Architectural Lighting Market Outlook:

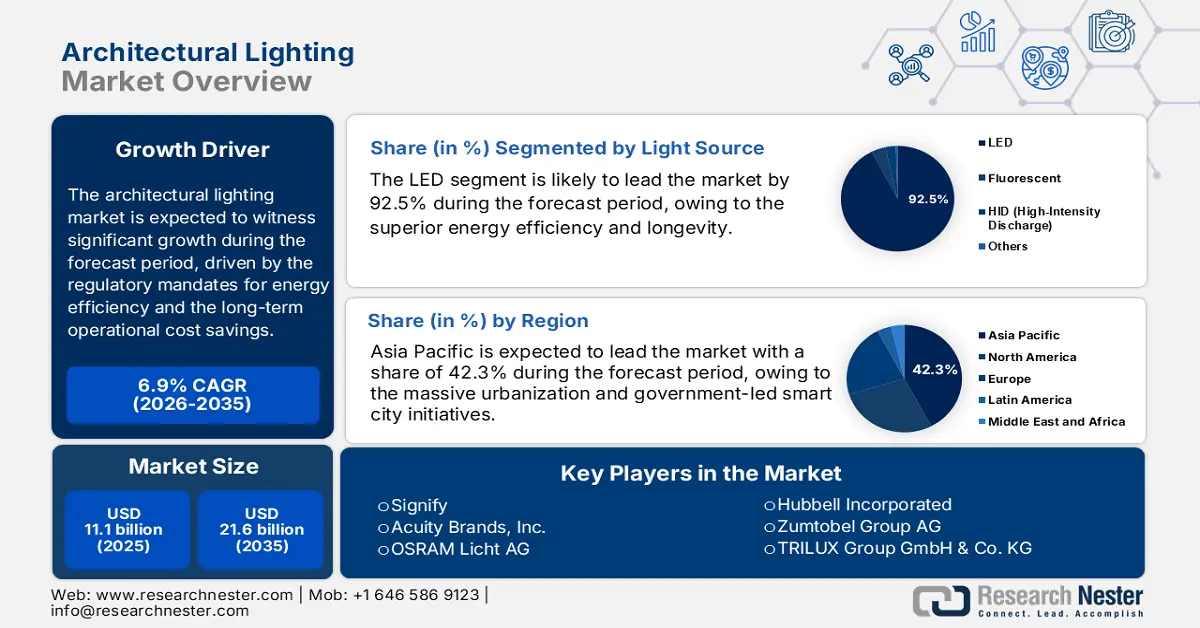

Architectural Lighting Market size was valued at USD 11.1 billion in 2025 and is projected to reach USD 21.6 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of architectural lighting is estimated at USD 11.8 billion.

The global market is fundamentally driven by regulatory mandates for energy efficiency and the long-term operational cost savings offered by advanced lighting systems. The government policies, such as the building energy codes and the phase-out of inefficient technologies, establish a compulsory upgrade cycle mainly in the commercial and public infrastructure sectors. This regulatory push is highlighted by the lifecycle cost analysis, where the significant energy savings of the LED systems justify the upfront of the capital expenditure. According to the U.S. Department of Energy's September 2021 data, the average home electricity usage is nearly 15%, and households save about USD 225 in energy costs per year by using LED lighting. This continues to increase the displacement of fluorescent and HID sources. Further, the rising shift creates a stable and regulation-driven demand for advanced and value-added lighting solutions.

The market expansion is increasingly concentrated on integrated networked systems that transcend illumination to become foundational elements of building management infrastructure. The key growth vector is the integration of lighting fixtures with sensors and controls, enabling data collection on occupancy, daylight availability, and space utilization. This transforms the lighting from a static utility into a dynamic grid supporting energy management, space optimization, and compliance with wellness standards. The DesignLights Consortium data in 2025 indicates that a non-profit standards body emphasizes that the lighting products used by the C&I facilities are mainly indoor linear fixtures, with 72% of installed products. Further, each C&I product category has a highly installed base, coupled with LED market saturation, enabling a significant potential for future energy savings, especially when paired with the networked lighting controls.

Key Architectural Lighting Market Insights Summary:

Regional Highlights:

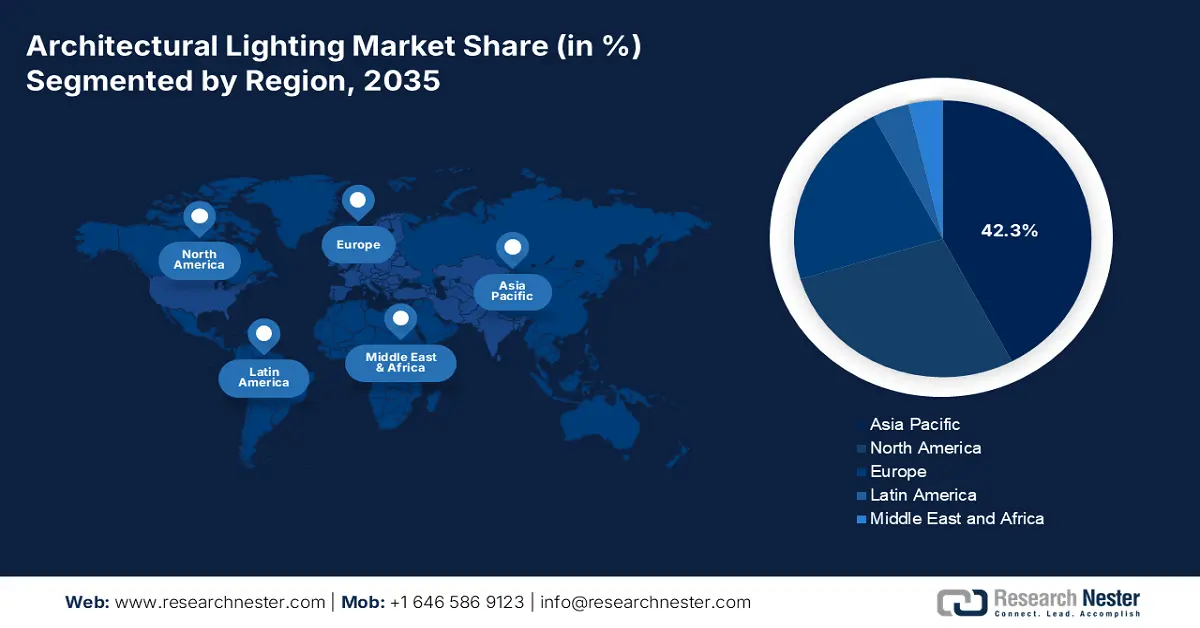

- Asia Pacific is anticipated to dominate the architectural lighting market with a 42.3% revenue share by 2035, supported by accelerated urbanization, government-backed smart city programs, stringent energy-efficiency standards, and large-scale infrastructure development across China, India, and Southeast Asia catalyzing LED adoption.

- North America is projected to emerge as the fastest-growing region during 2026–2035, expanding at a CAGR of 6.1% as regulatory energy codes, federal infrastructure investments, utility rebate schemes, and the shift toward connected, grid-interactive lighting systems intensify market uptake.

Segment Insights:

- The LED sub-segment is projected to command a dominant 92.5% share by 2035 in the architectural lighting market, underpinned by superior energy efficiency, extended lifespan, design versatility, cost reductions, and regulatory phase-outs of inefficient lighting technologies.

- The hardware segment within the offering category is anticipated to retain a leading share by 2035, supported by sustained demand for luminaires, light engines, and components in new construction and renovation activities, reinforced by robust investment in building electrical systems.

Key Growth Trends:

- Public infrastructure modernization programs

- Urban regeneration and smart city funding

Major Challenges:

- High R&D and certification costs

- Complex and fragmented supply chains

Key Players: Signify (Netherlands), Acuity Brands, Inc. (U.S.), OSRAM Licht AG (Germany), Hubbell Incorporated (U.S.), Zumtobel Group AG (Austria), TRILUX Group GmbH & Co. KG (Germany), Fagerhult Group (Sweden), Legrand S.A. (France), WAC Lighting (U.S.), Ideal Industries, Inc. (Cree Lighting) (U.S.), Panasonic Corporation (Japan), Toshiba Corporation (Japan), Mitsubishi Electric Corporation (Japan), Seoul Semiconductor (South Korea), LG Innotek (South Korea), Syska LED (India), Havells India Ltd (India), Gerard Lighting Group (Australia), Thorn Lighting (UK), First Choice Lighting (Malaysia)

Global Architectural Lighting Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.1 billion

- 2026 Market Size: USD 11.8 billion

- Projected Market Size: USD 21.6 billion by 2035

- Growth Forecasts: 6.9%

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Canada, France, Italy

Last updated on : 14 January, 2026

Architectural Lighting Market - Growth Drivers and Challenges

Growth Drivers

- Public infrastructure modernization programs: Government-led upgrades of transport hubs, civic buildings, and cultural assets are a primary demand driver in the architectural lighting market. The U.S. Census Bureau in November 2025 states that as of August 2025, the construction spending reached USD 2,169.5 billion, with airports, courthouses, and transit terminals driving the specifications for the architectural grade lighting that meets the durability and safety standards. Similar momentum is visible in Europe, where the EU Renovation Wave targets 35 million building renovations by 2030, as per the Climate Group in November 2024, with lighting upgrades embedded in the energy efficiency compliance frameworks. For suppliers, this shifts demand toward solutions aligned with long procurement cycles, certified performance benchmarks, and low lifecycle cost. The vendors that map offerings to federal and municipal tender criteria rather than private real estate cycles are better positioned to capture steady recession-resilient volumes.

- Urban regeneration and smart city funding: Large-scale urban renewal programs are reshaping the demand in the architectural lighting market in public spaces, streetscapes, plazas, and mixed-use developments. The UN Environment Programme in 2026 states that nearly 68% of the global population will live in cities by 2050, prompting governments to fund urban livability and safety upgrades. In the U.S., the Infrastructure Investment and Jobs Act allocates billions for streets, transit corridors, and public realm improvements where architectural lighting is integral to wayfinding and security. For vendors, this creates an opportunity in the integrated urban projects that value robustness, uniformity, and ease of maintenance over decorative features. The trend favors suppliers with strong public sector bidding capabilities and standardized product lines that scale across city-wide deployments.

- International development financing for public buildings: Multilateral development banks are funding large volumes of public construction in emerging market directly stimulating the demand for architectural lighting in hospitals, schools, and government facilities. The World Bank has committed significant funding to infrastructure and urban development with lighting systems embedded in building specifications. Similarly, the Asian Development Bank channels billions annually into municipal infrastructure across Southeast Asia and South Asia. For suppliers, this creates access to fast-growing markets via compliance with donor-funded procurement standards rather than local private developers. Winning strategies center on meeting international tender requirements, offering standardized product portfolios, and building partnerships with government contractors executing these projects.

Challenges

- High R&D and certification costs: Entering the high-performance segment requires a massive investment in R&D for optics, thermal management, and smart components alongside costly certifications such as UL DLC and regional standards. New entrants struggle to match the incumbents' budgets. Established players invest a significant amount in R&D to maintain a pipeline of connected and human-centric products, which is a barrier for the smaller companies to meet. The DLC’s stringent performance thresholds for rebates force significant pre-market invest for any serious market entry.

- Complex and fragmented supply chains: Manufacturing relies on a global network for the LED drivers, semiconductor drivers semiconductors and metal drivers. Geopolitical tensions, trade policies, and logistics disruption cause severe volatility. The top companies highlighted that the SEC filing that extended lead times and cost inflation for electronic components impacted margins, demonstrating how even players are vulnerable. A recent report has demonstrated that the lighting manufacturers have faced delays on key components, crippling the ability to fulfill orders predictably.

Architectural Lighting Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 11.1 billion |

|

Forecast Year Market Size (2035) |

USD 21.6 billion |

|

Regional Scope |

|

Architectural Lighting Market Segmentation:

Light Source Segment Analysis

The LED sub segment is leading the light source segment and is expected to hold the share value of 92.5% by 2035. The segment is driven by the superior energy efficiency, longevity, and design flexibility. Government mandates worldwide are phasing out inefficient technologies, solidifying LED dominance. A key driver is the dramatic drop in cost, coupled with continuous efficacy improvements, making LEDs the default choice for both new and retrofit projects across all applications. According to the 299 Lighting report in April 2023, LED lighting is 80% more efficient than fluorescent lamps. This data has a steady rise, underlining the near-total market saturation underway. This rapid adoption is central to national and global energy conservation targets as LEDs consume a fraction of the power used by traditional lighting sources such as fluorescents and HIDs.

Offering Segment Analysis

Within the offering segment, the hardware is leading in the architectural lighting market, and the segment is related to the luminaires, light engines, and components. While the software and services are growing, the fundamental need for the physical fixtures in new construction and renovation rapidly ensures hardware’s primary position. The segment is evolving, however, with value increasingly derived from the integrated sensors, connectivity modules, and advanced optics that enable smart functionality. The data from the U.S. Census Bureau’s Annual Value of Construction Put in Place surveys show that the spending on the electrical systems, a key proxy for lighting hardware installations in new building remained robust. For example, the FRED January 2026 data depicts that the monthly construction spending on electrical power installations is USD 13,197 billion in August 2025, indicating a sustained high-volume market for core lighting hardware, even as the product intelligence within it advances.

Electric Power Spending (2025)

|

Month |

Spending (Millions USD) |

|

Apr 2025 |

13,174 |

|

May 2025 |

13,290 |

|

Jun 2025 |

13,359 |

|

Jul 2025 |

13,125 |

|

Aug 2025 |

13,197 |

Source: FRED January 2026

Control System Segment Analysis

The smart/connected lighting systems sub segment is dominating the control systems segment in the market. It is the most strategic area within controls, transforming luminaires into data collection points for the Internet of Things. This shift is driven by the demand for energy optimization, space utilization analytics, and human-centric lighting that supports well-being and productivity. These systems move beyond simple dimming to enable granular data driven management of the built environment. Supporting this trend, the U.S. General Services Administration on its own building portfolio, found that the projects implementing advanced networked lighting controls achieved a significant percentage of energy savings. This compelling ROI, validated by a major federal agency, continues to stimulate the adoption of intelligent control systems over conventional wired solutions in both public and private sector projects.

Our in-depth analysis of the architectural lighting market includes the following segments:

|

Segment |

Subsegments |

|

Light Source |

|

|

Product Type |

|

|

Offering |

|

|

Control System |

|

|

Application |

|

|

Installation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Architectural Lighting Market - Regional Analysis

APAC Market Insights

Asia Pacific is the world’s largest and dominating market and is expected to hold a revenue share of 42.3% by 2035. The market is driven by massive urbanization, government-led smart city initiatives, and robust new energy efficiency standards. The primary demand stems from the rapid infrastructure development across China, India, and Southeast Asia, including commercial complexes, transportation hubs, and public buildings. A dominant trend is the stimulated mandatory shift from traditional lighting to LED technology, propelled by national policies aimed at reducing carbon emissions. Further, the market is evolving from basic illumination to connected intelligent systems as part of broader IoT and smart building ecosystems. Further, the demand is linked to the post pandemic economic recovery and renewed public infrastructure spending across major economies.

The India architectural lighting market is a high-growth sector primarily driven by the large-scale government-led urbanization and infrastructure modernization initiatives. The demand drivers include the Smart Cities Mission, the report from the PIB data in December 2024 targets 100 cities for comprehensive development, and the street lighting National Programme, focused on public energy savings. The Bureau of Energy Efficiency enforces strong star ratings and standards for commercial and public lighting, creating a regulated shift to LEDs. A strong trend is the integration of lighting with broader IoT-based city management systems for adaptive control and monitoring. For example, the report from the Press Information Bureau in May 2022 indicates that the LED street lights installed under the SLNP have saved more than 8587 million units of electricity annually. These installations showcase the scale of public-sector-driven demand.

The top-down national industrial and environmental policy is driving the China market. The 14th Five-Year Plan 2021 to 2025 for the Building Energy Efficiency sets mandatory targets, driving the massive demand for the LED retrofits and smart lighting systems in both new construction and existing buildings. The market is defined by the rapid technological adoption with a strong emphasis on integrating lighting into the smart city platforms and industrial IoT systems. The report from the EMBER in September 2025 shows that in 2023, the share of the final energy consumption in electricity reached 32%, which increased by 1% every year. This is stimulating the shift toward electrification, which is reinforcing the government pressure to ensure that the incremental power demand is met via efficiency gains rather than capacity expansion, positioning the market as the cost-effective tools for managing building sector energy growth.

North America Market Insights

North America architectural lighting market is the fastest growing and is expected to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The market is driven by the robust energy codes, federal infrastructure spending, and utility rebate programs. The transition to connected lighting systems for data-driven building management is a dominant trend. The demand is split among the mandatory retrofits in the existing building and specification-grade products in the new construction. The government spending via acts such as the U.S. Inflation Reduction Act and Canada’s Greener Homes Initiative directly funds the energy efficiency upgrades, including the advanced lighting. The focus extends beyond efficiency to include grid-interactive buildings and human-centric lighting for wellness standards, supported by public procurement policies from entities like the U.S. General Services Administration.

In the U.S. architectural lighting market is increasingly shaped by the efficiency and lifecycle advantages you outlined, which translate directly into policy-driven demand. The report from the Draw Down data in December 2025 indicates that the federal climate and energy frameworks aligned with the IPCC’s findings on the emissions from the fossil fuel power generation have made lighting upgrades a priority in public and commercial buildings. LEDs’ 4W to 10W power range, which is 3 to 10 times lower than the legacy lamps, supports the federal and state mandates to cut the building energy use and operating emissions, while their 25,000+ hour lifespan reduces the maintenance cycles in the high traffic facilities such as the hospitals, airports, and transit hubs. Overall, these structural advantages are repositioning architectural lighting in the U.S. from a design-led purchase to a strategic infrastructure investment, where long-term operating performance and regulatory alignment now outweigh aesthetic considerations in most large-scale projects.

A Comparison of Light Sources for Building Lighting

|

Light source type |

Power rating (watts) |

Luminous efficacy (lumens/watt) |

Lifespan (hours) |

|

Incandescent |

40–100 |

10–15 |

1,000 |

|

CFL |

12–20 |

60–63 |

10,000 |

|

LED |

4–10 |

110–150 |

25,000–100,000 |

Source: Draw Down, December 2025

The demand in the Canada market is increasingly shaped by the convergence of the manufacturing investment, public funding, and performance-driven specifications. In February 2023, Magna’s USD 470 million expansion across Ontario, supported by CAD 23.6 million in provincial grants, highlights how government backed industrial growth is strengthening the domestic supply chains for the advanced lighting and electronic components, including at facilities such as its Belleville lighting plant. This industrial momentum aligns with the rising adoption of high-efficiency architectural lighting systems across commercial and public infrastructure, where buyers now prioritize energy performance, durability, and smart controls over aesthetic differentiation alone. The product launches in November 2022, such as SloanLED’s Symphony Area Light offering up to 171 lm/W efficacy and IP66 rated durability, reflect the market’s shift toward solutions designed for large-scale urban campus and municipal environments that demand the lower power density and extended service life.

Europe Market Insights

The Europe architectural lighting market is mainly fueled by the robust EU-wide energy efficiency and circular economy regulations, such as the Ecodesign Directive and the Energy Performance of Buildings Directive. These policies mandate the phaseout of inefficient lighting in both new constructions and renovation projects, creating a steady regulation-driven demand. The key trends include the rapid integration of connected lighting systems with IoT-enabled building management for enhanced energy savings and the growing emphasis on human-centric lighting design to support the well-being in workplaces and healthcare facilities. The major renovation waves supported by the EU funding mechanisms, such as the Renovation Wave strategy, further stimulate the market growth mainly in the public and commercial sectors.

The developments, such as Sycra’s expansion in March 2022 in smart and connected lighting, closely reflect Germany architectural lighting market shift toward digitally enabled energy-efficient building infrastructure. Germany’s national smart city and energy transition agendas are surging the demand for lighting systems integrated with IoT sensors and automation, mainly in commercial offices, public building and high-end residential projects. Sycra’s model, combining hardware, software, and building-level control platforms, mirrors the type of solutions increasingly specified in projects that prioritize operational efficiency, carbon reduction, and intelligent facility management over standalone fixtures. Further, the government-backed innovation ecosystem, similar to Hong Kong’s HKSTP support for Sycra, via federal and state digitalization and green building programs. This demand positions architectural lighting as a core component of the country’s broader transition to intelligent, low-carbon urban infrastructure.

In the UK architectural lighting market, the recent developments such as Acclaim Lighting’s expansion and RIDI Lighting’s integration of Lightworks Architectural highlight how the demand is being shaped by a stronger focus on the design-led solution. The establishment of Acclaim Lighting Europe B.V. in September 2025, with its emphasis on energy efficiency and environmentally aligned lighting, directly supports the needs of UK architects and lighting designers working under the increasingly strict building regulations and carbon reduction targets. At the same time, RIDI Lighting’s takeover of Lightworks Architectural in September 2023 ensures continuity in the commercial and long-term project support in a market where the refurbishment and fit-out activity remains strong. Together, these moves reflect a UK market that is evolving forward with more capable suppliers able to combine advanced solid state lighting technologies with high performance and strong technical service.

Recent Development in Architectural Lighting Maret in UK

|

Year |

Company Name |

Advancements |

|

October 2025 |

David Village Lighting |

Is the Official UK Distributor for Artemide Architectural. |

|

September 2025 |

Acclaim Lighting |

Acclaim Lighting Launches Acclaim Europe BV to Support Architects and Lighting Designers |

|

February 2024 |

Sylvania Group |

The launch of Solstice was the perfect opportunity to relaunch Concord to a new generation of architects, lighting designers, specifiers and contractors. |

|

September 2023 |

Ridi Lighting Ltd |

Acquired Lightworks Architectural Ltd and continue to honour the supply of existing projects as well as the company’s future projects and client requirements. |

Source: David Village Lighting, Acclaim Lighting, Sylvania Group, Ridi Lighting Ltd

Key Architectural Lighting Market Players:

- Signify (Netherlands)

- Acuity Brands, Inc. (U.S.)

- OSRAM Licht AG (Germany)

- Hubbell Incorporated (U.S.)

- Zumtobel Group AG (Austria)

- TRILUX Group GmbH & Co. KG (Germany)

- Fagerhult Group (Sweden)

- Legrand S.A. (France)

- WAC Lighting (U.S.)

- Ideal Industries, Inc. (Cree Lighting) (U.S.)

- Panasonic Corporation (Japan)

- Toshiba Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Seoul Semiconductor (South Korea)

- LG Innotek (South Korea)

- Syska LED (India)

- Havells India Ltd (India)

- Gerard Lighting Group (Australia)

- Thorn Lighting (UK)

- First Choice Lighting (Malaysia)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Signify is a global leader in the architectural lighting market and is transitioning from a product-centric to a service-driven model. Their strategic initiative focuses on the connected lighting systems that utilize IoT sensors embedded in luminaires. This enables data collection to optimize energy space management and well-being, thereby creating recurring revenue streams beyond hardware. According to the 2024 annual report, the company has made a 90% of sales in the LED-based products.

- Acuity Brands, Inc., a dominant force in the North America market, differentiates itself via integrated technology and proprietary ecosystems. Their key initiatives is the development of Atrius-enabled solutions which combine advanced luminaires with sensor networks and data analytics software. This allows for the creation of an intelligent environment that supports smart building goals, asset tracking, and personalized lighting experience, positioning the company as a provider of holistic building intelligence. In Q4 2024, the company made a net sales of USD 1.03 billion.

- In the Europe architectural lighting market, OSRAM Licht AG has pursued a strategic initiative centered on spectrally tunable and horticultural lighting. By leveraging its expertise in opto semiconductors, the company develops advanced architectural fixtures that can dynamically adjust light spectra to enhance the human circadian rhythms in workplaces or precisely influence plant growth in urban agricultural installations, merging technical innovation with biological impact.

- Hubbell Incorporated competes in the architectural lighting market via a strategy of strategic acquisition and vertical integration. By purchasing the leading brands such as Columbia Lighting and Thread, Hubbell has expanded its portfolio to offer comprehensive solutions from fixture manufacturing to lighting controls and wiring. This allows them to provide single-source specification-grade systems for large commercial, industrial, and infrastructure projects, ensuring reliability and streamlined project delivery.

- Zumtobel Group AG, a specialist in the high-end market, adopts a strategy centered on human-centric lighting and premium design. Their lighting for people initiative emphasizes biologically effective lighting that supports visual comfort well being and performance. By combining photobiological research with award-winning architectural design, they target prestigious projects where lighting quality, aesthetics, and user-centric evidence are paramount, commanding a premium position.

Here is a list of key players operating in the global market:

The global architectural lighting market is defined by intense competition and consolidation, with the leading players expanding via strategic acquisitions, technological innovation, and a strong focus on sustainable and human-centric lighting solutions. The key initiatives include the integration of IoT and connected lighting systems to create smart buildings, alongside a push into higher-margin professional and project-based segments. The Europe and U.S. players historically dominate, but Asia manufacturers are growing rapidly via cost leadership and improving their design capabilities. For example, in May 2025, K-LITE launched an all-new series of LED Architectural Lighting products. It is the outdoor lighting industry and a strong proponent of the Make in India initiative. The market is increasingly driven by energy regulations and the demand for lighting as a service.

Corporate Landscape of the Market:

Recent Developments

- In August 2025, Hafele introduced the Columbia Series, a striking addition to its Architectural Lighting Range that delivers high-definition illumination and design-forward performance. With the successful legacy of the Loox Range, which revolutionized furniture lighting over the past decade, Hafele is now taking its lighting expertise beyond cabinetry to the entire room, redefining how spaces are lit, experienced, and appreciated.

- In May 2024, Lutron Electronics, the trusted leader in architectural lighting, window shades, and intuitive controls, debuts its all-new innovation in luxury downlighting, the Ketra D2 and Rania D2 architectural downlights.

- In November 2025, NEO Architectural Lighting launches the new Peak series of pedestrian-scale post tops. A flexible, powerful series featuring two luminaires: Peak 380 and Peak 320. Designed by AART Designers, these post tops offer state-of-the-art performance wrapped in minimalist, biophilic design, ideal for roadways, parks, residential developments, parking lots, pathways, and more.

- Report ID: 8342

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Architectural Lighting Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.