Architectural Coatings Market Outlook:

Architectural Coatings Market size was over USD 83.01 billion in 2025 and is poised to exceed USD 131.4 billion by 2035, growing at over 4.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of architectural coatings is estimated at USD 86.52 billion.

The market is observing pulsating growth on account of an increasing number of residential and commercial construction developments. Additionally, growing explorations and advances in the coating industry in the past few years, along with a growing population and a rise in per capita income of the people, are driving the market. For instance, according to the World Bank 2023, GDP per capita in the U.S. was USD 82,769.4. Rising disposable incomes provide people with the opportunity to invest more in their lifestyle and residences, which simultaneously boosts the expansion of the market.

Eco-friendly and water-based formulations, due to stricter environmental regulations and rising awareness, are also shaping the market with eco-friendly initiatives. In June 2024, PPG launched the TOMORROW INCLUDED sustainability marketing concept for its Architectural Coatings (AC) business in Europe, the Middle East, and Africa (EMEA), intending to highlight the sustainability advantages of many of PPG’s architectural products. The architectural market is also witnessing a wide range of innovations. For instance, in February 2022, AkzoNobel launched its Interpon architectural range of ready-to-ship (RTS) powder coatings to customers in North America. It comprises Interpon D1010, which is suitable for a broad range of interior and exterior applications.

Key Architectural Coatings Market Insights Summary:

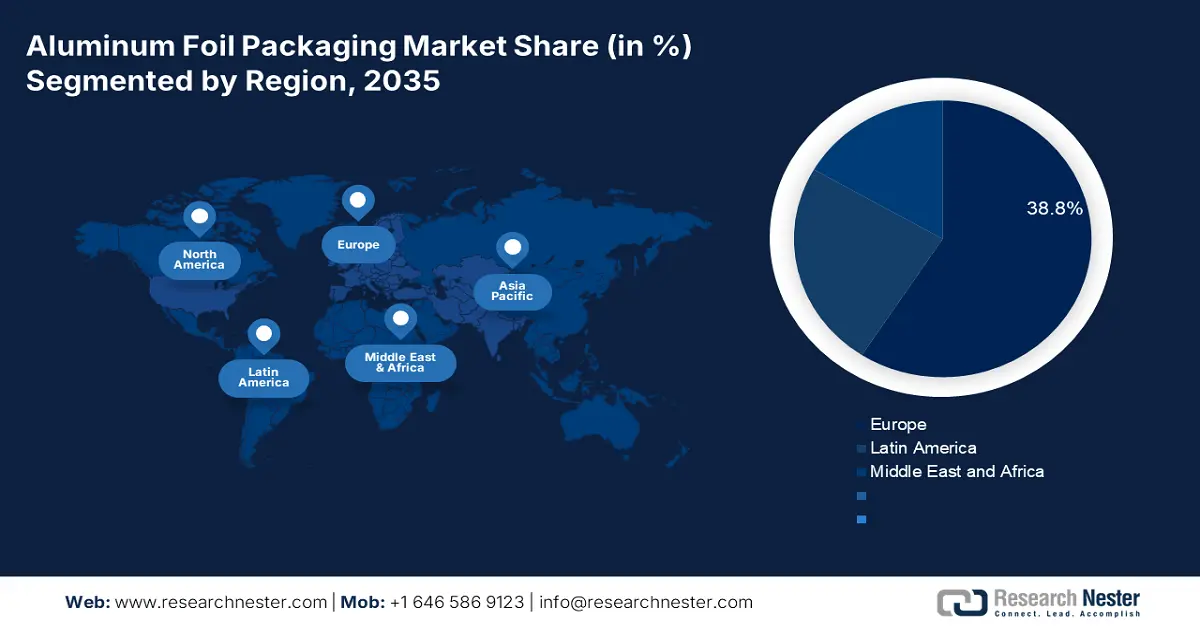

Regional Highlights:

- Europe architectural coatings market leads with the largest share by 2035, driven by rising reconstruction works and a strong emphasis on sustainability with waterborne and low-VOC formulations.

Segment Insights:

- The residential segment in the architectural coatings market will command a dominant share, propelled by technological advancements in eco-friendly coatings, 2026-2035.

Key Growth Trends:

- New Residential Projects

- Rising Construction Activities

Major Challenges:

- VOC emissions

Key Players: BASF SE; PPG Industries; AzkoNobel; Asian Paints; Nippon Paints; The Sherwin-Williams Company; Prisum Coatings Canada Inc.; Helios Group; A&A Coatings; Kansai Paint Co.

Global Architectural Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.01 billion

- 2026 Market Size: USD 86.52 billion

- Projected Market Size: USD 131.4 billion by 2035

- Growth Forecasts: 4.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Architectural Coatings Market Growth Drivers and Challenges:

Growth Drivers

- New Residential Projects: Increase in population and rising urbanization are increasing the housing demand worldwide. Developers and homeowners seek coatings that offer durability, aesthetic appeal, and environmental benefits, leading to increased consumption of decorative and protective paints. Furthermore, government initiatives also play a major role by increasing coatings usage in their projects. For instance, in November 2024, the Ministry of Housing and Urban Affairs (MoHUA) in partnership with the National Housing Bank (NHB) launched Pradhan Mantri Awas Yojana – Urban 2.0- Interest Subsidy Scheme (ISS) to provide housing to all under the Developed India by the year 2047

. - Rising Construction Activities: Emerging economies are undergoing a major change with a growth in the number of construction activities, boosting the demand for architectural coatings in both residential and commercial segments. According to the IBEF 2025, FDI in construction development, including townships, housing, built-up infrastructure, and more, stood at USD 26.76 billion to USD 35.24 billion, respectively, between April 2000 to September 2024. As infrastructure expands, coatings are essential for protecting surfaces from weathering, corrosion, and wear. This growth is also accelerating the adoption of specialized coatings such as waterproofing and thermal-insulating variants.

Challenge

- VOC emissions: The VOC emissions caused by these coatings are harmful to the environment and pose a threat to human health, leading to various health issues such as nausea, eye, nose, and throat irritation, among other serious health issues. These factors are anticipated to disrupt the market growth during the forecast period.

Architectural Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.7% |

|

Base Year Market Size (2025) |

USD 83.01 billion |

|

Forecast Year Market Size (2035) |

USD 131.4 billion |

|

Regional Scope |

|

Architectural Coatings Market Segmentation:

Type Segment Analysis

Acrylic coatings dominate the type segment due to their superior performance and versatility, offering durability, UV resistance, and color retention. Quick-drying nature and compatibility with waterborne formulation align with the rising demand for sustainable paints. As a result, acrylic-based coatings have become a preferred choice among customers. In April 2024, Engineered Polymer Solutions (EPS) launched a new all-acrylic polymer, EPS 2210, for elastomeric wall and roof coatings, capable of conforming to ASTM D6083 Type II standards.

Application Segment Analysis

The residential segment is anticipated to dominate the global architectural coatings market. Technological advancements, including the development of nonstructured coatings with antimicrobial and self-cleaning properties, have bolstered the segment’s growth. In February 2025, AkzoNobel announced the development of a new waterborne wood coating, RUBBOL WF 3350, featuring 20% bio-based content. Rising demand for eco-friendly products in residential areas is further boosting the market’s growth.

Our in-depth analysis of the global architectural coatings market includes the following segments:

|

Resin Type |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Architectural Coatings Market Regional Analysis:

Europe Market Insights

Europe is expected to have the largest growing of architectural coatings market during the forecast period. This is attributed to the rising reconstruction works in this region. Stringent environmental regulations and a strong emphasis on sustainability are also shifting attention towards waterborne and low-VOC formulations in the region. Germany leads in consumption with several manufacturers investing in eco-friendly solutions in the country and the whole of the EU region.

Italy’s market is fueled by home renovation and maintenance activities, and the development of office spaces and retail establishments. Companies in the region are focusing on innovative, sustainable products and expanding their digital platforms to enhance customer engagement. In May 2022, PPG announced the inauguration of a new architectural paint and coatings color automation laboratory, worth USD 2.1 million, in the country.

Asia Pacific Market Insights

Asia Pacific is anticipated to hold a considerable share in the overall market during the forecast period, which can be attributed to growing urbanization, construction, and infrastructural development in countries including China, India, Japan, and others. The rising government contribution for construction and various other projects in this region is expected to boost the demand for architectural coatings further.

India market is undergoing significant transformation, propelled by rapid urbanization and a rising emphasis on sustainability. The residential sector remains a dominant force, fueled by affordable housing schemes from the government. The commercial segment is driven by smart city projects primarily. In April 2024, BASF Coatings division announced the expansion of the e-coat manufacturing facility at its Mangalore site in India, driven by the demand for e-coat solutions by local automotive OEM customers.

Architectural Coatings Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PPG Industries

- AzkoNobel

- Asian Paints

- Nippon Paints

- The Sherwin-Williams Company

- Prisum Coatings Canada Inc.

- Helios Group

- A&A Coatings

- Kansai Paint Co.

Companies in the market adopt growth strategies such as product innovation with eco-friendly and low-VOC formulations, strategic mergers and acquisitions to expand market reach, investment in R&D for advanced performance coatings, and the development of smart coatings with self-cleaning or energy-efficient properties. Some of the prominent players are:

Recent Developments

- In September 2024, Engineered Polymer Solutions launched a new allacrylic polymer for cutting-edge flat through semi-gloss interior and exterior architectural coatings.

- In April 2024, Evonik Coating Additives launched TEGO Foamex 16 and TEGO Foamex 11, designed to improve the sustainability and performance of waterborne architectural coatings.

- Report ID: 1340

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Architectural Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.