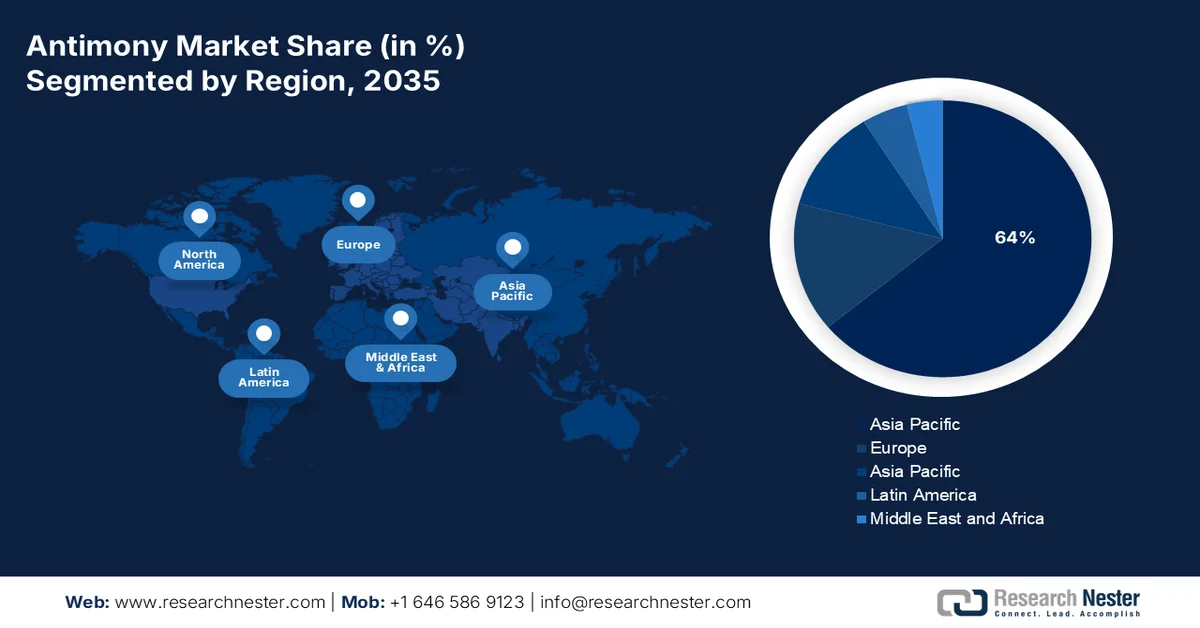

Antimony Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to garner the largest revenue share of over 64% during the assessment period. This is attributed to high production and supply of products such as automobile components and pigments from China, Japan, and India. Japan holds a critical place in the global pigments trade, accounting for USD 244 million in 2023 in the outbound pigment & titanium dioxide trade. Antimony is typically mined in the form of a sulfide mineral called stibnite (Sb2S3), while some occur in metallic form in APAC (including complex sulfosalt minerals - cylindrite, boulangerite, jamesonite, tetra, and pyrargyrite. In 2023, China had the highest reserves of 640 kt, followed by Russia (350 kt) and Kyrgyzstan (260 kt).

India was the 8th (out of 73) largest exporter in 2023 and held an outbound trade of USD 20.1 million. In 2023, the exports were destined mainly for the U.S. (USD 16.3 million), Brazil (USD 844k), the Netherlands (USD 577k), Spain (USD 317k), and Canada (USD 305k). According to the OEC, India exported a total of USD 20.1 million, primarily to the U.S. (USD 16.3 million), Brazil (USD 844k), and the Netherlands (USD 577k). Furthermore, India’s outbound antimony ores and concentrates trade was USD 23.1k in 2023. The fastest growing origins for imports in India during 2022-2023 included Tajikistan (USD 13.1 million), China (USD 8.79 million), and Italy (USD 181k). India was also the 11th largest exporter of antimony oxides out of 58 countries and was worth USD 5.21 million. This was primarily directed toward Oman (USD 961k), Saudi Arabia (USD 844k), the United Arab Emirates (USD 756k), Thailand (USD 591k), and Bangladesh (USD 480k). The country’s crucial role in the overall trade scenario has set the India antimony market on a global pedestal.

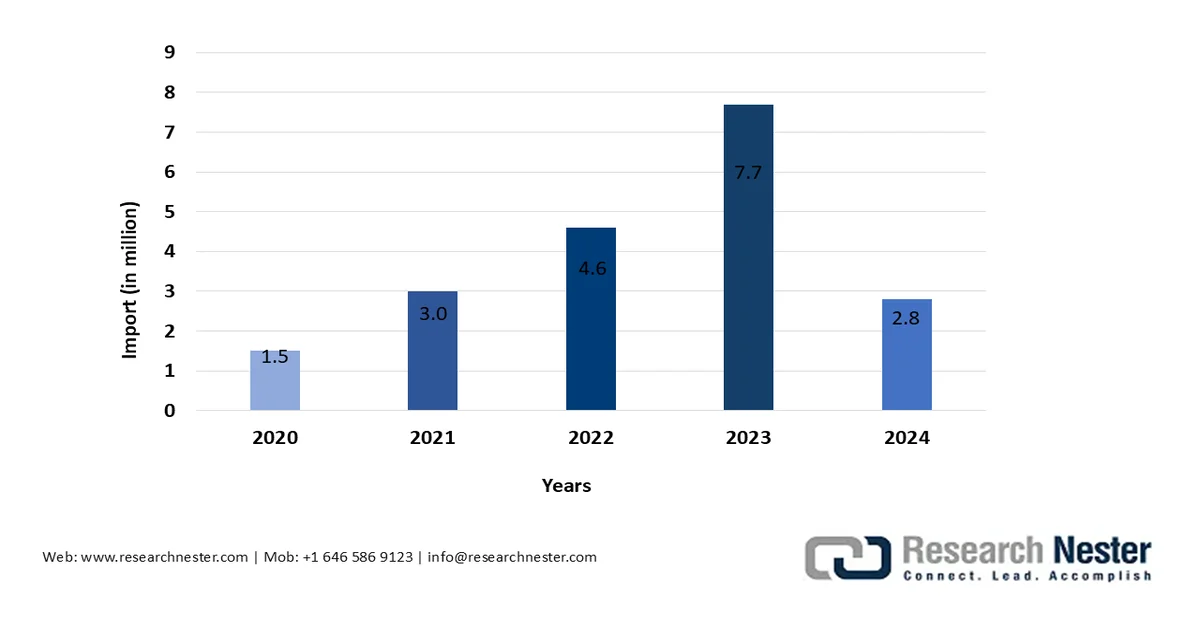

India Imports of Antimony & Articles Including Waste & Scrap from Oman (2020-2024)

Source: Trading Economics

China antimony market is driven by the country’s dominance in the global supply chain. The country has spent decades building a robust antimony mining, refining, and processing infrastructure. In 2024, China introduced export licensing measures on antimony ore, refined products, and related technologies, and later tightened its exports. This strategic policy sharply reduced outbound shipments and created global price volatility. The fastest growing end markets for China’s antimony oxide exports were the U.S. (USD 21.9 million), Mexico (USD 13 million), and Vietnam (USD 9.49 million).

Global Antimony Imports from China, 2020-2023

|

Ore & Concentrates |

23% |

|

Oxide |

76% |

|

Unwrought metal & powder |

24% |

|

Total metal & oxide |

63% |

Source: CSIS

North America Market Insights

The North America antimony market is projected to account for a significant revenue share owing to high demand in defense equipment manufacturing in the U.S. No marketable Sb was mined in the U.S. in 2024, and the primary Sb metal and oxide were formed by one player in Montana with imported feedstock. In addition, secondary antimony came from the recovered antimonial lead sourced from lead-acid batteries. The secondary antimony generated in 2024 held a value of USD 73 million and recycling resourced 15% of domestic consumption, while the differences were met using imports. The USGS data shows, i n 2024, antimony was used predominantly in metal products, such as antimonial lead and ammunition, ascribed to 40%; flame retardants at 39%; and ceramics, glass & rubber (non-metal products) for 21%.

The leading utilization of antimony in the United States is in ammunition, flame retardants, glass, ceramics, and rubber products, which typically rely on antimony oxides, antimony trisulfide, or antimony metal. Moreover, antimony trioxide as a clarifying agent in PV glass production has increased manifold over the past few years and widespread antimony hydride usage for silicon doping in the semiconductor industry via the chemical vapor deposition process (CVD) underscores the important stance that the market takes in the U.S. However, on the contrary, the U.S. has little to no domestic Sb generation (with only 60 kt in reserves, which is mostly found in Idaho, Alaska, Nevada, and Montana). A government-backed gold and antimony mine is being developed in Idaho with 18,477 kt of resource ore at 0.48% Sb. Also, the Sb refinery in western Montana processes foreign ore into antimony products. Occurrences of antimony mineralization in Montana is restricted around Thompson Falls in Sanders County. After mining here ended in 1980, smelting operations continued thereafter, and the deposits in the area are all in the polymetallic sulfide form.

The Canada antimony market is still in its nascent stage in terms of domestic production capacity and utilization. Historically, Canada’s key manufacturer has been Beaver Brook mine, with active exploration by companies such as Antimony Resources Corp., New Age Metals, and Madison Metals, targeting major deposits in New Brunswick, Newfoundland, and Ontario to develop future supply. Canada’s exports stood at USD 1. 5 million in 2021 and 109,327 kg in quantity. In 2023, the antimony oxides imports were valued at USD 15.3 million or 2,231,600 kg in quantity, whereas antimony and articles, including waste was USD 9.5 million or 1,671,820 kg.

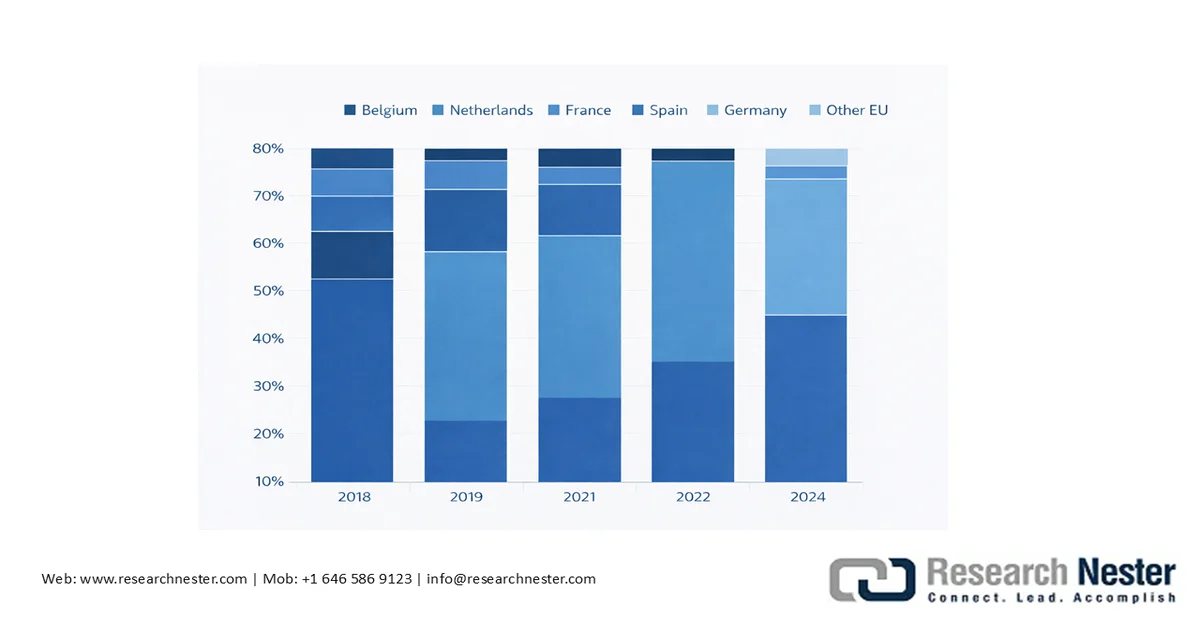

Europe Market Insights

Europe antimony market is driven by the increasing Sb applications across end use industries such as ceramics, paints, and automotive. The EU is dependent for its antimony ore imports, with Turkey supplying approximately 77%, primarily to Italy. According to the Joint Research Center, EU has a limited exposure to China’s ore supply owing to Chinese export restrictions. As a result of this, the EU has gradually diversified its import chains, leading to Tajikistan accounting for 52%, directed to France and Belgium, while China’s share declined to 18% in 2023 from 40% in 2020. However, the Netherlands remains the only country in Europe to continue to import significantly from China. The EU generates 28kt antimony oxides annually and exports 7.5 kt to the UK, the U.S., and Turkey, thereby making it a net exporter. If the EU market players can successfully stabilize Sb metal supplies, it can likely further strengthen their agency in global exports.

Distribution per EU Destination of Chinese Export of Antimony Metal (2018-2024)

Source: Joint Research Center, GACC (2024)

Material uses shares, NACE2 sectors assignment & Value added (VA)

|

Material |

Application |

Share |

NACE sector |

VA in million € |

|

Antimony |

Plastics (catalysts and stabilizers) |

6% |

C20 - Manufacture of chemicals and chemical products |

132,361

|

Source: Europa

The Netherlands in 2023, ascribed for about 98% of Chinese exports in Europe. The EU relies heavily on foreign entities for its antimony metal needs to produce oxides and compounds catering to its domestic industries. Indeed, the Sb metal inbound supply averaged at 19 kt between 2019 and 2023, while supply was only 456 t during the same timeline. During 2019-2023, EU consumption was 18.8 kt and in 2021, the imports reached its highest mark of 22.3 kt, with an eventual gradual decline to 16.7 kt in 2023. The slump was a notable -35% reduction in Chinese -63% decline from Vietnam between 2021 and 2023, underscoring minimized dependency on EU’s Southern Asian partners. Tajikistan (7.6 kt average), since 2020, is the first exporter, supplying mainly to Belgium and France.

Germany antimony market is still in its nascent stage in production terms. The country held a share of 0.9% or 0.8 tons of processed antimony in 2023. Germany is not a primary producer of antimony; the support/processing that exists is based on imported feedstock or small secondary recovery streams. Eurostat import unit values for HS 282580 and related codes as the best government-sourced landed cost proxy for German buyers. Eurostat notes impor/t/export prices rose strongly through 2022, eased in 2023, then hit new highs in 2024.