Antiscalants/Scale Inhibitors Market Outlook:

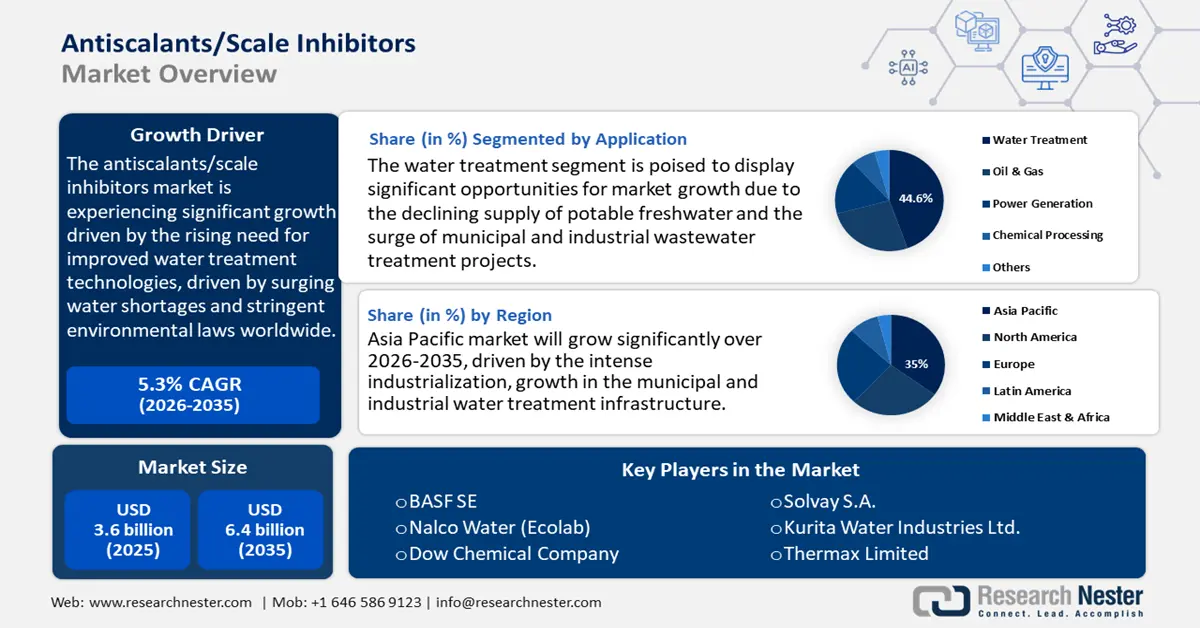

Antiscalants/Scale Inhibitors Market size was valued at USD 3.6 billion in 2025 and is projected to reach USD 6.4 billion by 2035, growing at a robust CAGR of 5.3% during the forecast period from 2026 to 2035. In 2026, the industry size of antiscalants/scale inhibitors is evaluated at USD 4.3 billion.

The market is projected to experience significant growth over the forecast period, primarily attributed to the rising need for improved water treatment technologies, driven by surging water shortages and stringent environmental laws worldwide. Industrial segments such as municipal water treatment, power generation, and oil and gas have to optimize water reuse and minimize scale deposits to meet compliance constraints. For example, according to the EPA’s National Water Reuse Action Plan, municipal wastewater facilities in the United States collectively treat an estimated 33 billion gallons per day, yet only about 2.2 billion gallons per day, which is approximately 6.6% is recovered for reuse, highlighting substantial untapped potential for expanding water recycling nationwide. According to the State Water Resources Control Board, the volume of recycled water used in California increased from 686,000 acre-feet in 2019 to 749,000 acre-feet in 2022. This growth reflects ongoing efforts within the state to enhance sustainable water management through expanded recycling and reuse programs. Such initiatives by the government show the role scale inhibitors play in the efficiency and sustainability of water treatment systems, and this segment should see stable growth.

The antiscalants/scale inhibitors market supply chain is highly reliant on the chemicals that contain phosphonates and carboxylates, and their manufacture falls within the developed base of chemical production. The most recent U.S. Producer Price Index (PPI) on chemical manufacturing, which encompasses specialty chemicals like scale inhibitors, was at 356.3 by the month of June 2025, an average fluctuation in price that producer of any chemical manufacturing industry receives. In addition, the U.S. imports of alkyl phosphate esters from China in the year 2021 were 51,713,548 kilograms costing USD 118,783,614. Imports were 53,501,318 kilograms in 2023 with a value of USD 73,791,562, showing a net change in the import volume over time, despite varying values. At the same time, some manufacturers both in North America and in Asia have spent or are in the process of expanding or commissioning new production lines to meet the demand.

Funding for research, development, and deployment (RDD) of sustainable and biodegradable antiscalant formulation to have minimal environmental impact has also been heavily increased by the government and public institutions. For instance, more than USD 18 million in funding for research and development projects focused on innovative chemical-based treatment of produced water and wastewater from oil, natural gas, and coal-based power generation was announced by the U.S. Department of Energy. These projects aim to develop and demonstrate new chemical treatment and management technologies to safely and effectively use wastewater for beneficial end-uses, such as irrigation, hydrogen generation, and aquifer recharge. Such investments not only increase the performance of their products but also safeguard the supply chains by stimulating the domestic manufacturing capacity.

Key Antiscalants-Scale Inhibitors Market Insights Summary:

Regional Insights:

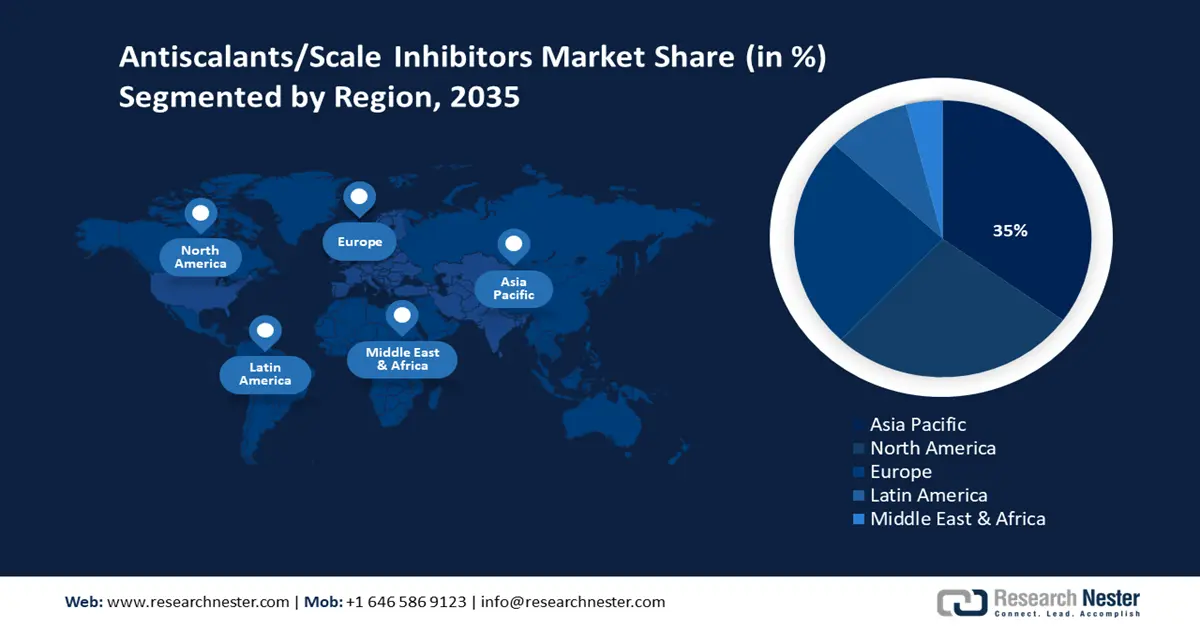

- By 2035, Asia Pacific is forecast to hold a 35% revenue share, underpinned by rapid industrialization, expansion of water treatment infrastructure, and rising investments in sustainable chemical technologies.

- From 2026 to 2035, the North American antiscalants/scale inhibitors market is expected to capture a 27% revenue share, reinforced by stringent EPA regulations and increasing demand across power generation and oil & gas industries.

Segment Insights:

- By 2035, the water treatment segment is projected to secure a 44.6% share of the antiscalants/scale inhibitors market, propelled by the declining availability of potable freshwater and expanding municipal and industrial wastewater treatment initiatives.

- From 2026 to 2035, the threshold inhibition segment is anticipated to command a 40.3% share, supported by its cost-efficient low-dose scale prevention and strong compliance compatibility.

Key Growth Trends:

- Raw material supply chain stability

- Increased cost of operation and need for efficiencies

Major Challenges:

- Pricing pressures due to volatility of raw materials

- Limited sustainable chemical manufacturing infrastructure

Key Players: BASF SE, Nalco Water (Ecolab), Dow Chemical Company, Solvay S.A., Thermax Limited, Clariant AG, SABIC, AkzoNobel N.V., Huntsman Corporation, Veolia North America, ChemTreat Inc.

Global Antiscalants-Scale Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, United Arab Emirates, Saudi Arabia, South Korea

Last updated on : 21 August, 2025

Antiscalants/Scale Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- Raw material supply chain stability: Antiscalant supply has been affected by supply chain risks of raw materials used, or phosphonates and carboxylates. However, the reduced supply security has been amended by industry initiatives to enlarge the sources of sourcing, such as local manufacturing in North America and Asia. For instance, in 2022, the U.S. imported phosphinates and phosphonates at USD 47075.18 globally, of which USD 40990.07 was imported from China. This constant supply from global sources is expected to support the availability of the raw materials essential to the antiscalants/scale inhibitors market. Such constant import volumes help ensure stable manufacturing and supply chain resilience, allowing manufacturers to uphold market stability and meet growing demand in water treatment applications. This has driven the antiscalants/scale inhibitors market toward steady growth despite varying trade dynamics due to controlled price fluctuations in the antiscalants/scale inhibitors market.

- Increased cost of operation and need for efficiencies: Increased industries require antiscalants not just to stop the scale build-ups but also to increase efficiencies to avoid the excess cost of downtimes. The Producer Price Index (PPI) for chemical manufacturing reached 356.3 as of June 2025, reflecting ongoing inflationary pressures and elevated input costs for water treatment chemicals in the U.S. The manufacturers of advanced formulations enhance the threshold inhibition and dispersion mechanisms to reduce maintenance costs, making them a preferred choice by the industries that want to streamline their operations concerning water treatment.

- Development in emerging markets: There is extensive industrialization and water filtration development of urban infrastructure in emerging markets, particularly in the Asia-Pacific, Latin America, and the Middle East. For example, the wastewater treatment industry in India is expanding quickly as a result of urbanization, water scarcity, and robust government support through programs like the National Mission for Clean Ganga and Jal Jeevan Mission. Significant market potential is highlighted by the fact that only 28% of the 72,368 million litres of sewage produced daily in urban India are treated and reused. Estimated at INR 7,000 crore in 2020, the industry is expected to reach USD 4.3 billion by 2025, growing at a 10–12% CAGR. Water quality and availability improvement programs by the government boost the demand, and it is one of the leading market growth factors in these regions.

Challenges

- Pricing pressures due to volatility of raw materials: Phosphonates and carboxylates are key raw materials required in the production of antiscalants and have been subjected to volatility. According to World Integrated Trade Solution (WITS), in 2022, raw materials accounted for approximately 9.69% of the U.S. total imports, driven by successive interruptions in the supply chain and increasing energy prices that directly affected the budget expenses of manufacturers. Such volatility will require producers to regularly revise the pricing models, resulting in the risk of lower demand in price-sensitive regions. Moreover, the variability of the costs makes long-term procurement and negotiations over the contracts difficult and a challenge to have a stable supply and price.

- Limited sustainable chemical manufacturing infrastructure: Most emerging economies do not have the infrastructure capable of aiding sustainable chemical manufacturing, including environmentally friendly antiscalants. According to the report of the International Energy Agency (IEA), in 2022, only 2% of global primary chemical production was achieved through low-emission or advanced sustainability methods. Furthermore, less than 1% of the necessary carbon capture, utilization, and storage (CCUS) and clean power infrastructure required for the chemical sector is currently in place worldwide. This constraint limits the capacity of the manufacturer to locally manufacture either biodegradable or environmentally friendly scale inhibitors and thus hinders the antiscalants/scale inhibitors market growth of sustainability products. Areas devoid of proper infrastructure also impede the adoption of cleaner production technologies and slow the attainment of compliance with the regulations and conservation targets.

Antiscalants/Scale Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

Antiscalants/Scale Inhibitors Market Segmentation:

Application Segment Analysis

The water treatment segment is expected to dominate the antiscalants/scale inhibitors market by 2035 with the largest revenue share of 44.6%, driven by the declining supply of potable freshwater and the surge of municipal and industrial wastewater treatment projects. High technologies like reverse osmosis and desalination are very dependent on antiscalants to ensure a high level of production and long life of equipment. Such government initiatives include the Water Reuse Action Plan of the U.S., developed by the EPA has significantly paced up investments in water treatment chemicals, leading to the growth of the antiscalants/scale inhibitors market.

Further, the municipal water treatment and wastewater treatment are the key drivers in the water treatment segment, representing an increased demand for antiscalants. The municipal water treatment is targeted at ensuring safe water, which is potable and can be provided to the increasing needs of urban centers, necessitating effective scale control against damage to facilities, as well as meet the high levels of regulatory requirements within the US, or standards established by the US EPA. Meanwhile, the wastewater treatment industry meets the growing demand for reusing water and the environment due to the restrictive discharge policies and the water scarcity issue in the global environment. For example, the European Union’s Urban Waste Water Treatment Directive (UWWTD) mandates the collection and treatment of urban wastewater and sets pollutant limits to reduce environmental impact. The two segments are strongly dependent on antiscalants to enhance system performance in filtration and process membranes, and investments in both segments are anticipated to increase due to the government's focus on ensuring water quality and sustainability.

Inhibition Method Segment Analysis

The threshold inhibition segment is projected to grow at a significant antiscalants/scale inhibitors market share of 40.3% from 2026 to 2035, owing to its cost-effective and reliable low chemical doses scale prevention. The inhibition method is extensively implemented in various industries because of its capability to avoid scale without causing a change in the chemical balance of the treated water. The ability of compatibility with other chemistries of water and regulation compliance, such as the guidelines by the European Chemicals Agency (ECHA), under the REACH Regulation, which ensures substances do not pose risks to water resources due to their persistence, mobility, or toxicity, serve as the basis of its broad application in large scale water treatment and industry.

Low concentration inhibitors and phosphonate-based threshold inhibitors are the major contributors to the segment's growth since they are highly effective in preventing scale formation at the lowest doses. The low concentration inhibitors are preferable because they are cost-effective and have minimal environmental impact, which makes them suitable in large-scale water treatment, whereby it is apparent that they have to optimize the utilization of the chemical in use. The phosphonate-based threshold inhibitors present better performance through crystal growth interference and are also known to be highly stable and biodegradable in accordance with the regulatory needs, i.e., European Chemicals Agency (ECHA).

End use Industry Segment Analysis

The phosphonates segment held a significant revenue share of 38.7% in 2025 and is estimated to grow at a steady pace during the projected years by 2035, attributed to its highly efficient scale inhibition and compliance with the environment. These have found extensive application in the fields of municipal water treatment, oil & gas, and power generation, supported by regulatory-approved low-toxicity and biodegradability. Enhancements in catalytic production methodologies through phosphonate chemistry innovations also reduced the cost of production and improved the performance and sustainability of the preferred products, further consolidating their market control.

Our in-depth analysis of the antiscalants/scale inhibitors market includes the following segments:

|

Segment |

Subsegment |

|

Type |

|

|

Inhibition Method |

|

|

Application |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antiscalants/Scale Inhibitors Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific dominated the global market and is expected to grow at the highest revenue share of 35% by 2035. This growth is attributed to the intense industrialization, growth in the municipal and industrial water treatment infrastructure, and a rise in investments in sustainable techniques in chemicals. The demand has also been accelerated by government projects in re-utilizing water and enforcing strict environmental policies throughout the region. Market growth is also driven by the increasing attention to the elimination of aspects related to scale-based operational inefficiencies in the power generation, oil & gas, and manufacturing industries.

In addition, the higher capital expenditure on innovative and improved technologies of treatment adds up to product innovation and execution. For instance, a comprehensive analysis from the World Bank shows that East Asia and the Pacific annually spend between USD 114.5 billion and USD 123.8 billion on the water sector, with about 2/3 dedicated to capital expenditure (CAPEX) on advanced treatment technologies and infrastructure developments, supporting product innovation and effectiveness gains in the region. In general, the Asia Pacific is considered to be the most promising and rapid buyer of antiscalants worldwide due to friendly policy packages and increasing manufacturing requirements of the treated water industry.

The antiscalants/scale inhibitors market in China is anticipated to grow with the largest revenue share in the APAC market by 2035, fueled by the large industrial base in the country, the high levels of urbanization, and the aggressive approaches of environmental sustainability by the government. In 2023, China’s green loan balance reached RMB 30.08 trillion (USD 4.26 trillion), a 36.5% increase year-on-year, supported by national and local incentives. Investments in green insurance were RMB 229.7 billion (USD 32.5 billion), with RMB 1.67 trillion (USD 236.3 billion) invested in green industries by mid-2023. These efforts enabled millions of companies to adopt sustainable chemical processes and green technologies. Major water treatment plants and industrial refurbishment throughout industries, such as oil & gas, power plants, and municipalities, are prime drivers of demand. Moreover, the National Development and Reform Commission (NDRC) sponsors catalytic chemical breakthroughs to enhance the antiscalant performance and have less environmental impact. The investment in green chemicals by China is its efforts to become a carbon-neutral country by 2060 and further strengthen its position in this market, as the investment program is as large as the government incentives as well as infrastructure developments.

India’s market is expected to grow at the fastest CAGR in the Asia Pacific region due to the government’s initiative through industrialization, and with the improvement of water infrastructure and the growing usage of sustainable chemical technologies. The Technology Development Board (TDB) in India has encouraged chemical innovation on an environmentally friendly path by funding 27 deals with chemical enterprises so far, with an amount of 94 crore rupees in 2024. Government efforts, research and development spending, and sustainable policies to promote bio-based chemicals and bio-based feedstocks, and minimize waste and promote waste reduction, support the chemical industry, which is expected to increase 6.8 times 2014 levels to 22.7 12 lakh crores by 2024. Such programs put India at the forefront of the innovative and sustainable chemical solutions world. Department of Science & Technology (DST) is making efforts in enhancing research in advanced formulations of the scale inhibitors to improve their applicability in other industries such as textiles, pharmaceuticals, manufacturing of water, etc. India is on the shift to become environmentally compliant. Improving urbanization and initiatives by the government on wastewater reuse and industrial effluent are further advancing the antiscalants/scale inhibitors market expansion.

North America Market Insights

The North American market is projected to grow at a substantial revenue share of 27% during the projected years from 2026 to 2035, due to the growing demand in both water treatment in municipal and industrial segments, EPA regulations on water quality that are quite restrictive, and the emphasis on chemical manufacturing in the region being more sustainable. Power generation and oil & gas are industrial applications that need higher-grade antiscalants to cut down scale-related inefficiencies, hence they penetrate the market.

Government expenditure has a huge influence on conditions in the antiscalants/scale inhibitors market. For example, the EPA’s FY 2022 budget request totals USD 11.2 billion to strengthen its capacity for protecting human health and the environment, including chemical safety management. Specifically, the EPA requested an additional USD 15 million and 87.6 full-time equivalents (FTEs), a 35% increase from 2021, to address new responsibilities under the 2016 Toxic Substances Control Act amendments. This funding boosts efforts in chemical risk evaluation, risk management, data development, and reviewing confidential business information. These investments aim to safeguard vulnerable populations disproportionately affected by chemical exposures. Additionally, Industrial adoption of green chemistry practices—such as next-generation catalyst design—helped reduce chemical waste released to land, air, and water by 7% between 2004 and 2013, with hydrochloric acid releases dropping by more than 60% in that time frame. Pharmaceutical industry chemical usage declined by nearly 50%, mainly due to improved catalysis, safer reagents, and reduced organic solvent use. BASF’s ibuprofen production increased atom efficiency from 40% to 77% by switching from a six-step to a three-step catalytic process. The combination of these factors forms the basis of a positive growth outlook for the North American antiscalants market.

The antiscalants/scale inhibitors market in the U.S. is predicted to hold a dominant position in the region with the largest revenue share in 2025, supported by its strong investments in water treatment for municipalities and industrial segments. In 2023, the Environmental Protection Agency (EPA) also invested approximately USD 1.2 billion in initiatives for water infrastructure improvements outlined in the Water Infrastructure Improvements for the Nation Act and other relevant legislation. This demand can further be justified by the existence of strict regulations that aim at hindering scale formation during power generation and oil & gas production, where efficiency gains cannot be overlooked. In addition, the U.S. Department of Energy (DOE) invested USD 78 million in 2023 to decarbonize chemical manufacturing, specifically through sustainable feedstocks, advanced process technologies, and catalytic innovations. This investment supports reduced energy use, lower carbon emissions, and viable demonstrations, including developments, directly aiding specialty chemicals such as antiscalants. The combination of these government programs, with the increase in interest in sustaining efforts in the environment and chemical safety, is likely to maintain the growth of the antiscalants/scale inhibitors market in the U.S.

The growth of Canada’s market is expected to be driven by the increasing water treatment infrastructure and the growth in the number of regulatory compliances. In 2023, the Canadian government made an investment of more than CAD 750 million in the protection of freshwater, as well as CAD 650 million over 10 years to monitor and recover the larger water bodies. Furthermore, CAD 85.1 million was designated to create the Canada Water Agency, and CAD 22.6 million to enhance the coordination of partners at the federal, provincial, Indigenous, and local levels. The purposes of the investments are to ensure clean and healthy water and ecosystem resilience in the face of climate change. Industrial sectors, including oil and gas and power generation, among others, are the other major consumers of antiscalants, with the government providing incentives to green chemicals adoption and improved practices concerning waste management.

Europe Market Insights

The European market is anticipated to expand at a steady pace during the forecast year by 2035, owing to the shift toward high standards of environmental regulations, growing water treatment in industries, and an emphasis on sustainable chemical technology with high growth margins. The level of green chemical innovation funding has expanded tremendously due to government programs in line with the European Green Deal and Horizon Europe programs. €1.8 billion in July 2022 was committed by the EU Innovation Fund to support 17 large-scale clean technology projects across Europe. These projects revolve around areas including safe manufacturing of hydrogen, clean energy, carburizing, and production of renewable sources, as well as sustainably manufactured chemicals.

The investment is expected to fast-track the decarbonization of industries through the demonstration of commercially viable options and the scaling of innovative clean technology to the EU member states. The chemical and pharmaceutical industry in Germany reported a turnover of 225.5 billion Euros in 2023. Almost three-quarters of firms in this industry are researching, and the annual R&D expenditures amount to approximately 14 billion euros, partly focusing on sustainability and climate protection as well as green innovative solutions. The industry is focused on developing new sustainable processes and materials, including chemical recycling and low-carbon technologies, aligned to Germany’s goal of climate neutrality by 2050. Increased investments are also being made by other Western European countries, such as Italy, Spain, and the Netherlands, to meet the changing environmental requirements.

Key Antiscalants/Scale Inhibitors Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nalco Water (Ecolab)

- Dow Chemical Company

- Solvay S.A.

- Thermax Limited

- Clariant AG

- SABIC

- AkzoNobel N.V.

- Huntsman Corporation

- Veolia North America

- ChemTreat Inc.

The global market is moderately consolidated, with only a few large participants, who have a large share of the antiscalants/scale inhibitors market jointly. The major antiscalant solution providers, including BASF SE and Nalco Water, can influence the Ecolab company, have a great influence in the industry because they provide sophisticated and sustainable antiscalant solutions. The relatively strong share of four Japanese companies, Kurita Water Industries, Mitsubishi Chemical Holdings, Tosoh Corporation, and Daicel Corporation, represents the strength of the Japanese industry in innovation and specialty water treatment chemicals, and the US. Based giants that gain advantage through large R&D and green product portfolios are Dow Chemical Company and Chum Treat Inc. The competitive standings are also somewhat consolidated in that the barriers to entry are high, with regulatory compliance, high investment in research.

Recent Developments

- In April 2024, Univar Solutions partnered with Italmatch USA Corp. to become the sole distributor of DEQUEST PB, a new line of phosphorus-free, environmentally friendly antiscalants and dispersants, throughout the US and Canada. Derivable from chicory root, the carboxymethyl inulin (CMI)-based technology is non-toxic, biodegradable, and offers a sustainable substitute to traditional phosphonates in the Homecare, Industrial & Institutional (HI&I) cleaning markets. The collaboration expands the company's range of environmentally friendly cleaning products and provides technical support through Univar's Solution Centre in Houston. Italmatch publicly launched the DEQUEST PB line at the end of April 2024, highlighting its performance, environmental benefits, and available grades, which include PB11625D (liquid) and SPE 1436 (powder).

- In April 2024, Gradiant introduced CURE Chemicals, an extensive range of solutions with more than 300 proprietary formulations, including antiscalants, intended for various applications, such as semiconductors, renewable energy, and mining. This strategic launch reflects Gradiant's transition to end-to-end chemical solutions by combining state-of-the-art chemistry with AI-powered operations through its "SmartOps" platform. The company becomes a provider of a full-stack water process due to the emphasis on sustainability and operational efficiency of this solution.

- Report ID: 8013

- Published Date: Aug 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.