Cervical Retractors Market Outlook:

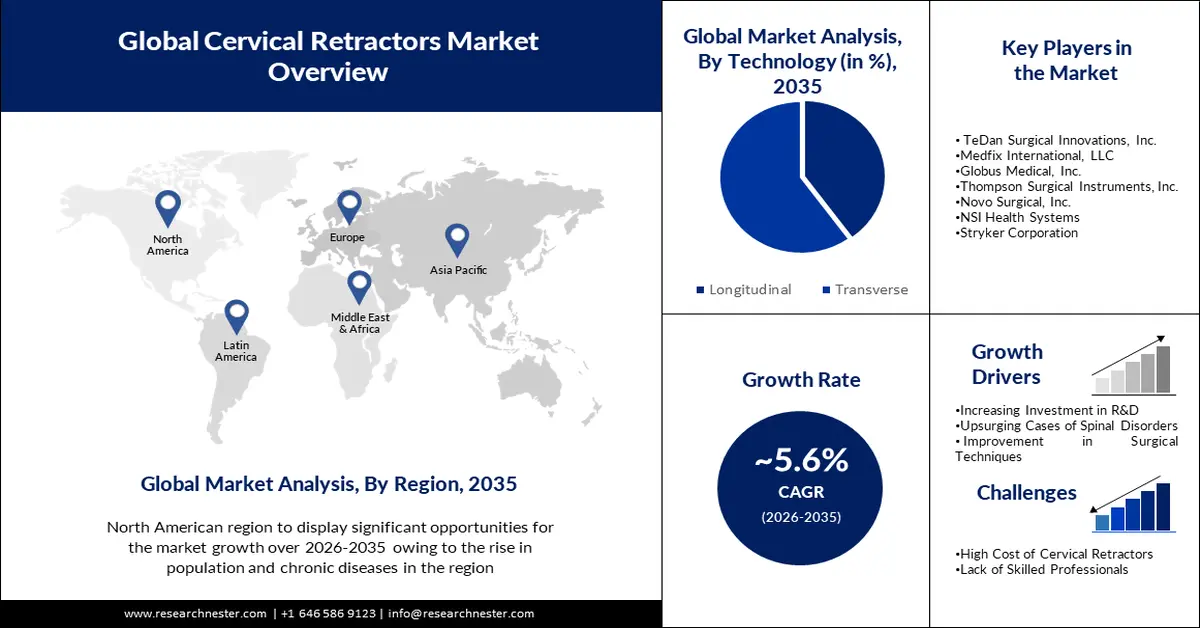

Cervical Retractors Market size was over USD 145.94 billion in 2025 and is poised to exceed USD 251.66 billion by 2035, witnessing over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cervical retractors is evaluated at USD 153.3 billion.

There is increasing use of spinal devices such as cervical retractors for treating cervical disc herniation. An estimated 5 to 20 cervical disc herniation per 1000 adults occur each year, which contributes to neck pain in adults. The cervical retractor is used to separate the vertebrae and expose the herniated disc while allowing a surgeon to access the herniated disc and surgically remove it.

Manufacturers' wide availability of retractor sets has created a lucrative opportunity for the cervical retractors market. MEDFIX VISION cervical retractor set by Medfix International, LLC features locking technology that ensures blades are snugly connected to retractor bodies, and hinged arms that conform to patient anatomy during surgical procedures.

Key Cervical Retractors Market Insights Summary:

Regional Highlights:

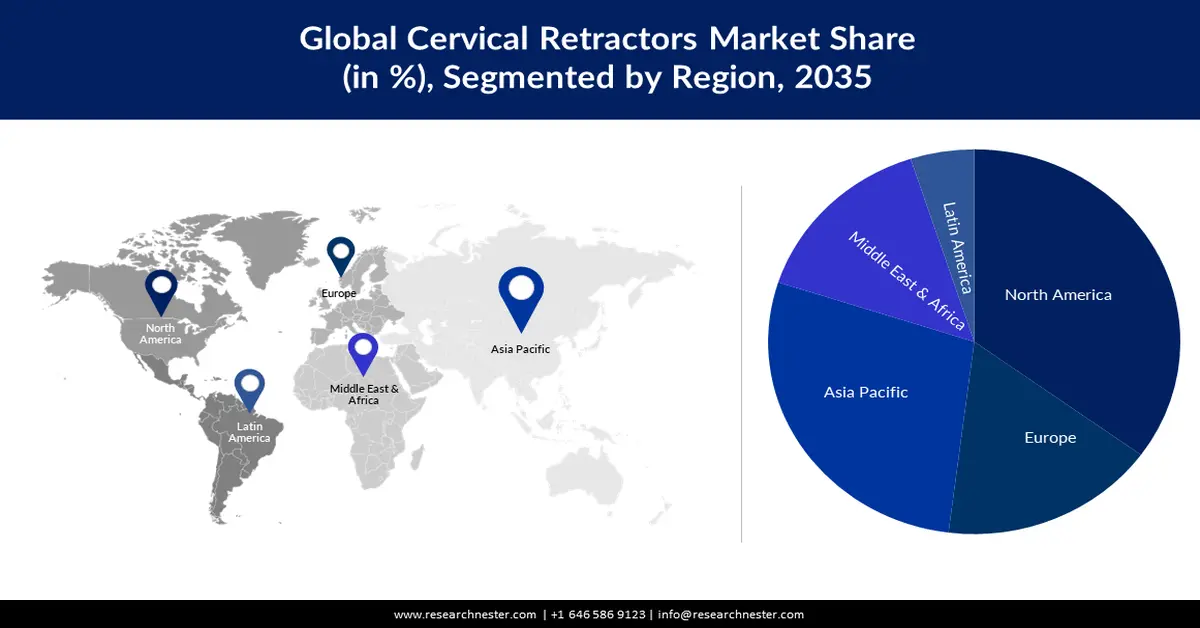

- North America is projected to hold a 37% share of the cervical retractors market by 2035, supported by the rising prevalence of cervical cancer and the presence of well-established healthcare systems in the region.

- Asia Pacific is expected to secure around a 28% share by 2035, propelled by increasing awareness of cervical retractor benefits in medical settings and the growing elderly population requiring cervical spine–related interventions.

Segment Insights:

- The transverse retractor segment is set to capture a 53% share by 2035 in the cervical retractors market, enabled by its secure engagement design, minimal tissue trauma, and enhanced surgical visibility.

- The hospitals segment is forecasted to command a 49% share by 2035, supported by the rising volume of minimally invasive procedures and ongoing investments in advanced medical infrastructure.

Key Growth Trends:

- Prevalence of Age Related Cervical Disorders

- Rise in Instrumented Spinal Procedures will boost the cervical retractors market demand

Major Challenges:

- Concern of tissue damage by self retaining retractors

- Lack of skilled labor and the presence of counterfeit products

Key Players: Aesculap Implant Systems, Inc., TeDan Surgical Innovations, Inc., Medfix International, LLC, Globus Medical, Inc., Thompson Surgical Instruments, Inc., Novo Surgical, Inc., NSI Health Systems, Stryker Corporation, Boston Scientific Corporation, Microcure (Suzhou) Medical Technology Co., Ltd.

Global Cervical Retractors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 145.94 billion

- 2026 Market Size: USD 153.3 billion

- Projected Market Size: USD 251.66 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, United Arab Emirates

Last updated on : 20 November, 2025

Cervical Retractors Market - Growth Drivers and Challenges

Growth Drivers

- Prevalence of Age-Related Cervical Disorders - As people age, their muscles, ligaments, and discs in the neck become weaker and less flexible, leading to degenerative changes in the cervical spine. This results in an increased risk of cervical spondylosis. In 2021, 28% of all diagnosed spinal degenerative diseases were age-related. Age-related cervical disorders can be relieved and improved through the use of cervical retractors. The retractors are designed to slowly and gently stretch the neck muscles, allowing them to relax and loosen up, reducing pain and restoring the normal range of motion.

- Rise in Instrumented Spinal Procedures will boost the cervical retractors market demand - There are over 1.60 million spinal surgeries performed every year. The cervical retractor system is designed to help surgeons carry out precise and safe spinal procedures. It provides a secure and stable platform for surgeons to perform surgery and facilitates implant placement accurately. It also allows for a minimally invasive approach to the cervical spine, which reduces complications risk.

- Rising Availability of Medical Devices Worldwide - In recent years, increased access to medical products has resulted in a surge in demand for cervical retractors in surgical settings. There are now more than 7000 generic medical devices available on the world market, with more than 2 million different varieties.

Challenges

-

Concern of tissue damage by self-retaining retractors - The self-retaining retractors have sharp edges which can lacerate or damage surrounding tissue when placed with too much tension, and this can lead to an infection or wound dehiscence. This can cause a delay in healing and lead to an increased risk of complications.

- Lack of skilled labor and the presence of counterfeit products

- Emergence of substitute products

Cervical Retractors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 145.94 billion |

|

Forecast Year Market Size (2035) |

USD 251.66 billion |

|

Regional Scope |

|

Cervical Retractors Market Segmentation:

Type (Transverse Retractors, Longitudinal Retractors)

By 2035, transverse retractor segment is poised to account for 53% of the market share. The transverse retractor system is designed to provide a secure engagement with minimal tissue trauma and improved visibility, while its low-profile design allows for easy access to the surgical site.

This allows surgeons to perform procedures with greater precision while reducing the risk of tissue damage. A Phantom CS Transverse Retractor by TeDan Surgical Innovations has been designed with Sure-Lock and Lever Lock technologies.

End-User (Hospitals, Clinics, Ambulatory Surgery Centers)

A significant share of 49% is predicted to be owned by the hospitals segment in the cervical retractors market by 2035. Hospitals are performing an increasing number of minimally invasive procedures to treat conditions such as hernias, spine ailments, and tumor removals. These procedures require the use of cervical retractors. In addition, hospitals are investing in advanced medical equipment and modernizing their infrastructure to improve patient outcomes.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cervical Retractors Market - Regional Analysis

North American Market Forecast

North America industry is poised to account for largest revenue share of 37% by 2035. A rising prevalence of cervical cancer is observed in the region, and the region has developed well-established healthcare systems to combat the disease. A cervical retractor is a surgical instrument that spreads and exposes the cervix to facilitate surgical access.

APAC Market Statistics

Asia Pacific cervical retractors market is expected to register a share of approximately 28% by 2035, driven by growing awareness of the benefits of cervical retractors in medical centers and hospitals.

A higher proportion of elderly people in the region creates a greater need for medical devices that can support the diagnosis and treatment of aging-related conditions, such as back pain. Cervical retractors are particularly useful in aiding the diagnosis and treatment of conditions related to the cervical spine, such as herniated discs or cervical stenosis, which are more common in older populations.

Cervical Retractors Market Players:

- Aesculap Implant Systems, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- TeDan Surgical Innovations, Inc.

- Medfix International, LLC

- Globus Medical, Inc.

- Thompson Surgical Instruments, Inc.

- Novo Surgical, Inc.

- NSI Health Systems

- Stryker Corporation

- Boston Scientific Corporation

- Microcure (Suzhou) Medical Technology Co., Ltd

Recent Developments

- Thompson Surgical Instruments, Inc., announced that the Thompson retractor, a general table-mounted, self-retaining retractor, was declared the most frequently used retractor in the United States.

- Aesculap Implant Systems, LLC, announced its long-term randomized IDE trial's successful outcome to treat single-level degenerative disease.

- Report ID: 3969

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cervical Retractors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.