Aircraft Cabin Interior Market Outlook:

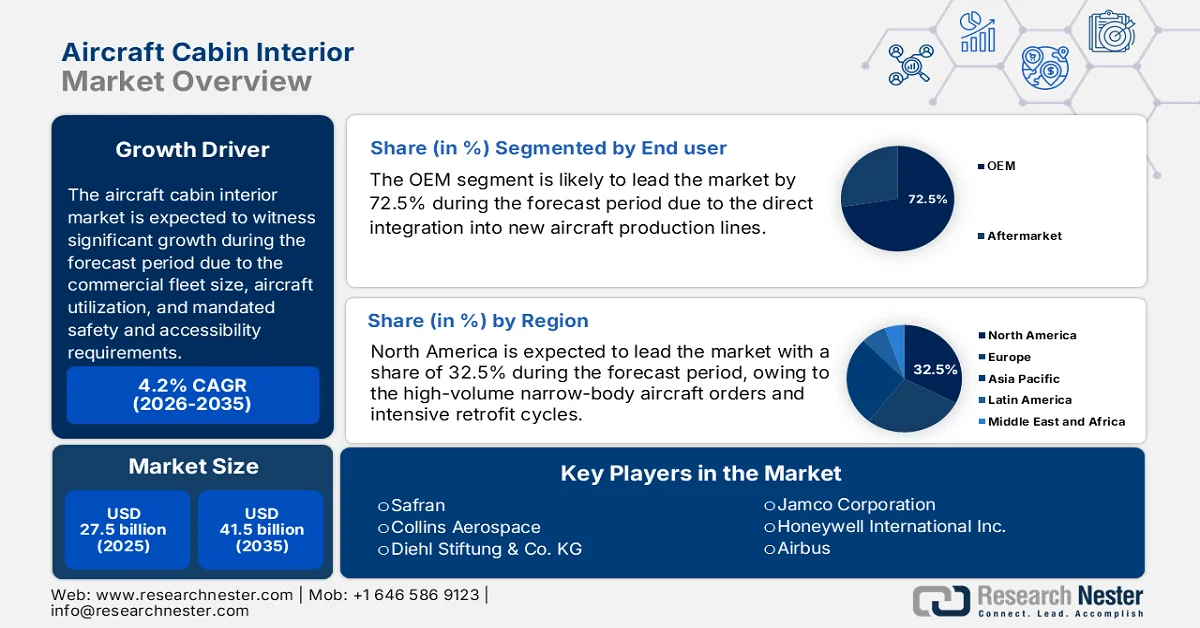

Aircraft Cabin Interior Market size was valued at USD 27.5 billion in 2025 and is projected to reach USD 41.5 billion by the end of 2035, rising at a CAGR of 4.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of aircraft cabin interior is estimated at USD 28.6 billion.

The global aircraft cabin interior market is structurally linked to commercial fleet size, aircraft utilization, and mandated safety and accessibility requirements set by the aviation authorities. According to the IATA August 2025 data, the global commercial fleet exceeds 35,550 aircraft, which includes 30,300 active units. Moreover, the narrowbody aircraft accounts for more than 60% of the total deliveries due to short and medium-haul route expansion. Besides the Bureau of Transportation Statistics, in March 2023, data depict that the U.S. carried nearly 853 million passengers in 2022, exceeding the pre-pandemic levels, which has stimulated the aircraft reactivation cabin refurbishment and deferred interior retrofits across legacy fleets. Additionally, this reactivation and refurbishment cycle is driving significant demand for cabin interior products within the maintenance, repair, and overhaul (MRO) segment of the market.

Further, the IATA June 2025 report indicates that in India, the air traffic levels exceed by 10.9%, reinforcing the sustained utilization pressure on seating, lighting, lavatories, galleys, and in-flight service equipment. The regulatory requirements related to flammability, crashworthiness, and accessibility continue to drive the standardized replacement cycles and compliance-driven upgrades supporting the recurring B2B demand from airlines, leasing companies, and maintenance, repair, and overhaul providers. Moreover, the U.S. airlines have spent billions on aircraft and related parts, a category that includes interior retrofits during heavy maintenance checks. Additionally, the aircraft lease rates are extending the aftermarket for interiors. Overall, the market is expanding with fleet growth, lifecycle maintenance, and regulatory compliance.

Growth of Air Traffic in India (2021-2024)

|

Year |

Percentage |

|

2021 |

28 |

|

2022 |

66 |

|

2023 |

18 |

|

2024 |

10 |

Source: IATA June 2025

Key Aircraft Cabin Interior Market Insights Summary:

Regional Highlights:

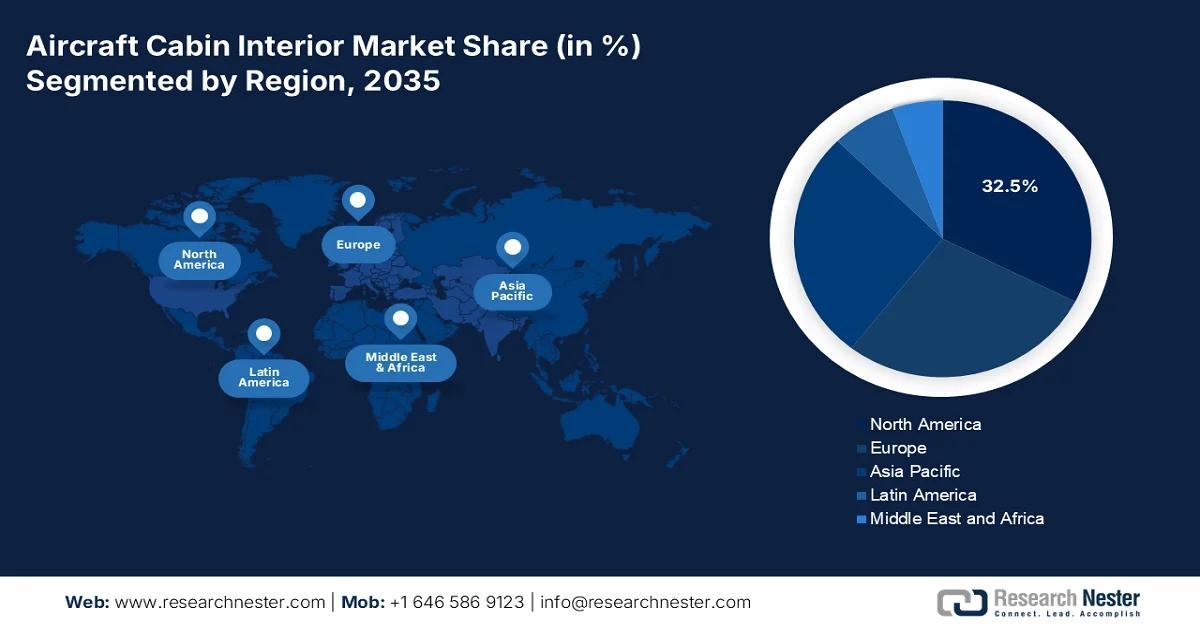

- North America is projected to command a 32.5% revenue share by 2035 in the aircraft cabin interior market, underpinned by large-scale narrow-body aircraft demand and recurring retrofit programs, reinforced by fleet replacement cycles and premium cabin enhancement strategies.

- Asia Pacific is anticipated to expand at a CAGR of 6.1% during 2026–2035, supported by aggressive fleet expansion from low-cost and full-service carriers, amplified by government-led aviation infrastructure development and localized aerospace manufacturing initiatives.

Segment Insights:

- The OEM segment under the end user category is forecast to account for a dominant 72.5% share by 2035 in the aircraft cabin interior market, strengthened by direct integration with new aircraft production lines, catalyzed by relentless narrow-body fleet expansion and next-generation cabin innovation adoption.

- The line fit sub-segment within the fit category is expected to retain the largest market share by 2035, sustained by continuous high-volume aircraft manufacturing rates, reinforced by airline preference for certified, cost-efficient factory-installed interior solutions.

Key Growth Trends:

- Growth in global commercial aircraft fleet

- Government supported airline recovery and capital expenditure program

Major Challenges:

- Robust and costly certification processes

- Extreme development costs and investment intensity

Key Players: Safran (France), Collins Aerospace (U.S.), Diehl Stiftung & Co. KG (Germany), Jamco Corporation (Japan), Honeywell International Inc. (U.S.), Airbus (France), Boeing (U.S.), GKN Aerospace (UK), Thales Group (France), Recaro Holding (Germany), Zodiac Aerospace (France), Panasonic Avionics Corporation (U.S.), STG Aerospace (UK), Geven S.p.A. (Italy), HAECO (Hong Kong), AIM Altitude (UK), Thompson Aero Seating (UK), B/E Aerospace (USA) [Now part of Collins Aerospace], FACC AG (Austria), Aviointeriors S.p.A. (Italy).

Global Aircraft Cabin Interior Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.5 billion

- 2026 Market Size: USD 28.6 billion

- Projected Market Size: USD 41.5 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, Japan

- Emerging Countries: India, China, Japan, South Korea, Brazil

Last updated on : 5 February, 2026

Aircraft Cabin Interior Market - Growth Drivers and Challenges

Growth Drivers

- Growth in global commercial aircraft fleet: The government aviation authorities project sustained fleet expansion, directly increasing the demand for cabin interiors across the line fit and retrofit programs. According to the ARSA 2022 to 2032 report, the global commercial aircraft fleet is expected to exceed 28,000 aircraft, driven mainly by the narrowbody aircraft used on short and medium haul routes. These aircraft require high-frequency interior replacements due to faster utilization cycles. Additionally, the U.S. air carrier aircraft utilization is rising steadily, increasing the wear on seats, panels, and lavatories. Besides, this translates into predictable long-term procurement cycles for certified interior components, mainly for leasing companies and MROs managing aging assets. Additionally, stringent safety, fire retardancy, and weight reduction regulations imposed by global aviation authorities are stimulating the adoption of advanced composite and lightweight interior materials, further boosting the demand for replacement in the market.

Narrowbody Fleet Summary

|

Region |

Fleet |

|

Africa |

430 |

|

Middle East |

505 |

|

APAC |

1,690 |

|

North America |

4,062 |

|

Europe |

3,931 |

Source: ARSA 2022 to 2032 report

- Government supported airline recovery and capital expenditure program: Post-pandemic recovery programs funded or supported by governments have revived airline capital expenditure. As per the report from the U.S. Department of Transportation in September 2023, nearly 14.8 million was allocated towards the air service development program, stabilizing balance sheets, and enabling deferred maintenance and interior upgrades to resume. Similarly, the state-backed carriers in the Middle East and Asia have surged in cabin modernization to restore their international operations. While the funds are allocated for all the service the government-backed liquidity directly enables the aircraft reactivation, which requires cabin inspection, refurbishment, and component replacement. These data directly stimulate the market and boost the compliance checks and refurbishment cycles.

- Growth in air travel driving utilization intensity: Government traffic statistics directly correlate with the market. As stated in the U.S. Bureau of Transportation Statistics in May 2024, approximately USD 7.8 billion is gained by the U.S. airlines, which drives the revenue growth translated into higher flight frequencies and aircraft utilization, which the BTS links to increased wear on seating, flooring, and galley equipment, thereby shortening cabin interior replacement and refurbishment cycles across high-density domestic fleets. Besides, the high aircraft utilization reduces the interior replacement intervals mainly for high-density single-aisle fleets. From a procurement standpoint, the airlines prioritize the durability and lifecycle cost over customization, reshaping the supplier value propositions.

Challenges

- Robust and costly certification processes: Entering into the aircraft cabin interior market requires navigating the rigorous aviation authority certification, which are time consuming and costly. Moreover, a single seat certification can cost over billions and take months to years. New players or startup companies in the market need to invest heavily in the compliance teams and testing facilities before generating revenue. Many startup companies have struggled with certification complexities for their hybrid electric regional jet concept, including cabin systems, contributing to its pause in operations despite early backing.

- Extreme development costs and investment intensity: Developing flight-worthy lightweight interior components demand massive R&D and capital investment in advanced materials and manufacturing processes. The ROI horizon is long and risky. Though the market is set grow, high suppliers should invest a certain percentage of their revenue in R&D, which is a barrier for the smaller firms.

Aircraft Cabin Interior Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 27.5 billion |

|

Forecast Year Market Size (2035) |

USD 41.5 billion |

|

Regional Scope |

|

Aircraft Cabin Interior Market Segmentation:

End user Segment Analysis

Under the end user segment, the OEM is leading in the market and is poised to hold the share of 72.5% by 2035. The dominance is due to the direct integration into new aircraft production lines. The massive backlog for new fuel-efficient aircraft from Airbus and Boeing ensures sustained high volume demand for cabin interiors from OEMs. A key driver is the relentless fleet expansion, mainly of narrow-body aircraft, which are manufactured with complete interior packages. Besides, OEMs are focusing on innovative designs, including next-gen entertainment systems, modular seating, and smart cabin technologies to meet the expectations of the customers. Moreover, the adoption of eco-friendly materials and energy efficiency systems in the cabin interiors is driving the push for fuel efficiency and sustainability. As global air travel demand rises, the OEM segment remains a vital driver of advanced aircraft modernization and interior development.

Fit Segment Analysis

Within the fit segment, the line fit sub-segment is leading and is poised to hold the largest share value in the market. The dominance is directly tied to recording the production rates and order backlogs at the major airframes, making line fit a continuous high-volume revenue stream for suppliers. Besides, the airlines mostly prefer line fit installations for efficiency cost effectiveness and guaranteed certification compliance. A pivotal statistical driver is the sustained pace of new aircraft manufacturing. According to the FAA 2023 to 2043 data, the active U.S. commercial fleet exceeded 6,852 in 2022 and 10,286 in 2043. This data directly supports the high demand for line-fit interiors integral to each new airframe. Moreover, the production ensures the line fit segment’s continued leadership.

Material Segment Analysis

Composite materials represent the leading sub-segment within the market and are driven by the industry’s imperative for weight reduction to enhance fuel efficiency and meet environmental goals. Their superior strength to weight ration allows for innovative, lighter designs in panels, bins, and seating without compromising safety or durability. The adoption is surging due to the sustainability mandates and next-gen aircraft programs that specify advanced material use. According to the FAA March 2024 report, the composite materials allow the design of parts and structures to address the challenges related to the strength, weight, flexibility, and more in traditional materials, and also simplify the advanced components and structures. This evolution is significant for achieving the aviation industry’s goal of net-zero carbon emissions.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Aircraft Type |

|

|

Fit |

|

|

Material |

|

|

End user |

|

|

Cabin Class |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Cabin Interior Market - Regional Analysis

North America Market Insights

The North America aircraft cabin interior market is dominating and the largest, and is expected to hold the regional revenue share of 32.5% by 2035. The regional dominance is due to the demand for high-volume narrow-body aircraft orders and intensive retrofit cycles. The primary driver is the replacement cycle for aging single-aisle fleets, coupled with the airline strategies to maximize revenue via premium cabin upgrades and enhanced passenger experience systems. further the key trend is the integration of advanced connectivity and lightweight sustainable materials to comply with operational efficiency goals. Moreover, the market is supported by the substantial defense and government spending on special mission aircraft and VIP transport modifications. Additionally, the regulatory environments that are set by the FAA ensure continuous upgrades for safety and accessibility.

The U.S. market is closely tied to the fleet utilization, regulatory compliance, and airline capital expenditure, which is supported by the government-reported data. According to the U.S. Bureau of Transportation Statistics, March 2025 data, the U.S. airlines carried over 83.3 million passengers in December, indicating a sustained recovery and increased aircraft utilization that accelerates cabin wear and refurbishment demand. Besides, the FAA 2024 to 2044 report depicts that the U.S. commercial aircraft fleet grew by 11% in 2022-2023. Further, the total number of commercial aircraft is expected to rise from 7,572 in 2023 to 10,793 in 2044, with narrowbody aircraft accounting for the majority of domestic operations, driving the frequent interior maintenance cycles. Together, there is a high demand for the certified cabin interior components in the U.S. market.

The market in Canada is supported by the rising passenger traffic, fleet activity, and regulated maintenance requirements reported by the government agencies. According to the Government of Canada's January 2026 report, Canada airlines carried over 150.7 million passengers in 2023, reflecting a strong recovery and an increase in aircraft utilization across domestic and transborder routes. Further, the Government of Canada in October 2025 indicates that nearly 1,889 aerodromes, including National Airports System airports, handle nearly 90% of all scheduled passengers and cargo, intensifying aircraft utilization and cabin wear. Additionally, the 34,000 registered civil aircraft is requiring the ongoing cabin safety inspections and component compliance under the Aeronautics Act. These data ensure a high aftermarket demand for seating panels and cabin systems, both in major and regional carriers.

APAC Market Insights

The aircraft cabin interior market in Asia Pacific is the fastest growing and is poised to grow at a CAGR of 6.1% during the forecast period 2026 to 2035. The dominance is due to the active fleet expansion by low-cost and full-service carriers and rising MRO investments in aircraft. The core demand stems from massive narrow-body aircraft orders from India and China carriers to service the domestic and regional routes, creating a sustained line-fit demand. Moreover, the key drivers include government-led aviation infrastructure development, establishment of local aerospace manufacturing clusters ad increasing passenger expectations for enhanced in-flight experience. Further, the vital trend is the localization of the supply chain with global OEMs and establishing production facilities in the region to be closer to key customers and reduce costs. Overall, the significant investments drive the aftermarket demand in the market.

The market in India is driven by the rapid passenger growth, fleet expansion, and regulatory oversight under the national aviation authorities. As stated in the PIB July 2024 data, the India airports handled over 37.6 crore passengers in 2024, reflecting a strong post pandemic recovery and sharply increasing aircraft utilization on domestic and regional routes. Further, the IBEF November 2024 report states that the aircraft fleet has increased by 5 times in the past 20 years, accounting for a majority of operations in narrowbody aircraft, leading to high cabin wear due to the short-haul high-frequency usage. Meanwhile, the country has expanded the aircraft deployment in major cities. Overall, the aircraft cabin market in India is expected to have a high growth opportunity in the region.

The market in China is supported by the large-scale passenger traffic and continued fleet expansion. According to the People’s Republic of China January 2024 report, China’s civil aviation sector handled over 620 million passengers in 2023, reflecting a strong recovery and significantly increasing the aircraft utilization across domestic and international routes. Besides, the data from Xinhua in August 2024 indicates that China’s commercial transport fleet is expected to grow annually from 4,345 to 9,740, making it one of the largest regulated fleets globally and a sustained source of cabin inspection and refurbishment demand. Moreover, the state-supported airport infrastructure expansion increases the aircraft rotations and maintenance cycles. Therefore, China is driving a continued B2B demand and boosting the market for further growth.

Europe Market Insights

Aircraft cabin interior market in Europe is expanding significantly with a strong consolidated aerospace industrial base and stringent EASA regulatory standards. The demand is further propelling the production rates of Airbus in France, Spain, Germany, and the UK, along with a large installed base of aircraft undergoing mandatory safety retrofits and airline upgrades to improve competitiveness. Moreover, the fleet renewal programs by the major European legacy carriers, with the growth from the low-cost operators, sustain both the line fit and retrofit demand. Further, the market is supported by substantial defense and government spending on transport, surveillance, and head-of-state aircraft, which require specialized, mission-specific interiors. The supply chain regionalization for the components and investment in digital MRO capabilities are shaping the market with suitable uplift and exposure.

The market in Germany is driven by the high passenger volumes, a large commercial fleet, and strict regulatory oversight aligned with the EU aviation standards. According to the Aviation Direct report in February 2025, Germany has handled over 2024 million passengers, reflecting a strong rebound and increasing aircraft utilization across short and long haul routes. Additionally, the sustained growth in the commercial flight movements increases carbon wear and stimulates the refurbishment cycles on high-frequency routes. Besides, the commercial aircraft in Germany are subjected to cabin safety, fire resistance, and accessibility inspections, driving the non discretionary interior upgrades. Overall, the data indicate there is a strong aftermarket demand for cabin interiors in aircraft.

The UK market is supported by the high passenger throughput, a sizable active fleet, and strong regulatory oversight under national and EU-aligned aviation frameworks. According to the Government of Wales May 2024 report, UK airports handled over 272.8 million passengers in 2023, marking a strong recovery and increasing aircraft utilization across domestic European long-haul networks. Besides, the UK-registered commercial aircraft are subject to mandatory cabin safety, fire resistance, and accessibility compliance, driving the recurring interior inspections and refurbishment cycles. Moreover, the high traffic concentration at the major hubs handle significant share of UK passenger volumes, further shortening cabin replacement intervals and sustaining aftermarket demand.

Key Aircraft Cabin Interior Market Players:

- Safran (France)

- Collins Aerospace (U.S.)

- Diehl Stiftung & Co. KG (Germany)

- Jamco Corporation (Japan)

- Honeywell International Inc. (U.S.)

- Airbus (France)

- Boeing (U.S.)

- GKN Aerospace (UK)

- Thales Group (France)

- Recaro Holding (Germany)

- Zodiac Aerospace (France)

- Panasonic Avionics Corporation (U.S.)

- STG Aerospace (UK)

- Geven S.p.A. (Italy)

- HAECO (Hong Kong)

- AIM Altitude (UK)

- Thompson Aero Seating (UK)

- B/E Aerospace (USA) [Now part of Collins Aerospace]

- FACC AG (Austria)

- Aviointeriors S.p.A. (Italy)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Safran is a dominant player in the aircraft cabin interior market, mainly via its Safran Seats division. A key strategic initiative is its heavy investment in lightweight composite materials and modular seat design to reduce aircraft fuel burn and offer airlines customized cabin configurations. These innovations extend to integrating advanced passenger wellness features to enhance the experience. According to the 2024 annual report, the company has made a revenue of €27,317 million.

- Collins Aerospace is a leading systems integrator in the aircraft cabin interior market, offering a comprehensive portfolio from seats and galley systems to advanced lighting and oxygen solutions. Their core strategy focuses on creating a connected cabin ecosystem where all interior systems share data to enhance operational efficiency and passenger comfort.

- Diehl Stiftung & Co.KG holds a significant position in the aircraft cabin interior market as a specialist in high-quality cabin lighting and air management systems. Their strategic focus is on developing innovative energy-efficient LED lighting solutions that are similar to the natural circadian rhythms to reduce passenger jet lag. In 2024, the company’s sales increased to €4,695.8 million, which is 20.9% higher than the previous year.

- Jamco Corporation is a major tier one supplier in the aircraft cabin interior market, renowned for its lavatory, galley, and stowage systems. A central strategic initiative involves the development of smart and hygienic cabin monuments. This includes integrating touchless technology and antimicrobial surfaces into lavatories as well as designing galleys with embedded sensors.

- Honeywell International Inc is a pivotal player in the aircraft cabin interior market, primarily via its advanced connectivity, air management, and health monitoring systems. A critical strategic move is its development of the Honeywell Forge connected cabin platform, which aggregates data from thousands of interior sensors. This data is analyzed to optimize cabin climate control, predict maintenance for components, and enhance passenger comfort.

Here is a list of key players operating in the global market:

The global aircraft cabin interior market is highly competitive and consolidated, dominated by various aerospace giants and some specialized subsystems players. The players from the U.S. and Europe hold the largest share of the market and are driven by deep integration with OEMs such as Boeing and Airbus. The strategic initiatives are highly focused on lightweight composite materials for customized design, fuel efficiency, and modularity for airline differentiation. Further, the growing emphasis on passenger experience has stimulated investments in advanced in-flight entertainment connectivity and LED lighting solutions. Moreover, mergers and acquisitions and long term supply agreements are common strategies to expand the product portfolios and secure market position, while the players in APAC are increasingly competing based on the cost-effective manufacturing centers. Besides, in December 2025, AAR acquired Aircraft Reconfig Technologies, expanding its engineering and certification capabilities and creating additional revenue streams.

Corporate Landscape of the Aircraft Cabin Interior Market:

Recent Developments

- In January 2026, Air India unveiled the custom-styled cabin interiors of its first line-fit Boeing 787-9 aircraft. Bearing registration mark VT-AWA, the new aircraft features completely new cabin interiors, designed especially for Air India and installed directly on Boeing's production line.

- In December 2025, ACM Aerospace has announced the launch of senseRest, a revolutionary in-flight wellbeing solution designed for premium airline cabins. senseRest is based on a soft, aviation-ready mattress that can be easily placed on existing premium seats, providing passengers with enhanced comfort, real-time monitoring, and personalized feedback, without any cabin modifications.

- In April 2025, Riyadh Air reveals world-class guest experience with striking interior cabin designs. The design combines high quality and the latest technology with industry-leading lighting and audio, including integrated suite lighting and embedded headrest speakers, for Business and Business Elite.

- Report ID: 178

- Published Date: Feb 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Cabin Interior Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.