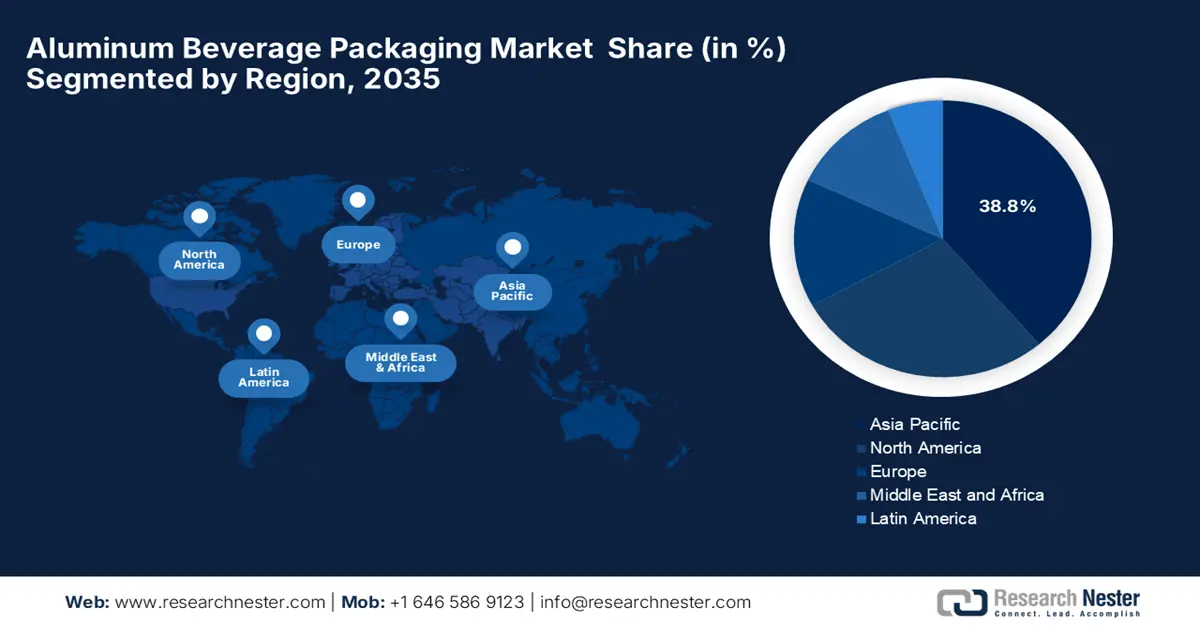

Aluminum Beverage Packaging Market - Regional Analysis

APAC Market Insights

Asia Pacific is expected to command the largest revenue share of 38.8% in the international aluminum beverage packaging market during the analyzed timeframe. The proprietorship of the region in this sector is efficiently fueled by rising urbanization, increasing disposable incomes, and expanding modern retail systems. In August 2022, Suntory announced that it had launched the world’s first-ever 100% recycled aluminum can for limited editions of the premium malt’s CO₂ reduction can and the premium malt’s 〈Kaoru〉 ale, which was developed in collaboration with UACJ and Toyo Seikan Group. It also stated that the new can reduces CO₂ emissions by 60% when compared to conventional aluminum cans, marking a major step toward circular packaging. Hence, this initiative aligns with the firm’s sustainability goals, including significant greenhouse-gas reduction targets across its entire value chain.

China’s market is continuously propelled by a booming beverage industry, especially in ready-to-drink teas, energy drinks, as well as flavored beverages. Simultaneously, the Government initiatives are supporting waste reduction and circular economy practices, thereby encouraging wider adoption of aluminum packaging in the country. The Ministry of Ecology & Environment in March 2025 reported that it issued a work plan that covers the steel, cement, and aluminum smelting industries in the national carbon emission trading industry, which also includes aluminum production in the country’s carbon trading system. It also underscored that the initiative aims to reduce greenhouse gas emissions from aluminum smelting by offering incentives for cleaner production. Furthermore, the focus on low-carbon aluminum, this plan supports the growth of sustainable aluminum beverage packaging in the country.

India in the aluminum beverage market is efficiently growing on account of consumer preference for ready-to-drink refreshments, juices, and functional beverages. On the other hand, brands in the country are embracing aluminum cans to enhance product shelf life and elevate brand appeal. In November 2023, the Aditya Birla Group announced that through its subsidiary Novelis, it is advancing sustainable aluminum beverage packaging with a prime focus on lightweight, completely recyclable cans and innovative aluminum bottles. It also notes that Novelis recycled more than 2.2 million tons of aluminum in 2022, promoting a circular economy by reducing energy consumption by up to 95% when compared to primary aluminum production. Furthermore, Aditya Birla invested around USD 2 billion in recycling capacity and a global decarbonization strategy, and it is committed to carbon neutrality by the end of 2050.

North America Market Insights

North America is the central player in the aluminum beverage packaging market, which is backed by a large consumer base that prefers recyclable packaging formats. Most of the beverage producers in the region are adopting aluminum cans for carbonated drinks, energy beverages, seltzers, and ready-to-drink products, which is also being supported by a mature recycling infrastructure. Similarly, the growing emphasis on circular packaging and brand campaigns promoting eco-friendly formats is also supporting the region’s upliftment over the recent years. Innovations such as high recycled content alloys, along with the lightweighting technologies, are enhancing energy efficiency in can production, also reducing the carbon footprint of each unit. Furthermore, aluminum scrap and the integration of digital supply chain tracking and automated recycling sorting systems are enabling near-real-time optimization of aluminum recovery, which is setting a benchmark for sustainable beverage packaging across the world.

U.S. Aluminum Scrap Supply, Trade, and Energy Impact (2023-2024)

|

Category |

Detail |

Statistic |

Notes |

|

Domestic Scrap Consumption |

Total consumed by U.S. industry (2024) |

5.6 MMT |

Supports ~85% of U.S. aluminum production |

|

Scrap Exports |

Total exported (2023/24) |

~2.0 MMT |

Increased by>17% from the previous year |

|

Scrap Imports |

Total imported |

~0.68 MMT |

At a decade-long high |

|

Net Scrap Trade |

Exports minus Imports |

~1.3 MMT |

Effective trade deficit |

|

Used Beverage Cans (UBCs) |

Generated in the U.S. (2023) |

1.4 MMT |

Less than half is currently recycled |

|

UBCs Imported (2023) |

Imported from Canada and Mexico |

0.183 MMT |

Primarily from Canada and Mexico |

|

Domestic Supply Gap |

Total primary aluminum shortfall |

~4.0 MMT |

Amount of imported ingot/raw aluminum needed |

|

Energy Savings |

Potential annual savings from recycling |

~31 billion kWh |

- |

|

Equivalent Power |

Homes powered by recycled energy |

~3 million U.S. homes |

- |

|

Current U.S. secondary aluminum production |

Approximately annual output |

5 MMT |

- |

Source: The Aluminum Association

In the U.S., the aluminum beverage packaging market is amplifying at a robust pace, supported by the high per-capita beverage consumption and rapid innovations in terms of can design and customization. In this context, the article published by the Aluminum Association in December 2024 reported the key policy priorities to strengthen the country’s aluminum production, by recycling and supply chains, emphasizing the material’s highly essential role in the economy and national security. It also underscored that more than USD 1 billion worth of aluminum beverage cans are wasted on a yearly basis, which reflects the urgent need for improved recycling infrastructure and extended producer responsibility programs. Therefore, boosting domestic aluminum collection and sustainable production, these initiatives support the growth of eco-friendly packaging, hence denoting a positive market outlook.

Key Statistics on Aluminum Can Usage and Trade Impacts in the U.S. Craft Beer Market (2023-2025)

|

Metric |

Value |

Context |

|

Aluminum can share in craft beer packaging (2023) |

68.4% by volume |

Represents growth of ~4% from 2022 |

|

Aluminum can share in early 2025 |

~75% of packaged craft beer |

Volume and revenue share for U.S. craft beer |

|

Tariff on imported aluminum (U.S., March 12, 2025) |

25% |

Applies to Canada, Mexico, and other countries |

|

Canada’s share of U.S. aluminum imports |

Largest supplier |

Inclusion in tariffs expected to increase U.S. aluminum prices |

|

Canada’s share of U.S. craft beer exports |

37.5% |

Largest export market for U.S. craft beer |

Source: Brewers Association

Canada is witnessing significant growth in the market, primarily shaped by strong government support and high recycling rates, making aluminum a preferred choice among beverage producers. The Government of Canada, in April 2025, announced support measures for businesses affected by U.S. aluminum tariffs, which also include a temporary 6-month relief for imports used in manufacturing and beverage packaging. It also underscored that the countermeasure tariffs applied by Canada covered aluminum products worth USD 3 billion, which are a part of a broader USD 29.8 billion in affected goods. Hence, these actions aim to help the firms to adjust supply chains, maintain operations by strengthening domestic aluminum production, and packaging stability. Hence, the existence of suitable government policies is expected to accelerate the market growth at a rapid pace.

Europe Market Insights

Europe has gained the most prominent position in the global aluminum beverage packaging market, shaped by stringent sustainability regulations and the presence of advanced recycling systems. Simultaneously, the presence of key market players and strong environmental consciousness further supports aluminum’s prominence in this region. According to the European Aluminum article published in February 2025, the EU expanded its 16th sanctions package in 2025 to include primary aluminum imports from Russia, by addressing longstanding industry requests and tightening restrictions on products that were previously sanctioned. It also underscores that the regional aluminum producers, already facing electricity costs 2 to 4 times higher than in the U.S. and China, continue to focus on low-carbon electrification to maintain competitiveness. Hence, this could tighten supply, potentially increasing the price and incentivizing greater recycling and use of sustainable aluminum in beverage packaging.

Germany represents one of the mature and largest aluminum beverage packaging markets in which the aluminum cans are valued for their recyclability and suitability for premium and craft beverages. The country hosts a well-established recycling systems that ensure high recovery rates for aluminum, which is reinforcing its appeal as a sustainable packaging solution. In addition, the consumers in the country are preferring the products that are environmentally responsible, allowing the beverage producers to adopt aluminum cans not only for functional benefits but also as a strategic choice to align with sustainability goals. Furthermore, the country’s robust beverage industry and focus on quality standards are also supporting the widespread adoption of aluminum cans, particularly among craft and premium beverage segments. Hence, the presence of all of these factors responsibly elevates Germany’s growth potential in this market in the years ahead.

In the UK, the aluminum beverage packaging market has gained enhanced traction, which is benefiting from the ongoing sustainability commitments and shifts in beverage trends. According to the findings from AEROBAL in January 2024, demand for aluminum aerosol containers in the combined region of the 27 EU member states, including the UK, increased significantly by 9% in 2023. This represents a significant share of the global market, contributing to approximately 72% of total deliveries that are directed to Europe. Therefore, this growth reflects strong consumer demand and the established preference for aluminum packaging in these regions, owing to the recyclability, durability, and suitability across various industries, particularly in terms of personal care and beverages. Hence, such instances position the U.K. as the predominant leader in the international aluminum beverage packaging sector.