Recreational Vehicle Market Outlook:

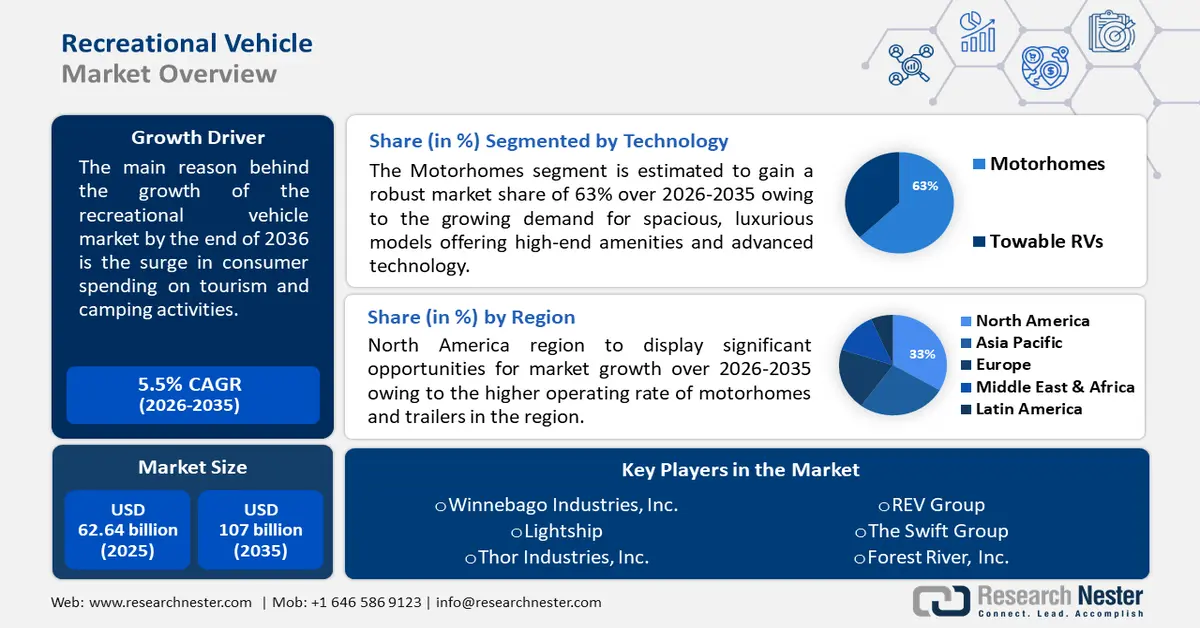

Recreational Vehicle Market size was valued at USD 62.64 billion in 2025 and is likely to cross USD 107 billion by 2035, registering more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recreational vehicle is assessed at USD 65.74 billion.

The market is expanding due to the surge in consumer spending on tourism and camping activities. According to a report by Eurostat, an estimated USD 514 billion was spent on travel by EU citizens in 2022, with foreign travel accounting for 53% of the total. Therefore, the demand for recreational vehicles is growing as more and more people seek out travel experiences that are interactive. These flexible vehicles, in line with the changing preferences of modern passengers, offer a blend of comfort, convenience, and mobility.

Key Recreational Vehicle Market Insights Summary:

Regional Highlights:

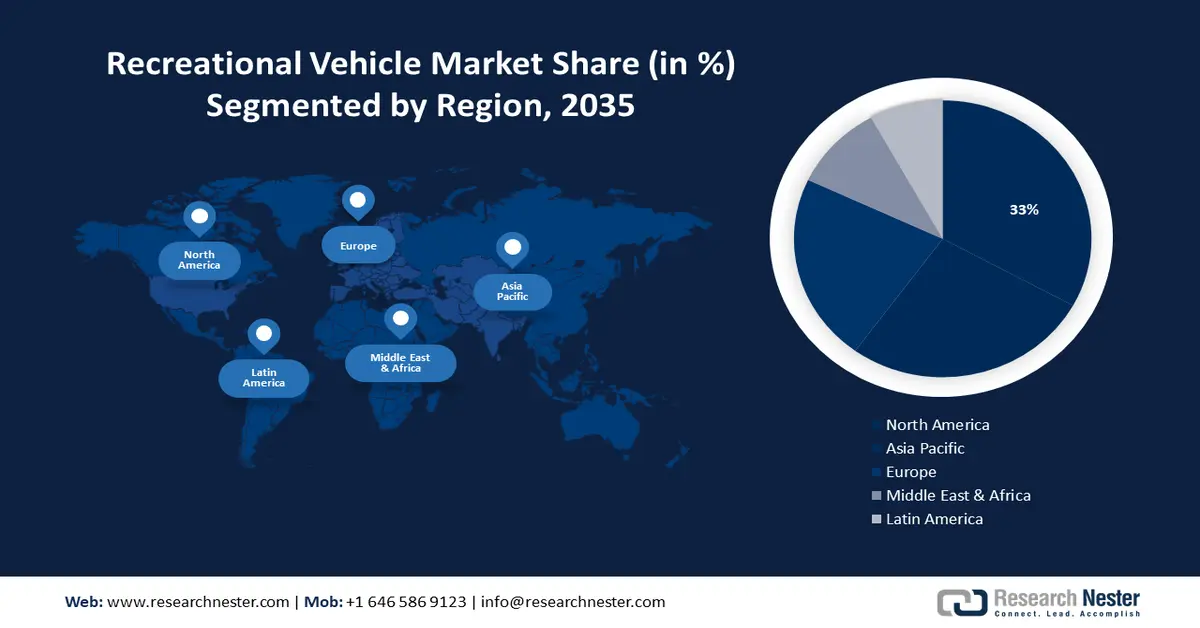

- North America recreational vehicle market will hold more than 33% share by 2035, driven by higher operating rates of motorhomes and trailers and the popularity of outdoor recreation.

- Asia Pacific market will achieve a 27% share by 2035, driven by the growth of the middle class, rising disposable incomes, and demand for convenient travel.

Segment Insights:

- The motorhomes segment in the recreational vehicle market is projected to witness robust growth till 2035, driven by the growing demand for spacious, luxurious models offering high-end amenities and advanced technology.

- The personal segment in the recreational vehicle market is projected to achieve a 58% share by 2035, driven by its numerous outdoor touring applications, such as road trips, camping, and transportation.

Key Growth Trends:

- Growing interest in outdoor recreation

- Increased integration of advanced materials and streamlined designs

Major Challenges:

- Increase in environmental concerns

- High initial costs

Key Players: Winnebago Industries, Inc. Lightship, Thor Industries, Inc., REV Group, The Swift Group, Forest River, Inc., Trigano, CMC Caravan, Dethleffs GmbH & Co. KG, Elddis.

Global Recreational Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.64 billion

- 2026 Market Size: USD 65.74 billion

- Projected Market Size: USD 107 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, Australia

- Emerging Countries: China, Japan, Australia, South Korea, Thailand

Last updated on : 17 September, 2025

Recreational Vehicle Market Growth Drivers and Challenges:

Growth Drivers

-

Growing interest in outdoor recreation - The growing interest in outdoor activities, road trips, and experiential travel has led to an increase in the popularity of RV travel. RVing is becoming increasingly accepted as a lifestyle choice by young and older generations alike. According to a report, around 22% percent of RV owners live in their vehicles full-time in the US.

Moreover, consumers are also looking for flexible recreational vehicles that can accommodate various preferences and lifestyles, such as compact campervans for solo travelers, family-friendly motorhomes with plenty of creature comforts, or off-road capable trailers for adventure seekers. - Surge in the trend for electrification of RVs - Environmentally friendly travel solutions are offered by electric recreational vehicles, which appeal to environmentally conscious consumers. Furthermore, the range and performance of electric recreational vehicles have been improved by battery technology which has attracted a broader customer base.

For instance, in 2023 RVShare, the biggest community for recreational vehicle owners and renters in the world, collaborated with an eRV company called GroundED to introduce EV rental services into Detroit's market. This program which is also supported by the Michigan Office for Future Mobility and Electrification (OFME) will offer travelers in a historically underserved city sustainable travel option. - Increased integration of advanced materials and streamlined designs - The RV market is on the rise, due to the use of lightweight materials and simplified design. Manufacturers can decrease vehicle weight through the use of sophisticated materials such as fiberglass and aluminum, without compromising durability.

This results in improved fuel efficiency, ease of towing, and more maneuverability for the consumer. Furthermore, the streamlined design optimizes aerodynamics, minimizes wind resistance, and increases the total performance. These innovations cater to the evolving preferences of modern travelers, boosting increased demand and market growth.

Challenges

-

Increase in environmental concerns - This industry may be hampered by international agreements to reduce carbon dioxide emissions and environmental regulations on fuel efficiency. An increased fuel tax, which is likely to raise transport costs and adversely impact demand for recreational vehicles, forms part of a number of Environmental Regulation proposals.

In addition, hybrid electric vehicles have the potential to offset increased environmental regulations on fuel efficiency but commercially viable alternatives are still not available in the recreational vehicle market. - High initial costs - The cost of an RV increases with the usage of premium components and creative design for vehicle modification. Furthermore, the desire for RVs is challenged by ancillary costs like insurance, fuel, parking, and upkeep. Early in the forecast period, these few elements may make it more difficult for consumers to adopt the product.

Recreational Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 62.64 billion |

|

Forecast Year Market Size (2035) |

USD 107 billion |

|

Regional Scope |

|

Recreational Vehicle Market Segmentation:

Type Segment Analysis

Motorhomes segment is estimated to dominate around 63% recreational vehicle market share by the end of 2035. The segment growth can be credited to the growing demand for spacious, luxurious models offering high-end amenities and advanced technology. Comfort, sake of simplicity, and environmental friendliness are top priorities for consumers, which pushes manufacturers to develop smart home systems, eco-friendly materials, and economical power sources. For instance, the percentage of families claiming an RV has expanded from 8-9% to more than 11%, with the best increment among long-term olds.

This is due to an increasing desire for luxury, experiential travel options that are suited to today's lifestyle and preferences. Furthermore, the development of electric vehicles in the market will be supported by stringent emission regulations and customer preferences. By 2025, significant auto OEMs are supposed to send off all-electric battery renditions of their current ICE-base campervan models, contending with RV/RV manufacturers for a portion of market incomes. Therefore, altogether these factors are contributing to the expansion of the motorhome segment.

Application Segment Analysis

By the end of 2035, personal segment is predicted to capture around 58% recreational vehicle market share. Due to its numerous outdoor touring applications, such as road trips, camping places, and transportation, the segment is expanding.

In addition, to enhance the comfort and convenience of recreational vehicles manufacturers are constantly developing new technologies. Modern recreation vehicles are equipped with luxuries such as higher fuel efficiency, luxurious interiors, cutting-edge entertainment systems, smart home connectivity, and environmentally friendly solutions. These technological developments, to improve the travel experience and further drive growth of the personal industry, attract buyers looking for a more sophisticated and comfortable journey.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Propulsion Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recreational Vehicle Market Regional Analysis:

North American Market Insights

North America in recreational vehicle market is likely to dominate around 33% revenue share by the end of 2035. The market growth in the region is expected on account of the higher operating rate of motorhomes and trailers.

There are more benefits and adoption rates for different RVs in this region due to the increased popularity of RV, portable power station, and camping sites. According to a report in 2022, about 39.3% of all campers in North America are RVers. Also, the rise is due to the high popularity and continued strong growth in outdoor recreational activities in this region.

The country’s growing inclination for recreational RV travel is demonstrated by the rise in campgrounds. As a result, there are over 230 chain stores in the US, and to keep up with the growing demand, local RV dealers are trading in RVs. These dealers offer the most recent model year used RVs that are favored by most fleet operators in addition to a variety of cutting-edge RVs.

APAC Market Insights

By the end of 2035, Asia Pacific recreational vehicle market is set to hold over 27% share and will hold the second position owing to the growing number of consumers looking for new and exciting ways to explore their surroundings.

The growth of the industry in the region has been driven by several factors such as the growth of the middle class, rising disposable incomes, and the desire to make travel more convenient and convenient. In addition, the Chinese market accounted for the largest share of the Asia Pacific region and the Indian market was experiencing a rapid growth rate.

The pandemic has highlighted the value of spending time outside and fostering a connection with nature. As Chinese citizens look for ways to get away from congested cities, they are finding their way to China's national parks, isolated regions, and natural landscapes. The demand for recreational vehicles (RVs) has increased due to the middle class's emergence, the nation's economic expansion, and the buildup of personal wealth.

The market growth in Korea can be attributed to the growing number of imports of RVs from developed nations. According to the International Trade Administration, Korea imports over 2,000 RVs annually in total. They import about 1,000 from England and Germany. RV imports are predicted to rise significantly as consumer demand for these goods and RV camping increases.

The market growth can be credited to the growing ownership of recreational vehicles in Japan. According to research by the Japan Recreational Vehicle Association, over 110,000 recreational vehicles were owned in Japan in 2018. This indicates that the country's RV ownership rate is rising.

Recreational Vehicle Market Players:

- Winnebago Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lightship

- Thor Industries, Inc.

- REV Group

- The Swift Group

- Forest River, Inc.

- Trigano

- CMC Caravan

- Dethleffs GmbH & Co. KG

- Elddis

The recreational vehicle market is very competitive, with several manufacturers offering goods that directly compete with one another through features. In order to gain a larger market share, businesses are implementing merger and acquisition tactics in addition to joint ventures and partnerships.

Recent Developments

- Winnebago launched Winnebago eRV2, North America's first all-electric, zero-emission recreational vehicle. Winnebago chose Ricardo due to its track record in a variety of product development cycles, launch management and expertise on the integration of electricity vehicles. In a particular one-year period, the team was responsible for monitoring program delivery of projects through from clean sheet design to vehicle launch. Support for project management in the fields of engineering, manufacturing, quality, procurement and supply chain management was also provided.

- Lightship, unveiled the Lightship L1, an aerodynamic battery-powered travel trailer and the first purpose-built self-driving travel trailer that enables near-zero range. A super-efficient design that's three times more aerodynamic than a traditional travel trailer for longer range and better efficiency means the 300-mile electric vehicle (EV) used to tow it remains a 300-mile, 25-mile EV -mpg gas car remains 25 mpg gas car.

- Report ID: 6073

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recreational Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.