Air Conditioning Market Outlook:

Air Conditioning Market size was valued at USD 184.1 billion in 2025 and is projected to reach USD 342.3 billion by the end of 2035, rising at a CAGR of 6.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of air conditioning is estimated at USD 195.8 billion.

The global market is expanding widely due to the high adoption rate in residential and commercial buildings across both developed and emerging nations. As per the U.S. Energy Information Administration data in May 2022, 90% of the U.S. households use air conditioning. The report also depicts that the usage varies regionally, as the Midwest Census Region and the South Census Region households use a high percentage of AC at 92% and 93%. The lowest percentage is seen in the West Census Region with 73%. Furthermore, air conditioning systems account for about 12% of residential energy usage in commercial markets, highlighting the efficiency and demand considerations for industrial buyers. The U.S. market reflects a steady modernization by utilizing advanced equipment patterns across climatic zones.

The market is revolving towards the higher efficiency systems, which is aided by the government energy standards and voluntary performance labeling programs. The U.S. Department of Energy data states that its updated energy conservation standards for commercial air conditioners are expected to yield substantial energy cost savings for businesses. This regulatory push surges the adoption of advanced technologies that optimize energy use, directly impacting operational expenditures. Additionally, groups such as the American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE) revise building performance and ventilation standards on a regular basis, which in turn determine requirements for new AC installations and retrofits in commercial buildings. This creates a market environment where lifecycle cost, energy performance, and regulatory adherence are paramount purchasing criteria for B2B clients.

Key Air Conditioning Market Insights Summary:

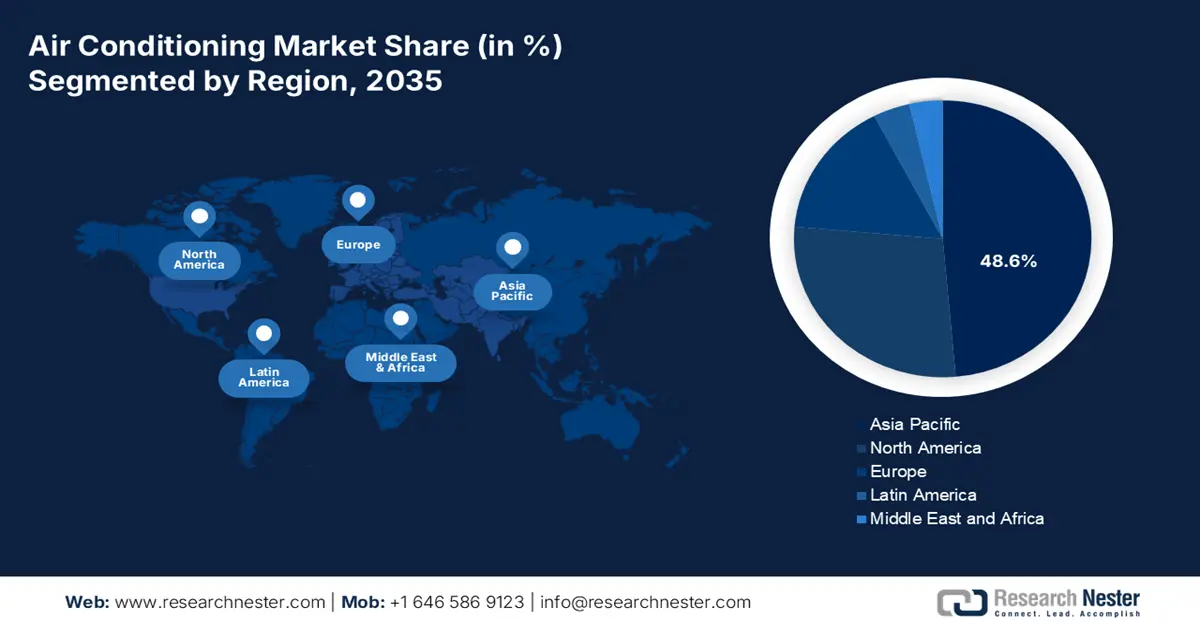

Regional Insights:

- Asia Pacific is anticipated to command a 48.6% share by 2035 in the air conditioning market, underpinned by escalating temperatures, rapid urban expansion, and extensive construction activity across major economies.

- North America is projected to witness the fastest CAGR of 5.2% during 2026–2035, supported by stringent efficiency standards, accelerating heat-pump adoption, and strong demand for smart, integrated AC systems.

Segment Insights:

- By 2035, the technology segment is led by inverter ACs, expected to secure a 65.7% share in the air conditioning market, bolstered by their higher energy efficiency and variable-speed compressor performance.

- The residential end-user segment is poised to retain a substantial share during 2026–2035, reinforced by climate-driven demand, urbanization, and supportive government incentives for high-efficiency installations.

Key Growth Trends:

- Regulatory push for energy efficiency and refrigerant transition

- Climate change and escalating cooling degree days

Major Challenges:

- Inconsistent global energy standards

- Skilled installer shortage and quality control

Key Players: Mitsubishi Electric (Japan), Fujitsu General (Japan), Panasonic (Japan), Midea Group (China), Gree Electric (China), Haier (China), LG Electronics (South Korea), Samsung Electronics (South Korea), Johnson Controls-Hitachi Air Conditioning (Japan), Blue Star (India), Voltas (India), Carrier Global Corporation (USA), Trane Technologies (USA), Lennox International (USA), Rheem Manufacturing (USA), Bosch Thermotechnology (Germany), Vaillant Group (Germany), Seeley International (Australia), O.Y.L. Industries (Malaysia).

Global Air Conditioning Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27 billion

- 2026 Market Size: USD 28.5 billion

- Projected Market Size: USD 47 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (48.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, Saudi Arabia

Last updated on : 13 November, 2025

Air Conditioning Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory push for energy efficiency and refrigerant transition: The government’s mandated energy performance is the key growth driver for AC replacement and innovation. Agencies such as the U.S. Department of Energy have provided a minimum efficiency requirement, forcing businesses to invest in advanced and high-efficiency systems to reduce operational costs and comply with regulations. Further, the global phasedown of hydrofluorocarbon refrigerants is pushing a strong technological shift. Businesses must consider future-proof equipment that uses lower GWP refrigerants to avoid regulatory non-compliance and rising refrigerant costs influence the capital expenditure planning directly for building HVAC systems.

- Climate change and escalating cooling degree days: The increasing frequency and intensity of heatwaves, which are quantified by a rise in the cooling degree days. This creates a fundamental, weather-driven demand for mechanical cooling. The National Oceanic and Atmospheric Administration reports that record-breaking global temperatures translate to longer and more intense cooling seasons. As per the Homepros data in January 2025, U.S. cooling degree days rose by 12% compared with 2023. This not only expands the AC market but also increases the cooling load and operational runtime for existing systems in already warm climates, surging the demand for both new installations and replacement units in the industrial and commercial sectors.

- Technological Advancements: The integration of inverter compressor technology and AI-driven predictive maintenance is optimizing energy usage and enhancing the operational efficiency of AC systems globally. This increases the demand for advanced equipment with connectivity and smart features by lowering the operating costs and extending the system's lifespan. According to the Haier data from September 2024, inverter compressors are leading the market demand. These compressors are stated to provide precise temperature control, lower noise, and the fastest controlling system, saving energy up to 35%.

Challenges

- Inconsistent global energy standards: Manufacturers face challenges due to the fragmented landscape of energy efficiency standards. This requires specific product design and compliance testing. Further, the increase in R&D costs makes the supply chain more complex and limits the economies of scale. A manufacturer must create various variants of a single model, raising the barrier to global expansion. Companies like Carrier manage this through modular product platforms that can be adapted with different components to meet diverse regional regulatory requirements from a common base design.

- Skilled installer shortage and quality control: Poor installation reduces the efficiency of the air conditioner, hence undermining the value of high-efficiency products and government energy goals. There is a global shortage of technicians trained to handle the new refrigerants and complex RF systems. Furthermore, various reports depict that proper maintenance is required to prevent health-related issues such as Legionnaires' disease. Giant players invest heavily in certified installer training programs to ensure system performance, protect the brand reputation, and align with public health guidelines for indoor air quality.

Air Conditioning Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 184.1 billion |

|

Forecast Year Market Size (2035) |

USD 342.3 billion |

|

Regional Scope |

|

Air Conditioning Market Segmentation:

Technology Segment Analysis

Under the technology segment, inverter ACs are the dominant ones and are expected to hold a share value of 65.7% by 2035. This dominance is due to their superior energy efficiency, providing significant electricity cost savings and enhanced comfort via variable speed compressor operation. LG Electronics announced the introduction of AI Dual Inverter air conditioners in February 2022. AI powers the device, which is the newest line of air conditioners with several built-in sensors and improved, variable-speed twin rotary compressor technology to deliver optimal cooling. This type of air conditioner is designed to improve the health of the consumer while being energy efficient.

End user Segment Analysis

Residential are leading the end user segment and is poised to hold a significant share in the market during the forecast period. Economic development and climate change are the key factors driving the segment. Rising global temperatures and intense heatwaves are transforming air conditioning from a luxury into a necessity for health and safety, particularly in urban areas. Growing urbanization and rising disposable incomes in populous emerging economies exacerbate this, making mass-market adoption possible. Additionally, home retrofits and new installations are being actively encouraged by government energy efficiency initiatives, such as subsidy programs for high-efficiency heat pumps. These factors collectively ensure sustained and robust demand from the residential sector, solidifying its leading revenue share.

Product Type Segment Analysis

The split system holds the largest share in the product type segment. The segment is propelled by its ideal fit for global urbanization trends. Its two-unit design offers superior energy efficiency and quieter operation compared to single-unit alternatives, making it perfectly suited for cooling individual rooms in apartments and homes. This relies with the growing urban population's needs and is a key solution for both new construction and retrofit projects. Additionally, the split AC's ductless installation and inverter technology enhance energy savings while supporting the space constraints of urban living. Manufacturers innovate with smart features and boost the adoption in the expanding middle-class residential segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

End user |

|

|

Distribution Channel |

|

|

Refrigerant |

|

|

Tonnage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Conditioning Market - Regional Analysis

APAC Market Insights

Asia Pacific is dominating the market and is expected to hold the market share of 48.6% by 2035. The growth drivers of the market are rising temperatures and rapid urbanization. Further, extensive commercial and residential construction in India, China, and Southeast Asia, where middle-class populations are surging and is boosting the demand for both residential and commercial AC systems. Energy efficiency and environmental concerns are promoting the adoption of advanced, eco-friendly technologies like variable refrigerant flow (VRF) systems and smart controls. The retail and healthcare industries also make substantial contributions; the latter is expanding quickly as a result of stringent temperature control regulations. Governments push for green building certifications to propel the market growth, and position APAC as the dominant global market.

The air conditioning market in China is the global leader in the APAC and is prominently driven by the replacement demand and the government’s dual carbon goals. The focus is transitioning to the inverter models and units by utilizing the environmentally friendly R32 refrigerant. According to the OEC 2023 data, China has exported USD 22.3 billion worth of air conditioners, highlighting the rising demand for market growth and innovation. Further, the CLASP data in June 2023 has depicted that China is the largest consumer and producer of air conditioners. To justify this, the report has provided evidence stating that in 2021, China produced 82% of the room air conditioners. This immense production volume solidifies its unassailable position in the global supply chain.

China Export Data on Room Air Conditioners from 2018 to 2022

|

Year |

Units (million) |

|

2018 |

58.0 |

|

2019 |

55.1 |

|

2020 |

59.2 |

|

2021 |

65.0 |

|

2022 |

61.2 |

Source: CLASP June 2023

The air conditioning market in India is the leading air conditioning market and is fueled by the rising temperatures and urbanization. The government’s robust energy standards and rapid shift of consumer preferences towards higher efficiency inverter ACs dominated the new sales. According to the NDMA report in February 2024, India is the first country to develop a cooling action plan to reduce the demand and enhance energy efficiency. Further, firms are actively expanding their footprint through strategic investments in local manufacturing and distribution networks. For example, LG Electronics India starts local manufacturing of Dual Inverter Air Conditioner Compressors and invests approximately INR 100 crores in March 2023. The company is always leading the market with its technological leadership. Major players are launching affordable inverter series specifically for the price-sensitive market, ensuring this growth trajectory continues across both urban and expanding rural demographics.

North America Market Insights

North America is witnessed to be the fastest-growing market and is expected to grow at a CAGR of 5.2% during the forecast period 2026 to 2035. The market is fueled by the rising average temperatures, strong federal energy efficiency standards, and commercial construction. Rapid adoption of high-efficiency inverters and heat pump systems is the key trend driving the market expansion. To maximize energy use, the smart AC market is growing and merging with home automation. Further, the replacement of aging R22 refrigerant units with R410A and lower-GWP alternatives is a major market driver, alongside resilience-focused demand in regions facing extreme heat events.

U.S. market is propelled by the strong shift towards climate resilience and efficiency systems. The U.S. Department of Energy data in 2023 depicts that 88% of the homes in the U.S. have air conditioning, and nearly 66% have central systems in their home. Further, air conditioning uses 12% of the electricity in U.S. households. With this rising adoption, manufacturers are actively launching innovative and upgraded air conditioning systems. For example, Panasonic has announced that its Heating & Ventilation A/C Company would release the OASYS Residential Central Air Conditioning System in the U.S. market. The product can effectively reduce the energy consumption for air conditioning and heating by over 50% while comparing it with other conventional systems. This creates a comfortable and healthy space to maintain air temperature differences and air purification technology.

The Canada market is characterized by the strategic push for building electrification and cold climate heat pump technology. The market is driven by climate change and federal decarbonization policies. The Statistics Canada data released in July 2025 has provided evidence that over two-thirds which is nearly 68% of people use air conditioners in their households, with an increase of 64% from 2021. This rising adoption surges in innovation and drives the demand. On the other hand, the rising adoption of cold climate air source heat pumps is effective for both cooling and heating in most Canadian climates. Further, the OEC data in 2023 depicts that Canada has imported USD 2.38 billion worth of air conditioners, highlighting the rising demand for the market.

Trade Flow of Air Conditioners in 2023

|

Country |

Export (USD billion) |

Import (USD billion) |

|

U.S. |

2.85 |

14.2 |

|

Canada |

1.21 |

2.38 |

Source: OEC 2023

Europe Market Insights

Europe’s air conditioning market is driven by the rising temperatures during summer and the robust EU decarbonization policies. The primary trend is the rapid growth in the heat pump market that provides both cooling and heating. According to the European Heat Pump Association data in 2025, nearly 10.2 million heat pumps were sold. Moreover, Norway is the top country with 632 heat pumps installed for every 1000 households. The convergence of heating and cooling is a significant trend, with reversible air-to-air heat pumps emerging as the preferred method due to their perfect alignment with the bloc's decarbonization objectives under the REPowerEU plan. The market is also seeing a strong shift towards natural refrigerants and smart, connected systems that integrate with building automation for optimized energy use.

Germany’s air conditioning market is defined by a strong emphasis on energy efficiency and regulatory compliance. The commercial and industrial sectors, where advanced ventilation and cooling systems are essential to contemporary building management, are the main drivers of growth. Further, 55% of the heat pumps were sold in the first half, and the sales reached 140,000 units in 2025. Integrating cooling solutions with heat pump technology for year-round temperature management is a notable development supporting Germany's larger electrification and decarbonization objectives. The market is also moving towards natural refrigerants and smart controls that optimize performance, reflecting a deep-seated preference for sustainable, high-quality, and durable engineering solutions over low-cost alternatives.

The air conditioning market in France is highly influenced by the rising need for climate resilience. Devastating heatwaves, national regulations now require cooling systems in facilities housing vulnerable populations, creating consistent public-sector demand. This is complemented by residential growth, fueled by rising temperatures and government renovation grants that incentivize the installation of efficient systems. Reversible air-to-air heat pumps, which offer both heating and cooling, are clearly in line with the country's energy transformation objectives. There is also a clear preference for quiet, discreet, and aesthetically integrated units, particularly in the residential sector, reflecting the importance of architectural preservation and living comfort.

Key Air Conditioning Market Players:

- Daikin Industries (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Electric (Japan)

- Fujitsu General (Japan)

- Panasonic (Japan)

- Midea Group (China)

- Gree Electric (China)

- Haier (China)

- LG Electronics (South Korea)

- Samsung Electronics (South Korea)

- Johnson Controls-Hitachi Air Conditioning (Japan)

- Blue Star (India)

- Voltas (India)

- Carrier Global Corporation (USA)

- Trane Technologies (USA)

- Lennox International (USA)

- Rheem Manufacturing (USA)

- Bosch Thermotechnology (Germany)

- Vaillant Group (Germany)

- Seeley International (Australia)

- O.Y.L. Industries (Malaysia)

- Daikin Industries is the leading player in the air conditioning market, and its leadership via a strategy of technological sustainability and superiority. The company heavily invests in R&D for inverter-driven, variable refrigerant flow (VRF) systems and the transition to R-32 and lower-GWP refrigerants. Daikin's strategic initiatives also include vertical integration, controlling key components like compressors, and aggressive global expansion through acquisitions

- By focusing on unmatched quality, dependability, and cutting-edge innovations, Mitsubishi Electric competes in the premium category of the air conditioning market. To enable predictive maintenance and intelligent energy management, the company is actively integrating the latest technologies, such as IoT and AI, into its products. The company has recorded 328.5 billion yen, with increased profits in all businesses.

- Fujitsu General maintains a strong position in the Air Conditioning market by focusing on innovation in comfort, health, and energy efficiency. The company's major goals include the development of cutting-edge features like its Plasma Quad Technology for better air filtration and its 3D i-See Sensor to optimize airflow and temperature distribution. Further, Fujitsu has invested ¥123.3 billion in R&D to surge in innovation and excellence in all sectors.

- Panasonic is witnessed as a global leader in consumer electronics, and differentiates itself with a strategy centered on intelligent ecosystems. This approach enhances the value proposition by selling the advanced air conditioners as air-purifying and quality-enhancing products and creates a unique value proposition. The company mainly focuses on developing ultra-quiet and compact designs tailored for the high-density urban residential market.

- Midea Group is a global air conditioning market leader and is dominating via massive scale, cost leadership, and aggressive automation. One of its core projects is the large investment in smart manufacturing that reduces production costs without compromising on the quality. Midea supports this by making significant R&D investments for its own compressor technology and intelligent, inverter-driven versions.

Here is a list of key players operating in the global market:

Of the top 20 global air conditioning manufacturers, the market is led by diversified giants from Asia, as they are dominating in volume and technological innovation. American players highly focus on high-efficiency commercial systems. The competitive environment is defined by the intense R&D, mainly in inverter and green refrigerant technologies, as companies strive for energy efficiency and compliance with global environmental regulations. Strategic initiatives include a major push into smart, connected HVAC systems integrated with IoT for energy management and predictive maintenance, as well as aggressive expansion in new markets and strategic acquisitions to diversify product portfolios. for example, Mitsubishi Electric acquired Crystal Air Holdings Limited, which is an Irish air-conditioning installation and maintenance company, in December 2024. This acquisition expands the business and penetrates the data center market.

Corporate Landscape of the Air Conditioning Market:

Recent Developments

- In February 2025, Samsung Electronics introduced the world’s first WindFree air conditioner, which reshapes home cooling with an innovative approach that avoids the discomfort of direct cold air.

- In July 2024, Bosch acquired the residential and light commercial HVAC business from Johnson Controls and Hitachi. This acquisition has strengthened the home comfort in the attractive segment. The purchase price for the acquired businesses is 8 billion dollars

- In February 2024, Panasonic Life Solutions India announced its 2024 line-up of Air Conditioners, including the latest range of Matter-enabled Room Air Conditioners (RACs). Responding to the sharp increase in demand for cooling appliances, Panasonic has introduced 60 new models across its complete range of ACs.

- Report ID: 8237

- Published Date: Nov 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Conditioning Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.