Automated Tow Tractor Market Outlook:

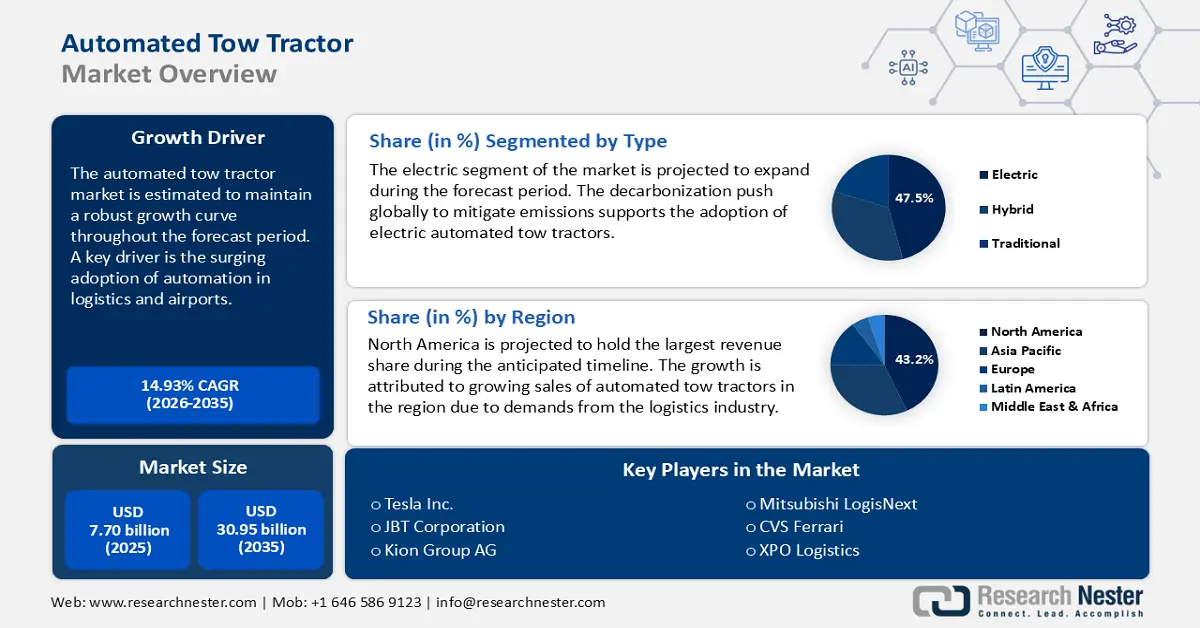

Automated Tow Tractor Market size was valued at USD 7.70 billion in 2025 and is projected to reach USD 30.95 billion by the end of 2035, rising at a CAGR of 14.93% during the forecast period, i.e., 2026-2035. In 2026, the industry size of automated tow tractor is assessed at USD 8.83 billion.

A key factor driving the sector’s growth is an increase in the adoption of automation technologies in airports and logistics observed in the past decade. The market analysis predicts that the trends are slated to continue throughout the forecast period. For instance, in 2022, the FAA released an Airport Technology Research & Development Plan, which emphasizes the importance of automation in airport operations. Moreover, with the rising privatization of airports in emerging economies, greater opportunities for the adoption of automated towing systems are predicted to arise to mitigate turnaround times, whilst adding to the reduction in labor costs. Moreover, advancements in technologies such as AI, ML, and computer vision enable new generations of tow tractors to be able to autonomously navigate in complex environments and evade obstacles while adapting to the continually varying operational conditions of the environment.

The supply chain of a market is its backbone, and the growth curve is intrinsically dependent on its efficiency. The market’s supply chain is associated with a plethora of stages, ranging from procuring raw materials, manufacturing, assembly, and finally distribution. Vital features of the supply chain are the electric drivetrains, sensors, automation software, chassis, etc., which are sourced from specialized suppliers. Moreover, the value chain is reliant on the smooth flow of global trade for either finished goods or raw materials. Concurrently, the regional markets that have managed to reduce reliance on imports are predicted to establish themselves as a leading investment destination in the near future.

Key Automated Tow Tractor Market Insights Summary:

Regional Insights:

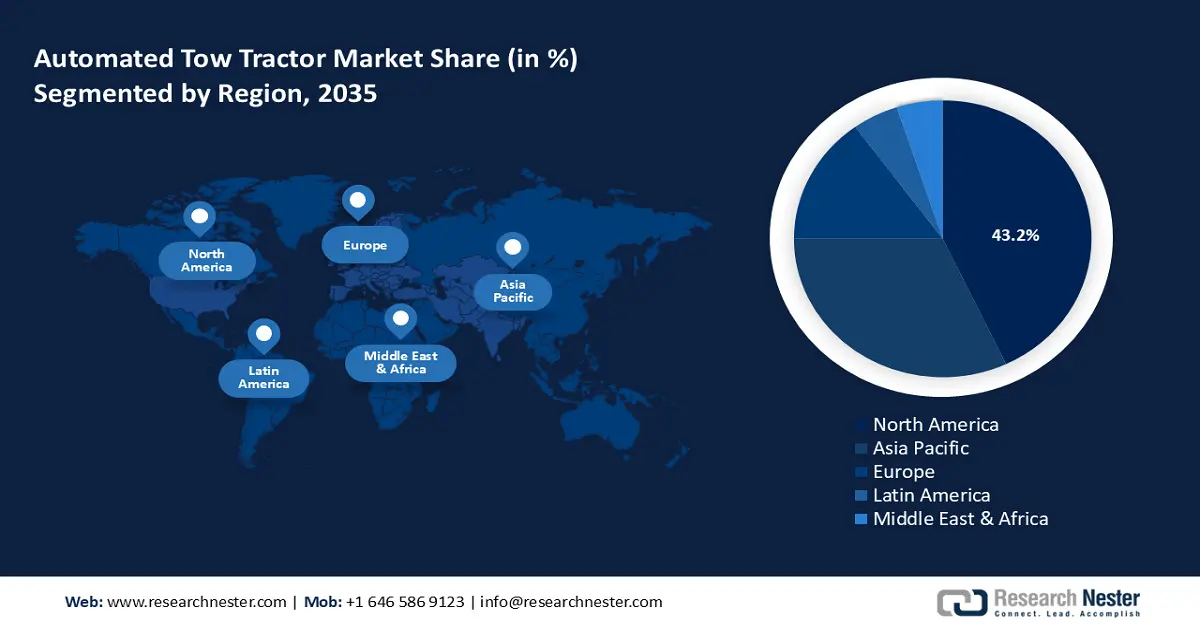

- North America is predicted to dominate with a 43.2% share by 2035, owing to a robust manufacturing ecosystem and technological advancements driving automated tow tractor adoption.

- APAC is expected to secure a 32.8% share by 2037, impelled by industrialization initiatives and rising demand from e-commerce and manufacturing sectors.

Segment Insights:

- The electric segment is projected to account for 47.5% share by 2035, driven by global decarbonization initiatives and infrastructure investments favoring electric automated tow tractors.

- The logistics segment is estimated to hold a 36.4% share by 2035, propelled by the growth of e-commerce and widespread automation adoption across industries.

Key Growth Trends:

- Technological Advancements in Automation and Electrification

- Regulatory Push Toward Sustainability

Major Challenges:

- Regulatory Restrictions

- Market Access Barriers

Key Players: Tesla, Inc., JBT Corporation, Hyster-Yale Materials Handling, Kion Group AG, Linde Material Handling, Raymond Corporation, Mitsubishi Logisnext, CVS Ferrari, XPO Logistics,.

Global Automated Tow Tractor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.70 billion

- 2026 Market Size: USD 8.83 billion

- Projected Market Size: USD 30.95 billion by 2035

- Growth Forecasts: 14.93% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, Germany, Japan, Canada

- Emerging Countries: India, South Korea, Australia, Indonesia, Mexico

Last updated on : 1 October, 2025

Automated tow tractor Market - Growth Drivers and Challenges

Growth Drivers

- Technological Advancements in Automation and Electrification: Ongoing trends that have impacted the broader automated vehicles include a surging focus on electric vehicles (EVs) and driving automation. With the consumer acceptance of automated vehicles improving over the past 5 years, manufacturers are incentivized to increase the production of automated tow tractors. Stakeholders in the market often analyze the success of key companies in the sector. Within the market, the KION Group and Toyota have established themselves as frontrunners in the successful integration of electric powertrains to tow truck models, leading to heightened fuel efficiency. Moreover, consumer interests indicate a greater interest in fuel economy, and these companies are set to tap into the opportunities by offering electric automated tow tractors.

- Regulatory Push Toward Sustainability: The current decade has raised questions about sustainability against the backdrop of lofty net-zero carbon goals by multiple economies. A key facet of the entire discussion revolves around strict environmental regulation, which includes ambitious carbon emission reduction targets. A convergence of these trends has impacted the calls for mobility solutions that are environmentally friendly as well as energy-efficient. The automated tow tractor segments have been able to answer the demands, impacting the positive growth trajectory of the market. Potential entrants in the market are looking towards the regions of North America, Europe, and APAC, which are leading in sustained regulatory drives. Moreover, the regulatory push for sustainable solutions alone is not lucrative for manufacturers, but they require market indicators of profitability.

- Growing Demand for Warehouse Automation: An emerging factor facilitating the expansion of the automated tow tractors market is the demand for automated truck mobility solutions in smart warehouses. After the COVID-19 pandemic, the e-commerce sector experienced substantial growth, and to support the continued expansion, the requirement for smart distribution centers is at an all-time high. The tow trucks solve critical pain points in smart warehouses, such as labor shortages or workplace safety concerns. Amazon has been a leading player in the establishment of automated warehouses. For instance, Amazon has been investing heavily in automating its warehouse via the successful integration of automated tow tractors in logistics operations.

Electric Vehicle (EV) Market Share by Country/Region in 2024

|

Country/Region |

Share of New Cars Sold That Are Electric (%) |

|

Norway |

92% |

|

Sweden |

58% |

|

China |

48% |

|

United Kingdom |

28% |

|

World (Global Avg.) |

22% |

|

European Union (27) |

21% |

|

Germany |

19% |

|

United States |

10% |

|

India |

2.1% |

Source: International Energy Agency - Global EV Outlook 2025

Quarterly Agricultural Tractor Registrations in Europe (2016-2024)

|

Year |

Key Observations (Quarterly Registration Trends) |

Moving Average Trend |

|

2016 |

Registrations ranged approx. 35,000-42,000 |

Stable around ~38,000-40,000 |

|

2017 |

Fluctuated; one dip observed below 35,000 |

Slight decline |

|

2018 |

Major spike above 55,000 in one quarter |

Brief peak in the moving average |

|

2019 |

Moderate variation; remained mostly between 32,000 and 42,000 |

Stable, mild recovery |

|

2020 |

Lower dip mid-year (~30,000), slight recovery end-year |

Gradual increase starts |

|

2021 |

Sharp growth, especially in Q3 and Q4 (~45,000+) |

Noticeable rising trend |

|

2022 |

Peak year; quarterly figures consistently above 45,000 (some near 50,000) |

Moving average peaks |

|

2023 |

Slight decline, still strong (~38,000-45,000 range) |

Declining trend begins |

|

2024 |

Clear downward trend; some quarters dip close to 30,000 |

Moving average continues to decline |

Source: Systematics International, formatted by CEMA

Challenges

- Regulatory Restrictions: Entry into the market is fraught with challenges. The challenges are compounded by strict compliance requirements, which impact manufacturers. Moreover, the regulatory requirements are also tied to the ease of doing business in a region. For instance, if the ease of doing business in a region is low, then that market is likely fraught with bureaucratic bottlenecks impacting market entry. It is recommended that market players thoroughly refine their GTM strategy for each market to mitigate the impact of regulatory challenges.

- Market Access Barriers: There are multiple market access barriers, ranging from overt reliance on one supplier to tariffs to limitations in infrastructure. These barriers hinder a sector’s growth curve. New entrants are particularly vulnerable to these barriers, whilst established players also face challenges in introducing products to a new market. These impediments to entering the market can both delay the commercialization process and raise the cost of entry. New entrants to the market bear the burdens disproportionately because they may lack the political capital, distribution networks, or a financial cushion that mitigates the stresses of onerous regulations, big tariffs.

Automated Tow Tractor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

14.93% |

|

Base Year Market Size (2025) |

USD 7.70 billion |

|

Forecast Year Market Size (2035) |

USD 30.95 billion |

|

Regional Scope |

|

Automated Tow Tractor Market Segmentation:

Type Segment Analysis

The electric segment is poised to register a dominating revenue share of 47.5% throughout the forecast period. The segment’s profitability is attributed to a sustained push by governments worldwide for decarbonization to adhere to the ambitious net-zero goals by 2050. Furthermore, EVs have comparatively lower maintenance costs in comparison to traditional models, making them lucrative additions to industries pushing for long-term savings. With several economies investing in improving their charging infrastructure and gradually phasing out ICE vehicles, the opportunities to push electric automated tow tractors are expected to be rife by the end of this decade. Two major initiatives that are set to impact the segment’s growth are briefly analyzed below.

End user Segment Analysis

The logistics segment is estimated to account for a 36.4% revenue share by the end of 2035. Two major factors supporting the segment’s expansion are the quantifiable boom in e-commerce and the surge in automation adoption spanning multiple industries. As per the International Trade Administration, by 2027, global B2C e-commerce sales are predicted to reach USD 5.5 trillion at a consistent compound annual growth rate of 14.4%. To maintain profitability, automated tow tractors are essential for use in distribution centers. Moreover, the growth of omnichannel retailing is adding further complexity to supply chains. Automated tow tractors also provide the requisite scalability and flexibility to manage this complexity, particularly when they come equipped with warehouse management systems (WMS) and industrial Internet of Things (IIoT) capabilities.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Automated Tow Tractor Market - Regional Analysis

North America Market Insights

The North America market is predicted to dominate with a 43.2% revenue share throughout the estimated forecast period. A major factor in the regional market’s dominance is due to a well-established manufacturing ecosystem driving demand. The market is also impacted by rapid technological advancements in the region, from IoT to the integration of AI. In North America, the e-commerce sector has been a leading player in pushing for the adoption of automated tow tractors. The U.S. and Canada remain major regional markets in North America, although the recent geopolitical tensions related to tariffs threaten to impact the supply chain.

The U.S. automated tow tractor market is positioned to hold a leading share in North America. The government incentives are pushing for the phasing out of ICE vehicles and embracing the complete electrification of vehicles. The trends create opportunities for the proliferation of automated tow tractors. Moreover, consumer preferences in the U.S. market indicate a rising demand for EV solutions. Below is a brief analysis of supportive regulatory policies in the U.S. that can positively impact the growth curve of the automated tow tractor market:

The Canada automated tow tractor market is projected to expand rapidly during the forecast timeline. The companies operating in the Canadian market are experiencing a heightened increase in the adoption of automated tow tractors in multiple applications, ranging from airports to warehouses. The supply chain of the automated tow tractor industry in Canada has faced a few challenges recently related to the acquisition of goods or services in the first quarter of 2023. To negate that, Transport Canada established the National Supply Chain Office in December 2023 to ensure there are no bottlenecks in logistics efficiency, facilitating the entry of new players in the market.

APAC Market Insights

The APAC automated tow tractor market is estimated to account for the second-largest revenue share by the end of 2037, with a projected revenue share of 32.8%. A key facet of the APAC market is the expansion of industrialization initiatives across the region. China remains a major market in APAC, along with Japan, India, South Korea, Indonesia, Australia, and others. Additionally, mandates to phase out ICE vehicles create lucrative opportunities for greater adoption of electric automated tow tractors in the region. Two emerging factors contributing to growth are the rapid surge in e-commerce industry and an increase in demand from the manufacturing sector.

The China automated tow tractor market is poised to hold the largest revenue share in APAC. A key facet of the regional market is China’s position as a global leader in EV adoption, which translates to opportunities in the electric automated tow tractors. The vast logistics industry in China, enhanced by the rapidly rising e-commerce companies, has resulted in large intelligent warehouses and fulfillment centers. These warehouses are increasingly utilizing automated tow tractors to meet throughput expectations, reduce labor, and improve efficiency. In addition, governmental initiatives—such as the Made in China 2025 initiative—strongly support automation and intelligent manufacturing, which align closely to the automation of goods and transportation within the logistics industry and production environment.

The automated tow tractor market in India is poised to exhibit sustained growth during the forecast period. The market in India is impacted by a two-pronged approach, such as the rising demand from the aerospace and manufacturing sectors for towing tractors. The demand is supported by a broader trend in mechanization. The other factor includes supportive government programs such as the National Logistics Policy and the Gati Shakti Master Plan. The global push for mechanization and automation in warehouses is on the rise in India's manufacturing and logistics landscape. As enterprises invest in smart factories, revamp their supply chain, and automate, powered tow tractors are firmly building their way into the intralogistics workflow across sectors like automotive, electronics, pharmaceuticals, and heavy engineering.

Europe Market Insights

The automated tow tractor market in Europe is expected to capture a significant share of the global market for a series of connected reasons. Europe has embraced Industry 4.0 and high levels of automation, and smart logistics in warehouses and factories is increasing the role of automated tow tractors in the efficiency of intralogistics operations. Europe has also adopted some of the most significant environmental legislation, leading many organizations to consider electric and hybrid tow tractors as they review their emissions policies to achieve sustainability goals. Furthermore, European markets have developed infrastructure, such as ports, airports, and distribution centers to assist in the implementation of these systems.

France's careful investment in warehouse automation and smart manufacturing is turning it into a key growth market for automated tow tractors. There are many sophisticated logistics hubs in France—most notably in and around Paris, Lyon, and Marseille—that have engaged in installing automated tow tractors to improve warehouse operations. France is a leader in promoting and supporting sustainability and digital transformation due to governmental support after the “France Relance” initiative that followed the onset of the pandemic. It has therefore enhanced the deployment of electric and hybrid automated solutions.

Germany is recognized as a European leader in the automated tow tractor space, which is often attributed to the robust industrial sector and the early shift in supply chain practices due to the era of Industry 4.0. As a world-leading manufacturer in the automotive and heavy machinery industries, factories in Germany are investing heavily in the automation of their intralogistics systems, featuring automated tow tractors to complete their lean production systems. With the level of warehousing and logistics infrastructure here in Germany, as well as the ongoing trend of employee costs being relatively high, automated towing-type solutions have greatly accelerated. Other drivers include regulatory requirements on sustainability and the national action of electrification.

Key Automated Tow Tractor Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The automated tow truck market is poised to exhibit rapid growth during the forecast timeline. Key players in the market are actively integrating long-term policies and initiatives to maintain a competitive advantage in the market. A notable strategic move was made by Tesla in 2023 through the expansion of their automated vehicle fleet, which included a focus on electric tow tractors for logistics centers. Here is a list of key players operating in the automated tow tractor market.

|

Company Name |

Headquarters |

Estimated Revenue Share (%) |

|

Tesla, Inc. |

USA |

22% |

|

Hyster-Yale Materials Handling |

USA |

13% |

|

JBT Corporation |

USA |

12% |

|

Kion Group AG |

Germany |

9% |

|

Linde Material Handling |

Germany |

9% |

|

Raymond Corporation |

USA |

XX |

|

Mitsubishi Logisnext |

Japan |

XX |

|

CVS Ferrari |

Italy |

XX |

|

Baoli Forklifts |

China |

XX |

|

Hangcha Group |

China |

XX |

|

Daimler AG |

Germany |

XX |

|

XPO Logistics |

USA |

XX |

|

Hyundai Heavy Industries |

South Korea |

XX |

|

Komatsu Ltd. |

Japan |

XX |

|

Toyota Industries |

Japan |

XX |

|

Doosan Industrial Vehicle |

South Korea |

XX |

|

HANGCHA |

China |

XX |

Below are the areas covered for each company that is a key player in the market:

Recent Developments

- In December 2022, Tesla, Inc. introduced the production version of the EV-maker’s long-awaited Tesla Semi, an all-electric class 8 commercial semi-truck. A gross vehicle weight of 82,000 lbs. will enable the Tesla Semi to reach its anticipated 500-mile range on a single charge (Tesla claims that federal regulations permit electric trucks to go 2,000 lbs. above the limit).

- In March 2025, Kion Group announced a partnership with NVIDIA and Accenture to present its first tangible AI-powered Omniverse solution at LogiMAT 2025 in Stuttgart, Germany, from March 11-13, to reinvent industrial automation. This milestone shows how supply chain operations may be transformed by AI-driven industrial trucks and digital twins, which increase cost-effectiveness, efficiency, and agility.

- Report ID: 3063

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Automated Tow Tractor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.