Conveyor System Market Outlook:

Conveyor System Market size was over USD 7.32 billion in 2025 and is poised to exceed USD 12.74 billion by 2035, witnessing over 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of conveyor system is estimated at USD 7.7 billion.

The growth of the market can be attributed to the increasing number of e-commerce companies across the globe. Furthermore, e-commerce companies are trying to provide the best experience to their customers by providing their orders at an accurate time, day, and place. Therefore, the conveyor system assists these companies in the warehouse through handling all their orders, and it is expected to boost the growth of the market over the forecast period. By the end of 2025, it is expected that retail e-commerce sales across the globe to reach more than USD 7,000 Billion.

A conveyor system refers to mechanical handling equipment that is used to move materials from one to another locations. They are popularly used for the transportation of high load materials, as they are difficult to carry. There has been continuous advancement in the conveyor system through different means, such as portable conveyors. In addition to these, factors that are believed to fuel the market growth of conveyor systems include the increasing use of conveyors in different industries such as the logistics, parcel, and automation industries. The logistics and parcel delivery industries use portable conveyors, also known as mobile line shaft conveyors, as it shortens production time and lowers overall costs.

Key Conveyor System Market Insights Summary:

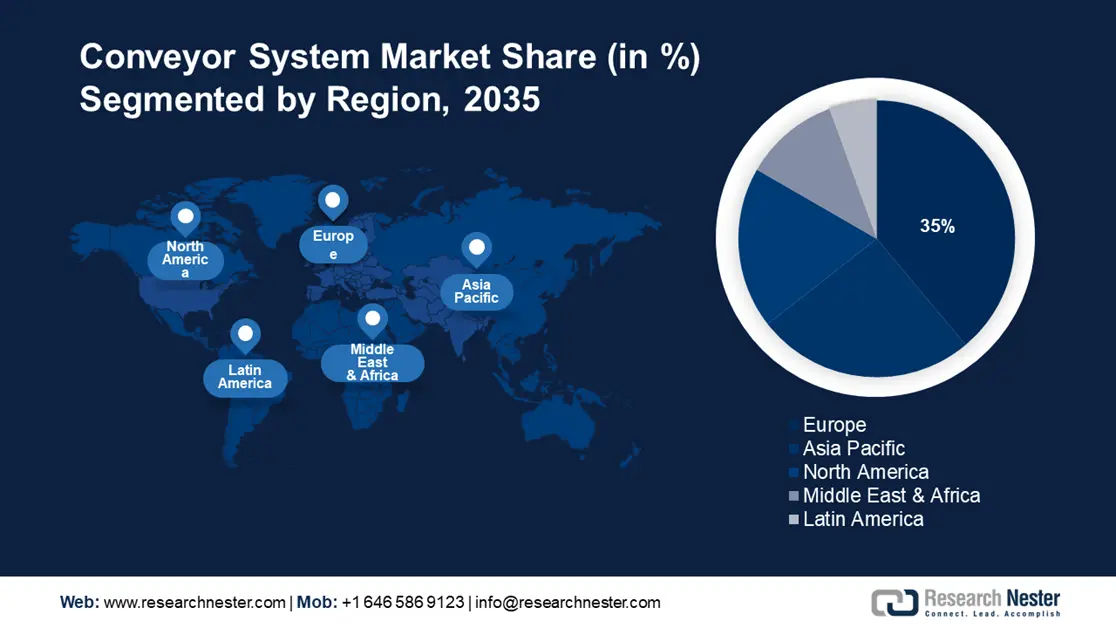

Regional Highlights:

- Europe conveyor system market is predicted to capture 35% share by 2035, increasing use of IoT and AI technologies in manufacturing units.

- Asia Pacific market will account for 24% share by 2035, demand from manufacturing industries to automate and industry 4.0 adoption.

Segment Insights:

- The automotive segment in the conveyor system market is projected to secure a significant share by 2035, driven by growing vehicle production and rising popularity of electric vehicles.

- The belt segment in the conveyor system market is projected to capture a significant share by 2035, fueled by the development of airports needing customizable, easy-to-maintain conveyor belts.

Key Growth Trends:

- Growing Intralogistics Operations

- Increasing Industrialization, and Urbanization

Major Challenges:

- High Cost of the Conveyor System

- Lack of Skilled Persons for Handling the Conveyor system

Key Players: Siemens AG, ContiTech AG, Daifuku Co., Ltd., Fives Group, Murata Machinery, Ltd., KUKA AG, Tsubaki Group, Interroll AG, Intralox, L.L.C., Fenner Conveyors.

Global Conveyor System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.32 billion

- 2026 Market Size: USD 7.7 billion

- Projected Market Size: USD 12.74 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Conveyor System Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Intralogistics Operations– According to the survey report, more than 40 percent of the respondents stated that intralogistics automation is very important for the success of the business. The conveyor system makes the products ready for loading, transport, and storage without getting damaged. Therefore, the goods that are manufactured in an industry goes through different process, and this increased the use of conveyors. Hence, it is anticipated to increase the growth of the market in the upcoming years.

-

Surging Expansion of Existing Airports- According to reports in 2021, the Airports Authority of India announced the investment of more than USD 3 Billion in order to expand the existing airports over the next four to five years in the country.

- Increasing Industrialization, and Urbanization– The industrialization rate has been increasing, owing to which, conveyors are used for various applications in the industries such as bottling, food processing, automotive, aerospace, and others. Moreover, it is also used for transporting products, buffering, and storage. Hence, it is predicted to drive the growth of the global conveyor system market over the forecast period. According to the most recent data, the Indian production rate increased by more than 4 percent year on year basis in December 2022.

- Surging in the Number of Warehouses Space- There has been an increase in the number of warehouse space, worldwide, which is driving up demand for conveyor systems to handle the stock in bulk. It reduces the labor costs, minimize human errors, and lower workplace risks in the warehouses. Moreover, the goods are transported and sorted with the conveyor belts, that is projected to rise the growth of the global conveyor system market over the forecast period. It is expected that the number of warehouses around the world to reach more than 175,000 by the end of 2025

- Increasing Number of Shopping Malls– The conveyor is used in multi-level retail stores in order to move shopping carts adjacently or parallel to escalators. There are more than 100,000 shopping centers in the United States as of now. Therefore, the advancement is required for the development of shopping malls, and it is predicted to increase the market’s growth by the end of 2035.

Challenges

-

High Cost of the Conveyor System - The high cost of the conveyor system owing to the increase in expenses related to the belt, hardware, truss, power source, wire rope, and others. Moreover, there are maintenance costs that are required for the conveyor system, such as repairs, insurance, registration, fuel costs, and others. This is expected to hamper the growth of the market over the forecast period.

-

Lack of Skilled Persons for Handling the Conveyor system

- High Chances of Workers Accidents in the Industries

Conveyor System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 7.32 billion |

|

Forecast Year Market Size (2035) |

USD 12.74 billion |

|

Regional Scope |

|

Conveyor System Market Segmentation:

Industry

The automotive segment is expected to hold a significant share over the forecast period on the back of growing production of vehicles, and the rising popularity of electric vehicles. Furthermore, the automotive plants opt for overhead conveyers owing to its capacity of carrying high load, along with the improvement in the production rate of the plant. Therefore, it is anticipated to rise the segment’s growth in the market. According to estimates, the number of electric vehicles that include electric vans, buses, cars, and heavy trucks on the road is expected to reach more than 145 million by the end of the year 2030. Furthermore, the final vehicles that are produced are difficult to carry from the production area to the transport area, and it is expected to boost the growth of the segment in the market over the forecast period.

Type

The belt segment is expected to garner a significant share by the year 2035. The growth of the segment can be attributed to the development of airports in different countries that require easy to install and little maintenance belts for baggage collection, and screening. Moreover, they are easy to handle, and can be customized according to the customer’s need, that is anticipated to boost the growth of the segment in the market. Furthermore, it allows to move objects that are bulky from one place to another such as metals in the mining industry with ease, and also saves time on transportation.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Conveyor System Market Regional Analysis:

Europe Market Insights

The share of conveyor system market in Europe, amongst the market in all the other regions, is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the increasing use of technologies such as IOT, and artificial intelligence in the manufacturing units. Furthermore, there is a need to reduce the labor costs, that is further predicted to drive the market’s growth in the region. In addition, the presence of large automotive companies in the region is anticipated to expand the conveyor system market in the region. Furthermore, there have been strict regulations in relation to the safety of the employees that are working in the manufacturing unit, such as in the automotive industries. According to the European Commission, atleast 2.6 million people work in the direct manufacturing of motor vehicles. Therefore, there is a need for a conveyor system in order to compile different parts of the motor vehicle. Hence, it is anticipated to boost the growth of the market in the European region.

APAC Market Insights

The Asia Pacific conveyor system market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the increasing demand from manufacturing industries to automate their processes, and the surging development among various industries such as airports, automobiles, mining industries, and others. In addition, there has been a growing demand for products from consumers, which is putting pressure on the companies to provide their products at the right time with lower cost. Moreover, surging adoption of industry 4.0, and the implementation of automation are further anticipated to boost the growth of the market in the region.

North American Market Insights

North America region is set to witness significant growth till 2035. The growth of the market can be attributed majorly to the surging problem faced by the industries related to the heavy traffic on conveyors. Moreover, the surging industrialization in the region, which requires conveyors in their production processes, is further estimated to rise the growth of the market in the region.

Conveyor System Market Players:

- Siemens AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ContiTech AG

- Daifuku Co., Ltd.

- Fives Group

- Murata Machinery, Ltd.

- KUKA AG

- Tsubaki Group

- Interroll AG

- Intralox, L.L.C.

- Fenner Conveyors

Recent Developments

-

KUKA AG announced the new conveyor technology in order to transport the car bodies safely with KUKA BOLT and KUKA PULSE. Moreover, the new generation of KUKA PULSE is faster, use less energy and lower the MTTR for which it is more flexible than the friction based conveyance systems

-

Intralox, L.L.C. announced the launch of new Sinamics G115D distributed drive system that is specifically designed for conveyor applications. Furthermore, the G115D comprises of frequency converter, motor, and gear box.

- Report ID: 4806

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Conveyor System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.