Air Brake System Market Outlook:

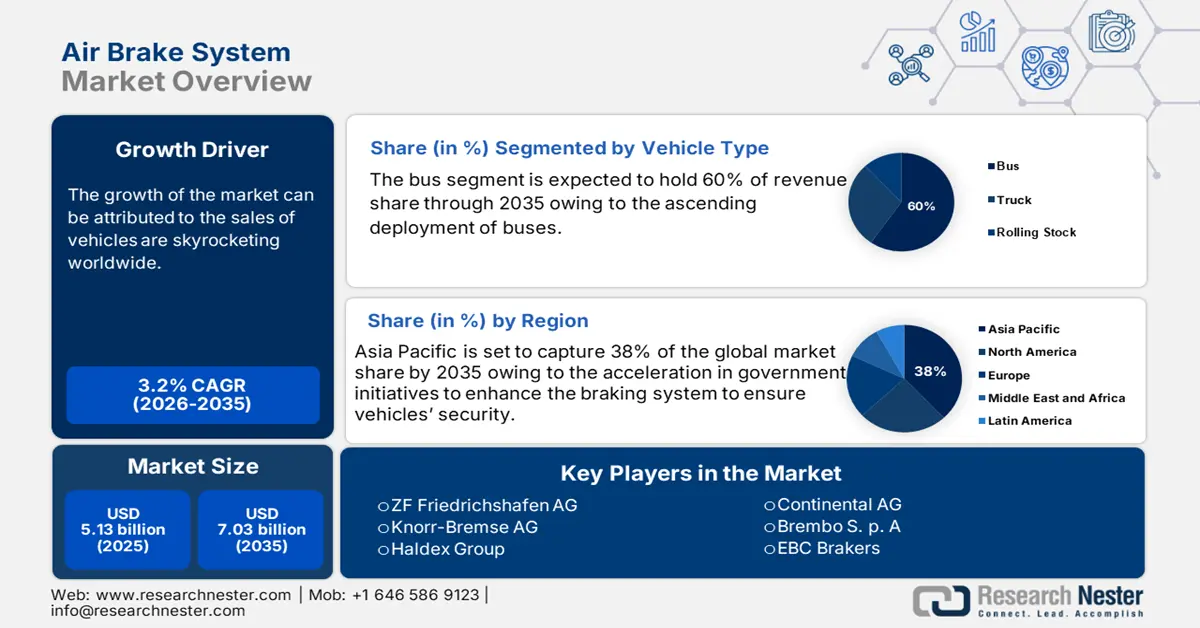

Air Brake System Market size was valued at USD 5.13 billion in 2025 and is likely to cross USD 7.03 billion by 2035, registering more than 3.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air brake system is assessed at USD 5.28 billion.

The growth of the market can be attributed to the rising sales of the vehicles. Air brakes give higher mechanical forces and it is best for greater distances covered by vehicles. In 2022, India surpassed Japan in auto sales, moving up to third position globally. At least 5 million new cars were sold in the country, exceeding Japan's almost 4 million sales. Moreover, around 19,000 luxury automobile units are predicted to be sold in Germany by 2027.

In addition to these, factors that are believed to fuel the market growth of air brake system include the rising instances of road accidents. Fatal road accidents are the main cause of global death for children and young adults aged 5 to 29. In addition to this, according to the statistics of the Ministry of Road Transport and Highways of India, every year, nearly 0.15 million people are killed on Indian roadways, which equates to 1130 accidents and 422 deaths every day, or 47 accidents and 18 deaths per hour. Besides this, the growth of the air brake system market is also attributed to the rising demand for recreational vehicles. Camping vehicle sales in Japan are expected to reach USD 470 million by 2021. Furthermore, around 600,000 recreational vehicles were shipped globally in 2021. It was around a 362% rise over 2009.

Key Air Brake System Market Insights Summary:

Regional Highlights:

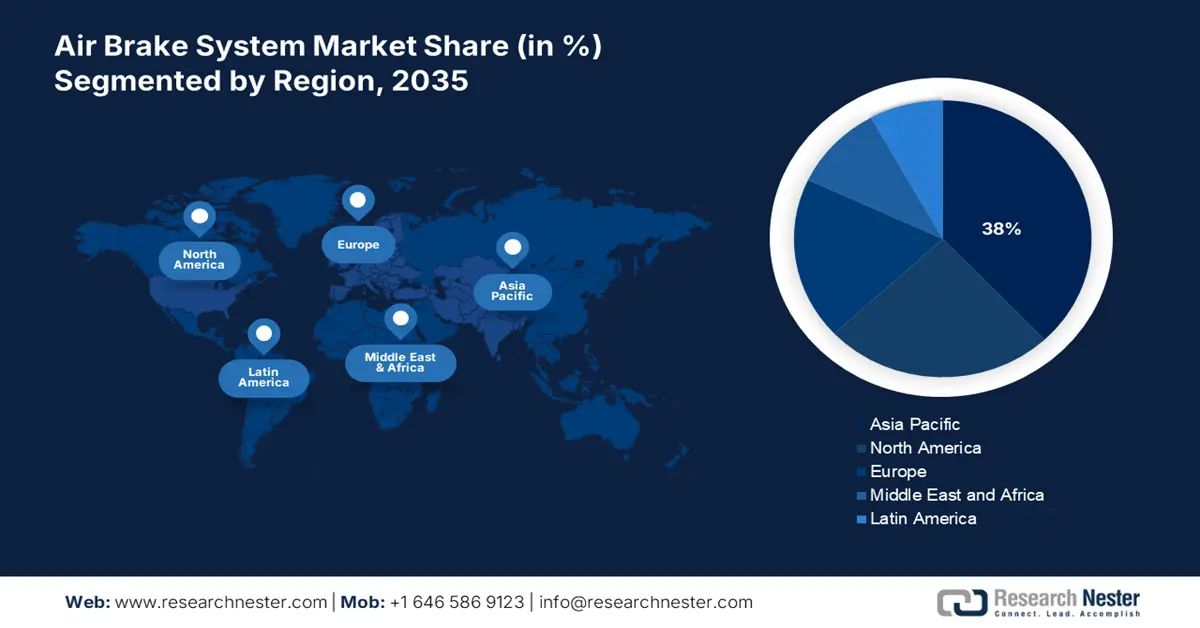

- Asia Pacific air brake system market will dominate more than 38% share by 2035, rising government healthcare spending and expanding medical tourism.

- North America market will account for 25% share by 2035, growing cases of chronic diseases and a strong healthcare infrastructure.

Segment Insights:

- The disc brakes segment in the air brake system market is projected to achieve significant share by 2035, attributed to growing sales of SUVs preferring disc brakes over drum brakes.

- The bus (vehicle type) segment in the air brake system market is expected to secure the largest share by 2035, fueled by increasing deployment of buses, including electric buses under government schemes.

Key Growth Trends:

- Growing Instances of Road Accidents

- Rising Demand for Automobiles

Major Challenges:

- Higher Cost of Air Brake System

- Availability of other options for the braking system

Key Players: ZF Friedrichshafen AG, Knorr-Bremse AG, Haldex Group, Continental AG, Brembo S.p.A., EBC Brakes, Nissin Kogyo Co., Ltd., Robert Bosch GmbH, Accuride Corporation, Aisin Corporation.

Global Air Brake System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.13 billion

- 2026 Market Size: USD 5.28 billion

- Projected Market Size: USD 7.03 billion by 2035

- Growth Forecasts: 3.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Air Brake System Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Instances of Road Accidents –The breaks are intended to avoid collisions between two vehicles, thereby reducing accidents and vehicle damage. Air brakes are designed to prevent trucks, trains, and buses from colliding. According to World Health Organization (WHO) numbers, around 1.35 million people die each year as a result of traffic accidents.

- Rising Demand for Automobiles– Large commercial trucks employ air brake system. Air brake system generate the force that applies the brakes at each wheel by using compressed air stored in tanks. As a result, increasing automotive sales will help the air brake system market thrive. Global car sales were around 67 million vehicles in 2021, and in 2022 the sales reached to nearly 66 million. Furthermore, car sales are predicted to reach around 70 million by the end of 2023.

- Increasing Implementation of Safety Standards– Rising attention to safety standards for vehicles is expected to increase the demand for air brake systems. In order to improve vehicle and road safety, the European Commission introduced the new Vehicle General Safety Regulation in. Automated braking, lane-keeping systems, speed assistance, and reversing detection with cameras and sensors are among the general safety regulations. The rules went into effect in July 2022 and will be in effect until July 2024.

- Growing Demand for Recreational Vehicles –Air brakes are widely employed on heavier vehicles, such as recreational vehicle, since their increased gripping force allows heavier vehicles to stop much more easily. Total RV shipments in the world in 2021 are expected to be around 576,000 units. This figure reflected an almost 34% increase over the previous year's total of 430,000 units.

- Rising Adoption of Luxury Vehicles– The combination of air disc brakes and hydraulic brakes is often employed in high-end vehicles. Luxury vehicle sales soared at over 2,000 units in 2022, worldwide, and are expected to reach close to 200,000 units by 2026.

Challenges

-

Higher Cost of Air Brake System - Air-brake system squeeze air, resulting in moisture which demands air dryers to remove. This raises the price of air-brake system and can lead to greater maintenance and repair expenses, particularly in the first five years. Since, they have so many components, repairing an air brake system might be more expensive than repairing a hydraulic brake system.

- Availability of other options for the braking system

- Air brakes need specialized training to operate it

Air Brake System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.2% |

|

Base Year Market Size (2025) |

USD 5.13 billion |

|

Forecast Year Market Size (2035) |

USD 7.03 billion |

|

Regional Scope |

|

Air Brake System Market Segmentation:

Vehicle Type Segment Analysis

The global air brake system market is segmented and analyzed for demand and supply by vehicle type into bus, truck, and rolling stock. Out of the three types of vehicles using air brake system, the bus segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the increasing deployment of buses. Under Phase II of the FAME India Scheme, the government of India deployed 2435 e-buses across various states and union territories. Moreover, as of September 2022, in the United States, around 1,200 electric school buses were either on order, delivered, or in service. In total, the United States now has around 13,000 committed electric school buses. The compressed air braking system is a sort of friction brake used on large vehicles such as buses. Given that buses are so enormous, they require a lot of effort to stop. With a hydraulic system, the driver must use more force on the brake pedal to bring the bus to a complete stop.

Type Segment Analysis

The global air brake system market is also segmented and analyzed for demand and supply by type into disc, and drum. Amongst these two types of air brakes system, the disc segment is expected to garner a significant share in the year 2035. In comparison with drum brakes, the automobile industry has embraced the new-age disc brakes in the braking system of cars. When opposed to drum brakes, disc brakes have more complex mechanics and more components. Moreover, automotive disc brake have a number of advantages over traditional drum brakes, which is why at least all mid-size sedans, sport utility vehicles (SUVs), and automobiles have disc brakes all around. The growth of the segment is primarily attributed to the growing sales of SUVs. Despite supply chain challenges and rising inflation, global SUV sales climbed by roughly 3% between 2021 and 2022. Moreover, SUV attributed to nearly 46% of global car sales in 2022, with the maximum growth marked in India, Europe, and United States.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Component |

|

|

By Technology |

|

|

By Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Brake System Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to dominate majority revenue share of 38% by 2035, owing to rising government initiatives to boost the braking system and ensure the security of the vehicles in the region.. The growth of the market can be attributed majorly to the rising government initiatives to boost the braking system and ensure the security of the vehicles. Ministry of Road Transport & Highways of India, stated that the large vehicles must now have advanced braking system. Moreover, existing vehicles will be obliged to accept the new provisions beginning in April 2021, with all new vehicles beginning in April 2022. Furthermore, rising sales of cars in the region is also expected to augment the market growth in Asia Pacific. In 2022, China's auto sales increased 9.5%, with electric vehicle purchases nearly doubling. Moreover, in 2021, around 56 million of passenger cars were sold in China.

North American Market Forecast

The North American air brake system market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the growing cases of vehicle crashes and road accidents. According to the National Highway Traffic Safety Administration, 38,824 people will die in motor vehicle accidents in the United States year 2022. On the other hand, the higher deployment of buses is also expected to drive market growth in the region. In the United States, zero-emission bus deployment is expected to increase by around 27% by 2021, reaching nearly 3,500 buses. More than 70% of US fleets have ten or fewer full-size ZEBs. As a result, the upcoming investment will be critical in scaling fleets.

Europe Market Insights

Europe region is likely to register significant growth till 2035. The growth of the market can be attributed majorly to the initiatives taken by the government to reduce road accidents. By improving passenger, pedestrian, and cycling safety across the EU, the European Commission hopes to save at least 140,000 deaths and avoid at least 140,000 serious injuries by 2038. On the other hand, market growth in the region is also expected on the account of rising vehicle crashes followed by a higher number of people dying in road accidents. As per the statistics of the Eurostat, around 18 800 people were killed in road accidents in the EU in 2020, out of which 44.2% were passenger car drivers or passengers, and 19.2% were pedestrians. Moreover, in 2020, 85 people were killed in road accidents in Romania.

Air Brake System Market Players:

- ZF Friedrichshafen AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Knorr-Bremse AG

- Haldex Group

- Continental AG

- Brembo S.p.A.

- EBC Brakes

- Nissin Kogyo Co., Ltd.

- Robert Bosch GmbH

- Accuride Corporation

- Aisin Corporation

Recent Developments

-

Knorr-Bremse AG signed a framework agreement with Alstom to provide braking, sanitary entrance, and climate control systems to 130 Coradia Stream regional trains. It is so far the largest contract of the Knorr-Bremse in Europe.

-

ZF Friedrichshafen AG introduced 100 international LT series trucks equipped with Wabco Maxxus L2.0 air disc brakes of the fifth generation. The MAXXUS L2.0 air disc brakes were chosen because of their durability, ease of maintenance, and high uptime. These disc brakes are manufactured in Charleston, South Carolina.

- Report ID: 4828

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Brake System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.