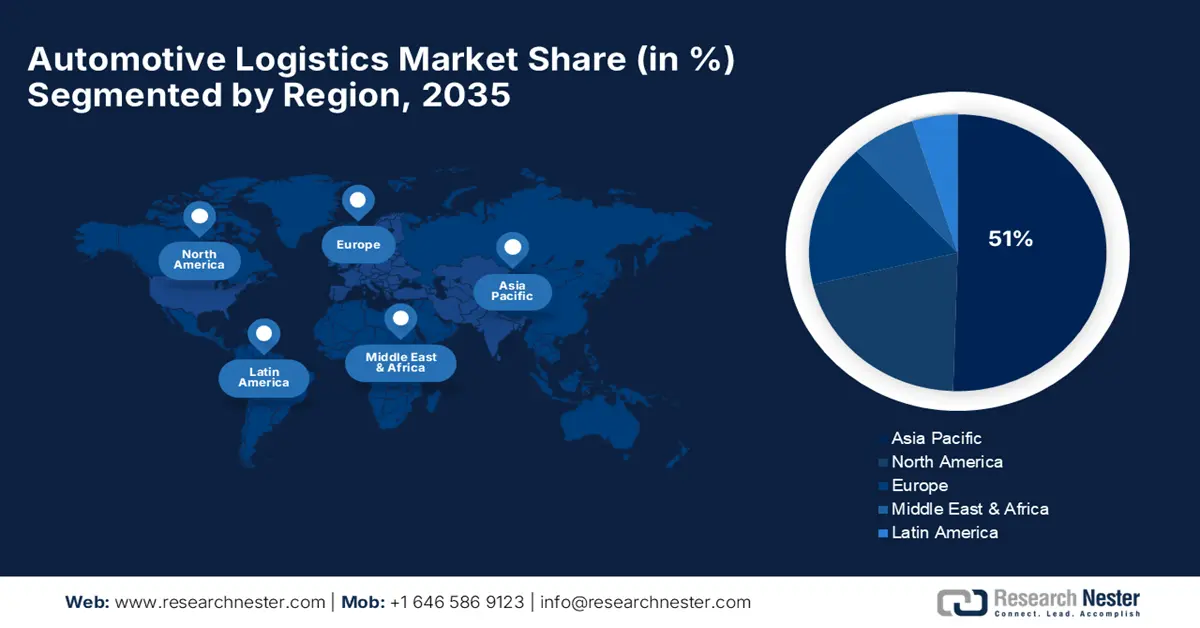

Automotive Logistics Market - Regional Analysis

APAC Market Insights

Asia Pacific automotive logistics industry is expected to retain a commanding 51% market share by 2035, fueled by rising volumes of automotive production, strong economic growth, and ongoing investment in manufacturing capacity that generates unprecedented levels of demand for bespoke logistics services. The region has developed automotive manufacturing clusters, expanding consumer bases, and government measures favoring infrastructure development and technology upgrading. Strategic growth supports market leadership through synergistic service integration that enables APAC firms to address regional and global automotive manufacturers' increasingly sophisticated supply chain needs.

China automotive logistics market is being reshaped by overarching government policies, huge infrastructure spending, and explosive adoption of electric vehicle technologies that need sophisticated logistics support for components, batteries, and finished vehicles. The domestic China market is supported by robust domestic manufacturing growth and strategic global expansion, creating opportunities for logistics providers to provide integrated supply chain solutions. In 2024, BYD became a one of the leaders in the electric vehicle market, delivering more than 4.27 million new energy vehicles while establishing an integrated supply chain with FinDreams Powertrain division. The firm has numerous mega-factories throughout China while establishing its initial European passenger car factory in Szeged, Hungary, showcasing a holistic vertical integration strategy.

India continues to provide the automotive logistics industry with a lucrative opportunity fueled by expanding manufacturing operations, investment in infrastructure growth, and holistic government initiatives promoting car industry expansion and technology development. The Indian economy is empowered by the high growth potential of the domestic market, strategic collaborations with overseas tech firms, and favorable policy environments that facilitate innovation and supply chain efficiency. As per NITI Aayog in April 2024, vehicle production in India has seen an exponential rise, with output exceeding 28 million units during the 2023–24 period. Industry leaders stressed the importance of logistics infrastructure investment in supporting the expansion of automotive manufacturing and combating issues such as skilled manpower needs and technology implementation.

North America Market Insights

North America market is projected to achieve a CAGR of 8.5% from 2026 to 2035, based on high manufacturing activity, technological advancement of logistics services, and holistic infrastructure investment that guarantees sophisticated automotive supply chain operations. The region has well-established automotive production clusters, advanced logistics networks, and ongoing investment in green transportation solutions that offer growth opportunities across various service segments. Expansion in the market is facilitated by strategic collaborations and technology implementation that enhance operational effectiveness while addressing changing customer needs for accuracy and reliability in automobile logistics services.

The U.S. automotive logistics market is expanding at a considerable rate owing to innovation in logistics technologies, deliberate fleet growth, and robust government support for green transportation initiatives. The market enjoys extensive infrastructure, sophisticated digital platforms, and consumer requirements for optimized supply chain solutions that enhance both conventional and electric vehicle production. Firms are deploying transformation plans with greater emphasis on higher-value services while maximizing operational efficiency. In June 2023, UPS collaborated with TuSimple and Waymo to use autonomous self-driving trucks for package delivery with the help of sophisticated cameras, lidar, and radar technology. The strategic alliances mark a substantial leap in last-mile delivery automation, covering 41% of transport costs incurred due to end-delivery phases, while building groundwork for unmanned delivery systems' broader extension across auto parts distribution networks in the future.

Canada auto logistics sector is founded on robust trade relationships, governmental support policies, and a dedication to innovation. This emphasis on a streamlined and up-to-date supply chain directly enhances the country's automotive production competitiveness, especially with its principal partner, the United States. This resilience is plain to see in recent export performance. In January 2025, motor vehicle and parts shipments hit a 25-year high, with more than 90% of them headed to the U.S. This record reflects the extent to which investment in sophisticated logistics is paying off in addressing the high-volume needs of the North America automotive sector.

Europe Market Insights

Europe is predicted to experience sustained growth from 2026 to 2035, driven by strict environmental regulations, high-end manufacturing capabilities, and investments in sustainable transportation infrastructure that enable automotive logistics innovation. The region enjoys advanced regulatory models, technology leadership, and demand for environmentally friendly logistics solutions, offering opportunities for firms providing high-end service capabilities. Europe market is moving towards green logistics operations, with precision and reliability still necessary for automotive manufacturing assistance.

Germany is a key market in Europe, marked by automotive manufacturing world-class capabilities, technological advancement, and end-to-end supply chain integration that makes German firms global leaders in automotive logistics solutions. Daimler Truck received the VDA Logistics Award in February 2025 for its Electrify Inbound Logistics project, which depends on electric trucks in its own supply chain, guaranteeing local zero emissions at four production locations in Gaggenau, Kassel, Mannheim, and Wörth. The firm embarks on complete electrification of delivery traffic with production materials within its own freight responsibility, with Wörth delivery traffic to be completely electrified by the end of 2026, setting realistic milestones for industry adoption of eco-friendly automotive logistics solutions.

The UK automotive logistics market shows robust performance through end-to-end service integration, selective international alliances, and ongoing investment in logistics infrastructure that addresses both domestic and international automotive manufacturing operations. British logistics firms are deepening their international reach while also developing robust domestic capabilities with technological innovation and strategic alliances. In October 2024, Yamato Holdings invested £2 million in all-electric UK delivery startup Hived as part of a strategic collaboration driving sustainable and technology-enabled logistics in the UK and Japan markets. The partnership facilitates continued sharing of ideas and best practices amongst companies while empowering Hiroshima Accord ambitions for UK-Japan cooperation in the technology and sustainability industries.