Automotive Logistics Market Outlook:

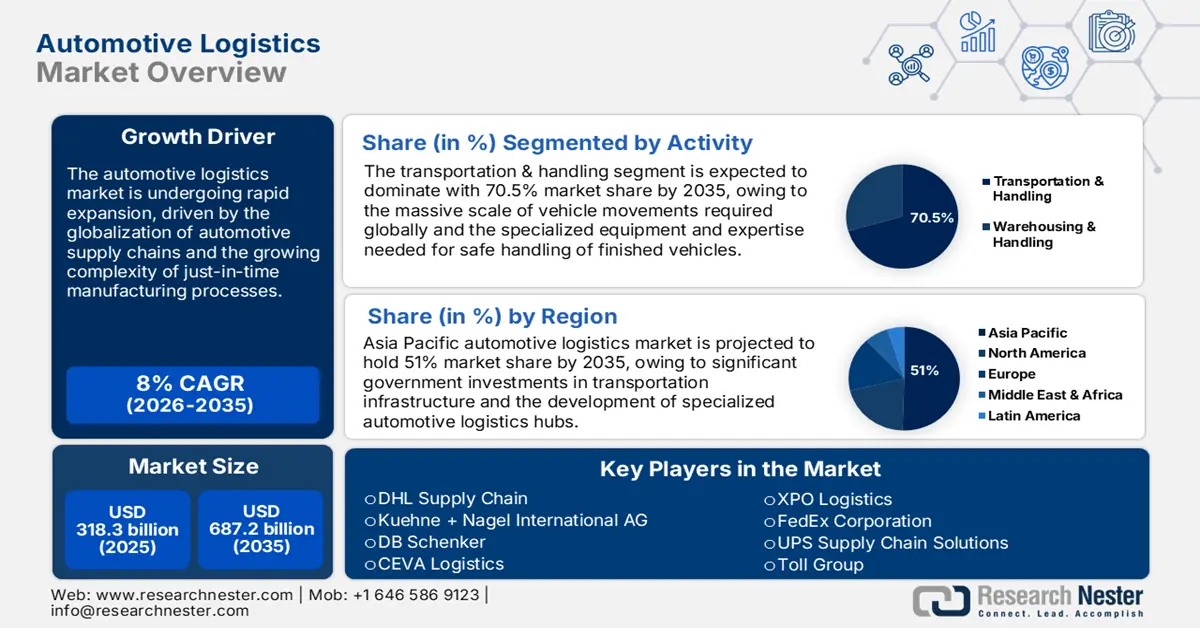

Automotive Logistics Market size is valued at USD 318.3 billion in 2025 and is projected to reach a valuation of USD 687.2 billion by the end of 2035, rising at a CAGR of 8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automotive logistics is anticipated at USD 343.7 billion.

The automotive logistics market is undergoing swift expansion fueled by the growing complexity of automotive production, the growth in electric vehicle technologies, and the changing needs of mobility-focused supply chains. The role of logistics in the development of the auto industry is clear from current industry acknowledgment, as noted by the Society of Indian Automobile Manufacturers in July 2025, which stressed logistics as a major driver for India's automotive industry to grow by 7.3% in FY25. Industry players continue to stress cooperative models between producers and logistics operators to meet supply chain optimization needs for continued industry growth and competitiveness.

One key market growth potential lies in creating end-to-end logistics solutions that can process advanced components and accommodate the just-in-time delivery needs of automotive Original Design Manufacturers. Such change is best seen in industry leaders such as DENSO Corporation, which posted consolidated revenue of ¥7.16 trillion ($47.9 billion) in April 2025, showing resilience in the supply chain and logistics efficiency skills that helped build profit during unfavorable market conditions. The sector is seeing record levels of innovation in digital transformation and automation technologies that streamline route planning, shorten delivery times, and minimize operational wastage.

Key Automotive Logistics Market Insights Summary:

Regional Insights:

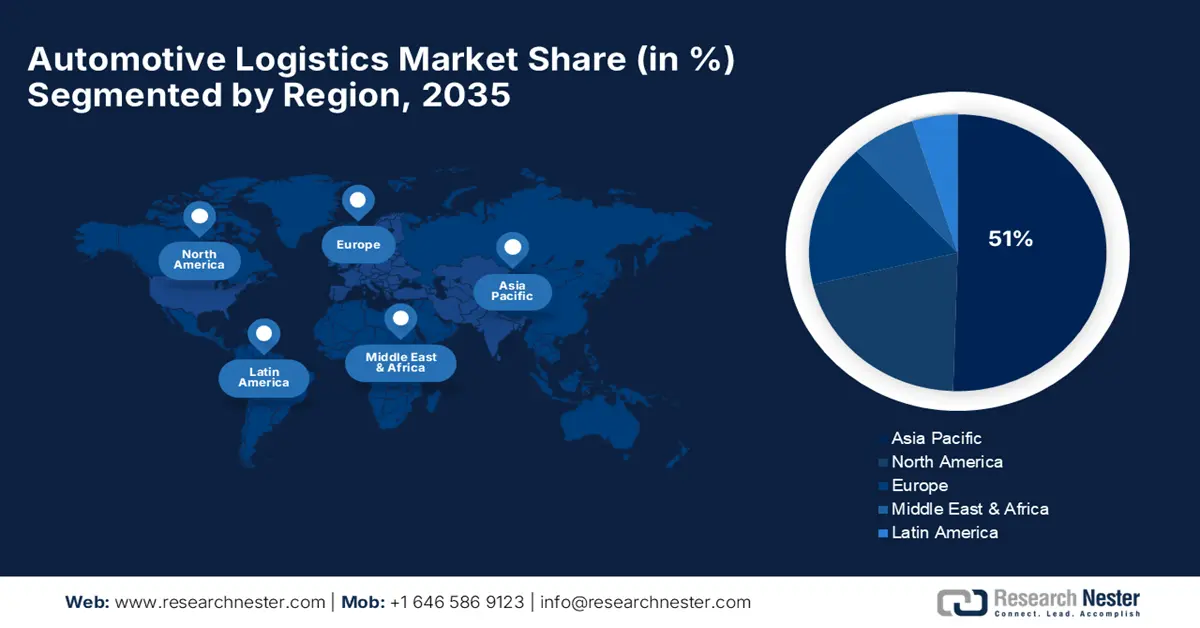

- By 2035, Asia Pacific is expected to secure a leading 51% share in the automotive logistics market, propelled by rising automotive production volumes and sustained investment in manufacturing capacity.

- North America is projected to record an 8.5% CAGR from 2026–2035, supported by heightened manufacturing activity and technologically advanced logistics networks.

Segment Insights:

- The transportation & handling segment is projected to command 70.5% share by 2035 in the automotive logistics market, bolstered by its essential role in moving vehicle parts and finished automobiles across complex global supply chains.

- The automobile components segment is set to hold about 65% share by 2035, reinforced by the escalating complexity and volume of parts required for modern vehicle manufacturing.

Key Growth Trends:

- Digital transformation and smart logistics integration

- Electrification and adoption of sustainable transportation

Major Challenges:

- Freight transportation volatility and capacity constraints

- Growing operating expenses and service complexity

Key Players: Kuehne + Nagel International AG, DB Schenker, CEVA Logistics, XPO Logistics, FedEx Corporation, UPS Supply Chain Solutions, Toll Group, Tata Motors Logistics, GDEX Berhad.

Global Automotive Logistics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 318.3 billion

- 2026 Market Size: USD 343.7 billion

- Projected Market Size: USD 687.2 billion by 2035

- Growth Forecasts: 8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (51% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 27 August, 2025

Automotive Logistics Market - Growth Drivers and Challenges

Growth Drivers

- Digital transformation and smart logistics integration: The automotive logistics sector is experiencing record growth through digital transformation programs that utilize artificial intelligence, IoT technologies, and sophisticated routing algorithms to streamline supply chain operations. Firms are investing heavily in digital platforms that provide real-time visibility, predictive analytics, and automated decision-making features, thereby reducing costs and improving delivery performance. In February 2023, Toyota Tsusho Corporation collaborated with Pioneer Corporation to create the Optimized Delivery Planning Service using proprietary Piomatix LBS APIs and a mobility AI platform. The partnership registered impressive outcomes, with over 94% on-time delivery rates and a decrease of 12% in overall delivery time for Tokyo-based logistics service firm WILLPORT Co., Ltd., highlighting the revolutionary potential of digital logistics solutions.

- Electrification and adoption of sustainable transportation: The shift to electric vehicles and sustainable transport solutions is opening up substantial opportunities for automotive logistics players to build specialist skills for managing electric vehicle components, batteries, and charging points. This trend demands complex logistics networks that are capable of maintaining temperature-controlled environments, safety procedures for hazardous materials, and specialized handling apparatus. BYD and CEVA Logistics exhibited European ground decarbonization initiatives in September 2024 at IAA Transportation Hannover, where CEVA received four BYD ETH8 pure-electric trucks in January 2025. The partnership is CEVA's way of supporting its net-zero goal of 2050 through green transportation solutions with the capability to keep operations running efficiently in logistics activities.

- Strategic acquisitions and worldwide network expansion: Auto logistics firms are recording impressive growth through strategic purchases that increase geographic coverage, service capabilities, and technological capabilities to serve the changing needs of global automotive manufacturers. In November 2024, Kuehne+Nagel purchased a 51% majority holding in IMC Logistics, a leading US-based marine drayage provider with more than 40 years of experience in intermodal solutions. IMC moves 2 million TEUs a year in drayage and rail movements across 49 facilities at primary US seaports and rail centers, generating approximately $800 million in revenue in 2023 and enabling Kuehne+Nagel to offer more competitive solutions for sea freight customers' value chains. Such consolidation efforts produce end-to-end service networks that can manage complicated global supply chains and sophisticated automotive parts.

Global Car Production Growth Trends & Impact on Automotive Logistics

|

Year |

Production Trend (% YoY) |

Car Production Scale (Est. in Mn Units) |

Automotive Logistics Market Implication |

|

2011 → 2012 |

+6.6% |

~63 → 67 Mn |

Rising vehicle output boosted demand for logistics capacity (inbound & outbound). |

|

2013 → 2014 |

+4.1% |

~71 → 74 Mn |

Stable growth supported steady automotive logistics expansion. |

|

2015 → 2016 |

+5.7% |

~74 → 78 Mn |

Peak demand in logistics networks as OEMs expanded global supply chains. |

|

2018 → 2019 |

-6.2% |

~80 → 75 Mn |

Decline disrupted logistics players; reduced shipments & overcapacity issues. |

|

2021 → 2022 |

+8.7% |

~63 → 69 Mn |

Strong recovery post-pandemic created surge in logistics needs for car distribution. |

Source: ACEA

Challenges

- Freight transportation volatility and capacity constraints: The automotive logistics sector is under serious threat from continued volatility in freight transport services and capacity shortages that affect supply chain stability and cost predictability. The volatility results in planning challenges for automotive manufacturers who need reliable logistics services to help facilitate just-in-time manufacturing operations and global supply chain coordination. In February 2025, the US Bureau of Transportation Statistics announced the December 2024 Freight Transportation Services Index decreased 0.1% compared to the previous month and decreased 1.0% compared to December 2023, with for-hire freight shipments at 137.3, still 2.9% below the all-time high in August 2019. The freight index decreased for the second month in a row, reflecting continued pressure faced by automotive supply chains that need assured freight movement.

- Growing operating expenses and service complexity: Automotive logistics carriers are facing growing operating expenses fueled by peak season premium surcharges, unique handling needs, and mounting service complexity that complicate profitability and competitive pricing models. These costs are especially concerning for carriers during high-demand seasons when premium pricing tiers become increasingly impactful on logistics budgets. FedEx in 2025 reported higher peak season surcharges than last year, starting September 29 with increasing prices from November 24 through December 28, encompassing the peak holiday shipping period. The carrier assesses residential delivery fees for more volume shippers with extra handling surcharges of $8.25 to $10.90 and oversize fees of $90 to $108.50 per package, which will impact automotive suppliers' logistics cost planning and supply chain optimization.

Automotive Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 318.3 billion |

|

Forecast Year Market Size (2035) |

USD 687.2 billion |

|

Regional Scope |

|

Automotive Logistics Market Segmentation:

Activity Segment Analysis

The transportation & handling segment is projected to hold a commanding 70.5% automotive logistics market share through the forecast period, motivated by the inherent function of these services in conveying automobile parts and finished cars within convoluted worldwide supply chains. The segment incorporates the main logistics functions of loading, unloading, warehousing, and distribution, critical to automobile production functions involving tight timing and coordination. The dominance of the segment is complemented by ongoing innovation in automation and efficiency gains. Nippon Express Co., Ltd., in September 2024, announced the NX Universal Harmonious Work Warehouse project, responding to Japan's challenges of an aging population and dwindling workforce by incorporating leading-edge logistics robots, work-assist machines, and optimized workplace conditions to improve productivity while opening up access to hitherto untapped labor pools.

Type Segment Analysis

The automobile components segment is anticipated to command around 65% market share by 2035, accounting for the immense complexity and quantity of components needed for contemporary vehicle production, driving persistent demand for specialized transport services. The segment benefits from the increasing complexity of automotive production processes, which demands precise coordination of thousands of discrete components from international suppliers. Businesses are developing expertise in temperature-controlled supply chains, anti-static conditions, and precision support required for these sophisticated components. In February 2025, Hesai Technology reported increased collaboration with BYD, supplying automotive lidar to over 10 BYD models that will be entering mass production this year. The collaboration illustrates alignment between automotive production and cutting-edge sensor technologies, needing unique supply chain solutions for intricate electronic components, enabling autonomous driving technologies.

Mode of Transport Segment Analysis

The roadways segment is expected to lead the market until 2035, boosted by the convenience, speed, and affordability of road transport for automotive logistics uses, especially for last-mile delivery and just-in-time production support. Road transport offers the diversity of service necessary to cover various pickup and delivery points, as well as the time precision necessary for automotive manufacturing operations. Strength in this segment is evidenced through successful fleet growth and operational enhancements. In January 2025, UPS announced fourth-quarter 2024 results with consolidated revenues of $25.3 billion, with strategic efforts to advance performance through the emphasis on increasing higher-yielding volume, along with accelerating transformation initiatives targeting about $1 billion in savings. Businesses are investing in electric vehicle fleets and high-tech solutions that retain road transport's flexibility benefits while satisfying environmental performance needs.

Our in-depth analysis of the global automotive logistics market includes the following segments:

|

Segment |

Subsegments |

|

Activity |

|

|

Type |

|

|

Mode of Transport |

|

|

Distribution |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Logistics Market - Regional Analysis

APAC Market Insights

Asia Pacific automotive logistics industry is expected to retain a commanding 51% market share by 2035, fueled by rising volumes of automotive production, strong economic growth, and ongoing investment in manufacturing capacity that generates unprecedented levels of demand for bespoke logistics services. The region has developed automotive manufacturing clusters, expanding consumer bases, and government measures favoring infrastructure development and technology upgrading. Strategic growth supports market leadership through synergistic service integration that enables APAC firms to address regional and global automotive manufacturers' increasingly sophisticated supply chain needs.

China automotive logistics market is being reshaped by overarching government policies, huge infrastructure spending, and explosive adoption of electric vehicle technologies that need sophisticated logistics support for components, batteries, and finished vehicles. The domestic China market is supported by robust domestic manufacturing growth and strategic global expansion, creating opportunities for logistics providers to provide integrated supply chain solutions. In 2024, BYD became a one of the leaders in the electric vehicle market, delivering more than 4.27 million new energy vehicles while establishing an integrated supply chain with FinDreams Powertrain division. The firm has numerous mega-factories throughout China while establishing its initial European passenger car factory in Szeged, Hungary, showcasing a holistic vertical integration strategy.

India continues to provide the automotive logistics industry with a lucrative opportunity fueled by expanding manufacturing operations, investment in infrastructure growth, and holistic government initiatives promoting car industry expansion and technology development. The Indian economy is empowered by the high growth potential of the domestic market, strategic collaborations with overseas tech firms, and favorable policy environments that facilitate innovation and supply chain efficiency. As per NITI Aayog in April 2024, vehicle production in India has seen an exponential rise, with output exceeding 28 million units during the 2023–24 period. Industry leaders stressed the importance of logistics infrastructure investment in supporting the expansion of automotive manufacturing and combating issues such as skilled manpower needs and technology implementation.

North America Market Insights

North America market is projected to achieve a CAGR of 8.5% from 2026 to 2035, based on high manufacturing activity, technological advancement of logistics services, and holistic infrastructure investment that guarantees sophisticated automotive supply chain operations. The region has well-established automotive production clusters, advanced logistics networks, and ongoing investment in green transportation solutions that offer growth opportunities across various service segments. Expansion in the market is facilitated by strategic collaborations and technology implementation that enhance operational effectiveness while addressing changing customer needs for accuracy and reliability in automobile logistics services.

The U.S. automotive logistics market is expanding at a considerable rate owing to innovation in logistics technologies, deliberate fleet growth, and robust government support for green transportation initiatives. The market enjoys extensive infrastructure, sophisticated digital platforms, and consumer requirements for optimized supply chain solutions that enhance both conventional and electric vehicle production. Firms are deploying transformation plans with greater emphasis on higher-value services while maximizing operational efficiency. In June 2023, UPS collaborated with TuSimple and Waymo to use autonomous self-driving trucks for package delivery with the help of sophisticated cameras, lidar, and radar technology. The strategic alliances mark a substantial leap in last-mile delivery automation, covering 41% of transport costs incurred due to end-delivery phases, while building groundwork for unmanned delivery systems' broader extension across auto parts distribution networks in the future.

Canada auto logistics sector is founded on robust trade relationships, governmental support policies, and a dedication to innovation. This emphasis on a streamlined and up-to-date supply chain directly enhances the country's automotive production competitiveness, especially with its principal partner, the United States. This resilience is plain to see in recent export performance. In January 2025, motor vehicle and parts shipments hit a 25-year high, with more than 90% of them headed to the U.S. This record reflects the extent to which investment in sophisticated logistics is paying off in addressing the high-volume needs of the North America automotive sector.

Europe Market Insights

Europe is predicted to experience sustained growth from 2026 to 2035, driven by strict environmental regulations, high-end manufacturing capabilities, and investments in sustainable transportation infrastructure that enable automotive logistics innovation. The region enjoys advanced regulatory models, technology leadership, and demand for environmentally friendly logistics solutions, offering opportunities for firms providing high-end service capabilities. Europe market is moving towards green logistics operations, with precision and reliability still necessary for automotive manufacturing assistance.

Germany is a key market in Europe, marked by automotive manufacturing world-class capabilities, technological advancement, and end-to-end supply chain integration that makes German firms global leaders in automotive logistics solutions. Daimler Truck received the VDA Logistics Award in February 2025 for its Electrify Inbound Logistics project, which depends on electric trucks in its own supply chain, guaranteeing local zero emissions at four production locations in Gaggenau, Kassel, Mannheim, and Wörth. The firm embarks on complete electrification of delivery traffic with production materials within its own freight responsibility, with Wörth delivery traffic to be completely electrified by the end of 2026, setting realistic milestones for industry adoption of eco-friendly automotive logistics solutions.

The UK automotive logistics market shows robust performance through end-to-end service integration, selective international alliances, and ongoing investment in logistics infrastructure that addresses both domestic and international automotive manufacturing operations. British logistics firms are deepening their international reach while also developing robust domestic capabilities with technological innovation and strategic alliances. In October 2024, Yamato Holdings invested £2 million in all-electric UK delivery startup Hived as part of a strategic collaboration driving sustainable and technology-enabled logistics in the UK and Japan markets. The partnership facilitates continued sharing of ideas and best practices amongst companies while empowering Hiroshima Accord ambitions for UK-Japan cooperation in the technology and sustainability industries.

Key Automotive Logistics Market Players:

- DHL Supply Chain

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kuehne + Nagel International AG

- DB Schenker

- CEVA Logistics

- XPO Logistics

- FedEx Corporation

- UPS Supply Chain Solutions

- Toll Group

- Tata Motors Logistics

- GDEX Berhad

The competitive dynamics of the automotive logistics industry include a composition of international logistics leaders, specialized automotive service firms, and technology-enabled organizations that capitalize on their differentiated capabilities to address diverse customer bases and geographies. Some prominent companies that lead in the market include DHL Supply Chain, Kuehne + Nagel International AG, CEVA Logistics, and DB Schenker, which lead primarily through vast global networks, sophisticated technology platforms, and specialized knowledge of automotive operations. In contrast, regional players such as DENSO Corporation, Toyota Tsusho Corporation, and Nippon Express Holdings have deep industry knowledge and offer localized service capabilities.

The industry is undergoing substantial strategic growth through focused acquisitions and partnership efforts that enhance service strength and geographical coverage to support automotive manufacturers' worldwide supply chain needs. In December 2023, Kuehne+Nagel acquired Farrow, a Canadian customs broker and logistics company, for an unspecified amount to further develop its customs strength in North America. These strategic acquisitions allow firms to consolidate complementary technologies and service offerings and realize synergies among various market segments and operating capabilities.

Here are some leading companies in the global automotive logistics market:

Recent Developments

- In May 2025, CEVA Logistics announced expansion of its global deep-sea car carrier operations, offering connections from the Far East to Central and South America via regular trade lane and spot services using three additional roll-on, roll-off vessels ranging from 5,500 to 7,000 car equivalent units.

- In February 2025, DHL Group reported strong fourth quarter 2024 performance with Express division achieving €281 million EBIT, up 45% year-over-year, while Supply Chain division reached €662 million EBIT with 5% growth driven by ongoing robotics & automation rollout.

- Report ID: 4503

- Published Date: Aug 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Logistics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.