Global Autosampler Vials Market TOC

1. An Outline of the Autosampler Vials Market

- Market Definition

- Market Segmentation

- Product Overview

2. Assumptions and Abbreviations

- Research Methodology

3.1. Research Process

3.2. Primary Research

- Manufacturers/Solution providers

- End Users

3.3. Secondary Research

3.4. Market Size Estimation

4. Summary of the Report for Key Decision Makers

5. Forces of the Market Constituents

5.1. Factors/Drivers Impacting the Growth of the Market

5.2. Market Trends for Better Business Practices

6. Key Market Opportunities for Business Growth

- Based on the type

- Based on the material

- Based on the product

- Based on the capacity

- Based on the end user

- Based on the geographical presence

7. Major Roadblocks for the Market Growth

8. Decarbonization Strategy and Carbon Credit Benefits for Market Players

8.1. Global Government Decarbonization Plans/Goals by Each Country under 2015 Agreement Agreed by 200 Countries

8.2. Measures taken by Countries to Reduce Carbon Footprints

8.3. Carbon Credits and Subsidy Plans/Benefits Rolled out by the Government for Market Players

8.4. Effective Ways to Harness Carbon-Credits and Impact on Profit Margins

8.5. Demand Impact on the Companies Opting for Carbon Credits

9. Government Regulations

10. Technology Transition and Adoption Analysis

11. Industry Risk Analysis

- Demand Risk Analysis

- Supply Risk Analysis

12. Regional Pricing Analysis

13. Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Autosampler Vials Market

13.1. Ukraine-Russia crisis

13.2. Potential US economic slowdown

14. Industry Growth Outlook

15. Industry Value Chain Analysis

16. End User Analysis

17. Competitive Positioning: Strategies to differentiate a company from its competitors

18. Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2023

- Business Profiles of Key Enterprises

- Agilent Technologies, Inc.

- Waters Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer, Inc.

- Shimadzu Corporation

- Merck KGaA

- Chemglass Inc

- Gilson, Inc.

- Restek Corporation

- Other major players

19. Global Autosampler Vials Market, Outlook & Projections, Opportunity Assessment, 2023-2036

19.1. Market Overview

19.2. Market Revenue by Value (USD /million) and Compound Annual Growth Rate (CAGR)

19.3. Year-on-Year (Y-o-Y) Growth Trend Analysis

19.4. Global Autosampler Vials Market Outlook & Projections, Opportunity Assessment by Segment, 2023-2036

- By Type

- HPLC Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Gas Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- By Material

- Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Deactivated Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Expansion Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Polypropylene Plastic Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Other Materials, Market Value (USD million), CAGR, 2023-2036

- By End User

- Pharmaceutical and Biopharmaceutical, Market Value (USD million), CAGR, 2023-2036

- Food and Beverage, Market Value (USD million), CAGR, 2023-2036

- Environmental Testing labs, Market Value (USD million), CAGR, 2023-2036

- Others, Market Value (USD million), CAGR, 2023-2036

- By Product

- Crimp Top, Market Value (USD million), CAGR, 2023-2036

- Screw Thread, Market Value (USD million), CAGR, 2023-2036

- Snap Ring, Market Value (USD million), CAGR, 2023-2036

- Shell Vial, Market Value (USD million), CAGR, 2023-2036

- Others, Market Value (USD million), CAGR, 2023-2036

- By Capacity

- Less than 1 ml, Market Value (USD million), CAGR, 2023-2036

- 1.1-1.5 ml, Market Value (USD million), CAGR, 2023-2036

- 1.6-2.0 ml, Market Value (USD million), CAGR, 2023-2036

- 2.1-3 ml, Market Value (USD million), CAGR, 2023-2036

- More than 3 ml, Market Value (USD million), CAGR, 2023-2036

- By Geography

- North America, 2023-2036 (USD Million)

- Europe, 2023-2036 (USD Million)

- Asia Pacific, 2023-2036 (USD Million)

- Latin America, 2023-2036 (USD Million)

- Middle East & Africa, 2023-2036 (USD Million)

20. Cross Analysis of Type w.r.t. End User (USD Million), 2023

21. North America Autosampler Vials Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Trends, Investments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Autosampler Vials Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Type

- HPLC Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- Gas Autosampler Vials, Market Value (USD million), CAGR,2023-2036

- By Material

- Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

- By Type

21.5.2.2. Deactivated Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

21.5.2.3. Expansion Glass Autosampler Vials, Market Value (USD million), CAGR, 2023-2036 (USD Million)

21.5.2.4. Polypropylene Plastic Autosampler Vials, Market Value (USD million), CAGR, 2023-2036

21.5.2.5. Other Materials, Market Value (USD million), CAGR, 2023-2036

- By End User

- Pharmaceutical and Biopharmaceutical, Market Value (USD million), CAGR,2023-2036

21.5.3.2. Food and Beverage, Market Value (USD million), CAGR, 2023-2036

21.5.3.3. Environmental Testing labs, Market Value (USD million), CAGR, 2023-2036

21.5.3.4. Others, Market Value (USD million), CAGR, 2023-2036

- By Product

- Crimp Top, Market Value (USD million), CAGR, 2023-2036

21.5.4.2. Screw Thread, Market Value (USD million), CAGR, 2023-2036

21.5.4.3. Snap Ring, Market Value (USD million), CAGR, 2023-2036

21.5.4.4. Shell Vial, Market Value (USD million), CAGR, 2023-2036

21.5.4.5. Others, Market Value (USD million), CAGR, 2023-2036

- By Capacity

- Less than 1 ml, Market Value (USD million), CAGR, 2023-2036

21.5.5.2. 1.1-1.5 ml, Market Value (USD million), CAGR, 2023-2036

21.5.5.3. 1.6-2.0 ml, Market Value (USD million), CAGR, 2023-2036

21.5.5.4. 2.1-3 ml, Market Value (USD million), CAGR, 2023-2036

21.5.5.5. More than 3 ml, Market Value (USD million), CAGR, 2023-2036 (USD Million)

- By Country

- United States, Market Value (USD million), CAGR, 2023-2036

- Canada, Market Value (USD million), CAGR, 2023-2036

22. Europe Autosampler Vials Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Developments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Autosampler Vials Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Type

- By Material

- By End User

- By Product

- By Capacity

- By Country

- United Kingdom, 2023-2036 (USD Million)

- Germany, 2023-2036 (USD Million)

- Italy, 2023-2036 (USD Million)

- Spain, 2023-2036 (USD Million)

- France, 2023-2036 (USD Million)

- Russia, 2023-2036 (USD Million)

- Netherlands, 2023-2036 (USD Million)

- Rest of Europe, 2023-2036 (USD Million)

23. Asia Pacific Autosampler Vials Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Investments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia-Pacific Autosampler Vials Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Type

- By Material

- By End User

- By Product

- By Capacity

- By Country

- China, 2023-2036 (USD Million)

- India, 2023-2036 (USD Million)

- Japan, 2023-2036 (USD Million)

- South Korea, 2023-2036 (USD Million)

- Singapore, 2023-2036 (USD Million)

- Australia, 2023-2036 (USD Million)

- Rest of Asia Pacific, 2023-2036 (USD Million)

24. Latin America Autosampler Vials Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Partnerships in the region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Autosampler Vials Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Type

- By Material

- By End User

- By Product

- By Capacity

- By Country

- Brazil, 2023-2036 (USD Million)

- Mexico, 2023-2036 (USD Million)

- Argentina, 2023-2036 (USD Million)

- Rest of Latin America, 2023-2036 (USD Million)

25. Middle East & Africa Autosampler Vials Demand Outlook & Projections, 2023-2036: A Comprehensive Study for Stakeholders

- Market Overview

- Analysis on Recent Developments in the Region & Impact on Y-O-Y Revenue

- Market Revenue by Value (USD million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Middle East and Africa Autosampler Vials Market Valuation, Business Viewpoint and Forecast by Segment, 2023-2036

- By Type

- By Material

- By End User

- By Product

- By Capacity

- By Country

- Israel, 2023-2036 (USD Million)

- GCC, 2023-2036 (USD Million)

- South Africa, 2023-2036 (USD Million)

- Rest of Middle East & Africa, 2023-2036 (USD Million)

Autosampler Vials Market Outlook:

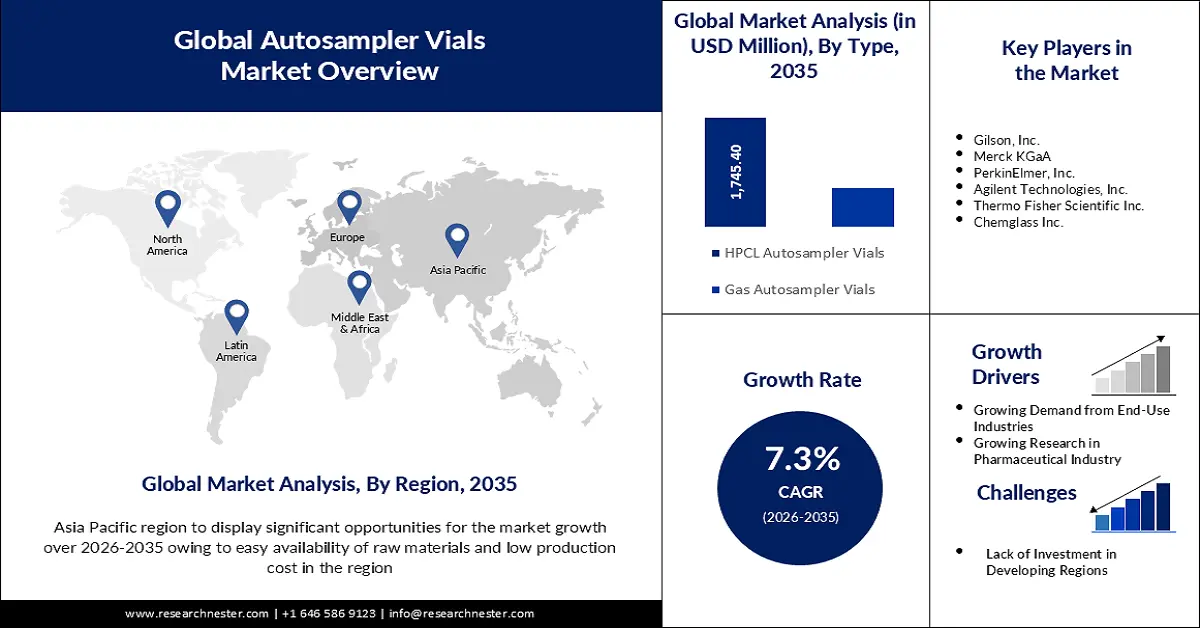

Autosampler Vials Market size was over USD 1.28 billion in 2025 and is anticipated to cross USD 2.59 billion by 2035, growing at more than 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of autosampler vials is assessed at USD 1.36 billion.

The growing demand for sample storage in the pharmaceutical industry, prevents any kind of leakages as compared to the conventionally used storage system. According to a ModuVision Technologies article released in September 2021, the two main uses of autosamplers are the efficiency of procedure (because many samples may be handled without the help of lab staff) and quality.

In addition to these, factors that are believed to fuel the market growth include the growing chromatographic technique applications at the time of the pandemic. The autosamplers reduce the dependence on manual injection of samples into the chromatographic system, and improve the accuracy of the analyzed results.

Key Autosampler Vials Market Insights Summary:

Regional Highlights:

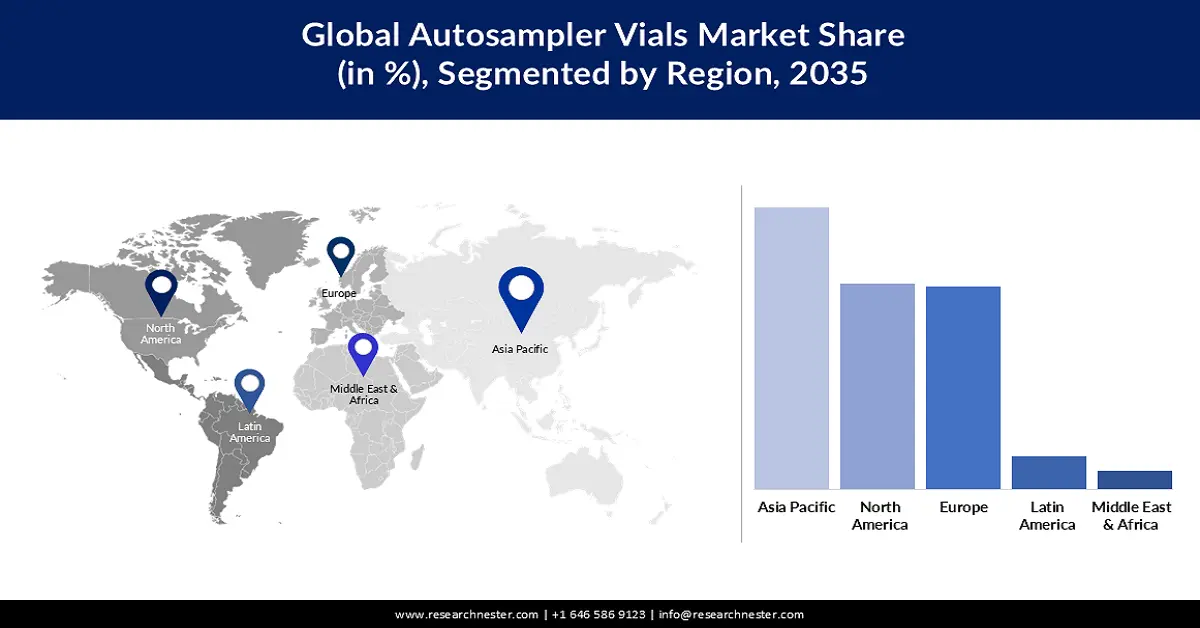

- By 2035, the Asia Pacific autosampler vials market is projected to command the largest revenue share, underpinned by easy raw material availability, low production costs, and expanding R&D and laboratory automation activities.

- The North America region is anticipated to secure a lucrative market share by 2035, supported by strengthened laboratory infrastructure, rising healthcare R&D funding, and expanding pharmaceutical modernization initiatives.

Segment Insights:

-

By 2035, the HPLC segment in the autosampler vials market is positioned to hold a remarkable revenue share, propelled by its extensive use in analytical separation and purification and its ability to minimize sample contamination.

-

The Polypropylene Plastics segment is set to attain a substantial share by 2035, driven by its compatibility with sensitive analytes and widespread application across diverse analytical platforms.

-

Key Growth Trends:

- Growing Demand from End Use Industries

- Technological Advancements

Major Challenges:

- Lack of Investment in Developing Regions

- Calibration Errors

Key Players: Agilent Technologies, Inc., Chemglass Inc., Gilson, Inc., Restek Corporation, Shimadzu Corporation, Gilson, Inc.

Global Autosampler Vials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.28 billion

- 2026 Market Size: USD 1.36 billion

- Projected Market Size: USD 2.59 billion by 2035

- Growth Forecasts: 7.3%

Key Regional Dynamics:

- Largest Region: North America (36.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: India, Singapore, Thailand, Australia, Mexico

Last updated on : 19 November, 2025

Autosampler Vials Market - Growth Drivers and Challenges

Growth Drivers

- Growing Demand from End-Use Industries – The vials are primarily utilized in autosamplers so that they can adhere securely to the precise dimensions when carrying out analytical tests in laboratory testing programmes like impurity research, stability tests, amount verification, and many others. The need for all efficient equipment and related items, including autosampler vials, is predicted to increase as a result of expanding end-use industries including the healthcare and pharmaceutical and food & beverage sectors.

- Technological Advancements – It is predicted that a number of product improvements will favorably affect the autosampler industry. Clear and amber glass-based goods that are highly inert are greatly preferred. Amber glass aids in preventing UV exposure, safeguarding the samples of a delicate nature. In comparison to commonly used screw cap vials, the structural construction of vials makes it possible to avoid any leakage, making them perfect for sample storage following processing. For high-grade performance during sample processing processes, vials that are often purchased with septa and vial caps are also employed for numerous injections and sample storage.

- Growing Research in Pharmaceutical Industry – The research-based pharmaceutical industry is extremely important across the globe. Europe spent an estimated USD 51,749 million on research and development in Europe in 2021. In 2021, North America accounted for 49.1% of global pharmaceutical sales while Europe only made up 23.4%.

- Increasing Demand for Glass Vials in Pharma Packaging – Pharmaceutical packaging takes up a small portion of garbage, while glass makes up most of the waste. Glass packaging is 100% recyclable, making it an environmentally preferable packaging option. Furthermore, according to NCBI, tinted glass can protect its contents from UV rays and specific wavelengths, like amber and red glass.

Challenges

- Lack of Investment in Developing Regions - A significant factor restraining the growth of the autosampler vials market is the lack of investments made by market participants in developing countries. The expenditure practices of hospitals, research labs, pharmaceutical businesses, contract research organizations, etc. are significantly influenced by factors including spending priorities, available resources, and product and economic cycles. The funding given for different research programs changes depending on budget allocations and the timely passage of the annual federal budget, which also affects how consumable products such as autosampler vials are used.

- Calibration Errors

- Less Vial Capacity

Autosampler Vials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 1.28 billion |

|

Forecast Year Market Size (2035) |

USD 2.59 billion |

|

Regional Scope |

|

Autosampler Vials Market Segmentation:

Type Segment Analysis

HPLC segment in autosampler vials market is expected to hold remarkable revenue share by the end of 2035. HPLC has been used to separate, identify, and quantify numerous components in mixtures in the manufacturing, research, and medical areas. Vials for autosamplers lessen the chance of sample loss and contamination.

In comparison to other methods, the HPLC method is more frequently used for separation and purification procedures because most of the samples that are analyzed in a controlled laboratory environment do so in a stable form in their liquid state. Customers favor using this chromatography technique over others due to its simplicity as well as the simpler availability of many types of filter columns.

Material Segment Analysis

By the end of 2035, polypropylene plastics segment is poised to account for market share.These are the preferred vials for the analysis of substances that are sensitive to pH, salt, or heavy metals. Sample volumes up to 700 L can be contained in polypropylene vials with low residual volumes of less than 3 L.

They come in screw vial, crimp vial, and snap vial varieties. They are the perfect match for HPLC and GC instrument platforms in a variety of applications, including pharmaceuticals, environmental science, energy and fuels, forensics, materials science, biopharmaceutics, proteomics, and metabolomics.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Material |

|

|

End User |

|

|

Product |

|

|

Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Autosampler Vials Market - Regional Analysis

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share by 2035, owing to the easy availability of raw materials and low production cost in the region. The market is growing as a result of factors including investment in research & development, and a surge in laboratory automation.

North American Market Insights

North America region is anticipated to hold lucrative market share by the end of 2035. Improved laboratory infrastructure, increased financing for R&D in the healthcare sector, and rising government initiatives to update the infrastructure in the pharmaceutical business are the primary factors affecting the market expansion in this area.

European Market Analysis

Europe region is estimated to capture significant autosampler vials market share by the end of 2035.The market for autosampler vials is growing as a result of increased R&D efforts in numerous end-use sectors. Germany broke all previous records for research and development investment in 2021. The Federal Statistical Office (Destatis) reported that the R&D expenditure increased from 2020 to 2021 by 5.6% to USD 121.57 billion based on preliminary data.

Autosampler Vials Market Players:

- Agilent Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Waters Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer, Inc.

- Shimadzu Corporation

- Merck KGaA

- Chemglass Inc.

- Gilson, Inc.

- Restek Corporation

- Others

Recent Developments

- The Thermo Fischer Scientific, Inc. acquired PPD, Inc., a U.S.-based global provider of clinical research services to the pharma and biotech industry, and included it within the Laboratory Products and Biopharma Services segment. The addition of PPD’s clinical research services enhanced its offering to biotech and pharma customers by enabling them to accelerate innovation and increase their productivity within the drug development process.

- Merck KGaA announced the acquisition of Exelead, which specializes in complex injectable formulations. Through this acquisition, the company strengthened its CDMO services across the mRNA value chain.

- Report ID: 1515

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Autosampler Vials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.