Automotive Brake System Market Outlook:

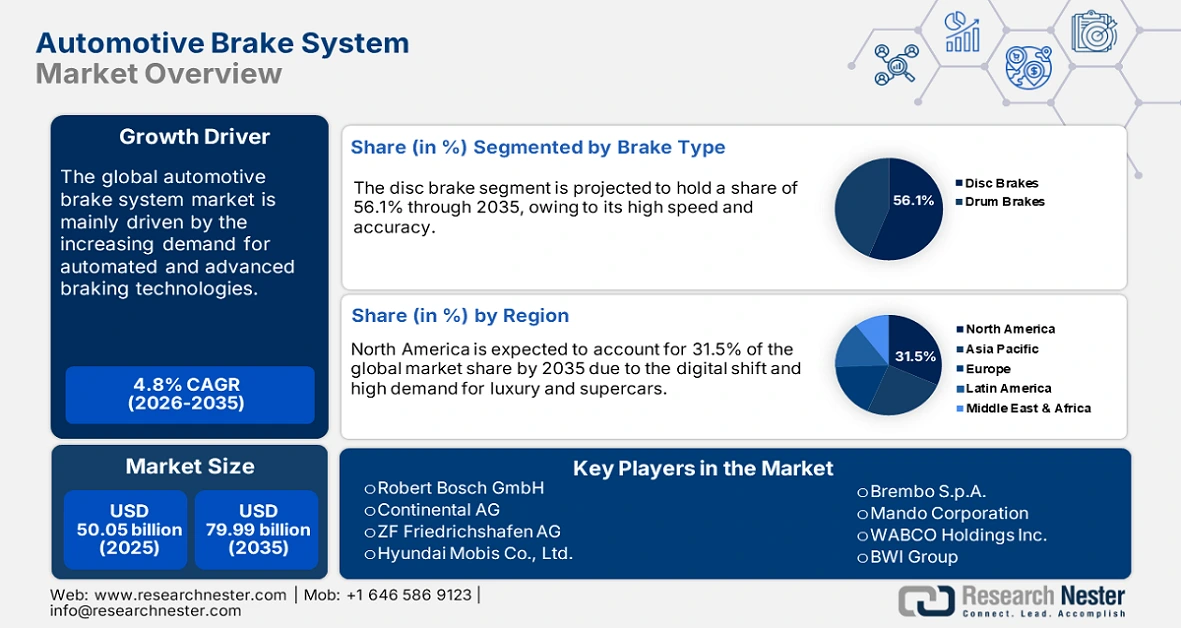

Automotive Brake System Market size was valued at USD 50.05 billion in 2025 and is expected to reach USD 79.99 billion by 2035, registering around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive brake system is evaluated at USD 52.21 billion.

The evolving safety and transportation rules and transition metal mining activities are estimated to influence the automotive brake system sales during the foreseeable period. Asia is the largest producer of earth elements such as copper, steel, iron, and aluminum, which are essential in the production of automotive brake components. The U.S. International Trade Commission (USITC) states that the country’s brake system import trade amounted to more than USD 4.8 billion in 2023. The same source also reveals that the U.S. brake system import trade was led by Mexico, China, and Germany. Furthermore, the automated and smart manufacturing practices are set to aid North America and Europe in dominating the automotive brake system sales in the years ahead.

The U.S. Bureau of Labor Statistics (BLS) reveals that the motor vehicle brake system’s producer price index (PPI) grew by 3.4% between January 2023 and December 2024. The BLS also projects that the consumer price index (CPI) for motor vehicle parts grew by 2.9% during the same period. The PPI and CPI underline modest growth during the efficiency-driven investments and multi-source supply agreements. Furthermore, between 2022 and 2024, the U.S. Department of Energy (DOE) initiated more than USD 45.5 million in R&D grants to accelerate brake system innovation in EVs. Government-backed research initiatives aimed at technological advancements are projected to increase the demand for advanced automotive brake systems.