Antimony Market Outlook:

Antimony Market held a value of USD 2.5 billion in 2025 and is estimated to reach USD 4.7 billion, expanding at a CAGR of 6.5% during the forecast period of 2026-2035. In 2026, the industry size of antimony is assessed at USD 2.6 billion.

The global antimony market has widespread applications across several end use verticals, such as pigments and paints, chemicals, ceramics, glass, electronics, semiconductors, precision optics, and battery production, among others. Primarily, antimony (Sb) is used as a lead (Pb) hardener in batteries, to increase bullet hardness (Sb is alloyed with Pb; usually <2 wt.% Sb), and in solders and other alloys. Antimony trioxide, a pivotal antimony compound, is popularly used in flame-retardant formulations, along with manufacturing children's toys, clothing, and automobile and aircraft seat covers. Furthermore, in terms of antimony availability in the product supply chain, the commercially viable forms include ingots, granules, shots, broken pieces, cast cake, powder, and single crystals. 0.2 to 0.5 parts per million are the estimates of the metalloid’s presence in the Earth's crust. Since antimony is chalcophile, it is typically retrieved with sulfur and heavy metals, such as lead, silver, and copper. Despite antimony’s prevalence in over a hundred forms, Stibnite (Sb2S3) is predominantly retrieved from the ore mineral of antimony.

According to the Montana Bureau of Mines and Geology (MBMG), prices in 2024 averaged at USD 5.60/lb and USD 12,346/t for metallic Sb in 2023. Recent prices are USD 11.38/lb., in light of China’s export restrictions. In August 2024, China imposed antimony shipments (including antimony oxide, antimony metals, antimony ore, gold-antimony smelting, and separation technologies) restrictions globally for national security. China is the top supplier, accounting for 48% of worldwide production and 63% of U.S. antimony imports. Owing to this, antimony price in 2024 was at its peak of approximately USD 33,000 per ton, as published by the U.S. Congress (The Joint Research Center stated costs reached USD 38,000 per ton in December 2024). With the ongoing disruptions in material supply, the U.S. is seeking to decouple from the dependency on China and secure antimony supply chains from non-Chinese sources.

Key Antimony Market Insights Summary:

Regional Highlights:

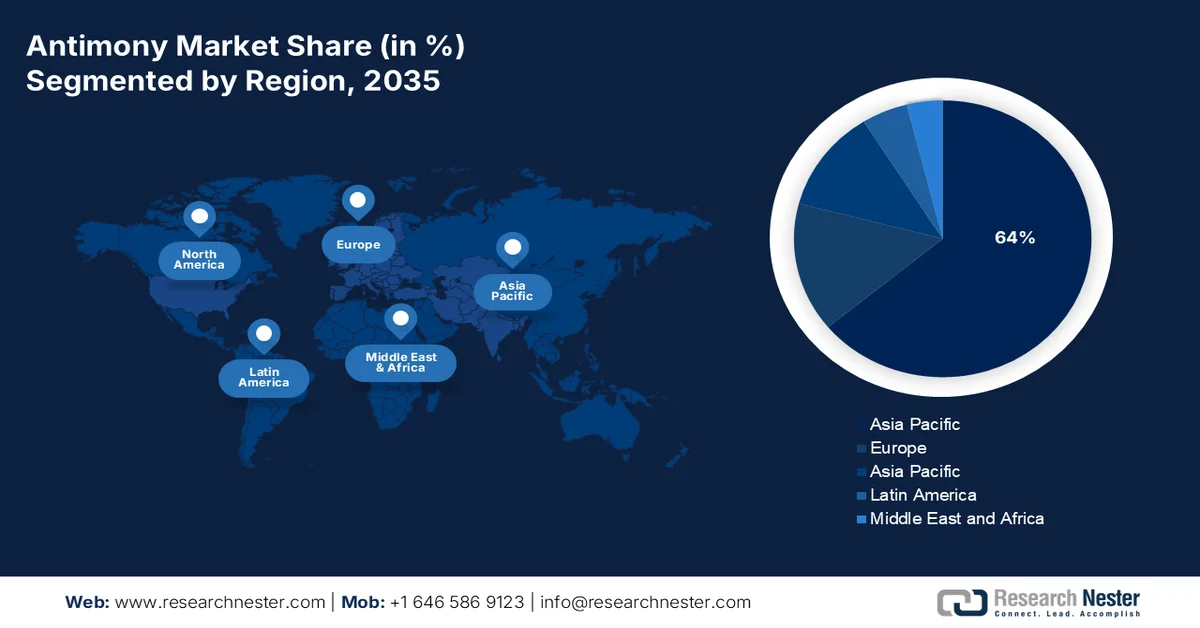

- Asia Pacific is expected to command over a 64% revenue share by 2035 in the antimony market, anchored by strong production and downstream manufacturing across China, Japan, and India and reinforced by extensive regional mining reserves and pigment, automotive, and industrial output growth.

- North America is projected to hold a notable revenue share by 2035, shaped by sustained U.S. demand for defense equipment, ammunition, and antimonial lead applications supported through recycling and import-dependent supply chains.

Segment Insights:

- The trioxide segment is projected to account for a 40% revenue share by 2035 in the antimony market, underpinned by its dominant role as a flame-retardant synergist and reinforced by tightening safety regulations across construction, automotive, electrical, and consumer goods industries.

- The flame retardant segment is anticipated to secure a significant revenue share over the forecast period, supported by its extensive use in brominated flame retardant production and rising adoption across industrial and consumer safety applications.

Key Growth Trends:

- Rising U.S. military demand has led to decoupling efforts from foreign reliance on raw materials

- High lead production to meet end use requirements, in turn indicating strong economic tailwinds

Major Challenges:

- The high bio deposition of antimony leading to environmental concerns

Key Players: Albemarle Corporation, BASF SE, Dow, Eastman Chemical Company, Huntsman Corporation, LANXESS AG, ICL Group Ltd., Clariant AG, Italmatch Chemicals S.p.A., Nabaltec AG, J.M. Huber Corporation, FRX Innovations, DuPont, DSM, THOR Group, Alexium International, Jiangsu Jacques Technology Co., Ltd., Rin Kagaku Kogyo Co., Ltd., Sanwa Chemical Co., Ltd., TOR Minerals International Inc.

Global Antimony Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.5 billion

- 2026 Market Size: USD 2.6 billion

- Projected Market Size: USD 4.7 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (over 64% share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, India, United States, Russia

- Emerging Countries: Kyrgyzstan, Turkey, Tajikistan, Belgium, France

Last updated on : 5 February, 2026

Antimony Market - Growth Drivers and Challenges

Growth Drivers

- Rising U.S. military demand has led to decoupling efforts from foreign reliance on raw materials: The U.S. military equipment sales increased at an unprecedented rate of 16% in 2023, amid the Russia-Ukraine conflict, and reached USD 238 billion. With antimony being crucial for defense equipment manufacturing, the U.S. stockpiles antimony up to only 1,100 compared to the 2023 consumption of 23,000, as per the 2024 Center for Strategic & International Studies report. The United States has not mined antimony ever since the 2001 cessation of the Sunshine Mine in Idaho. The U.S. meets 18% of its demand via lead-acid battery recycling, and imports the rest from China (63%), Belgium (8%), India (6%), and Bolivia (4%).

Perpetua Resources announced plans to revisit the Stibnite Gold Mine operations to once again domestically manufacture antimony-trisulfide, specifically for munitions and missile applications. The project was awarded with USD 24.8 million in December 2022 by the U.S. Department of Defense under its Defense Production Act Investments Program and USD 1.b billion in loans by the U.S. Export-Import Bank. Post China’s announcements on export restrictions, Perpetua share prices jumped 19% — surpassing a three-year high benchmark. After China (40kt), Tajikistan (21 kt), Turkey (6 kt), and Burma (4.6 kt) were the top antimony producers in 2023. Tajikistan, as the second-largest Sb maker, in February 2024 held a dialogue with the Department of State regarding C5+1 critical minerals for convening Central Asia’s five nations, to discuss shared goals of building a strong collaborative relationship for the trade of critical minerals. The Tajik government was onboarded, and U.S. investor Comsup Commodities funded more than USD 300 million in establishing antimony processing facilities in Tajikistan. This is estimated to boost the Sb offtake from Tajikistan and aid the U.S. antimony market growth. - High lead production to meet end use requirements, in turn indicating strong economic tailwinds: Lead has faced incremental demand from the battery manufacturing sector, with the cell production capacity expanded by 30% in 2024, reaching 1 TWh annual capability, while the U.S. EV battery demand registered a CAGR of 20% in 2024, finds IEA. In the U.S., lead was domestically produced by five Missouri lead mines, as a byproduct at two Alaskan zinc mines, and by two Idaho-based silver mines. The value of recoverable lead mined was USD 670 million in 2024, compared with USD 660 million in 2023. Furthermore, the sector is a direct economic contributor to the U.S. GDP and employment. The U.S. lead battery market in 2021 created 37,490 direct jobs, labor income of USD 3 billion; GDP of USD 4 billion, and total outcome of USD 14.5 billion; 37,400 supplier jobs, labor income of USD 2.8 billion, GDP contribution of USD 4.8 billion, and output of USD 10.1 billion; 45,720 induced impact jobs, USD 2.7 billion labor income, USD 4.7 in GDP, USD 8.4 billion in outputs.

Challenges

- The high bio deposition of antimony leading to environmental concerns: China, Bolivia, and Russa hold 80% of total production. The area near the world’s largest Sb-mining site in Hunan Province, China, has antimony concentrations in mining soils ranging from 101 to 5,045 mg kg−1 and from 17 to 288 μg L−1 in water, as mentioned in a January 2022 ScienceDirect report. Similarly, in Spain’s Extremadura province’s abandoned Sb-mining regions have a concentration between 225 and 2,449 mg kg−1. Moreover, in the U.S., roughly 1,900 tons are released from about 9,000 public shooting and 3,000 military shooting ranges. A high soil or sediment concentration of antimony is rendered potentially toxic to ecosystems and adversely affects human health via chemical accumulation in the food chains. Antimony and its derivatives interact with sulfhydryls in human bodies, thereby causing cellular hypoxia and cellular ionic imbalance. The metabolic impairment of the human nervous system and environmental concerns are the major market roadblocks.

Antimony Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 2.5 billion |

|

Forecast Year Market Size (2035) |

USD 4.7 billion |

|

Regional Scope |

|

Antimony Market Segmentation:

Type Segment Analysis

The trioxide segment is projected to account for a revenue share of 40% by the end of 2035. Antimony trioxide (Sb₂O₃) holds the largest share in all downstream antimony applications, wherein its primarily use case is as a flame-retardant synergist. In addition, the segment growth is fueled by the expanding safety regulations across building, automotive, electrical, and consumer goods industries. From a supply perspective, segment production is heavily concentrated in China, which dominates Sb mining and refining capacity. Recent policy tightening and export licensing measures by China have contributed to high procurement costs in Europe, North America, and Japan. The segment demand has been high amid the recent cost disruptions. In the forthcoming years, the market segment is expected to remain structurally important, supported by growth in flame-retardant applications, electronics manufacturing, and infrastructure development, while facing ongoing challenges related to supply security, environmental compliance, and price stability.

End use Segment Analysis

The flame retardant segment is expected to capture a significant revenue share during the forecast period. By 2030, the flame retardant market size is forecasted to reach USD 16.6 billion, according to the UN Environment Program (UNEP) report. In the U.S., flame retardants accounted for 39% of all antimony uses in 2024. Additionally, the primary global applications of bromine include brominated flame retardant production, usually derived from antimony oxides (BFRs), and clear brine drilling fluids. U.S. apparent 2024 bromine consumption was higher compared to the previous year. The high market share of the segment has driven the overall manufacturing of flame retardants and related equipment.

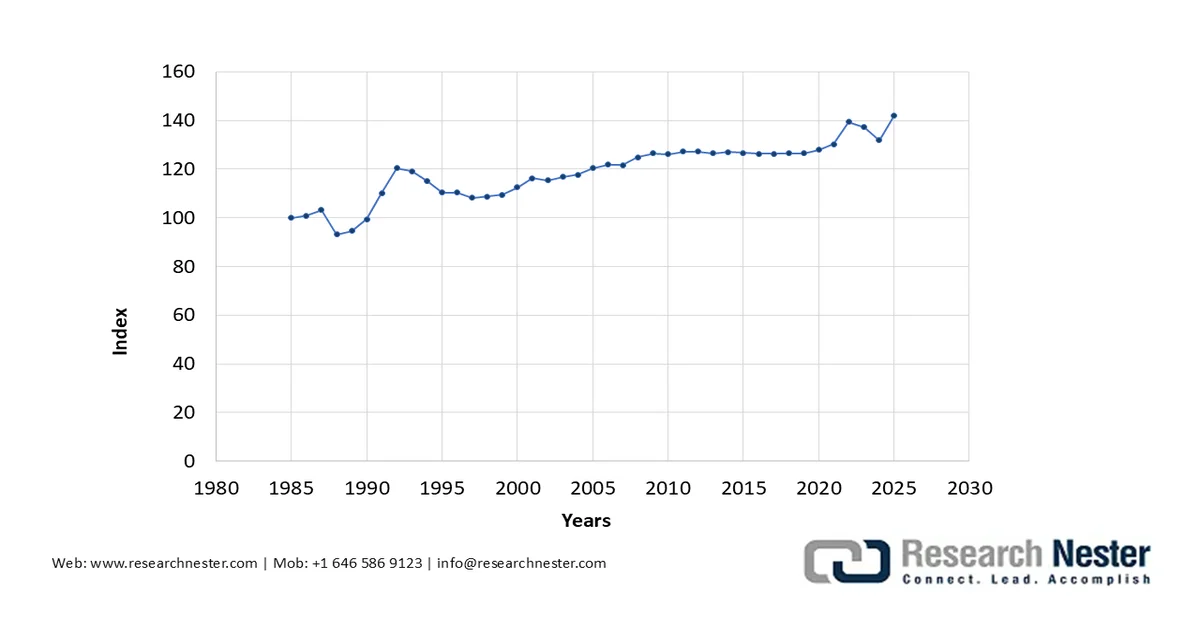

Producer Price Index by Commodity: Machinery and Equipment: Sighting, Tracking, and Fire-Control Equipment, Optical (1985-2025)

Source: FRED

Our in-depth analysis of the global antimony market includes the following segments:

|

Segment |

Sub-segment |

|

Type |

|

|

Product |

|

|

Production Method |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antimony Market - Regional Analysis

APAC Market Insights

Asia Pacific is anticipated to garner the largest revenue share of over 64% during the assessment period. This is attributed to high production and supply of products such as automobile components and pigments from China, Japan, and India. Japan holds a critical place in the global pigments trade, accounting for USD 244 million in 2023 in the outbound pigment & titanium dioxide trade. Antimony is typically mined in the form of a sulfide mineral called stibnite (Sb2S3), while some occur in metallic form in APAC (including complex sulfosalt minerals - cylindrite, boulangerite, jamesonite, tetra, and pyrargyrite. In 2023, China had the highest reserves of 640 kt, followed by Russia (350 kt) and Kyrgyzstan (260 kt).

India was the 8th (out of 73) largest exporter in 2023 and held an outbound trade of USD 20.1 million. In 2023, the exports were destined mainly for the U.S. (USD 16.3 million), Brazil (USD 844k), the Netherlands (USD 577k), Spain (USD 317k), and Canada (USD 305k). According to the OEC, India exported a total of USD 20.1 million, primarily to the U.S. (USD 16.3 million), Brazil (USD 844k), and the Netherlands (USD 577k). Furthermore, India’s outbound antimony ores and concentrates trade was USD 23.1k in 2023. The fastest growing origins for imports in India during 2022-2023 included Tajikistan (USD 13.1 million), China (USD 8.79 million), and Italy (USD 181k). India was also the 11th largest exporter of antimony oxides out of 58 countries and was worth USD 5.21 million. This was primarily directed toward Oman (USD 961k), Saudi Arabia (USD 844k), the United Arab Emirates (USD 756k), Thailand (USD 591k), and Bangladesh (USD 480k). The country’s crucial role in the overall trade scenario has set the India antimony market on a global pedestal.

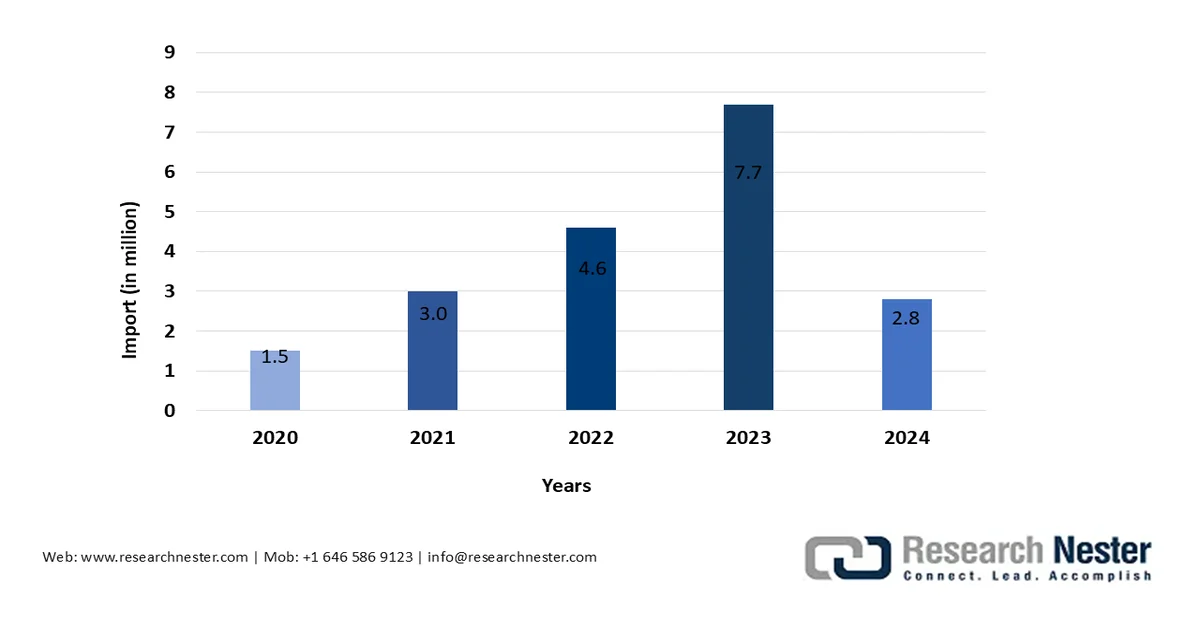

India Imports of Antimony & Articles Including Waste & Scrap from Oman (2020-2024)

Source: Trading Economics

China antimony market is driven by the country’s dominance in the global supply chain. The country has spent decades building a robust antimony mining, refining, and processing infrastructure. In 2024, China introduced export licensing measures on antimony ore, refined products, and related technologies, and later tightened its exports. This strategic policy sharply reduced outbound shipments and created global price volatility. The fastest growing end markets for China’s antimony oxide exports were the U.S. (USD 21.9 million), Mexico (USD 13 million), and Vietnam (USD 9.49 million).

Global Antimony Imports from China, 2020-2023

|

Ore & Concentrates |

23% |

|

Oxide |

76% |

|

Unwrought metal & powder |

24% |

|

Total metal & oxide |

63% |

Source: CSIS

North America Market Insights

The North America antimony market is projected to account for a significant revenue share owing to high demand in defense equipment manufacturing in the U.S. No marketable Sb was mined in the U.S. in 2024, and the primary Sb metal and oxide were formed by one player in Montana with imported feedstock. In addition, secondary antimony came from the recovered antimonial lead sourced from lead-acid batteries. The secondary antimony generated in 2024 held a value of USD 73 million and recycling resourced 15% of domestic consumption, while the differences were met using imports. The USGS data shows, i n 2024, antimony was used predominantly in metal products, such as antimonial lead and ammunition, ascribed to 40%; flame retardants at 39%; and ceramics, glass & rubber (non-metal products) for 21%.

The leading utilization of antimony in the United States is in ammunition, flame retardants, glass, ceramics, and rubber products, which typically rely on antimony oxides, antimony trisulfide, or antimony metal. Moreover, antimony trioxide as a clarifying agent in PV glass production has increased manifold over the past few years and widespread antimony hydride usage for silicon doping in the semiconductor industry via the chemical vapor deposition process (CVD) underscores the important stance that the market takes in the U.S. However, on the contrary, the U.S. has little to no domestic Sb generation (with only 60 kt in reserves, which is mostly found in Idaho, Alaska, Nevada, and Montana). A government-backed gold and antimony mine is being developed in Idaho with 18,477 kt of resource ore at 0.48% Sb. Also, the Sb refinery in western Montana processes foreign ore into antimony products. Occurrences of antimony mineralization in Montana is restricted around Thompson Falls in Sanders County. After mining here ended in 1980, smelting operations continued thereafter, and the deposits in the area are all in the polymetallic sulfide form.

The Canada antimony market is still in its nascent stage in terms of domestic production capacity and utilization. Historically, Canada’s key manufacturer has been Beaver Brook mine, with active exploration by companies such as Antimony Resources Corp., New Age Metals, and Madison Metals, targeting major deposits in New Brunswick, Newfoundland, and Ontario to develop future supply. Canada’s exports stood at USD 1. 5 million in 2021 and 109,327 kg in quantity. In 2023, the antimony oxides imports were valued at USD 15.3 million or 2,231,600 kg in quantity, whereas antimony and articles, including waste was USD 9.5 million or 1,671,820 kg.

Europe Market Insights

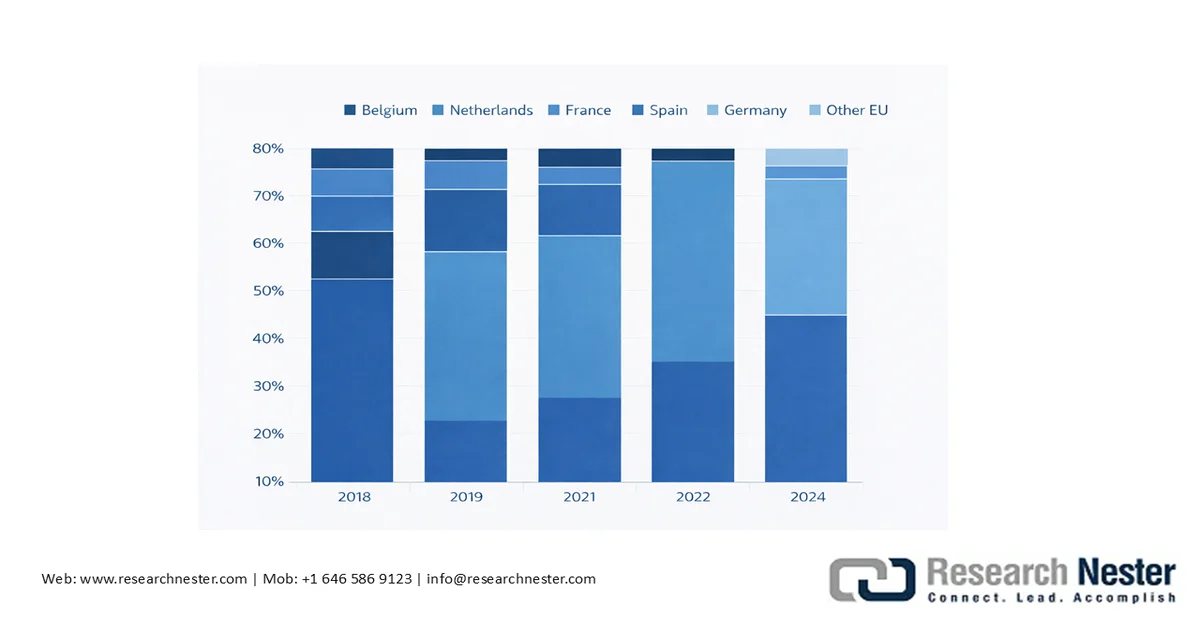

Europe antimony market is driven by the increasing Sb applications across end use industries such as ceramics, paints, and automotive. The EU is dependent for its antimony ore imports, with Turkey supplying approximately 77%, primarily to Italy. According to the Joint Research Center, EU has a limited exposure to China’s ore supply owing to Chinese export restrictions. As a result of this, the EU has gradually diversified its import chains, leading to Tajikistan accounting for 52%, directed to France and Belgium, while China’s share declined to 18% in 2023 from 40% in 2020. However, the Netherlands remains the only country in Europe to continue to import significantly from China. The EU generates 28kt antimony oxides annually and exports 7.5 kt to the UK, the U.S., and Turkey, thereby making it a net exporter. If the EU market players can successfully stabilize Sb metal supplies, it can likely further strengthen their agency in global exports.

Distribution per EU Destination of Chinese Export of Antimony Metal (2018-2024)

Source: Joint Research Center, GACC (2024)

Material uses shares, NACE2 sectors assignment & Value added (VA)

|

Material |

Application |

Share |

NACE sector |

VA in million € |

|

Antimony |

Plastics (catalysts and stabilizers) |

6% |

C20 - Manufacture of chemicals and chemical products |

132,361

|

Source: Europa

The Netherlands in 2023, ascribed for about 98% of Chinese exports in Europe. The EU relies heavily on foreign entities for its antimony metal needs to produce oxides and compounds catering to its domestic industries. Indeed, the Sb metal inbound supply averaged at 19 kt between 2019 and 2023, while supply was only 456 t during the same timeline. During 2019-2023, EU consumption was 18.8 kt and in 2021, the imports reached its highest mark of 22.3 kt, with an eventual gradual decline to 16.7 kt in 2023. The slump was a notable -35% reduction in Chinese -63% decline from Vietnam between 2021 and 2023, underscoring minimized dependency on EU’s Southern Asian partners. Tajikistan (7.6 kt average), since 2020, is the first exporter, supplying mainly to Belgium and France.

Germany antimony market is still in its nascent stage in production terms. The country held a share of 0.9% or 0.8 tons of processed antimony in 2023. Germany is not a primary producer of antimony; the support/processing that exists is based on imported feedstock or small secondary recovery streams. Eurostat import unit values for HS 282580 and related codes as the best government-sourced landed cost proxy for German buyers. Eurostat notes impor/t/export prices rose strongly through 2022, eased in 2023, then hit new highs in 2024.

Key Antimony Market Players:

- Albemarle Corporation (U.S.)

- BASF SE (Germany)

- Dow (U.S.)

- Eastman Chemical Company (U.S.)

- Huntsman Corporation (U.S.)

- LANXESS AG (Germany)

- ICL Group Ltd. (Israel)

- Clariant AG (Switzerland)

- Italmatch Chemicals S.p.A. (Italy)

- Nabaltec AG (Germany)

- J.M. Huber Corporation (U.S.)

- FRX Innovations (Canada)

- DuPont (U.S.)

- DSM (Netherlands)

- THOR Group (UK)

- Alexium International (Australia)

- Jiangsu Jacques Technology Co., Ltd. (China)

- Rin Kagaku Kogyo Co., Ltd. (Japan)

- Sanwa Chemical Co., Ltd. (Japan)

- TOR Minerals International Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albemarle Corporation: A major global specialty chemicals producer with a large portfolio that includes flame retardants used across electronics, building & construction, automotive, textiles, and other end-use sectors. A major global specialty chemicals producer with a large portfolio that includes flame retardants used across electronics, building & construction, automotive, textiles, and other end-use sectors. The company is listed among the top global flame-retardant players and is known for innovation in additive technologies to meet evolving fire-safety standards and regulatory requirements. While Albemarle is best known for bromine derivatives as flame retardants, such products often operate in tandem with synergists such as antimony trioxide in formulations where antimony’s heat-resistant properties enhance fire resistance.

- Dow: Dow is a major diversified chemical manufacturer with flame-retardant additives and solutions integrated into its polymer and specialty products. Dow’s products often play a role where fire safety compliance intersects with mechanical performance, and while Dow itself is not primarily an antimony producer, its flame-retardant formulations may incorporate synergists (like antimony trioxide) depending on application and regulatory requirements. The company’s inclusion in leading flame-retardant antimony market lists underscores its role in this segment.

- Eastman Chemical Company: Eastman is a global specialty chemicals and materials company with flame-retardant additives and engineered polymers used in construction, electronics, automotive, and other sectors. It invests in research and development to improve performance and safety characteristics — for example, producing flame-retardant polymer additives and compounds that help OEMs meet evolving fire-safety standards. Though not an antimony producer, Eastman’s product portfolio interacts with the antimony flame-retardant ecosystem via formulations where antimony trioxide or related synergists are combined with other flame-retardant chemistries to meet specific safety criteria.

Here is a list of key players operating in the global antimony market:

The global antimony market is driven by strategic company initiatives such as expansion of mining activities, stabilizing the overall supply chain, and building closer tie-ups with end use companies to strengthen market positioning. More players are complying with government regulatory frameworks global operational to penetrate larger markets and foster geographic expansion. Below mentioned is the Securities and Exchange Commission’s summary of key verified antimony company filings through 2021-2025.

Summary of Verified Antimony Company Filings

|

Company |

SEC Filings |

Primary Antimony Focus |

Notes |

|

United States Antimony Corp (UAMY) |

10-K / 10-Q / 8-K |

Yes |

Vertically integrated U.S. antimony producer & refiner. |

|

Nova Minerals Ltd |

SEC Exhibit filings |

Partial |

Gold & antimony exploration mix. |

|

Perpetua Resources Corp |

SEC mentions & project exhibits |

Yes (in field) |

Advancing Stibnite antimony mine (project documentation). |

|

Trafigura / Nyrstar |

Not SEC |

Yes (via facilities) |

Industrial production. |

Source: SEC

Corporate Landscape of the Market:

Recent Developments

- In September 2025, the U.S. Department of War awarded a funding of USD 43.3 million to Alaska Range Resources, LLC (ARR) for facilitating on-shore antimony trisulfide manufacturing. This will foster the mining and processing of critical minerals and miscellaneous derivatives.

- Report ID: 4171

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antimony Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.