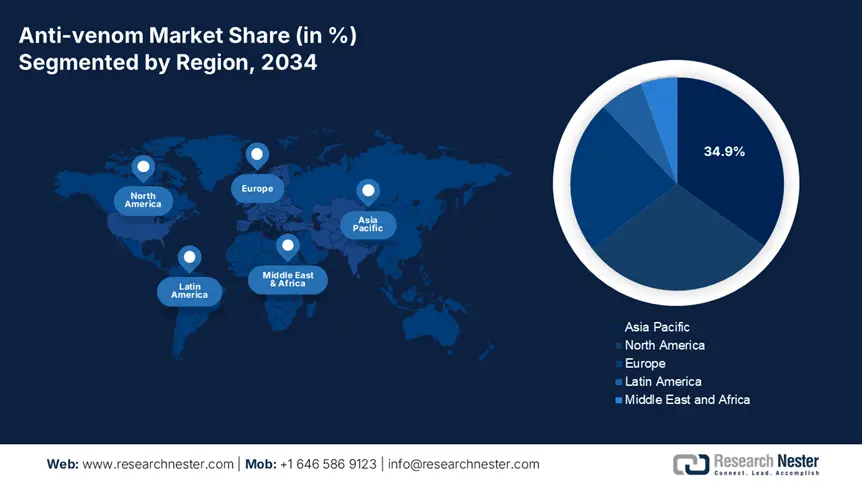

Anti-venom Market - Regional Analysis

Asia Pacific Market Insights

The Asia-Pacific is the dominant region in the anti-venom market and is projected to hold the maximum share of 34.9% at a CAGR of 7.7% by 2034. The market is fueled by a high incidence of envenoming, huge rural populations, and increasing government initiatives to enhance emergency response infrastructure. The governments of India, China, Japan, South Korea, and Malaysia are heavily investing in R&D, anti-venom production, and distribution. Further, climate change, urban growth into rural environments, and growing health awareness among the public are driving demand, particularly in India and China, which combined hold more than 60.4% of APAC's patient population. The World Health Organization has designated snakebite envenomation as a neglected tropical disease, which further boosts national initiatives and international funding.

India holds the largest share in the anti-venom market and is expected to hold a market share of 9.8% by 2034. The market is driven by rural vulnerability, high envenomation rates, and government interventions. Government spending on anti-venom was USD 2.2 billion in 2023, up 18.5% from 2015, as India surges in manufacturing via public sector units such as Haffkine Bio-Pharmaceutical Corporastion and Indian Immunologicals Ltd. India's emphasis on local production, regional stockpiling, and enhanced clinician training positions it for long-term anti-venom leadership in Asia in 2034.

APAC Anti-Venom Government Investment / Policy Budget (2021–2025)

|

Country |

Policy / Investment Initiative |

Launch Year |

Funding / Budget Allocation |

|

Australia |

National Antivenom Program – Indigenous & Rural Response Boost |

2022 |

AUD 62.4 million over 4 years |

|

Japan |

Biologic Anti-Venom R&D under AMED Emergency MedTech Initiative |

2023 |

¥380.5 billion allocated for pandemic & venom R&D |

|

South Korea |

Emergency Biologic Response Program by KDCA |

2024 |

₩210.2 billion over 3 years |

|

Malaysia |

MOH Venom Response Expansion – East Malaysia Focus |

2022 |

RM 190.7 million allocated between 2022–2025 |

North America Market Insights

North America is the fastest-growing region in the anti-venom market and is expected to hold the market share of 29.7% with a CAGR of 6.6% in 2034. The market is driven by increasing envenomation cases, most notably in southern states such as Texas, Arizona, and Florida. Moreover, high federal government expenditures via Medicare and Medicaid are combined to spend more than USD 2.4 billion on Anti-Venom treatment in 2024. The growth of the region is also surging by the inclusion of anti-venom to emergency preparedness strategies, next-gen biologics demand, and public-private collaborations for stockpiling and local distribution. However, pricing obstacles, U.S. fragmented private insurance coverage, and dependence on imported formulas in Canada continue to pose challenges.

The U.S. anti-venom market is driven by high treatment prices and extensive government involvement. As per the CDC report, more than 7950 incidents of snakebites occurred across the country in 2023, with CroFab and Anavip being the two most utilized treatments. These drugs are priced at USD 18,000.5 to USD 22,000.6 for a single dose. Further, according to CBO and Medicare, the government programs have expanded coverage, and Medicare's anti-venom expenditures have grown by 15.5% to USD 800.4 million. Medicaid increased only by USD 1.6 billion in expenditures for anti-venom treatment in 2024, supported by CMS-facilitated expansion in reimbursement, treating 10.6% more patients than in 2021. Further, the inclusion of Anti-Venom to regional emergency response plans has also impacted Florida, Texas, and Arizona stockpiling.

Europe Market Insights

Europe's anti-venom market is transforming with a growth rate, expected to account for 23.3% of the world's revenue at a CAGR of 5.9% by 2034, fueled by increasing envenomation incidents, climate change driven habitat changes, and enhanced funding through EU-wide health programs. The UK, Germany, France, Italy, and Spain are leading anti-venom delivery under emergency readiness programs and strategic health strategies. The cross-border collaboration work of the European Health Union and the fast-track authorizations of the European Medicines Agency (EMA) for biologics have spurred innovation and access. The EU invested €2.9 billion via the EU4Health program to aid R&D, regional stockpiling, and decentralized clinical manufacturing across member states.

Germany dominates the anti-venom market and is projected to maintain the market share of 6.8%, with an estimated outlay of €4.5 billion in 2024, up from a 12.3% growth since 2021, according to reports from BMG and the German Medical Association. The Federal Ministry of Health has incorporated anti-venom into national disaster response and emergency medicine procedures. Germany's rural regions have the most anti-venom demand due to the incidents of snakebite associated with the resurgence of wildlife and eco-tourism. Centralized authorization procedures by EMA have aided German producers like CSL Behring GmbH to enlarge distribution.

Europe Anti-Venom Government Investment / Policy Budget (2021–2025)

|

Country |

Policy / Investment Initiative |

Launch Year |

Funding / Budget Allocation |

|

United Kingdom |

NHS Antivenom Procurement & Emergency Response Scheme |

2023 |

£890.4 million allocated (NHS & MHRA) |

|

Italy |

AIFA Snakebite Response Expansion Plan |

2021 |

€600.3 million over 4 years (AIFA & Ministry of Health) |

|

France |

Regional Antivenom Distribution & Research Program |

2024 |

€750.6 million over 3 years (Ministry of Solidarity & HAS) |

|

Spain |

National Antivenom Access Strategy |

2023 |

€580.7 million earmarked (AEMPS & Ministry of Health) |