Anti-money Laundering Solution Market Outlook:

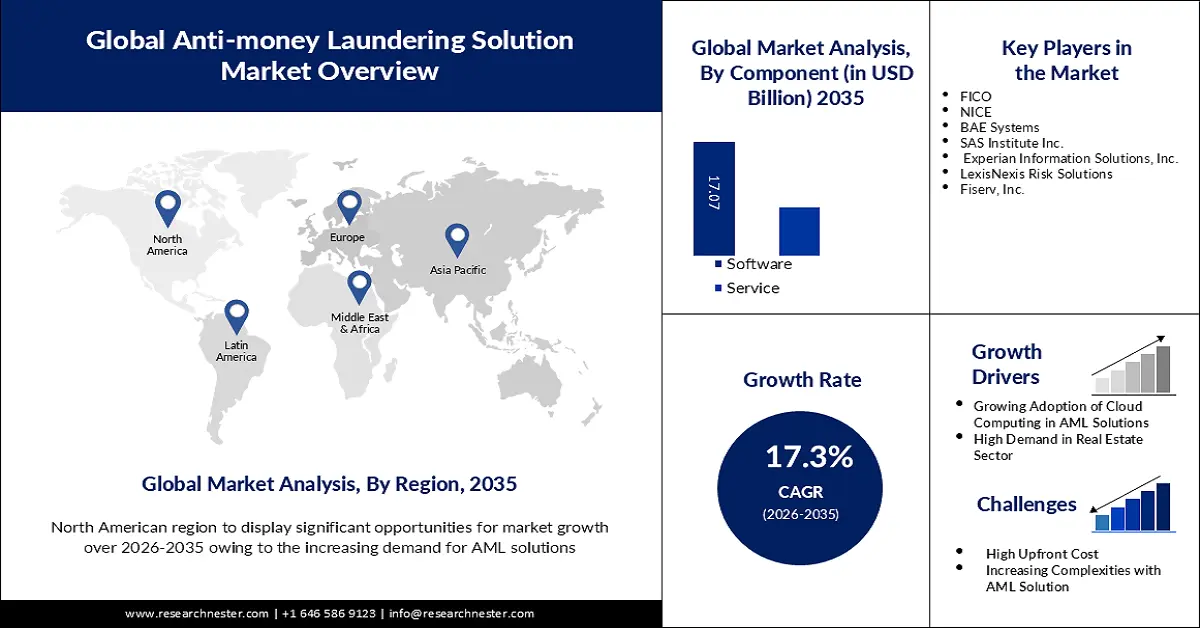

Anti-money Laundering Solution Market size was valued at USD 2.85 billion in 2025 and is set to exceed USD 14.05 billion by 2035, registering over 17.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-money laundering solution is estimated at USD 3.29 billion.

Money laundering is one of the most significant threats to global security and can be used for a variety of purposes, including drug trafficking and terrorist financing. Compliance with anti-money laundering standards can provide a safety net for businesses in the face of financial losses and damage to their reputation. According to United Nations Office on Drugs and Crime, it estimates that between 2% and 5% of global GDP is laundered each year, which would amount to around 715 billion dollars and 1.87 trillion.

Users using digital banking on tablets, computers, or phones can continue their activities by logging in with the details of their digital profile. When user log in to a financial institution account, the system allows real users to conceal their identity. Moreover, it can conduct this procedure anywhere on Earth.

The system enables the actual user to conceal their identity when logging on to a financial institution account, and it's capable of doing this from anywhere in the world. In addition, due to the growth of electronic payments and Internet banking solutions, there has been a high demand for anti-money laundering solution market