Automotive Brake System Market Outlook:

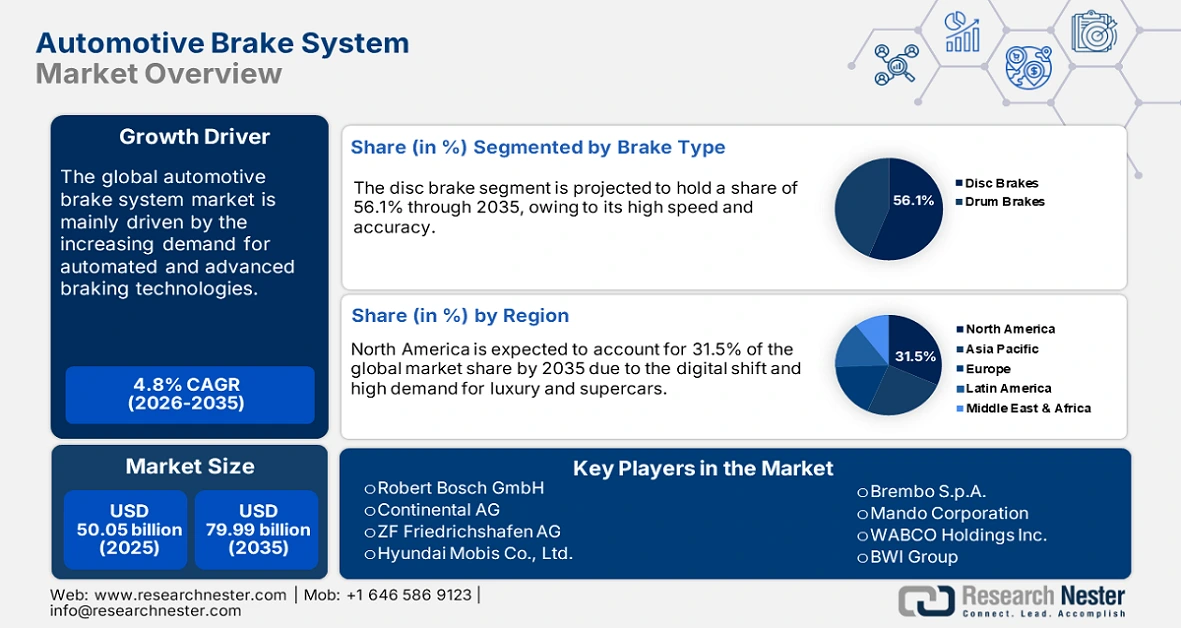

Automotive Brake System Market size was valued at USD 50.05 billion in 2025 and is expected to reach USD 79.99 billion by 2035, registering around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of automotive brake system is evaluated at USD 52.21 billion.

The evolving safety and transportation rules and transition metal mining activities are estimated to influence the automotive brake system sales during the foreseeable period. Asia is the largest producer of earth elements such as copper, steel, iron, and aluminum, which are essential in the production of automotive brake components. The U.S. International Trade Commission (USITC) states that the country’s brake system import trade amounted to more than USD 4.8 billion in 2023. The same source also reveals that the U.S. brake system import trade was led by Mexico, China, and Germany. Furthermore, the automated and smart manufacturing practices are set to aid North America and Europe in dominating the automotive brake system sales in the years ahead.

The U.S. Bureau of Labor Statistics (BLS) reveals that the motor vehicle brake system’s producer price index (PPI) grew by 3.4% between January 2023 and December 2024. The BLS also projects that the consumer price index (CPI) for motor vehicle parts grew by 2.9% during the same period. The PPI and CPI underline modest growth during the efficiency-driven investments and multi-source supply agreements. Furthermore, between 2022 and 2024, the U.S. Department of Energy (DOE) initiated more than USD 45.5 million in R&D grants to accelerate brake system innovation in EVs. Government-backed research initiatives aimed at technological advancements are projected to increase the demand for advanced automotive brake systems.

Key Automotive Brake System Market Insights Summary:

Regional Highlights:

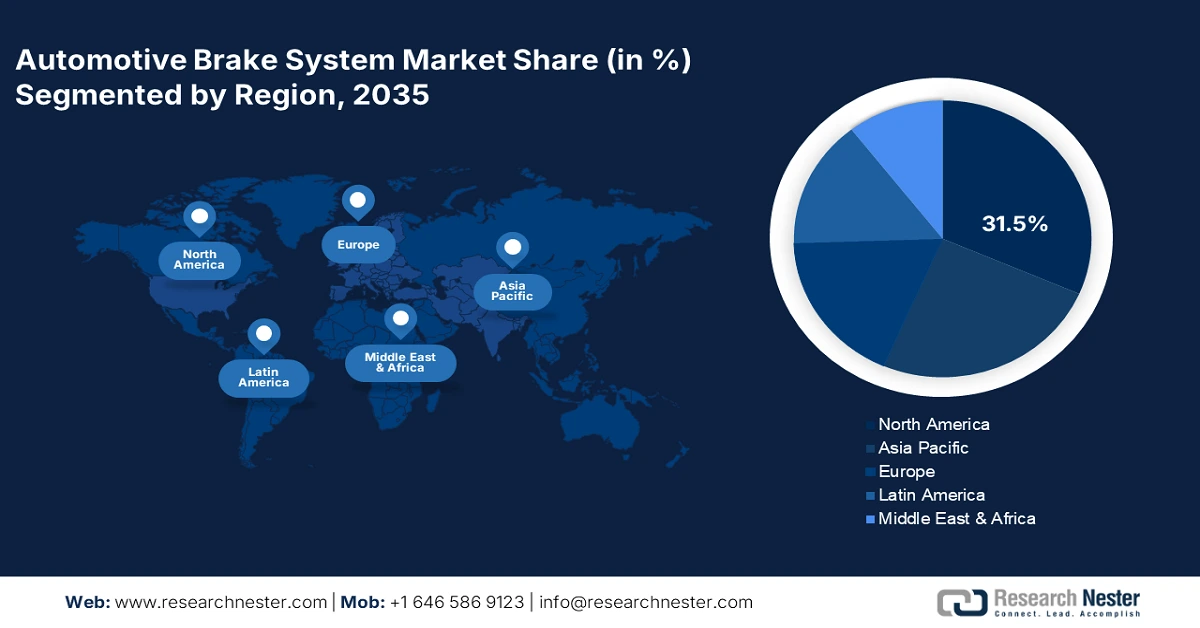

- The North America automotive brake system market is projected to secure a 31.50% share by 2035, driven by the high demand for luxury and supercars, along with public-private investments in ADAS-based brake systems.

- The Asia Pacific market is poised for significant growth over the forecast period 2026–2035, driven by supportive government policies, digitalization, and adoption of smart manufacturing technologies.

Segment Insights:

- The disc brakes segment in the automotive brake system market is projected to hold a 56.10% share by 2026-2035, fueled by superior heat dissipation, reduced stopping distances, and mandatory regulations.

- The passenger vehicles segment in the automotive brake system market is projected to hold a 50.20% share by 2035, driven by supportive government policies, rising individual spending power, and regulatory mandates.

Key Growth Trends:

- Boom in electrification of vehicles

- Strict safety regulations

Major Challenges:

- Cross-border trade restrictions

- Infrastructure gaps

Key Players: Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Hyundai Mobis Co., Ltd., and Brembo S.p.A.

Global Automotive Brake System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 50.05 billion

- 2026 Market Size: USD 52.21 billion

- Projected Market Size: USD 79.99 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Mexico, Brazil, Thailand

Last updated on : 8 September, 2025

Automotive Brake System Market Growth Drivers and Challenges:

Growth Drivers

-

Boom in electrification of vehicles: The swiftly expanding automotive market is driving significant opportunities for component manufacturers. The electrification of vehicles is estimated to increase the application of advanced braking technologies. In 2023, the electric vehicles captured 18.02% of the total car sales globally, states the International Energy Agency (IEA). The same source also estimates that this is anticipated to record a 35.3% rise by 2030. The continuous innovations in the electronic control units, EVs, and brake recovery systems are projected to attract investors in the automotive brake system trade.

- Strict safety regulations: The strict and mandatory transportation regulations are set to fuel the demand for automotive brake systems. Autonomous emergency braking (AEB) and electronic stability control (ESC) are gaining traction in many jurisdictions. The U.S. National Highway Traffic Safety Administration (NHTSA) is set to make autonomous emergency braking technologies mandatory in all light-duty vehicles from 2029. Such initiatives are expected to drive a high demand for sensor-integrated braking solutions in the years ahead.

Challenges

-

Cross-border trade restrictions: The evolving tariff barriers are expected to hamper the sales of automotive brake systems in the coming years. The high import costs in the form of tariffs hinder the cross-border supply chains. The changing certification rules in each region are other types of cross-border trade restrictions witnessed by the automotive brake system manufacturers. Delays in product launches are directly affecting the revenue growth of key market players.

- Infrastructure gaps: The poor infrastructure in the price-sensitive markets is challenging the growth of the automotive brake system market. The unavailability of vehicle-to-infrastructure (V2I) and 5G networks delays the implementation of new brake systems. However, industry giants are estimating these markets as high-earning opportunities. They are expanding their manufacturing plants in these regions and are collaborating with public entities to lead the automotive brake system sales.

Automotive Brake System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 50.05 billion |

|

Forecast Year Market Size (2035) |

USD 79.99 billion |

|

Regional Scope |

|

Automotive Brake System Market Segmentation:

Brake Type Segment Analysis

The disc brake segment is projected to hold 56.1% of the global automotive brake system market share by 2035. The superior heat dissipation and reduced stopping distances are attracting auto-savvy consumers to invest in vehicles with disc brakes. The legality of disc brakes in several countries is set to fuel the demand for disc brakes in the years ahead. The brake performance mandatory regulations are also contributing to the sales of disc brakes. Furthermore, continuous technological innovations are estimated to drive new avenues in the trade of advanced disc brakes.

Vehicle Type Segment Analysis

The passenger vehicle segment is anticipated to account for 50.2% of the global automotive brake system market share throughout the forecast period. Asia Pacific and Europe dominate the production and commercialization of passenger cars owing to supportive government policies and increasing spending power of individuals. The booming popularity of advanced driver assistance systems and automated braking systems is expected to increase the installation of advanced brakes in passenger vehicles. The U.S. Federal Motor Vehicle Safety Standards (FMVSS 126) requirement for passenger cars to be installed with electronic stability control (ESC) is spurring the demand for regenerative braking technologies, particularly in electric vehicles. The regulatory mandates are accelerating the adoption of advanced braking technologies.

Our in-depth analysis of the global automotive brake system market includes the following segments:

|

Brake Type |

|

|

Vehicle Type |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automotive Brake System Market Regional Analysis:

North America Market Insights

The North America automotive brake system market is estimated to capture 31.5% of the global revenue share through 2035. The high demand for luxury and supercars is accelerating the installation of automotive brake systems. The public-private investments are expected to open lucrative doors for the automotive brake system manufacturers. Between 2022 and 2025, the Federal Communications Commission (FCC) funded around USD 42.5 billion for the development of ADAS-based brake systems. The integration of ICT components in the automotive field is anticipated to fuel the introduction of advanced automotive brake systems in the coming years.

The strong presence of key manufacturers is aiding the U.S. in uplifting its position in the advanced braking systems’ competitive space. The strategic collaborations between high-tech companies and automakers are promoting the development of next-generation braking systems. The U.S. Department of Transportation states that in 2023, the connected vehicle R&D spending crossed USD 1.5 billion. The modernization of braking systems is projected to double the revenue shares of key market players in the coming years.

The increasing popularity of zero-emission vehicles in Canada is foreseen to drive sales of automotive brake systems in the years ahead. The supportive government policies and funding are accelerating innovations in the ranking systems. The Innovation, Science and Economic Development Canada (ISED) states that between 2022 to 2024, more than USD 2.65 billion was invested in the zero-emission vehicle supply chain resilience, including brake components. The electrification of vehicles is estimated to generate new opportunities for automotive brake system manufacturers during the foreseeable period.

APAC Market Insights

Asia Pacific region is expected to register significant growth till 2035. The digitalization trend is projected to increase the production of advanced braking technologies. The supportive government policies and initiatives are encouraging new companies to enter the market. the adoption of smart manufacturing technologies is leading to the development of next-gen automotive brake systems. Many manufacturers are collaborating with government entities to expand their operations.

The state-led smart mobility initiatives and large-scale ADAS deployment are augmenting the automotive brake system sales in China. The Ministry of Industry and Information Technology (MIIT) reveals that around USD 6.5 billion was invested in braking and driver assistance solutions between 2022 and 2024. The government funding is backing the manufacturers to increase their operations in the country. The Made in China initiative is also aimed at boosting the production of smart automotive components, including braking systems.

India’s robust growth in the digital infrastructure and smart city initiatives is accelerating the registration of modern vehicles. The electrification of automobiles and zero-emission goals are driving a high demand for energy-efficient power trains. The government-backed funding and policies are likely to encourage the development of advanced braking technologies. The Ministry of Electronics and Information Technology (MeitY) projects that the investments in the brake system technology increased by 27.4% between 2015 and 2023. Such developments are set to increase the domestic production of automotive brake systems during the foreseeable period.

Automotive Brake System Market Players:

- Robert Bosch GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Continental AG

- ZF Friedrichshafen AG

- Hyundai Mobis Co., Ltd.

- Brembo S.p.A.

- Mando Corporation

- WABCO Holdings Inc.

- BWI Group

- Knorr-Bremse AG

- Haldex AB

- Chassis Brakes International

- Brakes India Limited

- Proton Components (DRB-HICOM)

- PBR Australia (Bosch Group Subsidiary)

The technological innovation and new product launch strategies are expected to boost the revenues of the key market players. The increasing registrations of zero-emission vehicles and high demand for supercars in certain demographics are creating a profitable environment for automotive brake system manufacturers. The leading companies are employing marketing strategies including mergers & acquisitions, partnerships & collaborations, and global expansion to uplift their position in the global landscape. Furthermore, the R&D activities in the electronic braking systems (EBS) and ADAS-enabled modules are poised to double the revenues of automotive brake system manufacturers in the coming years.

Recent Developments

- In April 2024, ZF Friedrichshafen revealed the launch of an AI-driven adaptive braking algorithm. This solution personalizes brake sensitivity in real time based on vehicle load and terrain.

- In March 2024, Bosch Mobility announced the launch of its Advanced Braking System (ABS). These solutions are integrated with telematics, especially designed for electric vehicles.

- Report ID: 284

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automotive Brake System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.