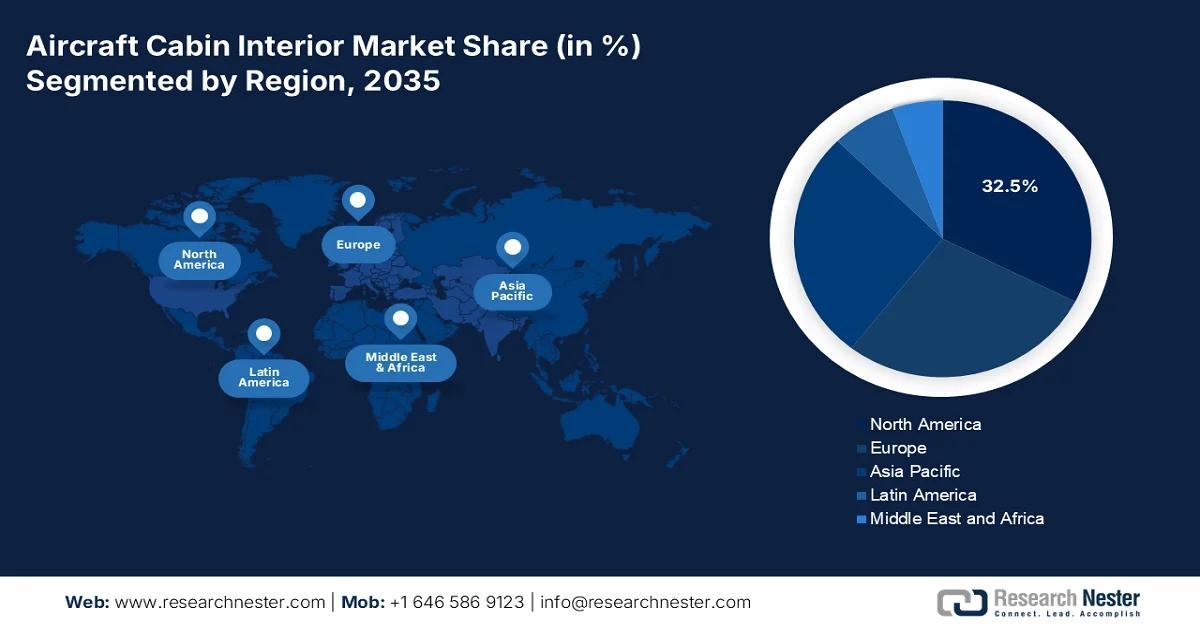

Aircraft Cabin Interior Market - Regional Analysis

North America Market Insights

The North America aircraft cabin interior market is dominating and the largest, and is expected to hold the regional revenue share of 32.5% by 2035. The regional dominance is due to the demand for high-volume narrow-body aircraft orders and intensive retrofit cycles. The primary driver is the replacement cycle for aging single-aisle fleets, coupled with the airline strategies to maximize revenue via premium cabin upgrades and enhanced passenger experience systems. further the key trend is the integration of advanced connectivity and lightweight sustainable materials to comply with operational efficiency goals. Moreover, the market is supported by the substantial defense and government spending on special mission aircraft and VIP transport modifications. Additionally, the regulatory environments that are set by the FAA ensure continuous upgrades for safety and accessibility.

The U.S. market is closely tied to the fleet utilization, regulatory compliance, and airline capital expenditure, which is supported by the government-reported data. According to the U.S. Bureau of Transportation Statistics, March 2025 data, the U.S. airlines carried over 83.3 million passengers in December, indicating a sustained recovery and increased aircraft utilization that accelerates cabin wear and refurbishment demand. Besides, the FAA 2024 to 2044 report depicts that the U.S. commercial aircraft fleet grew by 11% in 2022-2023. Further, the total number of commercial aircraft is expected to rise from 7,572 in 2023 to 10,793 in 2044, with narrowbody aircraft accounting for the majority of domestic operations, driving the frequent interior maintenance cycles. Together, there is a high demand for the certified cabin interior components in the U.S. market.

The market in Canada is supported by the rising passenger traffic, fleet activity, and regulated maintenance requirements reported by the government agencies. According to the Government of Canada's January 2026 report, Canada airlines carried over 150.7 million passengers in 2023, reflecting a strong recovery and an increase in aircraft utilization across domestic and transborder routes. Further, the Government of Canada in October 2025 indicates that nearly 1,889 aerodromes, including National Airports System airports, handle nearly 90% of all scheduled passengers and cargo, intensifying aircraft utilization and cabin wear. Additionally, the 34,000 registered civil aircraft is requiring the ongoing cabin safety inspections and component compliance under the Aeronautics Act. These data ensure a high aftermarket demand for seating panels and cabin systems, both in major and regional carriers.

APAC Market Insights

The aircraft cabin interior market in Asia Pacific is the fastest growing and is poised to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The dominance is due to the active fleet expansion by low-cost and full-service carriers and rising MRO investments in aircraft. The core demand stems from massive narrow-body aircraft orders from India and China carriers to service the domestic and regional routes, creating a sustained line-fit demand. Moreover, the key drivers include government-led aviation infrastructure development, establishment of local aerospace manufacturing clusters ad increasing passenger expectations for enhanced in-flight experience. Further, the vital trend is the localization of the supply chain with global OEMs and establishing production facilities in the region to be closer to key customers and reduce costs. Overall, the significant investments drive the aftermarket demand in the market.

The market in India is driven by the rapid passenger growth, fleet expansion, and regulatory oversight under the national aviation authorities. As stated in the PIB July 2024 data, the India airports handled over 37.6 crore passengers in 2024, reflecting a strong post pandemic recovery and sharply increasing aircraft utilization on domestic and regional routes. Further, the IBEF November 2024 report states that the aircraft fleet has increased by 5 times in the past 20 years, accounting for a majority of operations in narrowbody aircraft, leading to high cabin wear due to the short-haul high-frequency usage. Meanwhile, the country has expanded the aircraft deployment in major cities. Overall, the aircraft cabin market in India is expected to have a high growth opportunity in the region.

The market in China is supported by the large-scale passenger traffic and continued fleet expansion. According to the People’s Republic of China January 2024 report, China’s civil aviation sector handled over 620 million passengers in 2023, reflecting a strong recovery and significantly increasing the aircraft utilization across domestic and international routes. Besides, the data from Xinhua in August 2024 indicates that China’s commercial transport fleet is expected to grow annually from 4,345 to 9,740, making it one of the largest regulated fleets globally and a sustained source of cabin inspection and refurbishment demand. Moreover, the state-supported airport infrastructure expansion increases the aircraft rotations and maintenance cycles. Therefore, China is driving a continued B2B demand and boosting the market for further growth.

Europe Market Insights

Aircraft cabin interior market in Europe is expanding significantly with a strong consolidated aerospace industrial base and stringent EASA regulatory standards. The demand is further propelling the production rates of Airbus in France, Spain, Germany, and the UK, along with a large installed base of aircraft undergoing mandatory safety retrofits and airline upgrades to improve competitiveness. Moreover, the fleet renewal programs by the major European legacy carriers, with the growth from the low-cost operators, sustain both the line fit and retrofit demand. Further, the market is supported by substantial defense and government spending on transport, surveillance, and head-of-state aircraft, which require specialized, mission-specific interiors. The supply chain regionalization for the components and investment in digital MRO capabilities are shaping the market with suitable uplift and exposure.

The market in Germany is driven by the high passenger volumes, a large commercial fleet, and strict regulatory oversight aligned with the EU aviation standards. According to the Aviation Direct report in February 2025, Germany has handled over 2024 million passengers, reflecting a strong rebound and increasing aircraft utilization across short and long haul routes. Additionally, the sustained growth in the commercial flight movements increases carbon wear and stimulates the refurbishment cycles on high-frequency routes. Besides, the commercial aircraft in Germany are subjected to cabin safety, fire resistance, and accessibility inspections, driving the non discretionary interior upgrades. Overall, the data indicate there is a strong aftermarket demand for cabin interiors in aircraft.

The UK market is supported by the high passenger throughput, a sizable active fleet, and strong regulatory oversight under national and EU-aligned aviation frameworks. According to the Government of Wales May 2024 report, UK airports handled over 272.8 million passengers in 2023, marking a strong recovery and increasing aircraft utilization across domestic European long-haul networks. Besides, the UK-registered commercial aircraft are subject to mandatory cabin safety, fire resistance, and accessibility compliance, driving the recurring interior inspections and refurbishment cycles. Moreover, the high traffic concentration at the major hubs handle significant share of UK passenger volumes, further shortening cabin replacement intervals and sustaining aftermarket demand.