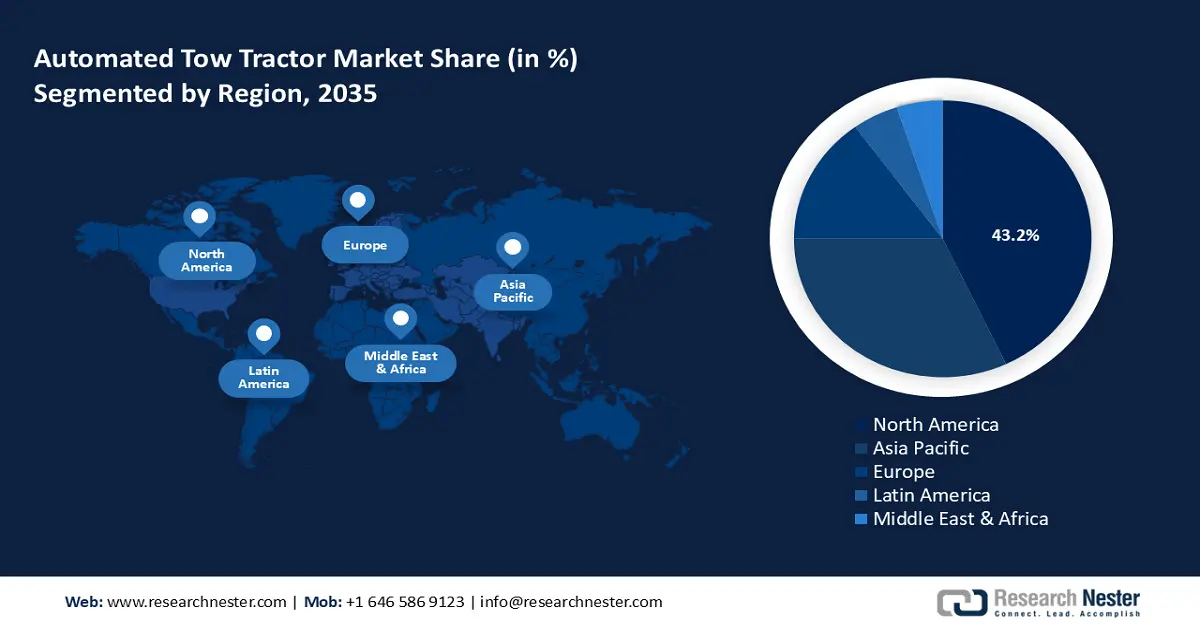

Automated Tow Tractor Market - Regional Analysis

North America Market Insights

The North America market is predicted to dominate with a 43.2% revenue share throughout the estimated forecast period. A major factor in the regional market’s dominance is due to a well-established manufacturing ecosystem driving demand. The market is also impacted by rapid technological advancements in the region, from IoT to the integration of AI. In North America, the e-commerce sector has been a leading player in pushing for the adoption of automated tow tractors. The U.S. and Canada remain major regional markets in North America, although the recent geopolitical tensions related to tariffs threaten to impact the supply chain.

The U.S. automated tow tractor market is positioned to hold a leading share in North America. The government incentives are pushing for the phasing out of ICE vehicles and embracing the complete electrification of vehicles. The trends create opportunities for the proliferation of automated tow tractors. Moreover, consumer preferences in the U.S. market indicate a rising demand for EV solutions. Below is a brief analysis of supportive regulatory policies in the U.S. that can positively impact the growth curve of the automated tow tractor market:

The Canada automated tow tractor market is projected to expand rapidly during the forecast timeline. The companies operating in the Canadian market are experiencing a heightened increase in the adoption of automated tow tractors in multiple applications, ranging from airports to warehouses. The supply chain of the automated tow tractor industry in Canada has faced a few challenges recently related to the acquisition of goods or services in the first quarter of 2023. To negate that, Transport Canada established the National Supply Chain Office in December 2023 to ensure there are no bottlenecks in logistics efficiency, facilitating the entry of new players in the market.

APAC Market Insights

The APAC automated tow tractor market is estimated to account for the second-largest revenue share by the end of 2037, with a projected revenue share of 32.8%. A key facet of the APAC market is the expansion of industrialization initiatives across the region. China remains a major market in APAC, along with Japan, India, South Korea, Indonesia, Australia, and others. Additionally, mandates to phase out ICE vehicles create lucrative opportunities for greater adoption of electric automated tow tractors in the region. Two emerging factors contributing to growth are the rapid surge in e-commerce industry and an increase in demand from the manufacturing sector.

The China automated tow tractor market is poised to hold the largest revenue share in APAC. A key facet of the regional market is China’s position as a global leader in EV adoption, which translates to opportunities in the electric automated tow tractors. The vast logistics industry in China, enhanced by the rapidly rising e-commerce companies, has resulted in large intelligent warehouses and fulfillment centers. These warehouses are increasingly utilizing automated tow tractors to meet throughput expectations, reduce labor, and improve efficiency. In addition, governmental initiatives—such as the Made in China 2025 initiative—strongly support automation and intelligent manufacturing, which align closely to the automation of goods and transportation within the logistics industry and production environment.

The automated tow tractor market in India is poised to exhibit sustained growth during the forecast period. The market in India is impacted by a two-pronged approach, such as the rising demand from the aerospace and manufacturing sectors for towing tractors. The demand is supported by a broader trend in mechanization. The other factor includes supportive government programs such as the National Logistics Policy and the Gati Shakti Master Plan. The global push for mechanization and automation in warehouses is on the rise in India's manufacturing and logistics landscape. As enterprises invest in smart factories, revamp their supply chain, and automate, powered tow tractors are firmly building their way into the intralogistics workflow across sectors like automotive, electronics, pharmaceuticals, and heavy engineering.

Europe Market Insights

The automated tow tractor market in Europe is expected to capture a significant share of the global market for a series of connected reasons. Europe has embraced Industry 4.0 and high levels of automation, and smart logistics in warehouses and factories is increasing the role of automated tow tractors in the efficiency of intralogistics operations. Europe has also adopted some of the most significant environmental legislation, leading many organizations to consider electric and hybrid tow tractors as they review their emissions policies to achieve sustainability goals. Furthermore, European markets have developed infrastructure, such as ports, airports, and distribution centers to assist in the implementation of these systems.

France's careful investment in warehouse automation and smart manufacturing is turning it into a key growth market for automated tow tractors. There are many sophisticated logistics hubs in France—most notably in and around Paris, Lyon, and Marseille—that have engaged in installing automated tow tractors to improve warehouse operations. France is a leader in promoting and supporting sustainability and digital transformation due to governmental support after the “France Relance” initiative that followed the onset of the pandemic. It has therefore enhanced the deployment of electric and hybrid automated solutions.

Germany is recognized as a European leader in the automated tow tractor space, which is often attributed to the robust industrial sector and the early shift in supply chain practices due to the era of Industry 4.0. As a world-leading manufacturer in the automotive and heavy machinery industries, factories in Germany are investing heavily in the automation of their intralogistics systems, featuring automated tow tractors to complete their lean production systems. With the level of warehousing and logistics infrastructure here in Germany, as well as the ongoing trend of employee costs being relatively high, automated towing-type solutions have greatly accelerated. Other drivers include regulatory requirements on sustainability and the national action of electrification.