Anterior Cervical Plating Market Outlook:

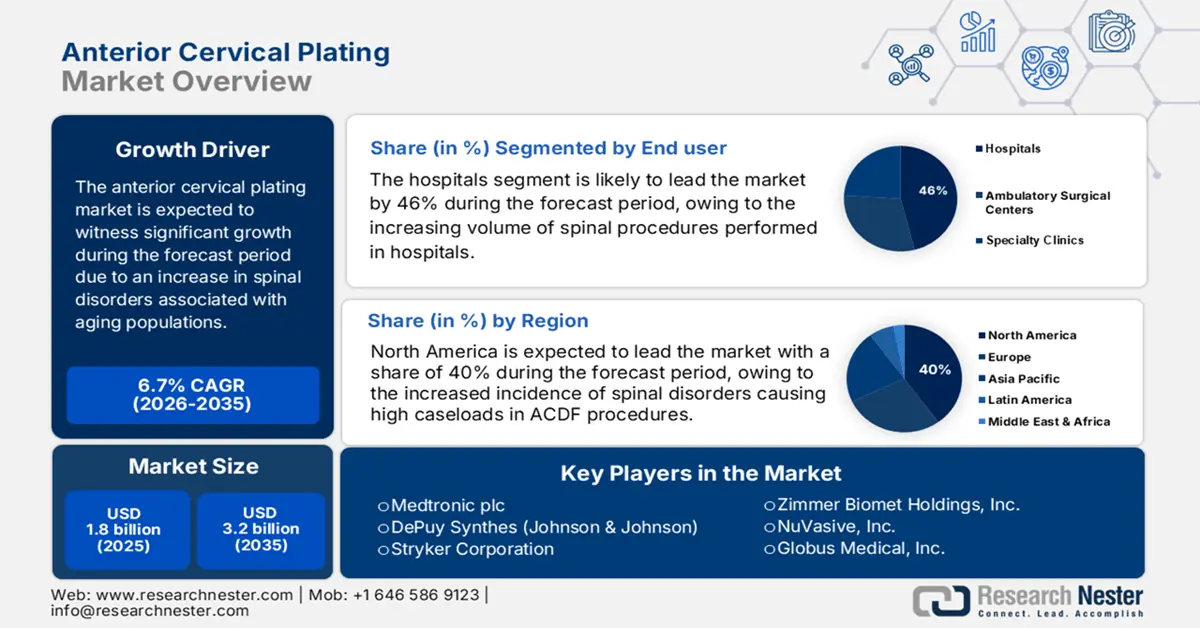

Anterior Cervical Plating Market size is valued at USD 1.8 billion in 2025 and is projected to reach USD 3.2 billion by the end of 2035, rising at a CAGR of 6.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of anterior cervical plating is evaluated at USD 1.9 billion.

The worldwide market is growing due to an increase in spinal disorders associated with aging populations, sedentary lifestyles, and more cases of trauma-related injuries. Between 2024 and 2025, the patient pool undergoing cervical spine surgical intervention has expanded significantly. As per a report by NLM in July 2022, one nationwide study found that 9,161 patients were operated on for degenerative cervical spine disorders, with 80.2% of them treated in public hospitals and 19.8% in private ones, the majority of them in their 50s. Upstream, raw materials such as biocompatible titanium and polyether ether ketone (PEEK) come from around the world, with Germany, Switzerland, and Japan being major exporters. Meanwhile, plating component imports and production are governed under class II medical device regulatory protocols. Additionally, the supply chains have sensitivities towards cost inflation and regulatory compliance costs.

The medical device supply chain is reshaping the global trade matrix of the anterior cervical plating market. According to the NIH in June 2025, the U.S. pharmaceutical trade deficit in 2024 amounted to USD 139 billion out of USD 1.2 trillion for all goods. The dependency on foreign manufacturing affects the pricing and availability of highly important components such as anterior cervical plates. Supply disruptions, geopolitical tensions, or tariff alterations have increased the complexity of procurement strategies. Additionally, the manufacturers are working towards supply diversification and sourcing of the critical components as risk mitigation measures. Regulatory bodies are also encouraging local production to strengthen supply chain resilience.

Key Anterior Cervical Plating Market Insights Summary:

Regional Insights:

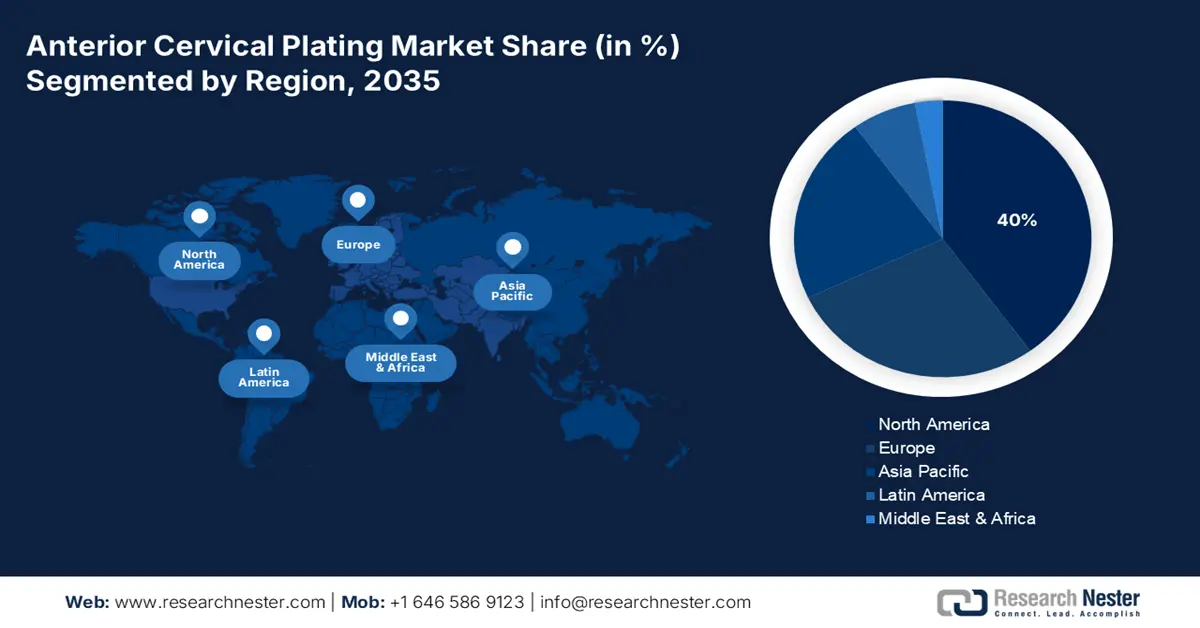

- The anterior cervical plating market in North America is predicted to hold a 40% share by 2035, driven by increased incidence of spinal disorders and continuous FDA approvals for next-generation plating systems.

- The Asia Pacific region is expected to be the fastest-growing market during the forecast period, due to rising healthcare investments, aging population, and rapid adoption of minimally invasive spine surgery.

Segment Insights:

- Hospitals sub-segment in the end-user segment is projected to account for 46% share by 2035, propelled by increasing volume of spinal procedures performed in hospitals.

- Static plating systems sub-segment is expected to hold the highest market share by 2035, owing to their tested reliability and simplicity in stabilizing the cervical spine.

Key Growth Trends:

- Aging population and rising degenerative cervical conditions

- Increasing surgical volumes & procedure preferences

Major Challenges:

- Regulatory and reimbursement pressures

Key Players: Medtronic plc, DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet Holdings, Inc., NuVasive, Inc., Globus Medical, Inc., B. Braun Melsungen AG, Aesculap Implant Systems (B. Braun), Orthofix Medical Inc., K2M Group Holdings, Inc. (Stryker), Invibio Ltd. (Victrex plc), MiRus LLC, SIGNUS Medizintechnik GmbH, RTI Surgical, Integra LifeSciences.

Global Anterior Cervical Plating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 1.9 billion

- Projected Market Size: USD 3.2 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, France, United Kingdom

- Emerging Countries: India, China, South Korea, Thailand, Brazil

Last updated on : 24 September, 2025

Anterior Cervical Plating Market - Growth Drivers and Challenges

Growth Drivers

- Aging population and rising degenerative cervical conditions: Global increase in the elderly populations are directly affecting the need for spinal surgery. As per a CDC report from July 2025, 24.3% of the population aged over 65 years has poor or fair health (2024), indicating that the geriatric age group will mostly be affected by musculoskeletal and degenerative cervical spine diseases. Growing adverse health conditions require more surgical procedures, such as anterior cervical plating surgeries. Thus, the growing elderly population is a key driver of market growth, which in turn is driving demand for advanced cervical implants and associated surgical solutions in the market.

- Increasing surgical volumes & procedure preferences: Growing cases of cervical spine disorders are driving rising surgical procedures in the market. According to a report by NIH in June 2025, out of almost 1.2 million cervical spine surgeries performed globally, Anterior Cervical Discectomy and Fusion (ACDF) are still the most common procedure, accounting for 61.6% of all procedures, followed by Lateral Fusion and Fixation with 22.1%, Posterior Cervical Fusion with 14.0%, and Cervical Disc Arthroplasty with 3.4%. This trend for ACDF is seen as extending into long-term demand for anterior cervical plating systems, with improved surgical technique further driving market growth.

- Advancements in implant technology and surgical techniques: Ongoing developments in anterior cervical plating systems, including the innovations of low-profile and zero-profile implants, have been enhancing patient outcomes by minimizing surgical complications and shortening recovery periods. Minimally invasive approaches are gaining preference among surgeons who seek a high level of plating design for better anatomical fit and biomechanical stability. Such improvements in technology are fostering the global adoption of anterior cervical plates and encouraging healthcare facilities to upgrade their existing surgical tools and invest in newer and more effective implant options in the anterior cervical plating sector.

Global Orthopedic Appliances Trade: Top Exporters and Importers by Country

Exporters and Importers of Orthopedic Appliances by Country (2023)

|

Country (Exporters) |

Export Value (USD) |

Country (Importers) |

Import Value (USD) |

|

Switzerland |

7.9 billion |

Netherlands |

8.9 billion |

|

Germany |

5.8 billion |

France |

3.3 billion |

|

China |

3.4 billion |

China |

3.9 billion |

|

Singapore |

3.3 billion |

Japan |

2.8 billion |

|

U.S. |

14.6 billion |

U.S. |

15.8 billion |

|

Mexico |

3.9 billion |

Canada |

1.7 billion |

|

Australia |

1.3 billion |

Australia |

1.7 billion |

Source: OEC, August 2025

Historical Trends in Spine Surgery Claims: Pathology and Procedure Analysis

Historical Spine Surgery Claims by Spinal Pathology

|

Year |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Total Spine Surgery claims |

26,066 |

20,437 |

24,829 |

26,271 |

30,485 |

|

Average ICD-10 diagnoses per claim |

9.8 |

10.4 |

10.5 |

10.4 |

10.3 |

|

Degenerative Spine claims |

18,413 (70.6%) |

14,756 (72.2%) |

17,953 (72.3%) |

19,127 (72.8%) |

24,245 (79.5%) |

|

Spine Trauma claims |

2,459 (9.43%) |

2,060 (10.08%) |

2,474 (9.96%) |

2,353 (8.96%) |

2,552 (8.37%) |

|

Spine Deformity claims |

307 (1.1%) |

211 (1.0%) |

237 (0.9%) |

245 (0.9%) |

206 (0.6%) |

|

Spine Tumor claims |

302 (1.1%) |

257 (1.2%) |

315 (1.2%) |

265 (1.0%) |

341 (1.1%) |

|

Spine Infection claims |

177 (0.6%) |

169 (0.8%) |

203 (0.8%) |

183 (0.7%) |

200 (0.6%) |

|

Emergency Surgery claims |

8,156 (31.2%) |

6,327 (30.9%) |

7,339 (29.5%) |

7,286 (27.7%) |

8,358 (27.4%) |

Source: NLM July 2025

Challenge

- Regulatory and reimbursement pressures: The market is facing increasing challenges, stemming from stringent regulatory mandates and evolving reimbursement policies. Lengthy approval processes and demand for stronger clinical evidence hinder fast product launches and market entry. Meanwhile, falling and uncertain reimbursement rates for spinal surgeries exert price pressure on both manufacturers and suppliers. In response, manufacturers are pushed to allocate heavier expenses into research and compliance with cost-effectiveness, which inevitably slows down innovation and hinders accessibility in certain markets.

Anterior Cervical Plating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 3.2 billion |

|

Regional Scope |

|

Anterior Cervical Plating Market Segmentation:

End user Segment Analysis

Hospitals sub-segment in the end user segment of the anterior cervical plating market is expected to have the highest market share of 46% in the forecast period, as the volume of spinal procedures performed in hospitals is increasing. Hospitals provide advanced infrastructure and extended postoperative care, thus making the demand for cervical plating procedures greater. According to a report by NLM in July 2025, in 2023, total combined spine procedures numbering 30,485 were undertaken in 2023, after the pre-pandemic levels and an indicator of strong recovery and growth in spinal cases within hospitals. Additionally, government health programs continue to support hospital upgrades, increasing access to newer surgery technology within regions.

Implant Type Segment Analysis

The static plating systems sub-segment in the anterior cervical plating market is expected to hold the highest market share under the implant type segment within the forecast period due to their tested reliability and simplicity in stabilizing the cervical spine. Surgeons favor static plates as they work well in multi-level cervical fusion surgery and are cost-effective. A study published by NLM in January 2024 found that anterior cervical discectomy and fusion (ACDF) surgeries utilized synthetic cages with anterior plates in 67.2% of cases, a testament to the continuing predominance of this pairing in practice. Furthermore, Static plating systems decrease operative time and complications as well and are thus popular in high-volume centers for surgery.

Product Type Segment Analysis

The titanium plates sub-segment in the anterior cervical plating market is expected to hold the highest market share under the product type segment within the forecast period due to the improved biocompatibility and strength-to-weight ratio of titanium. Titanium plates also minimize the risk of corrosion and implant rejection, leading to immense popularity in cervical procedures. Moreover, the compatibility of titanium with imaging modalities such as MRI enables easier postoperative evaluation. Its strength provides long-term stability and allows for a more rapid recovery of the patient. Also, continuous developments in titanium alloy compositions are improving the performance and safety of these implants.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Product Type |

|

|

Implant Type |

|

|

Application |

|

|

End user |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anterior Cervical Plating Market - Regional Analysis

North America Market Insight

The anterior cervical plating market in North America is expected to hold the highest market share of 40% within the forecast period due to the increased incidence of spinal disorders causing high caseloads in ACDF procedures, and the continuing FDA approvals for next-generation plating systems. According to a report by the AHA Organization, May 2025, 70% of medical devices marketed in the U.S. are manufactured overseas. In 2024, the U.S. imported over USD 75 billion in medical devices and supplies. Due to these improvements in medical devices, the market in North America is expected to maintain strong growth.

The anterior cervical plating sector in the U.S. is expected to grow due to increasing healthcare expenditure, an aging population, and the modernization of minimally invasive spine surgery. As per a report by the AHA Organization, May 2025, there are almost 5,000 member hospitals and health systems, 270,000 affiliated physicians, and 2 million nurses and caregivers in the U.S., showing the paramount importance of trade for the sustenance of critical medical supply chains. With a huge support of cervical plating devices and related components being manufactured, the U.S. market is susceptible to global trade policies, import regulations, and logistics disruptions.

Demographics of Cervical Spine Surgeries (2025)

|

Surgery Type |

Percentage of Total Surgeries |

Age Group Most Common |

|

Anterior Cervical Discectomy and Fusion (ACDF) |

61.6% |

55-74 years |

|

Lateral Foraminotomy and Fusion (LFF) |

22.1% |

55-74 years |

|

Posterior Cervical Fusion (PCF) |

14.0% |

55-74 years |

|

Cervical Disc Arthroplasty (CDA) |

3.4% |

≤54 years |

Source: NIH

Asia Pacific Market Insight

The anterior cervical plating market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to increasing healthcare investments, a growing aging population, and rapid adoption of minimally invasive spine surgery. As per a report by the World Bank 2025, this growth is further supported by the health sector as health expenditure increases across various other regions, with East Asia & Pacific spending some 6.5% of GDP on healthcare in 2022, while non-high-income countries stand at 5.1%, showcasing a shift toward better healthcare infrastructure. The demand for anterior cervical plating systems is also driven by a greater understanding of spinal health, easier access to sophisticated surgical technologies, and burgeoning medical tourism in countries such as India, Thailand, and South Korea.

The anterior cervical plating market in China is expected to grow within the forecast period due to the expansion of private hospitals, increased government support for domestic medical device manufacturing, and growing cases of spinal traumas. According to a report by NLM in March 2023, the random pooled incidence of traumatic spinal cord injury (TSCI) in China, estimated at 65.1 per million, coupled with in-hospital mortality and complication rates of 3% and 35%, respectively. Thisindicates the urgency of advanced spinal stabilization and encourage the demand for novel anterior cervical plating systems to enhance patient outcomes and lessen complications from cervical spine injuries.

Europe Market Insight

The anterior cervical plating industry in Europe is expected to grow steadily within the forecast period due to strong regulatory pathways, growth in the demand for biocompatible implants, and a good focus on value-based surgical outcomes. Government initiatives for helping the spinal healthcare infrastructure and increasing funds for advanced medical technologies give a bigger boost to market growth. Further, research and development activities carried out by key players in medical devices further fuel developments in implant material and design, producing safer and better anterior cervical plating systems that better suit patients and healthcare providers growing needs in the region.

The market in the UK is expected to grow due to an aging population, increasing in spinal surgeries on outpatient basis, and NHS procurement of new spinal implant systems. According to a report by the UK Government in April 2024, they launched a £30 million (USD 37.5 million) Health Technology Adoption and Acceleration Fund (HTAAF) in October 2023 to allow integrated care systems (ICSs) to invest in MedTech. This would strengthen the uptake of advanced anterior cervical plating technologies throughout NHS Centres, thereby raising the outcomes for patients and efficiency in operations. Additionally, existing investments in minimally invasive spine surgery and enhanced recovery protocols are expected to further propel the growth of the market in the country.

Key Anterior Cervical Plating Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- NuVasive, Inc.

- Globus Medical, Inc.

- B. Braun Melsungen AG

- Aesculap Implant Systems (B. Braun)

- Orthofix Medical Inc.

- K2M Group Holdings, Inc. (Stryker)

- Invibio Ltd. (Victrex plc)

- MiRus LLC

- SIGNUS Medizintechnik GmbH

- RTI Surgical

- Integra LifeSciences

The anterior cervical plating industry is facing huge competition from major players. Companies such as Medtronic, DePuy Synthes, and Stryker largely share the market. Thus, these companies focus on strategic measures to be able to establish, maintain, or improve their market standing through mergers and acquisitions, technology advances, and product portfolio expansions. For instance, the acquisition of Mazor Robotics by Medtronic has enabled the company to now include robotic-assisted surgery within its portfolio, providing enhanced surgical accuracy and improved patient outcomes. Similarly, DePuy Synthes invests in R&D to bring about new cervical plating systems that meet the changing needs of the spine surgeon and the patient.

Here is a list of key players operating in the global market:

Recent Developments

- In May 2024, Spineart in the U.S. announced the launch of its new anterior cervical cage, which is SCARLET AC-Ti secured. Clinicians praise its porous titanium design, optimized screw angulation, reliable stability, and improved patient recovery with no postoperative dysphagia observed.

- In October 2023, MiRus received approval from the FDA 510(k) for its CYGNUS MoRe Anterior Cervical Plate, which is a spinal fixation device made with a proprietary molybdenum-rhenium (MoRe) alloy that allows for an exceptionally thin and narrow profile.

- Report ID: 7748

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anterior Cervical Plating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.