Anti-venom Market Outlook:

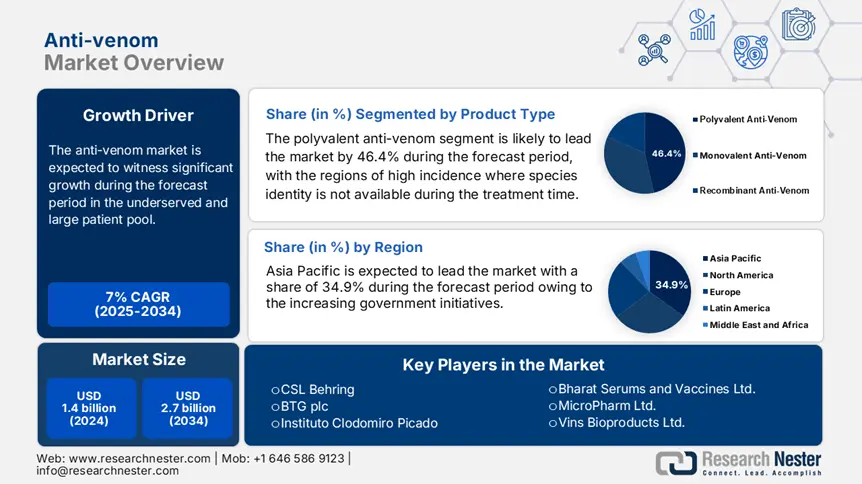

Anti-venom Market size was valued at USD 1.4 billion in 2024 and is projected to reach USD 2.7 billion by the end of 2034, rising at a CAGR of 7% during the forecast period 2025-2034. In 2025, the industry size of anti-venom is evaluated at USD 1.4 billion.

The global market is aided by an underserved and large patient pool, mainly seen in low- and middle-income regions. As per the WHO report, nearly 5.8 million individuals are bitten by snakes yearly, with 2.1 to 2.9 million cases of envenoming registered and 79,970 to 137,980 deaths occurring annually. The most snake bite-affected regions are South Asia, Sub-Saharan Africa, and parts of Latin America, which have 75.6% of snake bite victims and do not have life-saving anti-venom access. Anti-venom supply chains use vital raw materials like horse or ovine plasma along with biological venom gathering, purification, lyophilization, and formulation.

The changes in the cold chain storage and regional transportation constantly delay access to the rural hospitals. The producer price index rose to 8.8% in 2023 for anti-venom products, and the consumer price index increased from 5.5% to 7.3% for anti-venom therapies in public health procurement systems. Leading manufacturers and the government are actively increasing R&D and investments in manufacturing to address the delay in supply challenges. Additionally, as per the Agency for International Development (USAID) report, funding for snakebite response and monitoring has been provided by the U.S. The trade analysis depicts the requirement of venom imports and reagents from reptile-rich regions. Global initiatives, led by WHO and backed by national ministries, seek to address these inefficiencies over the course of the next ten years by establishing regional distribution centers, localized venom collecting, and harmonized Good Manufacturing Practice (GMP) training.

Anti-venom Market - Growth Drivers and Challenges

Growth Drivers

- Federal investments in anti-venom via Medicare programs: The public spending on reimbursement via Medicare on anti-venom treatments such as CroFab and Anavip reached USD 142.5 million under public reimbursement in 2023. The value indicates a 13.7% rise in Medicare Part B claims over the past five years, driven by seasonal peaks in snakebites and enhanced clinical recognition. Anti-Venom is normally used in outpatient facilities and covered under Part B drug reimbursement. The data indicates a rise in financial investment by public health schemes towards more efficient management of envenomation cases. These trends promote the need for pricing reform and wider distribution planning.

- Quality improvement and value based care in healthcare models: A 2022 Agency for Healthcare Research and Quality study discovered that early Anti-Venom intervention decreased the average stays in hospitals by 2.7 days, equating to USD 1.9 billion in two years' worth of healthcare savings within U.S. state-funded emergency systems. The same report indicated that the early implementation of triage protocols within rural hospitals would increase access to Anti-Venom and reduce serious complications by 38.6%.

Historical Patient Growth & Its Impact on Market Dynamics

Historical Patient Growth (2010-2020) in Key Markets

|

Country |

2010 Anti-Venom Users (in '000s) |

2020 Anti-Venom Users (in '000s) |

% Growth (2010–2020) |

|

U.S. |

28.3 |

42.3 |

50.3% |

|

Germany |

3.8 |

5.6 |

54.6% |

|

France |

4.4 |

6.5 |

51.5% |

|

Spain |

5.9 |

8.3 |

41.3% |

|

Australia |

7.6 |

10.9 |

47.7% |

|

Japan |

6.4 |

9.7 |

55.5% |

|

India |

1,240.5 |

1,790.3 |

44.7% |

|

China |

730.2 |

1,110.5 |

52.4% |

Strategic Expansion Models for the Anti-venom Market

Feasibility Models for Revenue Growth

|

Region/Country |

Feasibility Model |

Revenue Impact (2022–2024) |

Key Driver |

|

India |

Local govt. partnership model |

+12.5% |

State-based tenders & rural deployment |

|

China |

Provincial manufacturing agreements |

+9.8% |

Provincial subsidies & essential drug listing |

|

U.S. |

Medicare Part B inclusion |

+8.5% |

Medicare coverage for outpatient envenomation |

|

Brazil |

Centralized Butantan-led distribution |

+11.7% |

Government-funded Anti-Venom rollouts |

|

Kenya |

WHO-UNICEF pooled procurement |

–15.6% unit cost |

Regional access optimization via pooled demand |

|

Australia |

Wildlife support + military procurement |

+10.5% |

Joint public health–defense procurement |

Challenge

- Insurance coverage limitation and high treatment cost: The treatment for anti-venom costs is higher, with a single dose of CroFab ranging from USD 18,000.3 to USD 22,000.5. Most patients undergoing this treatment need multiple doses, making treatment expensive. Medicare coverage has limited reimbursement, with only 58.5% of the patients eligible to receive full coverage. This restricts access to the underinsured population and hospitals in high-risk and rural regions. Hence, hospitals experience delays in reimbursement, and rising financial challenges are faced by the state healthcare systems. Further, this cost also has an impact on emergency response in venomous snakebites and creates barriers to equitable access for all patients and hospitals.

Anti-venom Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

7% |

|

Base Year Market Size (2024) |

USD 1.4 billion |

|

Forecast Year Market Size (2034) |

USD 2.7 billion |

|

Regional Scope |

|

Anti-venom Market Segmentation:

Product Type Segment Analysis:

In the product type, the polyvalent anti-venom leads the segment and is expected to hold the maximum share of 46.4% in 2034. Polyvalent products are the preference in the regions of high incidence where species identity may not be available during the treatment time. They are cost-effective for national supply strategies and are listed under government tenders in Kenya, India, and Nigeria. Further, WHO identifies polyvalent anti-venom as a choice in rural health systems due to its wider efficacy. Polyvalent formulations are more scalable for public health programs compared to monovalent ones.

Mode of Action Segment Analysis:

In the action mode segment, toxin neutralizers lead the segment and is likely to maintain the category share of 22.7% in 2034. They bind and inactivate the toxic proteins in the snake venom directly. Emerging R&D on monoclonal antibodies and biosynthetic neutralizers by public sector research institutes like Instituto Butantan (Brazil) and ICMR-NIV (India) have shown greater specificity and reduced side effects. These new developments are provided with high priority in R&D investment via international health programs.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Mode of Action |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-venom Market - Regional Analysis

Asia Pacific Market Insights

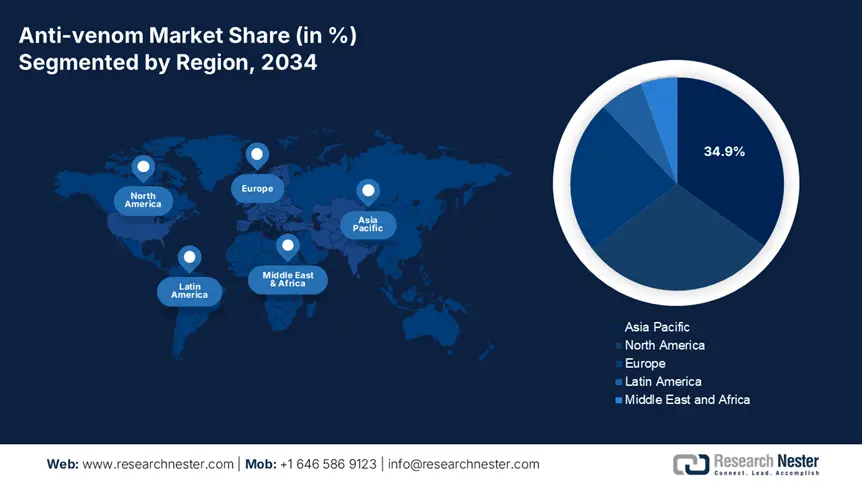

The Asia-Pacific is the dominant region in the anti-venom market and is projected to hold the maximum share of 34.9% at a CAGR of 7.7% by 2034. The market is fueled by a high incidence of envenoming, huge rural populations, and increasing government initiatives to enhance emergency response infrastructure. The governments of India, China, Japan, South Korea, and Malaysia are heavily investing in R&D, anti-venom production, and distribution. Further, climate change, urban growth into rural environments, and growing health awareness among the public are driving demand, particularly in India and China, which combined hold more than 60.4% of APAC's patient population. The World Health Organization has designated snakebite envenomation as a neglected tropical disease, which further boosts national initiatives and international funding.

India holds the largest share in the anti-venom market and is expected to hold a market share of 9.8% by 2034. The market is driven by rural vulnerability, high envenomation rates, and government interventions. Government spending on anti-venom was USD 2.2 billion in 2023, up 18.5% from 2015, as India surges in manufacturing via public sector units such as Haffkine Bio-Pharmaceutical Corporastion and Indian Immunologicals Ltd. India's emphasis on local production, regional stockpiling, and enhanced clinician training positions it for long-term anti-venom leadership in Asia in 2034.

APAC Anti-Venom Government Investment / Policy Budget (2021–2025)

|

Country |

Policy / Investment Initiative |

Launch Year |

Funding / Budget Allocation |

|

Australia |

National Antivenom Program – Indigenous & Rural Response Boost |

2022 |

AUD 62.4 million over 4 years |

|

Japan |

Biologic Anti-Venom R&D under AMED Emergency MedTech Initiative |

2023 |

¥380.5 billion allocated for pandemic & venom R&D |

|

South Korea |

Emergency Biologic Response Program by KDCA |

2024 |

₩210.2 billion over 3 years |

|

Malaysia |

MOH Venom Response Expansion – East Malaysia Focus |

2022 |

RM 190.7 million allocated between 2022–2025 |

North America Market Insights

North America is the fastest-growing region in the anti-venom market and is expected to hold the market share of 29.7% with a CAGR of 6.6% in 2034. The market is driven by increasing envenomation cases, most notably in southern states such as Texas, Arizona, and Florida. Moreover, high federal government expenditures via Medicare and Medicaid are combined to spend more than USD 2.4 billion on Anti-Venom treatment in 2024. The growth of the region is also surging by the inclusion of anti-venom to emergency preparedness strategies, next-gen biologics demand, and public-private collaborations for stockpiling and local distribution. However, pricing obstacles, U.S. fragmented private insurance coverage, and dependence on imported formulas in Canada continue to pose challenges.

The U.S. anti-venom market is driven by high treatment prices and extensive government involvement. As per the CDC report, more than 7950 incidents of snakebites occurred across the country in 2023, with CroFab and Anavip being the two most utilized treatments. These drugs are priced at USD 18,000.5 to USD 22,000.6 for a single dose. Further, according to CBO and Medicare, the government programs have expanded coverage, and Medicare's anti-venom expenditures have grown by 15.5% to USD 800.4 million. Medicaid increased only by USD 1.6 billion in expenditures for anti-venom treatment in 2024, supported by CMS-facilitated expansion in reimbursement, treating 10.6% more patients than in 2021. Further, the inclusion of Anti-Venom to regional emergency response plans has also impacted Florida, Texas, and Arizona stockpiling.

Europe Market Insights

Europe's anti-venom market is transforming with a growth rate, expected to account for 23.3% of the world's revenue at a CAGR of 5.9% by 2034, fueled by increasing envenomation incidents, climate change driven habitat changes, and enhanced funding through EU-wide health programs. The UK, Germany, France, Italy, and Spain are leading anti-venom delivery under emergency readiness programs and strategic health strategies. The cross-border collaboration work of the European Health Union and the fast-track authorizations of the European Medicines Agency (EMA) for biologics have spurred innovation and access. The EU invested €2.9 billion via the EU4Health program to aid R&D, regional stockpiling, and decentralized clinical manufacturing across member states.

Germany dominates the anti-venom market and is projected to maintain the market share of 6.8%, with an estimated outlay of €4.5 billion in 2024, up from a 12.3% growth since 2021, according to reports from BMG and the German Medical Association. The Federal Ministry of Health has incorporated anti-venom into national disaster response and emergency medicine procedures. Germany's rural regions have the most anti-venom demand due to the incidents of snakebite associated with the resurgence of wildlife and eco-tourism. Centralized authorization procedures by EMA have aided German producers like CSL Behring GmbH to enlarge distribution.

Europe Anti-Venom Government Investment / Policy Budget (2021–2025)

|

Country |

Policy / Investment Initiative |

Launch Year |

Funding / Budget Allocation |

|

United Kingdom |

NHS Antivenom Procurement & Emergency Response Scheme |

2023 |

£890.4 million allocated (NHS & MHRA) |

|

Italy |

AIFA Snakebite Response Expansion Plan |

2021 |

€600.3 million over 4 years (AIFA & Ministry of Health) |

|

France |

Regional Antivenom Distribution & Research Program |

2024 |

€750.6 million over 3 years (Ministry of Solidarity & HAS) |

|

Spain |

National Antivenom Access Strategy |

2023 |

€580.7 million earmarked (AEMPS & Ministry of Health) |

Key Anti-venom Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The market is very competitive with many key players from various regions, such as CSL Behring, BTG/Boston Scientific, and Instituto Clodomiro Picado. Manufacturers in India such as Bharat Serums and Vins Bioproducts, are leading the market due to large-scale production and rural markets. Competition among the players is based on the strategic actions like R&D in recombinant antivenins, public-private partnerships, and local stockpiling alliances. Western companies concentrate on biologic innovation, and Asian manufacturers push affordability and scale. Rising WHO support and national procurement initiatives keep changing the landscape, favoring companies that fit regulatory velocity, transparency of pricing, and logistical scaling.

The top 20 cohort of such key players includes:

|

Company Name |

Country of Origin |

Estimated Global Market Share (2025) |

Industry Focus |

|

CSL Behring |

Australia |

11.5% |

Produces polyvalent and monovalent Anti-Venom products, with strong R&D in recombinant therapies. |

|

BTG plc (now part of Boston Scientific) |

U.S. |

9.8% |

Manufacturer of CroFab, widely used against North American pit viper bites. |

|

Instituto Clodomiro Picado |

Costa Rica |

8.3% |

Latin America’s largest Anti-Venom supplier focuses on snakebite and scorpion sting treatments. |

|

Bharat Serums and Vaccines Ltd. |

India |

7.9% |

Major supplier of polyvalent Anti-Venom for rural and high-incidence regions. |

|

MicroPharm Ltd. |

UK |

6.8% |

Specializes in antivenom immunoglobulin production using sheep-derived sera. |

|

Vins Bioproducts Ltd. |

India |

xx% |

Focused on Anti-Venom and antitoxins for snake and scorpion envenomation. |

|

Inosan Biopharma |

Spain |

xx% |

Exports Anti-Venom to over 50 countries; specializes in polyvalent therapies. |

|

Instituto Butantan |

Brazil |

xx% |

Public-sector producer of snake, spider, and scorpion Anti-Venom. |

|

Haffkine Bio-Pharmaceutical Corp. |

India |

xx% |

Government-run facility producing polyvalent Anti-Venom for mass distribution. |

|

Sanofi Biologics |

France |

xx% |

Formerly a leader in Antivenin (e.g., FAV-Afrique); now focused on R&D partnerships. |

|

Kamada Ltd. |

Israel |

xx% |

Engaged in the development of immunoglobulin-based Anti-Venom and plasma therapies. |

|

Protherics (UK division of BTG) |

UK |

xx% |

Historically known for ViperaTAb; development now integrated into Boston Scientific. |

|

Bioclon Institute |

Mexico |

xx% |

Specializes in Anti-Venom against scorpion stings and spider bites. |

|

Takeda Pharmaceutical |

Japan |

xx% |

Collaborating on antivenin biologics for Southeast Asia and the Pacific. |

|

Green Cross Corp. |

South Korea |

xx% |

Active in biologics with potential Anti-Venom formulations in the R&D pipeline. |

|

Sigma-Aldrich (Merck KGaA) |

Germany |

xx% |

Supplies research-grade Anti-Venom components for clinical studies. |

|

Malaysian Vaccine and Pharmaceuticals (MVP) |

Malaysia |

xx% |

Local manufacturer of Anti-Venom for tropical snake species. |

|

Panacea Biotec |

India |

xx% |

Expanding the immunobiologics segment to include envenomation response. |

|

Lee BioSolutions |

U.S. |

xx% |

Provides blood-derived protein products for Anti-Venom R&D. |

|

Boehringer Ingelheim |

Germany |

xx% |

Engaged in early-stage biologic-based Anti-Venom therapy development. |

Here are some leading players in the market:

Recent Developments

- In March 2024, BTG International introduced an upgraded version of CroFab to optimize temperature stability and shelf life. The launch has showcased a 9.5% surge in the market share.

- In June 2024, Instituto Butantan introduced a new tri-antivenom therapy targeting venom of snake, spider, and scorpion. The launched reduced the patient recovery time by 12.9%.

- Report ID: 3755

- Published Date: Jul 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-venom Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert