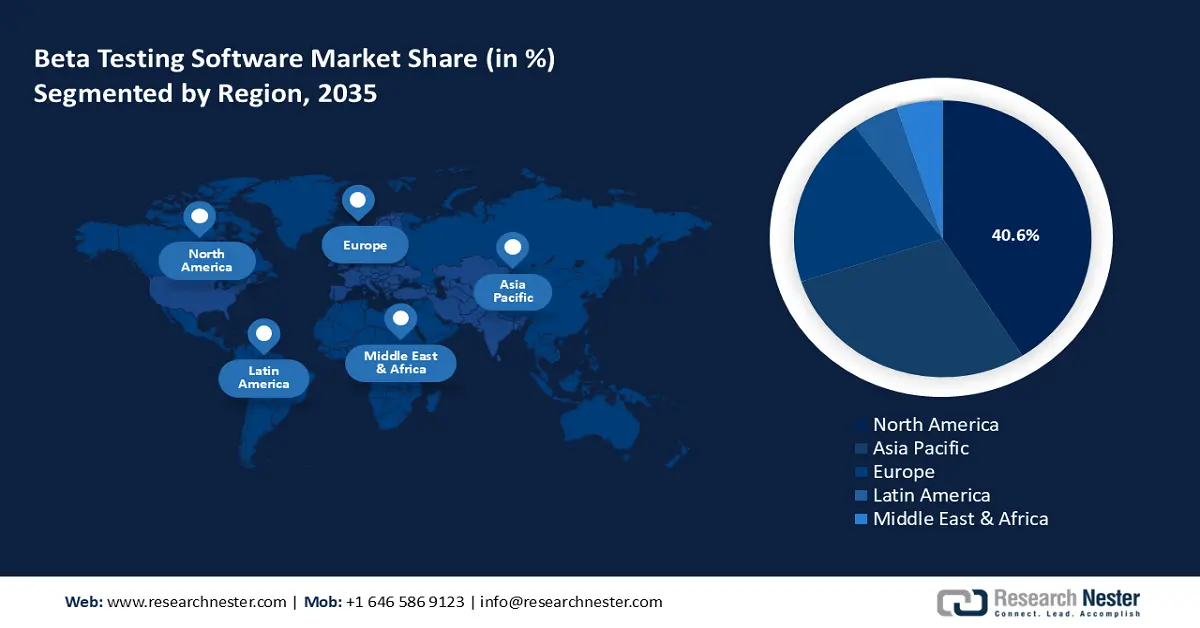

- By 2035, North America is expected to command a 40.6% share in the Beta Testing Software Market, underpinned by accelerating 5G adoption.

- The APAC region is projected to grow at a 13.6% CAGR during 2026–2035, supported by rising cloud-native application deployment and an increasingly robust tech ecosystem.

Segment Insights:

- By 2035, the in-house beta testing segment is projected to capture a 65.6% share in the Beta Testing Software Market, bolstered by enterprises’ preference for maintaining full control over their testing workflows.

- The post-release beta testing segment is anticipated to secure a strong share by 2035, supported by the increasing adoption of agile development practices and continuous delivery systems.

Key Growth Trends:

- Integration of beta testing into continuous integration/continuous deployment (CI/CD) pipelines

- Rising emphasis on security testing amidst surging cybersecurity threats

Major Challenges:

- Adapting beta testing software to the rapid evolution of 5G standards and protocols

- Difficulty in recruiting and keeping qualified beta testers

Key Players: SmartBear Software, Tricentis, Micro Focus, Capgemini, Qualys, Inc., IBM Corporation, Infosys, Accenture, Cognizant, Wipro Technologies, ThoughtWorks, Seiko Solutions, Hexaware Technologies, iTestify, Atlassian.

Global Beta Testing Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.3 billion

- 2026 Market Size: USD 10.5 billion

- Projected Market Size: USD 33.8 billion by 2035

- Growth Forecasts: 13.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 3 October, 2025

Beta Testing Software Market - Growth Drivers and Challenges

Growth Drivers

- Integration of beta testing into continuous integration/continuous deployment (CI/CD) pipelines: Due to the surging adoption of CI/CD practices, modern software development practices are likely to integrate beta testing solutions in the coming years. Additionally, the integration of beta testing to CI/CD pipelines has ensured continuous testing of software throughout the development process. Moreover, the integration of CI/CD to beta testing software ties with the steady shift to DevOps methodologies as organizations seek faster time-to-market (TTM). With a greater number of organizations seeking quicker time-to-market, the demand for advanced beta testing solutions is poised to intensify.

- Rising emphasis on security testing amidst surging cybersecurity threats: The surging frequency of cybersecurity threats has pushed organizations to place a greater focus on security testing during the beta phase. It is necessary to identify and address security vulnerabilities early in the development process to mitigate major breaches after launch. The greater focus on secure testing is slated to drive the sustained demand for beta testing. Additionally, beta testing software provides the environment for identifying vulnerabilities before a product is launched, which is vital in the context of post-release beta testing.

- Greater emphasis on U.S.bility, user experience, and human-centered design: Government policies increasingly mandate or recommend U.S.bility testing. For example, the U.S. Office of Management and Budget (OMB) issued guidance in 2024 that elaborates U.S.bility testing as an integral tool to improve digital public services. Departments like the U.S. Department of Energy provide detailed U.S.bility Testing Best Practices, which reflect rising institutional recognition of the importance of U.S.bility in digital systems. With more attention to user-centric design, beta testing becomes more valuable to gather real user feedback in realistic scenarios, beyond internal QA.

Challenges

- Adapting beta testing software to the rapid evolution of 5G standards and protocols: A major challenge in the global beta testing software market is the continuous evolution of 5G standards, which impacts the testing environments for software products and services. As new features are continuously upgraded, such as ultra-low-latency and network slicing, the constant changes have created hurdles for companies involved in beta testing software. The constant changes cause hurdles for companies involved in beta testing software, as they must continuously adapt their testing processes.

- Difficulty in recruiting and keeping qualified beta testers: The effectiveness of beta testing leans on having the right testers, users who represent the target market, use the product in real-world conditions, and provide detailed feedback. Recruiting diverse testers across geographies, industries, and device ecosystems is a challenge. Retention is another problem, as many testers drop off midway due to a lack of incentives or engagement.

Beta Testing Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 9.3 billion |

|

Forecast Year Market Size (2035) |

USD 33.8 billion |

|

Regional Scope |

|

Beta Testing Software Market Segmentation:

Deployment Segment Analysis

The in-house beta testing segment is poised to maintain a leading revenue share of 65.6% throughout the forecast period. The segment’s expansion is supported by the trend of large enterprises and software development companies seeking to maintain complete control over their testing processes. This trend has ensured a greater scope of deployment for in-house beta testing. The largest opportunities are slated to be in the healthcare and finance industries. As a greater number of enterprises adopt AI-powered solutions, the demand for in-house beta testing is expected to remain steady throughout the forecast timeline.

Testing Type Segment Analysis

The post-release beta testing segment is estimated to hold a robust share by the end of 2035, owing to surging adoption of agile development methodologies and continuous delivery systems. The rising adoption has shifted the focus to post-release testing, allowing companies to gather real-world feedback from users after a product’s launch. Additionally, post-release beta testing has been particularly in demand from the gaming sector, where frequent updates are necessary for improvements.

Organization Segment Analysis

The large enterprises segment is expected to expand rapidly as these organizations prioritize quality assurance to protect brand reputation and avoid expensive post-launch failures. With complicated product portfolios and global user bases, large enterprises rely on beta testing to validate scalability, security, and U.S.bility under real-world conditions. Their significant budgets also support them in investing in advanced beta testing platforms integrated with DevOps and cloud infrastructure. For instance, in September 2025, Skytree Scientific, a leader in ClimateTech innovation, launched beta testing for its advanced LRA Plus platform. Built to revolutionize lightning risk assessment with state-of-the-art automation and intelligent algorithms, the platform offers precision insights that go beyond traditional manual methods.

Our in-depth analysis of the global market includes the following segments:

|

Segments |

Subsegments |

|

Deployment |

|

|

Testing Type |

|

|

Organization |

|

|

User Role |

|

|

Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Beta Testing Software Market - Regional Analysis

North America Market Insights

The North America market is projected to maintain a leading revenue share of 40.6% throughout the forecast period. A major factor of the sector’s dominance is the surging adoption rates of 5G tech, which has improved the scope of deployment for beta testing software. Additionally, there have been extensive investments in advanced technology solutions. The regional market is favorably impacted by the rise of digital-native industries and enterprises adopting DevOps and agile methodologies.

The U.S. beta testing software market is estimated to maintain a major revenue share during the anticipated timeline. The market’s expansion is favorably reinforced by a deep integration of software testing tools across industries such as healthcare, telecom, and technology. Opportunities remain rife in the U.S. market with the prominence of SaaS companies, along with the greater consumer demand for high-quality applications. The launch of Trump Media’s public beta testing of Truth Search AI in August 2025 is a major indicator of how the U.S. market is being driven by the rising adoption of AI-powered features in consumer-facing platforms. As platforms such as Truth Social increase their ecosystems with AI search and personalization tools, beta testing becomes essential to validate accuracy, usability, and security before full-scale release. Such initiatives expand the demand for effective beta testing software that can manage AI-driven, data-intensive applications, thereby speeding up overall market growth in the U.S.

In Canada, the market is expanding as startups and enterprises use beta programs to compete in global technology markets. Supportive government programs in digital innovation and cybersecurity strengthen the adoption of in-house and external beta testing platforms. The country’s increasing SaaS sector depends heavily on beta testing to enhance offerings for international customers. In 2024, Shopify developed beta trials for its AI-powered commerce tools with a few Canadian merchants to achieve real-world validation before expanding globally. This demonstrates how Canadian firms leverage beta testing to improve product quality, gain user insights, and maintain competitiveness in the worldwide market.

Asia Pacific Market Insights

The APAC market is expected to register a CAGR of 13.6% during the forecast period, owing surging adoption of cloud-native applications and an improving tech ecosystem. Additionally, the rapid adoption of 5G infrastructure, coupled with an expanding IoT ecosystem has ensured a sustained requirement for advanced beta testing solutions that can ensure high-quality mobile applications. As the requirement for mobile-first applications significantly expands, the demand for reliable beta testing solutions is projected to remain steady.

The China market is slated to maintain a major revenue share in APAC owing to the proliferation of mobile applications. Additionally, major investments, funneled under the Made in China 2025, have set the stage for unparalleled growth in notable sectors such as AI and cloud computing. With the investments in smart city solutions expanding the region, the demand for rigorous beta testing software for applications is poised to increase.

The South Korea market is fueled by the country’s advanced digital infrastructure and huge smartphone penetration. Tech firms and gaming companies, in particular, depend on beta testing to ensure seamless performance across devices and networks in a highly competitive consumer market. Moreover, government initiatives supporting AI, 5G, and digital transformation further encourage the demand for robust pre-release testing platforms. Such efforts highlight how beta testing is becoming a strategic tool for South Korean enterprises to maintain global competitiveness.

Europe Market Insights

The Europe beta testing software market is poised to expand its revenue share during the anticipated timeline, supported by the regional emphasis on digital innovation and the proliferation of mobile-first applications. Additionally, Europe has a well-established tech ecosystem, which has pushed the adoption of advanced software testing tools across critical industries such as fintech, e-commerce, and telecommunications. The market is also buoyed by the EU’s Digital Single Market strategy, which seeks to harmonize regulations and bolster cross-border cooperation in software development.

The Germany market is poised to register a major revenue share during the forecast period, owing to rising investments in beta testing software solutions with major end users in the thriving automotive, industrial automation, and fintech sectors. The Industry 4.0 Initiative has heightened the demand for automated testing platforms that are capable of handling long product development cycles.

Additionally, the market is expected to be continuously driven by the automated testing frameworks that can meet the demands of a digital economy. For instance, in December 2024, Siemens ran a number of beta programs for its industrial automation software updates, collaborating with selected enterprise clients to validate performance under real-world factory conditions. This trend shows how Germany’s focus on industrial digitalization and precision engineering promotes growth in beta testing adoption.

In the UK, the market is expected to expand due to an evolving fintech, gaming, and SaaS ecosystem that depends heavily on pre-release testing to maintain competitiveness. Companies increasingly invest in beta programs to fulfill data security requirements and provide effortless customer experiences in a post-Brexit digital economy. The UK government’s target on AI and digital innovation funding also pushes the adoption of advanced testing methods. Such initiatives reflect the country's solid role in shaping beta testing adoption.

Key Beta Testing Software Market Players:

- SmartBear Software

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Tricentis

- Micro Focus

- Capgemini

- Qualys, Inc.

- IBM Corporation

- Infosys

- Accenture

- Cognizant

- Wipro Technologies

- ThoughtWorks

- Seiko Solutions

- Hexaware Technologies

- iTestify

- Atlassian

The global beta testing software market is projected to remain competitive throughout the forecast period. The sector’s revenue share is dominated by key players such as SmartBear Software, Tricentis, Micro Focus, and others. For instance, SmartBear focuses on expanding its offerings by inculcating AI-driven features, whilst Tricentis has strengthened its position in the market by embracing automation tools. Additionally, the scope of deployment expands in emerging markets due to the proliferation of smartphones. Below are the major players in the beta testing software market:

Recent Developments

- In September 2025, MoneyHero, a leading personal finance aggregation and comparison platform as well as a digital insurance brokerage in Greater Southeast Asia, announced the launch of the invite-only beta version of Credit Hero Club for a select group of its users. The beta phase, expected to run for about three weeks, will serve as a structured evaluation period before final product refinements are made. The Company plans to move forward with a full public launch in Q4 2025.

- In August 2025, Anthropic started piloting a Chrome extension that enables its Claude AI assistant to operate directly within users’ web browsers. With this step, the San Francisco-based company is entering a fast-growing but sensitive space where AI systems are given the ability to interact with computer interfaces on behalf of users.

- Report ID: 3869

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Beta Testing Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.