Attention-Deficit Hyperactivity Disorder Market Outlook:

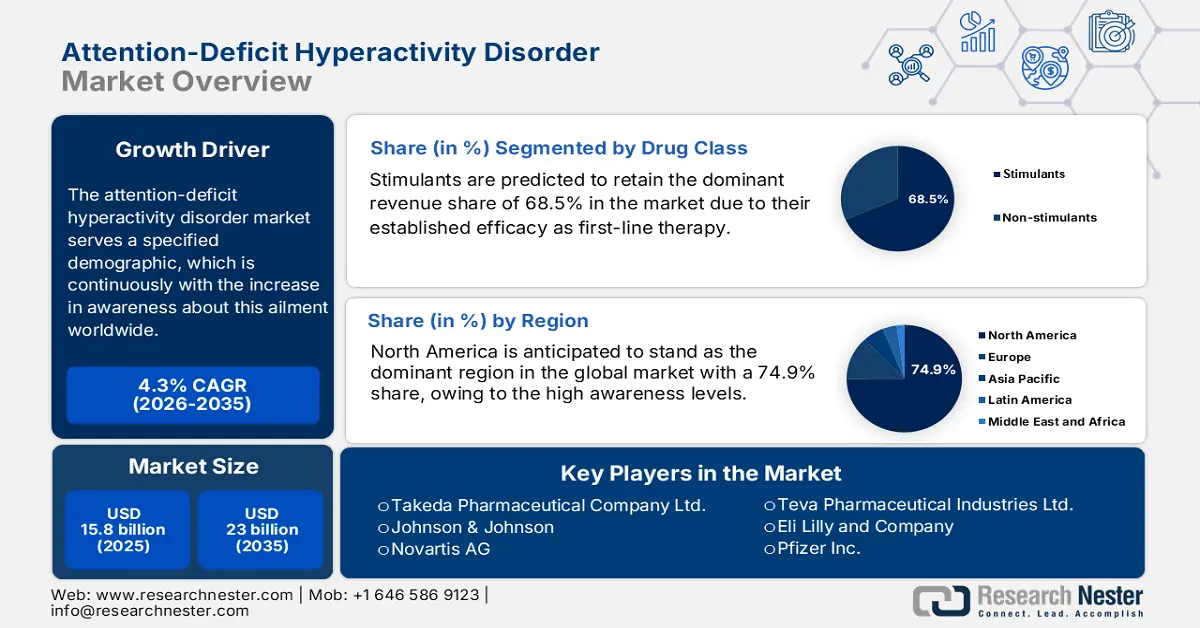

Attention-Deficit Hyperactivity Disorder Market size was over USD 15.8 billion in 2025 and is estimated to reach USD 23 billion by the end of 2035, expanding at a CAGR of 4.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of attention-deficit hyperactivity disorder is assessed at USD 16.4 billion.

The market serves a specified demographic, which is continuously with the increase in awareness about this ailment worldwide. Evidencing the same, a 2023 NLM-backed meta-analysis on the growing burden unveiled that the occurrence of this disease among children and adolescents around the globe surpassed 8%. It also highlighted that attention-deficit hyperactivity disorder (ADHD) was more prevalent among the group of boys than in girls by 2x, where the episodes of inattentive, hyperactive, and combined types of ADHD were underscored. This demography indicates the growing demand for effective diagnostics and therapies available in this sector.

As the supply chain of the market, particularly therapeutics, largely depends on specialized chemical manufacturing and API outsourcing, the inflation in payers’ pricing for disease management continues to increase. This can be testified by the 2024 findings from the Journal of Clinical Psychiatry, which unveiled that the average annual medical expenses for ADHD-afflicted individuals grew by approximately USD 1.5 thousand in comparison to those without the condition. Similarly, another study from the American Psychological Association calculated the total lifetime expenditure on these patients to range between USD 12 thousand and USD 17 thousand.

Key Attention Deficit Hyperactivity Disorder Market Insights Summary:

Regional Highlights:

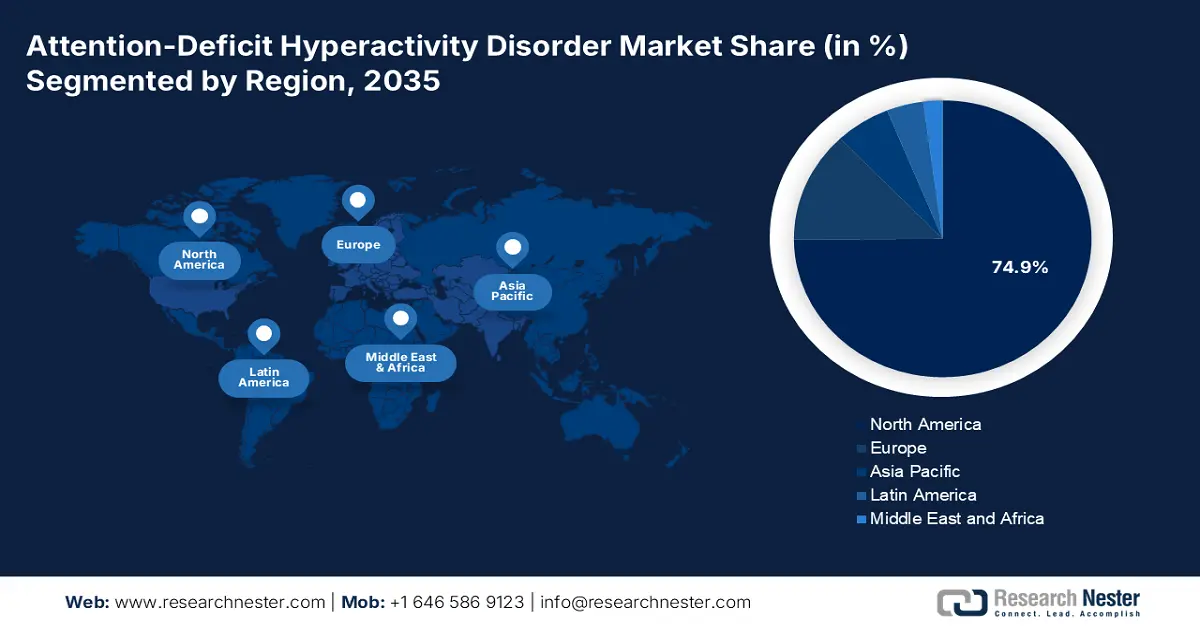

- North America is anticipated to hold the largest share of 74.9% by 2035, driven by high awareness levels, advanced healthcare infrastructure, and government support for widespread diagnostic and treatment availability.

- Asia Pacific is projected to be the fastest-growing region through 2035, owing to increasing awareness, improving healthcare access, and rising diagnostic capabilities.

Segment Insights:

- The stimulants segment is predicted to retain the dominant revenue share of 68.5% by 2035, propelled by their established efficacy as first-line therapy and the development of improved, long-acting formulations with reduced abuse potential.

- The adult segment is poised to grow at the fastest rate, capturing 55.4% share over the forecast period, owing to increasing ADHD diagnosis in adults, greater awareness, and expanded treatment guidelines.

Key Growth Trends:

- Expanding geriatric demography with ADHD

- Increased activities in research and development

Major Challenges:

- Restrictive controlled substance regulations

- Social stigma and limited diagnostic capacity

Key Players: Johnson & Johnson, Novartis AG, Pfizer Inc., Eli Lilly and Company, Teva Pharmaceutical Industries Ltd., Viatris Inc. (includes Mylan), Sun Pharmaceutical Industries Ltd., Amneal Pharmaceuticals, Inc., Hikma Pharmaceuticals PLC, Tris Pharma, Inc., Supernus Pharmaceuticals, Inc., Aurobindo Pharma Ltd., Reddy's Laboratories Ltd., Impax Laboratories, LLC, Noven Pharmaceuticals, Inc., UCB S.A., Corium, Inc., Neos Therapeutics, Inc., Rhodes Pharmaceuticals L.P., Lupin Limited

Global Attention Deficit Hyperactivity Disorder Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.8 billion

- 2026 Market Size: USD 16.4 billion

- Projected Market Size: USD 23 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (74.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, Canada

- Emerging Countries: India, China, Brazil, South Korea, Mexico

Last updated on : 11 September, 2025

Attention-Deficit Hyperactivity Disorder Market - Growth Drivers and Challenges

Growth Drivers

- Expanding geriatric demography with ADHD: Recent data show that ADHD is not limited to children but persists into adulthood, including older populations. Thus, with the aging global population, the market is earning a larger consumer base with more adults and seniors. Moreover, this age group requires precise diagnosis and tailored treatment approaches, which fuel a greater cash inflow in this sector. Testifying to the same, a 2025 study, conducted by a team of researchers at West Virginia University, found that more than 25% of adults living across the U.S. suspect of having undiagnosed ADHD. It also underscored the growing scope for extended-release medications for the age groups of 36-45 and 56-65.

- Increased activities in research and development: As higher complexity and extended occurrence are observed across the global patient pool, more public and private R&D-based organizations are investing heavily in the cultivation of an innovative and more effective pipeline. This is ultimately creating new opportunities for the market. The amplification of research and exploration project volumes can further be testified by the data collected from the EU Clinical Trials Register, which recorded 7,382 clinical trials that are focused on subjects with ADHD. This accounted for over 16.6% of the total trials registered till 2024.

- Introduction of non-pharmaceutical solutions: With the increasing risk of substance use disorder among afflicted individuals on medication, the tech-based therapies from the market are gaining traction. This is ultimately opening new channels of revenue generation for this sector, boosting the value of global trade in this category remarkably. Following the same pathway, in April 2024, Tris Pharma signed a licensing agreement with Braingaze to launch a new business, Tris Digital Health, in the U.S. and Canada. This subsidiary focuses on the development and commercialization of digital diagnostic and therapeutic products for ADHD, using Braingaze’s digital ADHD diagnostic platform.

Trends in the Patient Pool of the Attention-Deficit Hyperactivity Disorder Market Analysis of Global ADHD Prevalence Among Children and Adolescents

(2023)

|

Children (<12 yrs) |

Subtype / Diagnostic Criterion |

Prevalence (%) |

95% Confidence Interval (CI) |

|

Children (<12 yrs) |

Inattentive Subtype |

33.2 |

27.6-39.3 |

|

|

Hyperactive-Impulsive Subtype |

30.3 |

23.8-37.7 |

|

|

Combined ADHD |

31.4 |

24.6-39.1 |

|

Teenagers (12–18 yrs) |

General ADHD Prevalence (25 studies) |

5.6 |

4-7.8 |

|

|

DSM-IV Diagnostic Criterion |

7.1 |

4.9-10.1 |

|

|

DSM-IV-TR Diagnostic Criterion |

7.5 |

1.7-15.2 |

|

|

DSM-V Diagnostic Criterion |

12.7 |

6.7-19.1 |

|

|

ICD-10 Diagnostic Criterion |

1.7 |

1.1-4.5 |

Source: NLM

Clinical Trials and Studies Establishing the Foundation and Expanding the Pipeline in the Market

Overview of Current/Recent Clinical Trials on ADHD Drugs

|

Drug Name (Company) |

Trial Phase |

Target Population |

Description / Purpose |

Timeline |

Current Status |

|

NRCT-101SR (Neurocentria) |

Phase 2/3 |

Adults and Pediatric |

Efficacy and safety evaluation for adult and pediatric ADHD treatment |

2023-Onwards |

Investigational Drug |

|

Solriamfetol (Axsome Therapeutics) |

Phase 2 |

Adults (18-65 years) |

Controlled dose-optimization study for ADHD symptoms |

2021-2023 |

Showed promising results; Planned to be under trial for pediatric use |

|

Centanafadine (Otsuka) |

Phase 3 |

Adults |

Efficacy and safety trials, including comorbid anxiety |

2025-2027 |

Positive topline results; Planning to apply for NDA to the FDA |

|

AK0901 (ArkBio) |

Phase 3 |

Pediatric (aged 6 to 12) |

Testing efficacy and safety |

2021-2025 |

Granted by the FDA for marketing and NMPA for priority review |

Source: Clinicaltrials.gov and Company Press Release

Challenges

- Restrictive controlled substance regulations: Many ADHD therapies are identified as regulated medicinal compounds in various key landscapes, which may create roadblocks in the wide availability of certain drugs from the market. This also imposes stringent storage, tracking, and distribution requirements on manufacturers and distributors, increasing operational costs and complexity. It ultimately limits dispensing channels and garners additional regulatory hurdles for prescribers, indirectly suppressing market volume.

- Social stigma and limited diagnostic capacity: The primary constraint in the market is not just economic barriers, but by public health infrastructure. The World Health Organization (WHO) also highlighted the worldwide gap in mental health services, including diagnosis, particularly in low- and middle-income countries. This is further accompanied by a profound lack of trained clinicians, which causes delays in diagnosing ADHD, shrinking the volume of adoption of pharmaceutical products before pricing even becomes a factor.

Attention-Deficit Hyperactivity Disorder Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 15.8 billion |

|

Forecast Year Market Size (2035) |

USD 23 billion |

|

Regional Scope |

|

Attention-Deficit Hyperactivity Disorder Market Segmentation:

Drug Class Segment Analysis

Stimulants are predicted to retain the dominant revenue share of 68.5% in the market by the end of 2035. This leadership is primarily empowered by their established efficacy as first-line therapy, where a study published in March 2023 unveiled that the proportion of ADHD patients prescribed with stimulants remained consistently higher than non-stimulants, ranging between 61% and 64% from 2013 to 2022. Additionally, the development of improved formulations, such as extended-release methylphenidate and amphetamine, that offer long-term efficacy and have less abuse potential, continues to solidify the segment’s position in this sector.

Demographics Segment Analysis

The adult segment is poised to grow at the fastest rate in terms of demographics in the attention-deficit hyperactivity disorder market, while capturing a share of 55.4% over the assessed period. This augmentation is largely fueled by the increased ADHD diagnosis in adults, widespread awareness, and expanded treatment guidelines. Testifying to the demographic expansion, a report published by the University of Utah unveiled that the incidence rate of ADHD among adult Americans increased from 6.1% to 10.2% from 2020 to 2023, where the number of diagnosed cases totaled 8.7 million. Moreover, this age group is increasingly seeking age-appropriate diagnosis and management, creating a surge in future innovations and greater drug consumption.

Distribution Channel Segment Analysis

Retail pharmacies are expected to dominate the market with a 52.8% share throughout the discussed timeframe. Their widespread presence and accessibility make them the primary point of access for patients seeking regular medications and related products. Retail pharmacies also offer convenience, immediate availability, and personalized customer service, which are critical for ongoing ADHD treatment adherence. Besides, these distribution channels often serve as key touchpoints for patient education and support, helping to bridge the gap between prescription and effective medication use and establishing a strong supply ecosystem in this category.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Demographics |

|

|

Gender |

|

|

Distribution Channel |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Attention-Deficit Hyperactivity Disorder Market - Regional Analysis

North America Market Insights

North America is anticipated to stand as the dominant region in the global attention-deficit hyperactivity disorder market during the analyzed tenure by capturing the highest share of 74.9%. High awareness levels, advanced healthcare infrastructure, and massive healthcare expenditure are the foundational assets of the region’s leadership in this sector. On the other hand, the government's efforts to enable widespread diagnostic capabilities and availability for pharmacological treatments are propelling adoption in this landscape. For instance, in September 2024, the U.S. Drug Enforcement Administration increased the limit on manufacturing the ADHD drug Vyvanse and its generic versions by 24%.

The well-established insurance and reimbursement frameworks, coupled with universal standardization regulations, are collectively positioning the U.S. as the epitome of clinical advances in the market. Additionally, increasing recognition of adult ADHD and growing emphasis on early diagnosis in children contribute to sustained consumer base enlargement. Testifying to the growing epidemiology, the National Center for Health Statistics Rapid Surveys System unveiled that the count of adult ADHD diagnoses in the U.S. crossed 15.5 million in 2023 alone, and 50% of this volume identified this condition at the age of ≥18.

Robust government initiatives and active participation from globally leading pharmaceutical companies reinforce the position of Canada in the North America market. As the country emphasizes early diagnosis and comprehensive care through initiatives and public health programs, demand in this sector grows significantly. Additionally, the increasing R&D efforts and public-private partnerships (PPPs) are driving innovation in this sector, which is further backed by continuous government allocations.

APAC Market Insights

Asia Pacific is predicted to become the fastest-growing region in the global attention-deficit hyperactivity disorder market by the end of 2035. The region’s pace of progress in this field is backed by increasing awareness, improving healthcare access, and rising diagnostic capabilities. Rapid urbanization is also helping to promote early identification of ADHD in both susceptible children and adults. On the other hand, growing emphasis on developing and producing advanced treatment options is cultivating a lucrative business atmosphere for this merchandise. Moreover, the growing trend of modernizing diagnostic capabilities and investing in healthcare access is solidifying the region’s position for the coming years.

China is a key driver of growth in the Asia Pacific market, benefiting from rising mental health awareness and government efforts to improve clinical services. With a large pediatric population and rising recognition of ADHD symptoms among adults, demand for effective therapies across the country is amplifying rapidly. On the other hand, the ambitious goal of China to improve access to medications by enabling a centralized medical system is influencing more patients to receive timely treatment. Besides, ongoing research and partnerships with global pharmaceutical companies are further helping to introduce innovative ADHD treatments.

India is establishing itself as an epitome of affordable generic production for the APAC attention-deficit hyperactivity disorder market. With an outstretched healthcare access across urban and semi-urban areas, the country is fostering a substantial surge in both pharmaceutical and digital therapies. Besides, government initiatives focused on mental health, along with public educational campaigns, are helping to reduce stigma and encourage early intervention. Furthermore, increasing involvement of governing authorities in PPPs is cultivating a wide range of advanced therapeutics for afflicted patients.

Country-specific Commercial Strategies/Success

|

Country |

Key Notes |

Timeline |

|

India |

Granules Strengthens ADHD Portfolio with FDA Approval for Lisdexamfetamine Dimesylate Capsules |

January 2025 |

|

China |

ArkBio’s urge for priority review for the New Drug Application of Azstarys granted by the NMPA |

June 2025 |

|

South Korea |

INTHETECH plans to showcase EYAS at CES 2025 to reintroduce its capabilities in treating ADHD |

January 2025 |

Source: Company Press Releases

Europe Market Insights

Europe is poised to hold the position of second-largest shareholder in the global attention-deficit hyperactivity disorder market over the timeline from 2026 to 2035. The well-developed healthcare systems, strong regulatory frameworks, and rising awareness of neurodevelopmental disorders are the major drivers behind the region’s consistent augmentation in this sector. Besides, developed countries are increasingly implementing early screening programs in schools and primary care settings, leading to higher cash inflow. The landscape is currently benefiting from broader acceptance of both stimulant and non-stimulant medications, as well as integrated care models that combine medical and behavioral therapies.

The UK is a leading participant in the regional progress in the attention-deficit hyperactivity disorder market. The country’s significance in this sector is highly attributable to the increasing diagnosis rates, strong public healthcare support, and growing awareness of the condition across all age groups. The National Health Service (NHS) plays a key role in providing access to ADHD assessments and a range of treatment options. Testifying to such an increase in public expenditure, a 2024 study published by the researchers at Cambridge University unveiled that the NHS costs for ADHD in England and Wales totaled USD 26.8 million for the initial specialist assessment. This is further accompanied by an annual expense of USD 16.3 million on follow-up care.

Rising recognition of adult ADHD is expanding the patient base in Germany for the attention-deficit hyperactivity disorder market. As a result, this landscape is prompting both domestic and foreign pharma and MedTech leaders to capitalize on the heightening demand for specialized services. In this regard, in November 2024, GAIA signed a licensing agreement with MEDICE to commercialize its personalized, fully automated digital therapy, Attexis, in the country for symptom management among ADHD patients. In addition, ongoing research, mental health advocacy, and the availability of newer targeted medications are contributing to the sustained growth of the merchandise in Germany.

Country-wise Government Provinces

|

Country |

Initiative/Allocation |

Year |

|

UK |

USD 11 million funding to support 300,000 children with autism, ADHD, and dyslexia across 1,200 primary schools |

2025 |

|

Italy |

Medicines Agency (AIFA) enabled reimbursement for Metilfenidato (Medikinet) under the National Health Service (SSN) for newly diagnosed adults with ADHD |

2023 |

|

Germany |

ZNS launched a nationwide information campaign to raise awareness of mental health and brain health, including ADHD and dementia |

2024 |

Source: GOV.UK, AIFA, and SPIZ

Key Attention-Deficit Hyperactivity Disorder Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis AG

- Pfizer Inc.

- Eli Lilly and Company

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc. (includes Mylan)

- Sun Pharmaceutical Industries Ltd.

- Amneal Pharmaceuticals, Inc.

- Hikma Pharmaceuticals PLC

- Tris Pharma, Inc.

- Supernus Pharmaceuticals, Inc.

- Aurobindo Pharma Ltd.

- Reddy's Laboratories Ltd.

- Impax Laboratories, LLC

- Noven Pharmaceuticals, Inc.

- UCB S.A.

- Corium, Inc.

- Neos Therapeutics, Inc.

- Rhodes Pharmaceuticals L.P.

- Lupin Limited

The competitive dynamics of the attention-deficit hyperactivity disorder market are evolving rapidly, with pioneers expanding their pipelines beyond traditional pharmaceuticals by developing digital therapeutics. This can be exemplified by the release of new gameplay features for EndeavorRx by Akili Interactive in July 2021. It was the first and only FDA-cleared video game treatment for children with ADHD during the timeline, marking the sector’s shift toward non-pharmacological, tech-driven solutions aimed at improving attention through engaging, clinically validated gameplay.

Such key players are:

Recent Developments

- In November 2024, Lupin attained approval for an Abbreviated New Drug Application (ANDA) for its Mixed Salts of a Single-Entity Amphetamine Extended-Release Capsules from the FDA. The mix of Dextroamphetamine Saccharate, Amphetamine Aspartate Monohydrate, Dextroamphetamine Sulfate, and Amphetamine Sulfate is intended to treat ADHD in adults and pediatric patients 6 years and older.

- In May 2024, Tris Pharma gained marketing clearance for its once-a-day extended-release oral suspension, ONYDA XR (clonidine hydrochloride), with nighttime dosing. This is directed to be used for the treatment of ADHD as a monotherapy or as an adjunctive therapy to approved central nervous system (CNS) stimulant medications in pediatric patients six years and older.

- Report ID: 8088

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Attention Deficit Hyperactivity Disorder Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.