Anticholinergic Drugs Industry - Regional Synopsis

North America Market Insights

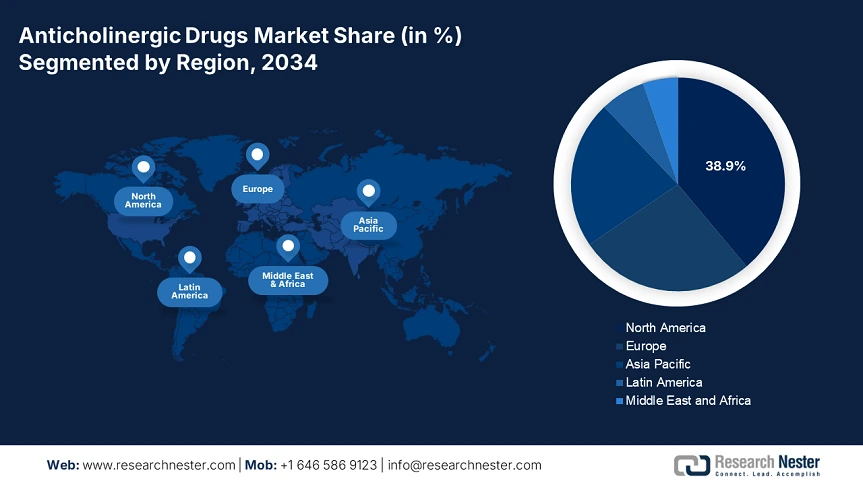

The anticholinergic drugs market in North America is dominating and is poised to have a market share of 38.9% at a CAGR of 6.5% by 2034. The market is driven by aging populations, strong institutional backing via Medicare, Medicaid reimbursement, and increased occurrence of neurological disorders. the market expansion in the U.S. is driven by the federal investments via CDC, AHRQ, and NIH, with 9.4% of the budget in healthcare allocated to anticholinergic-related disorders. further, the Medicare expenditure also rose to 15.6% over the past five years to USD 800.5 million due to the expanded reimbursement policies. Increased investment, budget allocations, regulatory efficiency, and R&D are positioning North America as a dominant player in the anticholinergic drugs market.

In the U.S. anticholinergic drugs market keeps developing as a result of a confluence of federal investment, favorable reimbursement structures, and an expanding population of seniors. The CDC and AHRQ reported that 9.5% of the federal health budget, which is $5.6 billion in 2023, was spent on conditions urging for anticholinergic treatment. Medicaid policies evolved to cover 10.5% more patients in 2024, with a funding of $1.7 billion. Medicare expenditures also rose, increasing 15.6% in the past four years to $800.5 million in 2024, increasing access for aging populations. Steady growth in geriatric neurological diagnosis and bladder disorders also underpins long-term demand, especially as models of outpatient and home care win Medicare and Medicaid approval.

Asia Pacific Market Insights

The Asia Pacific is the fastest-growing region in the anticholinergic drugs market and is anticipated to hold the market share of 22.4% at a CAGR of 7.3% by 2034. The region is driven by the rising prevalence of neurological and urological disorders, an increase in geriatric populations, and expanding government funding. Japan leads the anticholinergic drugs market in innovation and funding. Further, the AMED and the Ministry of Health, Labour and Welfare are experiencing a rise in the patient pool and have increased the spending by 15.4% on anticholinergic therapies over the past ten years. The region is specially aiming for reimbursement reforms, clinical trial localization, and domestic manufacturing. Furthermore, governments are scaling digital health systems for real-time monitoring and public-private collaborations to expand therapy access.

Japan possesses the highest market share in the anticholinergic drugs market in Europe and will lead the market share with 8.7% by 2034. Japan has spent over 12.5% of its healthcare budget in 2024 on anticholinergic drugs, reaching $3.3 billion increase in 2022, aided by MHLW and AMED plans targeting disorders related to aging. Public health measures include subsidized care for neurological and urological therapies under national coverage. These measures boost the market in Japan due to a rising aging population, as nearly 30.6% of the total population is people aged above 60, hence increasing the demand for bladder disorder and Parkinson's therapies. Research programs funded by AMED have fueled domestic drug development, cutting imports. Moreover, revised MHLW guidelines in 2024 widened coverage for combination therapies, further propelling hospital and outpatient prescription volumes.

Country-wise Government Provinces

|

Country |

Policy / Investment Program |

Budget / Funding |

Launch Year |

|

Australia |

National Strategic Framework for Chronic Conditions |

AUD 220.8 million |

2021 |

|

India |

National Programme for Health Care of the Elderly (NPHCE) |

INR 900.4 crore |

Revised in 2023 |

|

South Korea |

Korean Dementia Master Plan 4.0 |

₩1.8 trillion |

2024 |

|

Malaysia |

National Policy for Older Persons (enhanced funding under 12MP) |

MYR 400.6 million |

2022 |

Sources: health.gov, aihw, mohfw, pharmaceuticals.gov, npra

Europe Market Insights

Europe anticholinergic drugs market is expanding significantly and is poised to hold the market share of 26.6% at a CAGR of 5.9% by 2034. The region is driven by the rising occurrence of neurological and urological disorders and supportive policy initiatives. The region dominates due to strong healthcare systems, generous public funding and high drug accessibility. European Health Data Space (EHDS) and the EU4Health program together have surged their clinical trials, enhanced drug reimbursement, and improved data sharing. For instance, the anticholinergic class benefited from €2.7 billion in 2023 European Commission funding for research and innovation in neurological and geriatric medication development. Trends in hospital linked procurement platforms, patient adherence monitoring tools and digital prescribing are also enhancing the patient outcome and driving the product demand.

Germany anticholinergic drugs market is dominating the region and is expected to hold the market share of 9.8% by 2034. Germany's expenditure on anticholinergic drugs in Europe reached €4.5 billion in 2024, funded by the Federal Ministry of Health (BMG). Further, the country has experienced a rise of 12.4% since 2021, fueled by extensive application in older people's care and institutional healthcare. The German Medical Association (BÄK) indicates an increasing number of prescriptions being written in urology and neurology clinics. HealthTech projects, such as AI-powered polypharmacy monitoring, have contributed to decreased adverse drug interactions, stimulating more use.

Government Investments, Policies & Funding

|

Country |

Policy / Investment Program |

Budget / Funding |

Launch Year |

|

UK |

NHS Long Term Plan – Neurological and Geriatric Care Expansion |

USD 2.6 billion |

2021 |

|

Germany |

Digital Health Innovation Fund (supports e-prescription and CNS drugs) |

USD 3.1 billion |

2022 |

|

France |

Ma Santé 2022 Plan – Elderly and chronic care funding |

USD 3.9 billion |

2022 |

|

Italy |

National Recovery and Resilience Plan (PNRR) – Healthcare Mission 6 |

USD 4.7 billion |

2023 |

|

Spain |

Strategic Health Plan 2021–2024 – CNS and geriatrics focus |

USD 1.8 billion |

2021 |

Sources: NHS England, AEMPS, AIFA, Ministry of Health