Automotive Instrument Cluster Market Outlook:

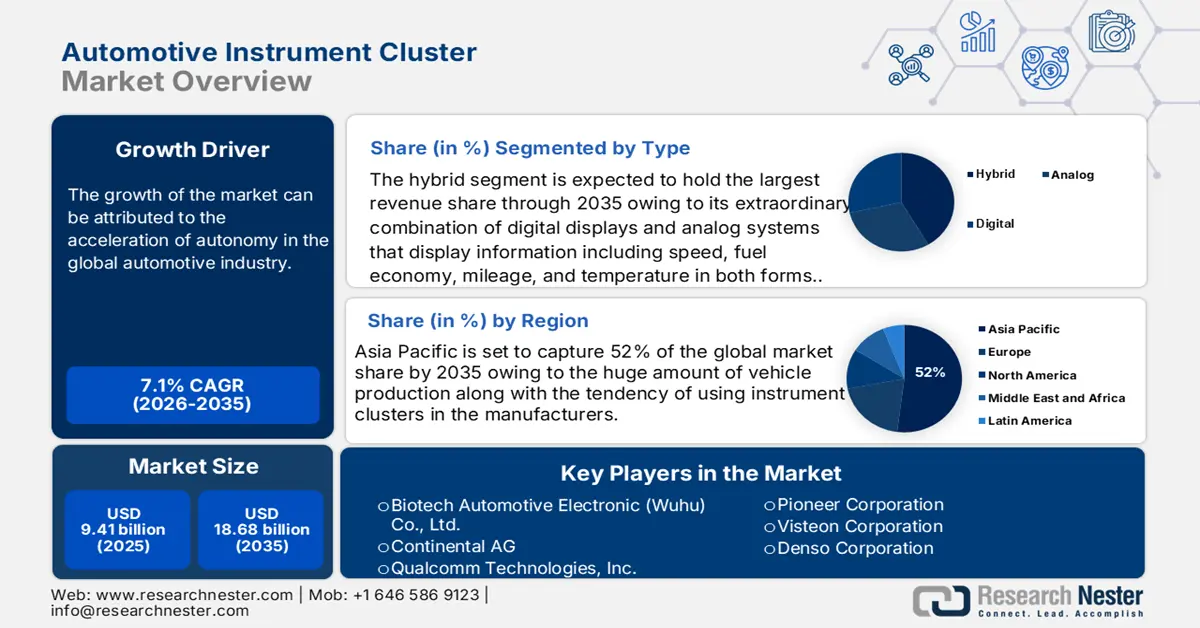

Automotive Instrument Cluster Market size was valued at USD 9.41 billion in 2025 and is set to exceed USD 18.68 billion by 2035, registering over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive instrument cluster is estimated at USD 10.01 billion.

The growth of the market can primarily be attributed to the growing level of autonomy in vehicles worldwide. Furthermore, the automotive instrument cluster provides information that enables the driver to operate the vehicle without much intervention. For instance, as per the data reported, automotive vehicles are anticipated to account for more than 10 percent of car registrations by the end of 2030.

The automotive instrument cluster houses various displays and indicators that enable a driver to operate the vehicle. Several gauges such as speedometers, fuel gauges, odometers, tachometers, oil pressure gauges, and others, as well as various indicators, are responsible for warnings about system malfunctions. In modern cars, all of the sensors are connected to the electronic control unit (ECU). The ECU sends all the relevant information to the instrument cluster, while the instrument cluster provides drivers with all critical system information. With the recent advancements in automotive as well as electronics, the demand for automotive instrument clusters is on the rise amongst automobile manufacturers, which in turn, is expected to create massive revenue generation opportunities for the key players operating in the global automotive instrument cluster market during the forecast period. It is estimated that by 2030, electronics will make up around 50% of the cost of a new car.

Key Automotive Instrument Cluster Market Insights Summary:

Regional Highlights:

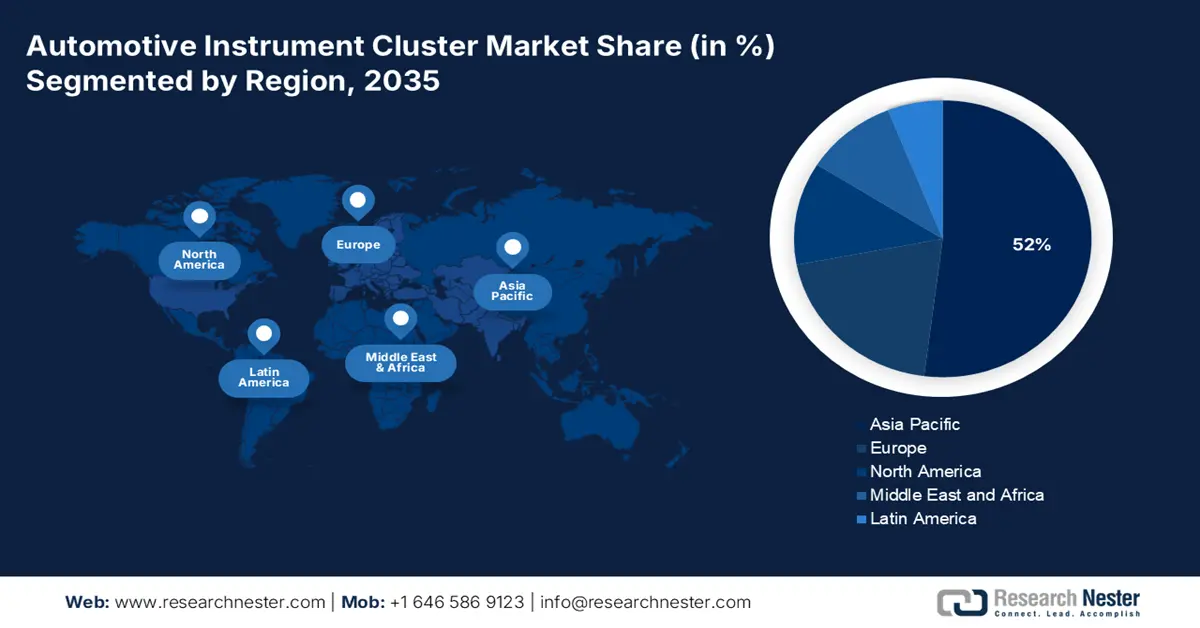

- Asia Pacific automotive instrument cluster market is predicted to capture 52% share by 2035, driven by a strong automobile network and demand for advanced clusters.

- Europe market will achieve the highest CAGR during 2026-2035, driven by the rising presence of luxury cars and digital technology adoption.

Segment Insights:

- The passenger vehicles segment in the automotive instrument cluster market is anticipated to secure the largest share by 2035, fueled by surging sales of passenger cars and urbanization.

- The hybrid segment in the automotive instrument cluster market is expected to secure the largest share by 2035, fueled by growing demand and sale of hybrid vehicles.

Key Growth Trends:

- Growing Sales of Sensors

- Rising Installations of Speedometers

Major Challenges:

- Fluctuation in the Price of Raw Material and Maintenance

- Concern About Parallax Error in an Analog Gauge

Key Players: Biotech Automotive Electronics (Wuhu) Co., Ltd., Continental AG, Qualcomm Technologies, Inc., Pioneer Corporation, Visteon Corporation, Denso Corporation, Aptiv Global Operations Limited, Panasonic Corporation, BlackBerry Limited, Infineon Technologies AG, Robert Bosch GmbH.

Global Automotive Instrument Cluster Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.41 billion

- 2026 Market Size: USD 10.01 billion

- Projected Market Size: USD 18.68 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Automotive Instrument Cluster Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Sales of Sensors – Nowadays, all of the sensors in a car are connected to the ECU, and the ECU is responsible for sending all the relevant information to the instrument cluster. Instrument clusters are connected to the vehicle with a wiring harness. Hence, the rising demand for sensors is expected to boost the global automotive instrument cluster market in the forecasted period. According to the estimated data, over 9.5 billion automotive sensors were sold globally in 2021.

-

Rising Installations of Speedometers –The number of speedometer installations has been increasing in order to keep a check on the speed limit of a vehicle, and display the mileage of the vehicle. The continuous display of the speed on the screen is expected to decrease the crash risk, and it is projected to boost the market’s growth in the upcoming years. According to the World Health Organization 2022 data, every 1% rise in mean speed produces a 3% increase in the serious crash risk and a 4% rise in the fatal crash risk.

-

Increasing Control Modules – Control modules help in detecting the warning lights that are displayed on the instrument cluster module. Therefore, increasing control modules in the vehicles are anticipated to surge the market’s growth. As per the data discovered, modern cars can have more than 100 control modules to control everything in the car.

-

Rising Demand for Advanced Driver Assistance System (ADAS) –ADAS provides driver vision at night through projecting enhanced images on the instrument clusters, and it is expected to increase the growth of the global automotive instrument cluster market. According to the data, ADAS was installed in approximately in 1 billion cars in use worldwide in 2020.

-

Growing Demand for Cars – With the increase in demand for cars and surging number of registrations across the globe, it is predicted to rise the market’s growth over the forecast period. As per the data estimated for 2030, the sales of cars are expected to exceed 100 million units, worldwide.

Challenges

- Fluctuation in the Price of Raw Material and Maintenance - There is a high installation, and repair cost of the automotive instrument cluster, that includes the high cost of integrated circuits, digital systems, displays, and repair cost. Furthermore, the cost of cyber threats is also added to the cost of the system. Therefore, it is expected to restrain the market’s growth in the upcoming years.

- Concern About Parallax Error in an Analog Gauge

- High Cost of Research & Development

Automotive Instrument Cluster Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 9.41 billion |

|

Forecast Year Market Size (2035) |

USD 18.68 billion |

|

Regional Scope |

|

Automotive Instrument Cluster Market Segmentation:

Type Segment Analysis

The global automotive instrument cluster market is segmented and analyzed for demand and supply by type segment into analog, digital, and hybrid. Amongst these segments, the hybrid segment is anticipated to garner the largest revenue by the end of 2035, backed by the growing demand for instrument clusters along with the surge in the sale of hybrid clusters, followed by the increasing sale of hybrid vehicles worldwide. For instance, as per the data estimated, more than 5 million hybrid electric cars were sold in the United States through December 2020. Under hybrid cluster, a digital display system that comprises of automotive smart display including LCD screen that provides information related to the traffic data, temperature, and others in the form of numbers. Moreover, the analog system in the hybrid cluster consists of an odometer, and a speedometer that display the information through the deflection of a pointer on a scale. Therefore, it is projected to surge the segment’s growth in the market.

Vehicle Type Segment Analysis

The global automotive instrument cluster market is also segmented and analyzed for demand and supply by vehicle type into commercial vehicles, and passenger vehicles. Out of these, the passenger car is expected to hold the largest share over the forecast period. The surging sale of passenger cars across the globe, and the increasing urban population, followed by the improving standard of living, are expected to boost the growth of the passenger vehicles segment in the market. Furthermore, the rising population percentage is further expected to increase the segment’s growth in the market. In January 2023, more than 300,000 passenger cars were sold in India as per the reported data.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Instrument Cluster Market Regional Analysis:

APAC Market Insights

The Asia Pacific automotive instrument cluster market is projected to hold the largest share of 52% by 2035. The growth of the market can be attributed majorly to the presence of a strong automobile network in the region, the rising trend amongst automobile users for advanced instrument clusters, as well as a growing production of vehicles. For instance, the total production volume of vehicles in China was more than 2.5 million in September 2022 as compared to 2.3 million in August 2022. Furthermore, there have been growing initiatives taken by the government in countries such as Japan, and China to improve the automotive industry, and it is expected to increase the market’s growth in the region. Moreover, there is high demand for automotive including electric vehicle in which hybrid or digital instrument clusters are installed, that is predicted to further contribute to the growth of the market in the region.

Europe Market Insights

The European automotive instrument cluster market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market can be attributed majorly to the increasing presence of luxury cars along with the adoption of digital and hybrid instrument cluster in the countries such as the United Kingdom. Moreover, there has been an advancement in vehicle technologies that is further anticipated to surge the growth of the European region in the market. In addition, there are presence of luxury cars manufacturers, along with the rising purchasing power of the people, that is predicted to boost the region’s growth in the market.

Automotive Instrument Cluster Market Players:

- Biotech Automotive Electronics (Wuhu) Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- Qualcomm Technologies, Inc.

- Pioneer Corporation

- Visteon Corporation

- Denso Corporation

- Aptiv Global Operations Limited

- Panasonic Corporation

- BlackBerry Limited

- Infineon Technologies AG

- Robert Bosch GmbH

Recent Developments

-

Continental AG launched its MultiViu Sports display platform, a highly adaptable instrument cluster for motorcycles and motor scooters, that can be easily adjusted to the requirements of diverse groups of motorcyclists

-

Qualcomm Technologies, Inc. announced the Snapdragon Automotive Cockpit platform powered the digitally advanced communication and infotainment system, the PEUGEOT i-Cockpit featured in the new PEUGEOT 308.

- Report ID: 4580

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.