Amylin Analogs Market Outlook:

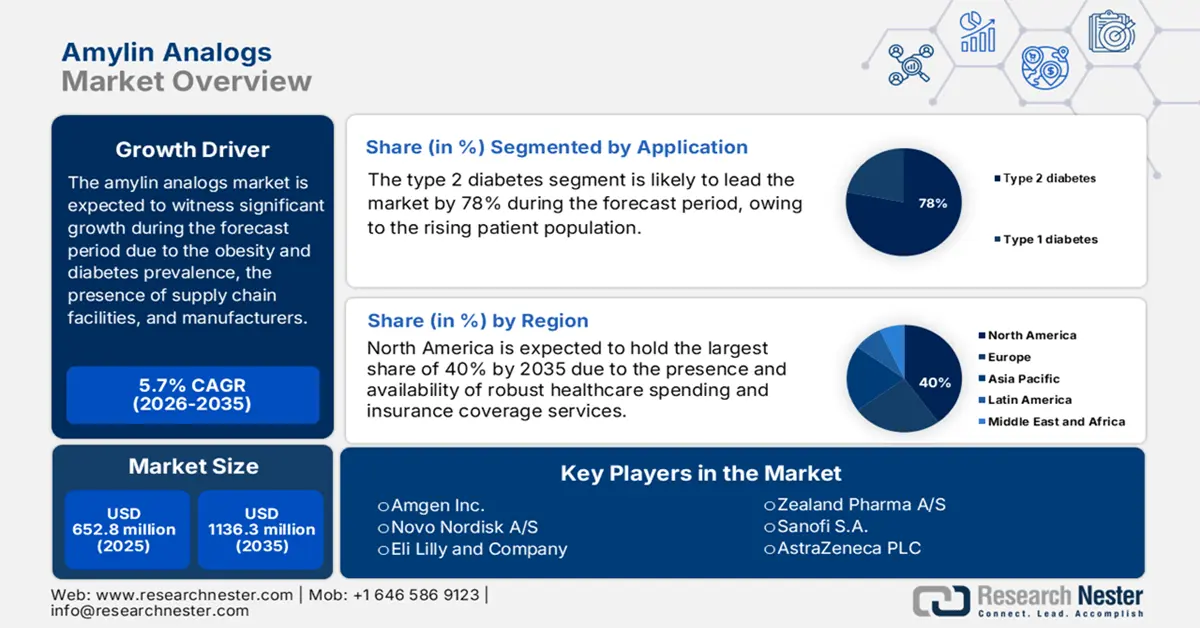

Amylin Analogs Market size was valued at USD 652.8 million in 2025 and is projected to reach USD 1136.3 million by the end of 2035, rising at a CAGR of 5.7% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of amylin analogs is evaluated at USD 690 million.

The international patient pool in the market is substantial, which is highly attributed to a rise in obesity and diabetes prevalence. In this regard, an article was published by the UN News in November 2024, demonstrating that more than 800 million elders suffered from diabetes in 2024. This, however, is projected to exceed by the end of 2045. Likewise, people suffer from obesity globally, eventually resulting in a huge need for metabolic therapies such as amylin analogs. Besides, the supply chain system for these medications includes active pharmaceutical ingredient (API) manufacturers from Europe, China, and India, catering to the production, thus making it suitable for market growth.

Furthermore, the amylin analogs market is also boosted by the trade dynamics, readily dominated by the EU and the U.S. imports from Asia, of which China exports peptide APIs internationally. In addition, the U.S. imported USD 100 billion of pharmaceutical products which includes obesity and diabetes-based drugs in 2023. Besides, the aspect of funding for research, deployment, and development for the market has also increased, with the provision by the NIH for research in metabolic disorders. Likewise, the Europe Commission allocated funding to initiate innovation for obesity and diabetes drugs under Horizon Europe, thereby effectively driving market expansion.

Key Amylin Analogs Market Insights Summary:

Regional Highlights:

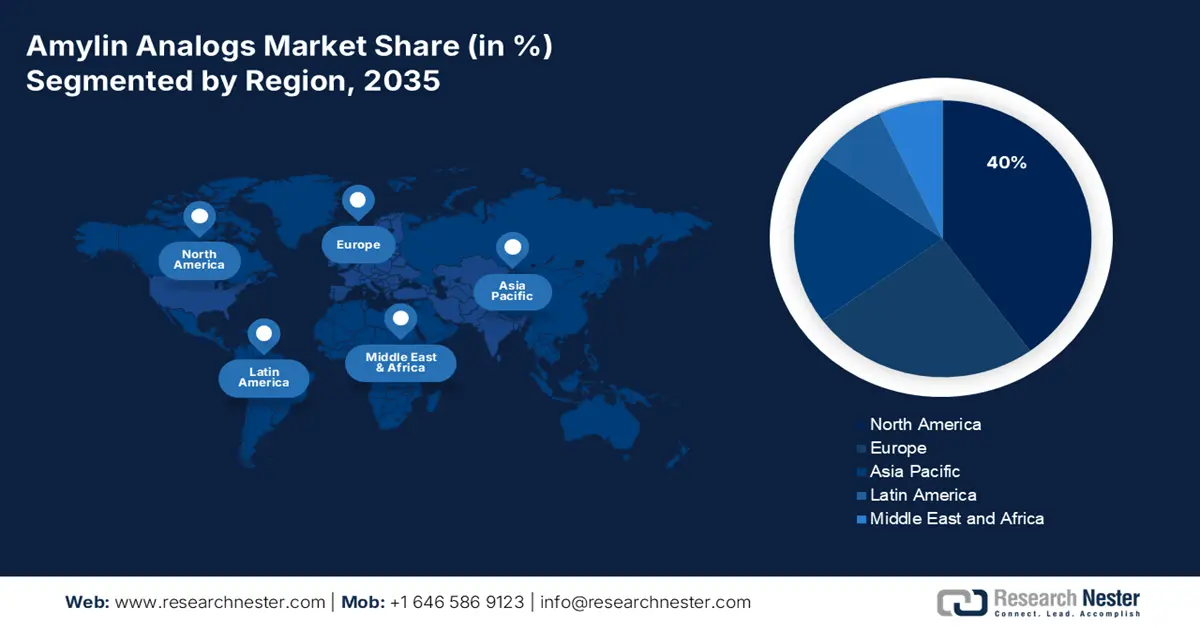

- North America is projected to hold 40% share by 2035, owing to strong medical spending and rising obesity rates.

- Asia Pacific is anticipated to be the fastest-growing region, driven by the escalating burden of type 2 diabetes, obesity, and expanding healthcare access.

Segment Insights:

- Type 2 diabetes segment is projected to hold 78% share by 2035, driven by the high unmet need for adjunctive therapies providing glycemic control without weight gain or hypoglycemia risk.

- Pramlintide segment is anticipated to maintain a dominant position, impelled by its established efficacy as the first and only approved synthetic amylin analog.

Key Growth Trends:

- Intervention and improvement in healthcare quality

- Patient-centric drug delivery

Major Challenges:

- Barriers in emerging market facilities

- Threats in biosimilar and patent cliffs

Key Players: Amgen Inc., Novo Nordisk A/S, Eli Lilly and Company, Zealand Pharma A/S, Sanofi S.A., AstraZeneca PLC, Pfizer Inc., Merck & Co., Roche Holding AG, Johnson & Johnson, Teva Pharmaceutical, Viatris Inc., Sun Pharmaceutical, Dr. Reddy's Laboratories, Lupin Limited, Cipla Limited, Celltrion Inc., JW Pharmaceutical, CSL Limited, Hovid Berhad

Global Amylin Analogs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 652.8 million

- 2026 Market Size: USD 690 million

- Projected Market Size: USD 1136.3 million by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Canada, United Kingdom, Japan

- Emerging Countries: India, China, Australia, South Korea, Brazil

Last updated on : 6 October, 2025

Amylin Analogs Market - Growth Drivers and Challenges

Growth Drivers

- Intervention and improvement in healthcare quality: The amylin analogs market is positively influenced by evidence-specific medical quality improvements. As per the January 2024 NLM clinical study, the total medical expenditure for diabetes incur USD 19,736 annually. Further, the medical expenditure of people diagnosed with diabetes is 2.6 times higher than the expected amount. Owing to this, amylin analogs are regarded as cost-efficient solutions for buyers seeking to combat long-term complications, thereby denoting a positive impact on the overall market scenario internationally.

- Patient-centric drug delivery: The latest trend towards patient-centric drug delivery devices is a key driver for adoption. The establishment and marketing of single-use, pre-filled disposable pens for subcutaneous delivery greatly enhanced patient convenience and compliance. The FDA guidance on human factors engineering for combination products highlights this trend. Simpler-to-use, unobtrusive, and dependable delivery systems decrease the indignity of injectable therapy, thus making it a more acceptable drug for patients and a more commonly prescribed drug for clinicians.

- Rising disease prevalence and patient pool: The growing patient pool for diabetes is the key driver for the market. As per the CDC data in May 2024, 38.4 million people in the U.S. have diabetes, which is almost 11.6% of the overall population. Hence, this creates a huge addressable market mainly for people not achieving glycemic targets with insulin. On the other hand, Europe also experiences a rising population with diabetes, which ensures a sustained demand for the market. This epidemiological trend guarantees a continuously growing base of potential candidates for therapy.

Estimated Economic Costs of Diagnosed Diabetes

|

Category |

2012 (USD, billions) |

2022 (USD, billions) |

Change (2012 - 2022) |

|

Total Direct Costs |

227 |

307 |

+80 |

|

Total Indirect Costs |

89 |

106 |

+17 |

|

Total Costs (Direct + Indirect) |

316 |

413 |

+97 |

|

Excess Medical Costs per Person |

10,179 |

12,022 |

+1,843 |

Source: CDC May 2024

Estimated Crude Prevalence of Diagnosed Diabetes, Undiagnosed Diabetes, and Total Diabetes Among Adults Aged 18 Years or Older

|

Characteristic |

Diagnosed diabetes Percentage |

Undiagnosed diabetes Percentage |

Total diabetes Percentage |

|

Total |

11.3 (10.3–12.5) |

3.4 (2.7–4.2) |

14.7 (13.2–16.4) |

|

Ages in Years |

|||

|

18–44 |

3.0 (2.4–3.7) |

1.9 (1.3–2.7) |

4.8 (4.0–5.9) |

|

45–64 |

14.5 (12.2–17.0) |

4.5 (3.3–6.0) |

18.9 (16.1–22.1) |

|

≥65 |

24.4 (22.1–27.0) |

4.7 (3.0–7.4) |

29.2 (26.4–32.1) |

|

Sex |

|||

|

Men |

12.6 (11.1–14.3) |

2.8 (2.0–3.9) |

15.4 (13.5–17.5) |

|

Women |

10.2 (8.8–11.7) |

3.9 (2.7–5.5) |

14.1 (11.8–16.7) |

Source: CDC May 2024

Challenges

- Barriers in emerging market facilities: The existence of developing nations comprises unique challenges, owing to limited healthcare systems that negatively impact the amylin analogs market. For instance, according to the 2024 WHO AFRO report, very few clinics in Africa are able to perform diagnostic tests. Besides, India comprises gaps in the pharmaceutical cold chain system, wherein many pharmacies improperly store temperature-specific peptides. However, these limitations require manufacturers to initiate parallel investments to cater to drug development and restore market expansion.

- Threats in biosimilar and patent cliffs: The aspect of limited patient protection effectively poses revenue risks for innovators in the amylin analogs market internationally. For instance, Novo Nordisk is projected to experience a revenue exposure during the core patent expiry of cagrilintide, with biosimilar developers initiating preclinical trials. Besides, in 2023, Eli Lilly invested in defending pramlintide patents against challengers, which reflected an intense competition in the obesity and diabetes space. Therefore, all these challenges effectively limit the growth and expansion of the market globally.

Amylin Analogs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 652.8 million |

|

Forecast Year Market Size (2035) |

USD 1136.3 million |

|

Regional Scope |

|

Amylin Analogs Market Segmentation:

Application Segment Analysis

The type 2 diabetes is dominating the segment and is expected to hold the largest share of 78% by 2035. The segment is driven due to the larger patient population compared to type 1 diabetes. According to the Centers for Disease Control and Prevention (CDC) report in May 2024, 1 in 10 U.S. population have diabetes of type 2. The driver is the high unmet need for adjunctive therapies that provide glycemic control without weight gain or hypoglycemia risk. Pramlintide is used in type 2 diabetes patients using mealtime insulin, addressing a specific, challenging-to-treat subpopulation within this vast demographic, thereby securing its substantial revenue base.

Drug Type Segment Analysis

Pramlintide's dominant revenue share is driven by its established efficacy as the first and only approved synthetic amylin analog. Its primary driver is its indication for both type 1 and type 2 diabetes, as documented by the National Institutes of Health (NIH), which expands its addressable patient population. It can be used as an adjuvant therapy to insulin to improve glycemic control and also support in weight loss, according to American Diabetes Association (ADA) clinical guidelines. Further, continued clinical use and a lack of widespread generic competition solidify its market position, despite the presence of next-generation GLP-1/GIP receptor agonists.

Distribution Channel Segment Analysis

Hospital pharmacies dominate the distribution channel segment. This is because the drug is a specialty injectable that usually starts under direct physician direction in the clinic. The Centers for Medicare & Medicaid Services (CMS) payment systems for physician-administered medications also encourage this channel. According to the CDC in May 2024, approximately 7.86 million discharges from hospitals were reported with diabetes fully dependent on hospital pharmacies for medication. Further, hospital pharmacies are positioned to manage the inventory, patient education, and complex billing ensuring controlled access and adherence.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Drug Type |

|

|

Distribution Channel |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Amylin Analogs Market - Regional Analysis

North America Market Insights

North America in the amylin analogs market is projected to account for the highest share of 40% during the forecast timeline. The market’s growth in the region is propelled by the presence and availability of strong medical spending as well as a rise in obesity rates. For instance, as stated in the NIDDK report in September 2021, approximately 42.4% of the adult population in the U.S. readily suffers from obesity. Besides, the U.S. effectively dominates the region with the overall regional demand, attributed to expansion in insurance coverage and the adoption of private insurers. Also, Canada caters the regional revenue due to administrative controls and provincial formulary additions.

The market in the U.S. is readily dominating the region mainly due to the obesity epidemic. Besides, the obesity cost in the U.S. healthcare system is nearly USD 173 billion per year, according to CDC report in January 2025. On the other hand, Medicare spending in 2021 is USD 829 billion and is expected to increase by 18% in the upcoming years, based on the KFF data in January 2023. Moreover, a private insurer provides coverage of cagrilintide scripts that result in AHRQ-driven cost savings. Also, hospital-centric distribution along with combination therapies are other trends that are proactively amplifying the market in the country.

The amylin analogs market in Canada is continuously growing, which is attributed to the existence of provincial healthcare investments. For instance, the CMA report in 2025 states that nearly 30% to 40% of provincial and territorial budgets are taken by the healthcare sector, which positively impacts the market growth in the country. Meanwhile, there are other factors, including the presence of cold chain gaps, along with price regulations, that positively contribute to market upliftment.

Prevalence of Obesity in Adults in 2023

|

Age |

Men (%) |

Women (%) |

Total (%) |

|

20 and above |

39.2 |

41.3 |

40.3 |

|

20-39 |

34.3 |

36.8 |

35.5 |

|

40-59 |

45.4 |

47.4 |

46.4 |

|

60 and above |

38.0 |

39.6 |

38.9 |

Source: CDC September 2024

APAC Market Insights

The amylin analogs market in the Asia Pacific is the fastest-growing region in the world and is fueled by a high and escalating burden of type 2 diabetes and obesity, especially in highly populated countries. Main drivers for the market are escalating healthcare spending, enhanced diagnosis rates, and increased knowledge of innovative therapeutic solutions beyond conventional insulin. Of particular note is the growth of government-sponsored programs and health care reforms that have seen wider coverage of chronic disease management, resulting in an enhanced access by patients to these expensive treatments.

Japan's market is defined by extensive government spending and a fast aging population with a high incidence of type 2 diabetes. The NLM report in April 2022 states that the annual healthcare expenditure in Japan is 59.5 trillion JPY facilitating broad access under the national health insurance. A central trend is the accelerated approval and reimbursement of innovative biologics, which is necessitated by the necessity to control the disease burden of the elderly population effectively and reduce long-term healthcare expenditure.

China leads the market in the APAC region and is driven by its enormous patient base and increasing government investment in chronic disease management. Statistics from the National Medical Products Administration indicates that the medical support funds in 2023 were 74.5 billion yuan. The primary trend is the integration of newer, more effective analogs into the National Reimbursement Drug List (NRDL), which dramatically expands patient access and drives market volume, even as price negotiations pressure unit costs.

Europe Market Insights

Europe in the amylin analogs market is expected to account for a considerable share by the end of the forecast duration. According to the July 2024 eurostat report, an estimated 63.6% of the adult population age from 65 to 74 in the region is readily affected by obesity. In addition, the region also constitutes streamlined administrative acceptances through the EMA PRIME scheme that positively influences the market upliftment. Besides, Germany has been deliberately leading with growth rate since 2021. Meanwhile, the UK caters the largest regional healthcare budget, thus denoting a positive outlook for market growth.

The market in Germany is projected to capture the highest of the overall regional revenue by the end of 2035. This is effectively driven by the presence of an efficient reimbursement system and a surge in the occurrence of obesity. Besides these factors, the country has made an expenditure of €501 billion, which also includes amylin therapies in 2024, of which 12% yearly growth, as per Statistisches Bundesamt (Destatis) in 2025. Moreover, regional hospitals currently stock cagrilintide, owing to the availability of G-BA mandates for metabolic care services, thus suitable for market growth in the country.

The amylin analogs market in the UK is projected to hold a considerable regional revenue during the forecast period. This upliftment is mainly driven by the budget allocation by the NHS. The UK's growth is fueled by a well-defined patient pathway within the National Health Service (NHS) and strategic government initiatives targeting obesity and diabetes prevention. According to the Association of the British Pharmaceutical Industry (ABPI), navigating the NICE technology appraisal process is critical for market access. Meanwhile, the market is shaping due to the NHS's centralized procurement program, with R&D incentives that are meant to increase local production.

Key Amylin Analogs Market Players:

- Amgen Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novo Nordisk A/S

- Eli Lilly and Company

- Zealand Pharma A/S

- Sanofi S.A.

- AstraZeneca PLC

- Pfizer Inc.

- Merck & Co.

- Roche Holding AG

- Johnson & Johnson

- Teva Pharmaceutical

- Viatris Inc.

- Sun Pharmaceutical

- Dr. Reddy's Laboratories

- Lupin Limited

- Cipla Limited

- Celltrion Inc.

- JW Pharmaceutical

- CSL Limited

- Hovid Berhad

The international market is readily dominated by key players, including Novo Nordisk, accounting for the highest of the global share, and Eli Lilly, is holding the next highest of the share. Both these organizations have leveraged their diabetes as well as obesity portfolios, thereby catering to market upliftment on a worldwide basis. Besides, Sanofi and Zealand Pharma both have readily focused on combination therapies. Meanwhile, organizations in India, such as Dr. Reddy’s and Biocon, have readily targeted biosimilars, thus a prolific opportunity for market upliftment on the international scenario.

Below is the list of some prominent players operating in the market:

Recent Developments

- In June 2025, Metsera, Inc. announced the positive topline data from the MET-233i, a Phase 1 clinical trial, which is an ultra-long-acting amylin analog engineered for class-leading durability, potency, and combinability with Metsera’s fully-biased monthly GLP-1 receptor agonist candidate, MET-097i.

- In March 2025, AbbVie and Gubra together announced the license agreement to develop amylin the best class and long acting amylin analog for the treatment of obesity.

- In October 2024, ADOCIA announced patenting stable combinations of GLP-1 and amylin analogs for the treatment of obesity and diabetes using its BioChaperone platform

- Report ID: 7710

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Amylin Analogs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.