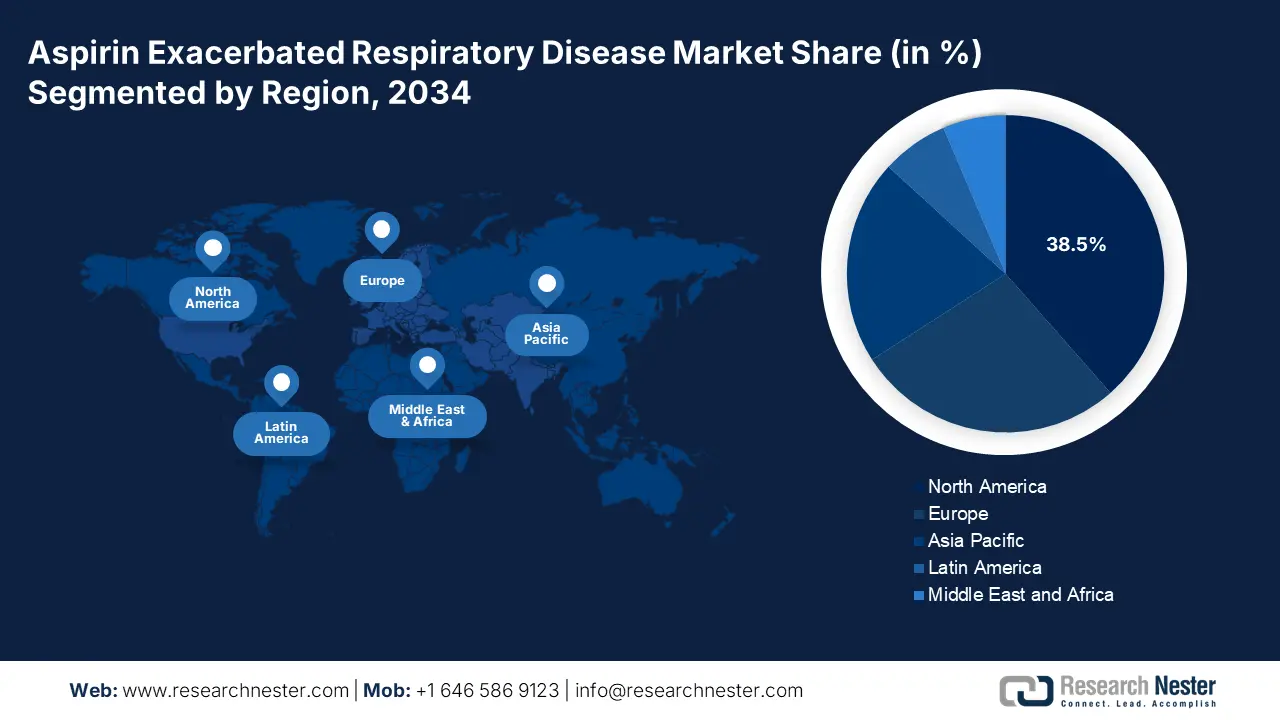

Aspirin Exacerbated Respiratory Disease Market - Regional Analysis

North America Market Insights

The aspirin exacerbated respiratory disease market in North America dominates the region and is projected to have a market share of 38.5% at a CAGR of 10.2% by 2034. The aspirin exacerbated respiratory disease market is fueled by the increasing prevalence of asthma and chronic rhinosinusitis with nasal polyposis, rising biologics adoption, and substantial government healthcare spending. The U.S. leads the aspirin exacerbated respiratory disease market by the support of Medicare and Medicaid coverage due to the rising patient cases, with over USD 4.9 billion in asthma-related diseases in 2023. Further, Canada has allocated 8.2% of its healthcare budget in 2023 for aspirin-exacerbated respiratory diseases. The North America market is expanded by strategic partnerships among pharmaceutical companies and healthcare providers, enhancing treatment accessibility and cost.

The U.S. is the biggest market for Aspirin Exacerbated Respiratory Disease treatments is supported by increasing biologic adoption, high prevalence of the disease, and inclusive public spending. In 2023, the U.S. spent USD 5.3 billion, or 9.4% of the federal healthcare budget, on AERD-related diseases through organizations such as CDC and AHRQ. Further, the AHRQ asthma quality initiative has facilitated early-stage intervention, leading to a 15.4% rise in Medicare reimbursement expenditure between 2020 and 2024. Medicaid also widened its coverage, allocating USD 1.5 billion in 2024 for AERD procedures and making coverage possible for an additional 10.3% of patients. Demand is set to remain on an upward trend, driven by payer reforms and government investment in chronic respiratory care.

Asia Pacific Market Insights

The APAC is the fastest-growing region in the aspirin exacerbated respiratory disease market and is projected to have a market share of 20.9% at a CAGR of 10.5% by 2034. The aspirin exacerbated respiratory disease market is driven by rising diagnostic rates, increased government healthcare spending, and urban respiratory disease burden. China leads the region by having a patient population of 1.7 million diagnosed with aspirin-exacerbated respiratory disease in 2023, with a 15.5% rise in government healthcare spending for asthma-linked conditions for the past five years. Further, the aspirin exacerbated respiratory disease market is also driven by the rising awareness of the healthcare systems, expanded biologic availability, and digital diagnostic tools.

China holds the maximum share in the aspirin exacerbated respiratory disease market and is expected to hold the market share of 36.7% in 2034. China experienced a 15.3% growth in government spending on aspirin-exacerbated respiratory disease conditions in the last five years, fueled by increasing asthma prevalence and massive investment in hospital facilities. As per the National Medical Products Administration (NMPA) report, more than 2.0 million patients were diagnosed with AERD phenotypes in 2023. The government Healthy China 2030 strategy has further surged the investment into respiratory disease initiatives and local biologic drug production. These initiatives are expected to enhance countrywide access to complex therapeutics and narrow the urban-rural gap in treatment, making China an important growth market for AERD therapeutics.

APAC Government Investment and Funding (2021–2025)

|

Country |

Year Launched |

Investment Initiative |

Budget Allocation |

|---|---|---|---|

|

Australia |

2022 |

Inclusion of biologics for severe asthma under PBS |

AU USD 240.4 million (2022–2025) via Pharmaceutical Benefits Scheme |

|

Japan |

2024 |

Respiratory Biologics Innovation Program via AMED & MHLW |

USD 3.3 billion increase from 2022; 12.4% of the national healthcare budget |

|

India |

2023 |

National Chronic Respiratory Disease Strategy Implementation |

USD 2.2 billion annually for AERD-related care |

|

South Korea |

2021 |

HIRA integration of AERD into asthma & CRSwNP reimbursement plans |

Nationwide rollout of biologics under National Health Insurance |

|

Malaysia |

2023 |

MOH-led biologics procurement and digital asthma registry launch |

20.6% increase in AERD funding since 2013; doubled patient coverage |

Europe Market Insights

The Europe market for aspirin-exacerbated respiratory disease is steadily expanding and is projected to have a market share of 27.4% at a CAGR of 8.8% by 2034. Countries including the UK, France, and Germany are leading the EU market and are expected to hold over 70.2% of the revenue share by 2034. As per the European Medicines Agency report, the national health programs are prioritizing biologics and focused therapies for respiratory diseases. Funding for research, medication development, and fair access to cutting-edge treatments has been allocated €2.8 billion via EU-wide policy frameworks, including the European Health Data Space and the EU4Health initiative. The cross-border clinical trial initiatives are surging with the rapid development of next-gen AERD therapies.

Germany has become Europe's biggest aspirin exacerbated respiratory disease market and is expected to hold a market share of 28.8% by 2034. According to the Federal Ministry of Health and EMA. Germany has achieved €4.3 billion in expenditure through 2024, a growth of 12.5% over demand for 2021. The wide availability of biologics for severe respiratory diseases is facilitated by Germany's robust public insurance coveraage. The Federal Joint Committee (G-BA) and Institute for Quality and Efficiency in Health Care (IQWiG) facilitate market access for new treatments within a timely manner, usually 7 to 10 months after EMA approval. The government has also allocated more than €450.4 million towards innovation funds on respiratory research, such as trials of dupilumab and mepolizumab in chronic sinusitis with AERD.

Europe Government Investment and Budget (2021–2025)

|

Country |

Launch Year |

Policy / Investment Initiative |

Budget / Funding Allocation |

|---|---|---|---|

|

United Kingdom |

2023 |

NHS Biologics Expansion Plan for Chronic Respiratory Diseases |

8.4% of healthcare budget (~£11.6 billion for AERD care) |

|

France |

2023 |

ALD Protocol Expansion for Severe Asthma & Nasal Polyposis Treatments |

7.5% of total health budget (~€2.8 billion) |

|

Italy |

2022 |

AIFA Respiratory Disease Therapeutic Reimbursement Policy |

6.8% of national healthcare budget allocated to AERD therapies |

|

Spain |

2021 |

National AERD Biologic Drug Procurement and Public Coverage Initiative |

6.1% of health budget; steady 10% increase in respiratory drug spend |