Aortic Aneurysm Market Outlook:

Aortic Aneurysm Market size was over USD 5.71 billion in 2025 and is projected to reach USD 16.07 billion by 2035, growing at around 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aortic aneurysm is evaluated at USD 6.27 billion.

The demand in the market is growing faster due to the increasing prevalence of the associated medical condition worldwide. According to NLM, death cases of aortic aneurysm (AA) in all regions is expected to rise by 42.0% by 2030 from 2019, accounting for 244,685. The magnifying presence of high-risk factors, such as tobacco consumption, atherosclerosis, and the aging population, are accumulatively contributing to this demography. On this note, WHO reported that around 1.3 billion people across the globe were using tobacco products till 2023, where 80.0% of them originated from low- and middle-income countries. In addition, 49.2% of the cardiovascular deaths in 2023 caused by an atherosclerotic-mediated disease, ischemic heart disease (IHD): ScienceDirect.

Currently, organizations and healthcare authorities are putting efforts to reduce the payers’ pricing of available treatment options, such as OSR and EVAR, in the aortic aneurysm market to make them more accessible. In this regard, a real-world cost analysis was published by the Journal of Vascular Surgery in February 2020, which compared the expenses on nonruptured abdominal aortic aneurysms (non-rAAA). It established that the mean hospitalization expenditure on EVAR (USD 32,052.0) to be lower than OSR (USD 36,091.0). Simultaneously, another report study published by ScienceDirect in August 2023 identified Terumo Aortic RELAY stent graft to be a cost-effective solution for TAA. It further found the pricing of commercially available thoracic endovascular aortic repair (TEVAR) devices to range between USD 12,000.0 and USD 19,495.0.

Key Aortic Aneurysm Market Insights Summary:

Regional Highlights:

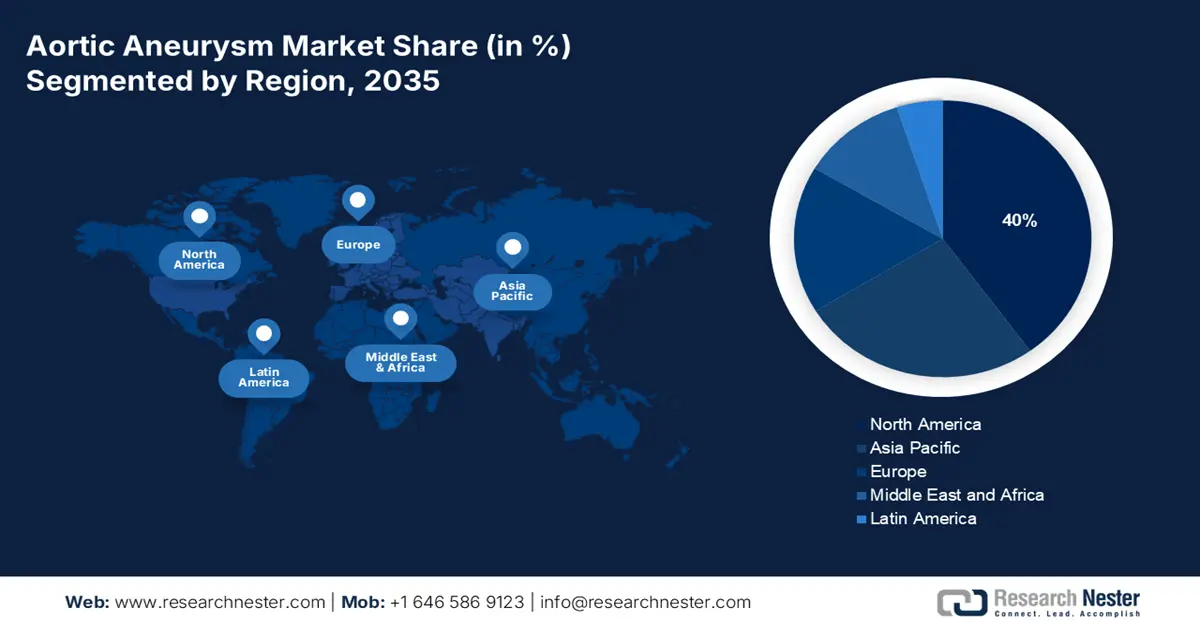

- The North America aortic aneurysm market is projected to capture a 40% share by 2035, driven by top-tier healthcare and R&D on innovative AA treatments.

- The Asia Pacific market is anticipated to experience the highest CAGR from 2026 to 2035, fueled by increasing CVD prevalence and investment in AA solutions.

Segment Insights:

- The abdominal aortic aneurysm segment in the aortic aneurysm market is anticipated to secure a 90% share by 2035, driven by high prevalence, severity, and market prioritization.

- The stent grafts segment in the aortic aneurysm market is projected to achieve an 84.20% share by 2035, driven by the widespread use of stent grafts in minimally invasive endovascular aneurysm repair procedures.

Key Growth Trends:

- Expanding pipeline and increasing investment s

- Evolving approach toward early detection

Major Challenges:

- Lack of competency in pricing and market presence

Key Players: Medtronic, W. L. Gore & Associates, Inc., MicroPort Scientific Corporation, Terumo Corporation, Endologix LLC, Boston Scientific Corporation, Japan Lifeline Co., Ltd.

Global Aortic Aneurysm Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.71 billion

- 2026 Market Size: USD 6.27 billion

- Projected Market Size: USD 16.07 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Aortic Aneurysm Market Growth Drivers and Challenges:

Growth Drivers

- Expanding pipeline and increasing investments: Government-led initiatives and public funding are conjugately fueling adoption in the market through spreading knowledge and providing financial support. For instance, in February 2025, NHS North West commenced a campaign for the abdominal aortic aneurysm (AAA) screening programme. This intended to educate and encourage eligible men to undergo a 10-minute, pain free scan. Similarly, in March 2024, LIOF and Chemelot Ventures collaboratively invested in TripleMed to help it achieve CE marking for AneuFix Endoleak Repair and AneuFill Prophylactic Sac Filling in treating AA. Additionally, the efforts to improve access to advanced care is empowering this sector for globalization.

- Evolving approach toward early detection: As the awareness about the importance of preventive measures spread worldwide, the success rates of treatments available in the market heightens. This impels consumer trust and inspire medical settings to adopt them, propelling the cash flow in this sector. Particularly, the integration of advanced technologies, such as AI and data-driven diagnosis, are ensuring progress in this field. On this note, in January 2023, Viz.ai introduced an AI-powered software, Viz Vascular Suite, to enable early detection and intervention for susceptible patients with vascular diseases, including AAA by automating the workflow. Such innovations are further inspiring other pioneers to invest in this sector.

Challenges

- Lack of competency in pricing and market presence: Despite the comparative cost-effectiveness, the existing commodities in the market still remain unaffordable for a majority of the population from the underserved regions. The necessity of accommodating skilled surgeons, specialized devices, and advanced imaging cultivate higher overall expenses. However, developing affordable essentials tools is challenging while maintaining their quality and efficacy. Thus, the economic barrier continues to hinder worldwide adoption in this field. Moreover, sufficient reimbursement policies and extensive R&D is required to mitigate this financial disparity.

Aortic Aneurysm Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 5.71 billion |

|

Forecast Year Market Size (2035) |

USD 16.07 billion |

|

Regional Scope |

|

Aortic Aneurysm Market Segmentation:

Type Segment Analysis

The abdominal aortic aneurysm segment is projected to gain the biggest share of 90% over the forecasted time range. AAA is a life-threatening condition that is observed among the most prevalent site of the true arterial aneurysm, causing up to 150.0% increase in the average size of the healthy aorta (2025 NLM article). As per a study published by ScienceDirect in April 2021, the global prevalence of this sub-type ranged between 2.0% and 12.0%, which occurred among 8.0% of men aged 65 and over. On the other hand, a 2024 report from the Cleveland Clinic mentioned that over 75.0% of all AAs is originated from abdominal aortic aneurysm. These conclusions signify the predominant captivity of this segment on incidence and severity, making it a priority for pioneers in the market.

Product Type Segment Analysis

The stent grafts segment is estimated to account for 84.2% of the aortic aneurysm market revenue by 2035. This instrument is widely used for endovascular aneurysm restorations, which has become a first-line minimally invasive treatment for AA. In addition, the availability of option for customization by using measurements from CT scan makes them more desired by surgeons. This

Our in-depth analysis of the global aortic aneurysm market includes the following segments:

|

Type |

|

|

Product Type |

|

|

Treatment Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aortic Aneurysm Market Regional Analysis:

North American Market Insights

The aortic aneurysm market in North America is forecasted to hold the largest revenue share of 40% by throughout the analyzed timeline. Significant driving factors in the region include the presence of top-notch healthcare infrastructure and concentrated focus on R&D units to procure new approaches of treating AA. For instance, in August 2023, the American Heart Association awarded USD 750,000.0 to accelerate the collaborative project of developing an early, minimally invasive treatment, named Clickable Extracellular Vesicles for Aneurysm Stabilization. It was led by a team of researchers from the University of Pittsburgh Swanson School of Engineering and Carnegie Mellon University Biomedical Engineering. Such advancements are further widening business opportunities in this landscape.

The mortality rate of AAA in the U.S. was calculated to be 15,000 per year in 2021 (ScienceDirect). Thus, healthcare professionals in this country are opting for advanced procedures, available in the market, to minimize patient impediment and reduce required time for operation. For instance, in March 2024, a well-known vascular surgeon from UC Davis Health earned FDA approval for using physician modified aortic endografts (PMEGs) to treat various complex aortic aneurysms. This was also a part of the clinical trial for full-scale commercialization of this device. Such regulatory support, coupled with the surging demand, is fostering a profitable atmosphere for the AA merchandise in this country.

APAC Market Insights

The Asia Pacific aortic aneurysm market is set to witness the highest growth through 2035. The strong emphasis of various key players on this region is propelling its pace of growth in this field. Additionally, they are investing heavily in developing innovative medical products to help professionals treat the growing susceptible population China, India, and Japan. Besides, regulatory bodies from these landscapes are also promoting the nationwide use of associated restoration devices. Furthermore, the enlarging volume of patients with cardiovascular disease (CVD) across the region is also a driving factor in this sector. For instance, in 2022, the prevalences of IHD in Central Asia and South Asia were 8,573.3 per 100,000 and 2,214.6 per 100,000.

India is emerging as a lucrative investment opportunity for global leaders in the market, attributable to its large patient pool and advancing healthcare industry. The initiatives from both public and private organization to prevent the widespread of related vascular diseases are fueling demand in this category. On this note, in September 2024, Fortis Escorts Heart Institute a dedicated facility to offer complete diagnosis and treatment for aortic diseases, Aorta Centre. This entity is fully equipped to avail all kinds of surgical, endovascular, and hybrid interventions, along with radiological diagnosis. These efforts are further attracting more companies to invest in this sector.

Aortic Aneurysm Market Players:

- Medtronic

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- W. L. Gore & Associates, Inc.

- MicroPort Scientific Corporation

- Terumo Corporation

- Endologix LLC

- Boston Scientific Corporation

- Japan Lifeline Co., Ltd.

- Bentley InnoMed GmbH

The current dynamics of the aortic aneurysm market are following the trend of innovation and globalization. To participate in this cohort, key players in this field are increasingly expanding their territory in un-tapped or emerging landscapes. For instance, in May 2023, Therapeutic Solutions International formed a new subsidiary, VasoSome Vascular Inc., cultivating innovative AA treatments by utilizing stem cell–derived exosomes. Simultaneously, in August 2024, Terumo introduced its advanced solution for EVAR procedures, TREO Stent-Graft System, to the market in India. This remarkable device is capable of supporting both suprarenal and infrarenal active fixation, solidifying the company’s debut overseas. Such key players are:

Recent Developments

- In January 2025, Bentley InnoMed announced the commercial launch of two additional products, BeGraft Stent Graft System and BeFlared FEVAR Stent Graft System, at LINC in Leipzig. This dual market launch strengthened the company’s leadership as a pioneer of bridging stents for FEVAR procedures.

- In June 2024, Medtronic introduced Steerant Aortic Guidewire for EVAR and TEVAR procedures. This product is designed to facilitate catheter placement and exchange during diagnostic or interventional procedures in the aorta, solidifying its portfolio of minimally invasive surgeries.

- Report ID: 5073

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aortic Aneurysm Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.