Mobile Banking Market Outlook:

Mobile Banking Market size is valued at USD 4.1 billion in 2025 and is projected to reach a valuation of USD 17.8 billion by the end of 2035, rising at a CAGR of 15.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobile banking is assessed at USD 4.7 billion.

The mobile banking market is experiencing considerable expansion driven by technological convergence, enhanced regulatory frameworks, and shifting consumer expectations of easy digital financial services for all segments and geographies. This is indicated in the form of industry leaders achieving record rates of adoption, as evidenced by the U.S. Federal Reserve's FedNow Service, which processed over 1,400 participating financial institutions through July 2025 and settled 2,130,889 transactions in Q2 2025, representing 62.7% quarterly volume growth. The sector continues to experience record-level innovation in customized financial management solutions and bundled service packages that position mobile banking as the primary customer engagement channel.

Government policy worldwide is establishing inclusive regulatory environments that support financial innovation while maintaining consumer and data protection through the development of comprehensive policy frameworks and infrastructure. The accelerating influence of government-backed programs is evidenced in countries like India, where the electronic sector supported by Make in India programs trumped China in US-bound exports of smartphones for the first time in August 2025, as Made in India phones maintained 44% of US imports in Q2 2025. This manufacturing surge directly supports mobile banking expansion by popularizing affordable smartphones and accelerating digital financial inclusion in emerging economies across the globe.

Key Mobile Banking Market Insights Summary:

Regional Highlights:

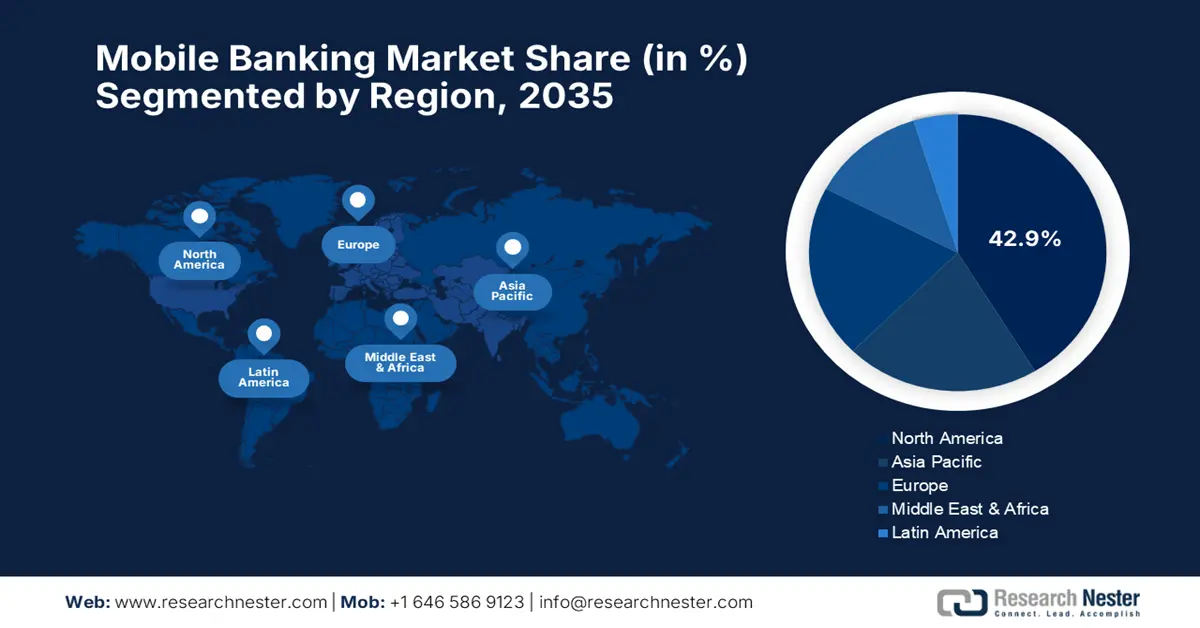

- By 2035, North America is anticipated to secure a 42.9% share of the mobile banking market, stemming from its advanced financial infrastructure, strong regulatory systems, and broad digital banking adoption.

- Europe is projected to expand rapidly through 2026-2035, arising from extensive regulatory harmonization, robust digital infrastructure, and accelerating adoption of innovative financial services.

Segment Insights:

- By 2035, the android segment in the mobile banking market is expected to command a 65% share, propelled by its vast global user base, open ecosystem, and integration of advanced mobile payment capabilities.

- Cloud deployment is forecast to hold a 70% share by 2035, fueled by its scalability, operational efficiency, and rapid adoption of emerging technologies.

Key Growth Trends:

- Government-led payment infrastructure modernization initiatives

- Artificial Intelligence integration and personalized financial management

Major Challenges:

- Cybersecurity and digital operational resilience requirements

- Regulatory complexity and cross-border compliance challenges

Key Players: American Express Company (USA), JPMorgan Chase (USA), Bank of America (USA), Wells Fargo (USA), Citigroup Inc. (USA), HSBC Holdings (UK), Barclays (UK), Deutsche Bank (Germany), BNP Paribas (France), ING Group (Netherlands).

Global Mobile Banking Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.1 billion

- 2026 Market Size: USD 4.7 billion

- Projected Market Size: USD 17.8 billion by 2035

- Growth Forecasts: 15.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, Indonesia, South Korea, United Arab Emirates

Last updated on : 28 August, 2025

Mobile Banking Market - Growth Drivers and Challenges

Growth Drivers

- Government-led payment infrastructure modernization initiatives: Governments are leading mobile banking growth through extensive investments in real-time payments infrastructure, digital identity infrastructure, and regulatory change, building foundational infrastructure supporting advanced financial services. In July 2023, the U.S. Federal Reserve launched the FedNow Service, an instant payment infrastructure that allows banks and credit unions of any size to send money in real-time, 24/7. This flagship government initiative modernizes the country's payment infrastructure, enabling companies and consumers to transfer and receive payments instantly through mobile banking apps. It also provides financial institutions with a platform to build innovative mobile-led payment products.

- Artificial Intelligence integration and personalized financial management: The mobile banking market is experiencing growth with cutting-edge AI integration offering customers bespoke financial intelligence, predictive analytics, and self-service advisory solutions that promote customer engagement and monetary gains. In July 2024, JPMorgan Chase revealed the introduction of new AI-based features in its mobile application, such as an enhanced Wealth Plan virtual money coach that allows customers to plan, track, and manage financial goals in real time. This effort is a demonstration of the bank's emphasis on utilizing technology to provide hyper-personalized mobile banking experiences and enhancing customer interaction through advanced digital channels.

- Open banking and API-driven ecosystem growth: The growth of open banking models across the world is building unprecedented possibilities for mobile banking innovation through safe data sharing, third-party incorporation, and integrated financial service aggregation within individual mobile apps. In October 2023, the U.S. Consumer Financial Protection Bureau released a landmark rule to implement Section 1033 of the Dodd-Frank Act, establishing consumers' right to their personal financial data and pushing towards open banking. Financial institutions must provide consumer data on demand to third-party apps using secure APIs under this landmark legislation, promoting competition and making it easier for consumers to use innovative mobile banking and money management features.

Mobile Banking Penetration & Market Readiness

|

Region / Country |

Fintech Adoption Rate |

Mobile Banking Market Potential |

Key Driver |

|

Global Average |

33% |

Mature but growing |

Increased smartphone usage |

|

China |

69% |

Very High |

Skip legacy systems, direct to mobile |

|

India |

52% |

High |

High mobile penetration, gov't support (UPI) |

|

Brazil |

40% |

High |

Young population, digital banking growth |

|

Mexico |

35% |

Moderate-High |

Rising smartphone access |

|

South Africa |

35% |

Moderate |

Mobile money solutions |

|

U.S. |

33% |

Mature |

Legacy system integration |

|

UK |

42% |

Mature |

Open banking regulations |

|

Japan |

14% |

Low-Moderate |

Aging population, trust in traditional banks |

|

Germany |

35% |

Moderate |

Slow but steady digital transition |

Source: United Nations Economist Network

Challenges

- Cybersecurity and digital operational resilience requirements: The mobile banking market is confronted with increasing cybersecurity requirements as regulatory bodies implement comprehensive standards in digital operational resilience, ICT risk management, and incident response capacity, involving significant capital investments and ongoing compliance monitoring. Germany's financial regulator, BaFin, in December 2024, finished installing the EU's Digital Operational Resilience Act (DORA), which requires strict standards of cybersecurity and ICT risk management for financial firms. This governmental initiative has important consequences for security in mobile banking in the sense that German banks need to increase digital defenses, conduct strict testing, enhance incident reporting, and stay stable and secure in a more digitalized finance landscape.

- Regulatory complexity and cross-border compliance challenges: Mobile banking operators face increased regulatory complexity as governments adopt divergent data protection, consumer rights, and financial services provision frameworks, leading to compliance demands and operational complexities across different jurisdictions. The complexity of evolving regulations is exemplified by initiatives such as the July 2025 UK formal announcement of its National Payments Vision, a strategic framework designed to define the future of payment systems. This integrated model aims to propel Open Banking forward by implementing sustainable commercial models, removing regulatory oversight from government bodies like the FCA, and introducing new compliance requirements for mobile banking providers across various regulatory regimes.

Mobile Banking Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.4% |

|

Base Year Market Size (2025) |

USD 4.1 billion |

|

Forecast Year Market Size (2035) |

USD 17.8 billion |

|

Regional Scope |

|

Mobile Banking Market Segmentation:

Platform Segment Analysis

The Android segment is forecast to hold a dominant 65% mobile banking market share through 2035, led notably by Android's enormous international user base and superior accessibility across various economic segments and geographic markets. This supremacy is rooted in Android's open ecosystem design that allows financial institutions to create flexible mobile banking apps while accessing the widest possible customer base. Platform support for newer technology features like NFC payments, QR code scanning, and contactless payments positions Android-based banking apps at the forefront of payment innovation. In June 2024, HDFC Bank launched a completely redesigned mobile banking app known as HDFC SmartWealth, built on a new technology stack to provide more intuitive and personalized user experiences with over 150 transactions, featuring easy-to-use interfaces, biometric authentication, and in-app customization options. This highlights how Android's technical capability enables sophisticated delivery of banking services.

Deployment Type Segment Analysis

Cloud deployment is projected to hold a 70% mobile banking market share by 2035, driven by its higher scalability, cost-effectiveness, and ease of onboarding new technologies that enhance mobile banking services and customer experience. Cloud infrastructure supports stress-free scaling during peak demand periods, security patching on the fly, and third-party fintech services to enhance mobile banking services beyond traditional offerings. The solution enables faster time-to-market for new services and capabilities, reducing operation complexity and technical debt associated with legacy infrastructure maintenance. In June 2024, Microsoft Corporation significantly expanded its Azure Blockchain Service with new compliance features and enhanced integration capabilities, enabling DeFi applications. This demonstrates how cloud platforms enable financial institutions to rapidly adopt new technologies while maintaining security and regulatory compliance.

End user Segment Analysis

The individual segment is expected to command a strong 75% mobile banking market share through 2035, driven by the growth of smartphone penetration, enhanced digital literacy, and heightened consumer need for easy-to-use, self-directed financial capabilities provided by mobile banking platforms. Individual consumers increasingly require sophisticated security functionality, seamless user experiences, and integration with broader digital lifestyle offerings that enhance the value proposition beyond fundamental banking transactions. In April 2025, India's Axis Bank introduced an industry-first In-App Mobile OTP feature, which replaces traditional SMS-based authentication with more secure codes generated only within the mobile banking app, an indication of how financial institutions are continually enhancing security and customer experience for individual customers.

Our in-depth analysis of the mobile banking market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Service |

|

|

Platform |

|

|

Deployment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobile Banking Market - Regional Analysis

North America Market Insights

North America is projected to maintain a strong 42.9% mobile banking market share through 2035, driven by sophisticated financial infrastructure, developed regulatory frameworks, and strong consumer take-up of digital financial services across age segments. The region has seen proven technology ecosystems, established payment infrastructures, and continuous investment in mobile banking innovation that position North American financial institutions at the forefront of digital transformation worldwide. Market leadership is enabled by strategic platform consolidation and sophisticated service integration that constructs end-to-end financial management capacity in connected mobile applications.

The U.S. mobile banking market leads with considerable growth through sophisticated regulatory innovation, infrastructure investment, and globally leading innovation in mobile financial services that are benchmarks for global best practices. In March 2024, JPMorgan Chase announced at its Investor Day that its mobile app had become the most-used banking app among incumbent U.S. banks, following significant investments in its platforms, which included over 20 new features introduced in 2024. These advanced wealth management capabilities included fractional share trading, sophisticated performance reporting, and the launch of J.P. Morgan Financial Centers, which seamlessly blend digital and in-person advice for comprehensive, mobile-first client experiences.

Canada mobile banking market is driven by strategic government initiatives, stringent regulatory systems, and strong bank innovation that fosters competitive capabilities in digital delivery of services and consumer engagement. In November 2023, the Government of Canada's Department of Finance concluded consultations on a consumer-driven banking system, moving forward with open banking legislation to enable consumers and small and medium-sized businesses to securely share financial information with qualified third-party providers. The action is expected to propel significant innovation in Canada mobile banking sector through promoting competition and enabling the development of new finance apps and services that enhance customer choice and quality of service.

Europe Market Insights

Europe is expected to experience rapid growth from 2026 to 2035 through extensive regulatory harmonization, extremely high digital infrastructure, and extensive consumer adoption of new financial services across national markets. The region is supported by sophisticated regulatory infrastructures, including Open Banking rules, GDPR guidelines on data privacy, and forthcoming digital operational resilience standards, ensuring consistent, secure environments for mobile banking innovation. European financial institutions are developing global best practices in customer data protection, service integration, and cross-border interoperability, which placed the region on a trajectory towards further growth and technological dominance.

The UK mobile banking market showcases exceptional innovation, characterized by extensive Open Banking adoption, regulatory integrity, and astute industry collaboration, which builds competitive advantage for financial service providers and offers more affluent value propositions to consumers. British banks lead the world in fraud defense, customer protection, and service integration capabilities. In November 2023, Barclays UK introduced an innovative in-app caller verification service, Barclays Verify, designed to prevent impersonation scams. This service enables customers to generate unique one-off codes via the mobile banking app, thereby verifying caller identity when receiving suspicious calls claiming to be from Barclays.

Germany mobile banking market is characterized by digital excellence, complex regulatory compliance, and strategic industry consolidation that positions German financial institutions as leaders in digital innovation and customer service delivery. For instance, Deutsche Bank, back in June 2024, launched a major enhancement to its Deutsche Bank Mobile app that includes a full Financial Cockpit that provides customers with fully integrated views of their finances based on aggregated account information, spending behavior analysis, and personalized savings and investment recommendations. This release marks Deutsche Bank's push to bring more sophisticated digital offerings to compete against nimble fintech players through end-to-end digital solutions.

APAC Market Insights

Asia Pacific mobile banking market is estimated to record around CAGR of 16.8% during the forecast period, boosted by immense smartphone penetration, rapidly growing digital infrastructure, and extensive government initiatives supporting financial inclusion and digitalization in diverse economic landscapes. The region benefits from state-of-the-art regulatory efforts, high technology sector collaboration, and shifting consumer habits to digital-first financial solutions that open unprecedented opportunities for mobile banking expansion.

China mobile banking market keeps leading global innovation with a superior payment ecosystem interconnection, integrated fintech platform construction, and rapid internationalization, which makes Chinese players innovation leaders in technology. China market includes a massive scale, advanced regulatory frameworks, and continuous innovation in cross-border payment functions and digital currency rollout. In December 2023, Ant Group announced the expansion of its Alipay+ cross-border mobile payment solution by adding more international e-wallets to its network in China. This expansion aims to facilitate convenient payments for international tourists at millions of Alipay-accepting merchants in China using their home country's mobile payment apps.

India mobile banking market is garnering steady growth driven by bold government digital infrastructure initiatives, rapidly expanding smartphone penetration, and strategic financial inclusion initiatives that provide opportunities for new service delivery innovation and development of customer relationships. The Indian market is underpinned by world-leading payment system innovation, conducive regulatory environments, and strong domestic technology industry capabilities. In April 2024, the Reserve Bank of India, in association with the National Payments Corporation of India, launched plans to deploy the next version of the Unified Payments Interface with features like offline payments (UPI Lite X) and AI-based conversational payments.

Key Mobile Banking Market Players:

- American Express Company (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- JPMorgan Chase (USA)

- Bank of America (USA)

- Wells Fargo (USA)

- Citigroup Inc. (USA)

- HSBC Holdings (UK)

- Barclays (UK)

- Deutsche Bank (Germany)

- BNP Paribas (France)

- ING Group (Netherlands)

The market is dominated by intense competition among well-established global banking behemoths, innovation-oriented neobanks, and technology companies that leverage their unique capabilities in an effort to accumulate share and drive adoption through different geographic and demographic foundations. Pioneering leaders, including JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup, dominate the industry through shared service platforms, advanced technology, and extensive customer relationships. In contrast, European leaders like HSBC Holdings, Barclays, and Deutsche Bank, along with emerging contenders, are introducing innovative business models and customer-centric service strategies.

The market keeps evolving through technology alliances, cross-platform support, and emerging security deployments that create both customer trust and service capabilities, as well as neutralize increasing threats and compliance requirements. In August 2024, Cryptomathic partnered with Barclays on a strategic level to modernize its cryptographic infrastructure with a centralized Crypto Service Gateway for cryptographic key handling and prep for post-quantum cryptography migration. Next-generation security innovations and customer experience enhancements are leading investments for businesses, which are making these investments to differentiate their services and products in increasingly competitive markets.

Here are some leading companies in the mobile banking market:

Recent Developments

- In January 2025, American Express announced record-breaking annual revenues, driven significantly by strong growth in its digital and mobile engagement. The company reported a substantial increase in mobile app users who actively manage their accounts, make payments, and redeem rewards through the platform. The announcement highlighted key app features launched during the period, including advanced fraud protection alerts.

- In May 2024, ING Bank launched three new digital features in the first quarter to enhance its mobile banking experience, which now serves a primary channel for 62% of its customers. A unique instant app verification feature was introduced to combat fraud, allowing a client to verify if a call is genuinely from an ING employee.

- Report ID: 8024

- Published Date: Aug 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobile Banking Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.