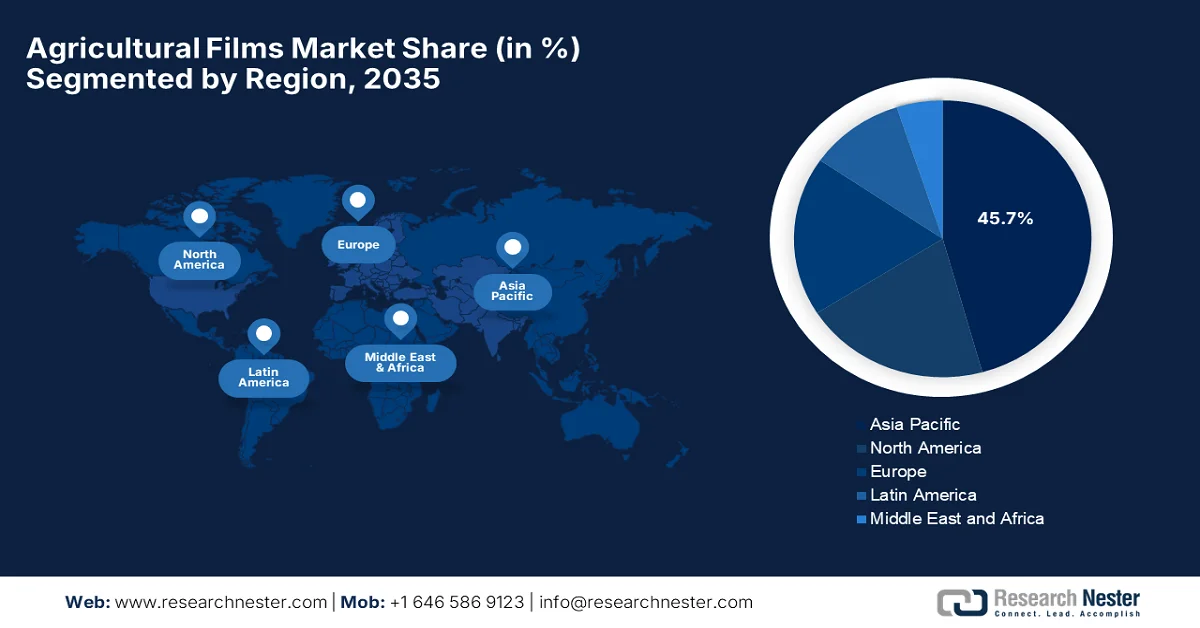

Agricultural Films Market - Regional Analysis

APAC Market Insights

The Asia Pacific agricultural films market is forecasted to be the dominating region, capturing a share of 45.7% during the forecasted period. The rising population, coupled with increasing food demand are the main factor driving this leadership. Governments across the region are promoting these films to accelerate agricultural production in order to meet this demand. In this context, FFTC revealed that the FY2023 White Paper highlights challenges from rising food prices, climate change, and Japan’s aging population, reflecting the urgent need for a sustainable and resilient food system. It also mentioned the policy measures, which include legal revisions, fiscal allocations of ¥2.2683 trillion (USD 16.55 billion) for agriculture, and additional supplementary budgets of ¥818.2 billion (USD 5.97 billion), supporting infrastructure, smart agriculture, and disaster resilience. Furthermore, the future contributions are mainly focused on strengthening food security, the Green Food System Strategy for environmental sustainability, and supporting rural communities.

The increasing adoption of plastic mulch and greenhouse films are responsible factor for the growth of the market in China. The constant government backing in terms of protected cultivation methods is readily accelerating the demand. Based on the government data from SCN in January 2024, Sichuan Province is deliberately promoting the scientific use, recycling, and disposal of plastic mulch films to protect farmland and support ecological revitalization, adopting the completely biodegradable films on more than 11.5 million mu (767,000 ha), with ¥375 million (USD 27.4 million) in government funding. Besides, it also observed that the province has successfully established a three-tiered recycling network of 8,883 outlets, subsidized farmers (over ¥40 per mu) and disposal companies (up to ¥2,800 per ton), and processes waste film into reusable materials. Hence, such instances encourage both domestic and international players in the country to develop environmentally secure films.

Subsidy Rates for Mulch Films in Qianjiang City (RMB & USD)

|

Mulch Film Type |

Covered Crops |

Subsidy Amount |

Subsidy Amount (USD) |

|

Thickened High-Strength |

Fruit trees |

15 RMB |

2.10 USD |

|

Thickened High-Strength |

Watermelon, greenhouse vegetables, open-field crops, medicinal herbs, potatoes |

30 RMB |

4.20 USD |

|

Fully Biodegradable |

Potatoes, greenhouse vegetables |

60 RMB |

8.40 USD |

Source: HBQJ, March 2025

The government’s preference for modern agriculture and favorable schemes are the key factors driving the upliftment of the agricultural films market in India. These initiatives provide financial assistance, encouraging farmers to opt for technically advanced farming procedures. In this context, in August 2024 government of India reported that it is proactively promoting sustainable and organic farming through initiatives such as NMSA, PKVY, and MOVCDNER with a collective aim to enhance soil health, climate resilience, and long-term food security. As of June 2024, MOVCDNER has released ₹1,150.09 crore (USD 140 million) by covering 172,966 hectares and benefiting 189,039 farmers, whereas PKVY has allocated ₹2,078.67 crore (approximately USD 253 million) across 38,043 clusters covering 8.41 lakh hectares. On the other hand, programs such as PM-PRANAM and Large Area Certification have supported natural farming on 4.09 lakh hectares and certified 77,145 hectares in Andaman, Lakshadweep, Ladakh, and Sikkim. Hence, these constant administrative efforts are strengthening farmer income and the resilience of India’s agricultural systems, thereby expanding the use of agricultural films.

India Fruits & Vegetables Production and Exports: Official Statistics (2021-22)

|

Category |

Data |

Notes |

|

Vegetable Production (2021-22) |

204.61 million tonnes |

India is the 2nd largest producer globally |

|

Fruit Production (2021-22) |

107.10 million tonnes |

Up from 97.97 million tonnes in 2018-19 (CAGR 3%) |

|

Area under Vegetable Cultivation |

11.28 million hectares |

Major states: UP, MP, WB, Bihar, Gujarat, Odisha, Maharashtra |

|

Area under Fruit Cultivation |

7.09 million hectares |

Major states: Andhra Pradesh, Maharashtra, MP, UP, TN, Karnataka, Gujarat |

|

Fresh Fruits & Vegetables Exports (2021-22) |

USD 1,527.6 million (₹11,412.5 crore) |

Fruits: USD 750.7 million, Vegetables: USD 767.01 million |

|

Processed Fruits & Vegetables Exports (2021-22) |

USD 1,724.88 million (₹12,858.66 crore) |

Vegetables incl. pulses: USD 610.69 million |

|

HortiNet-Mango |

38,000 farmers, 66,000 farms |

Digital traceability system |

|

HortiNet-Vegetables |

10,000 farmers, 10,000 farms |

Covers 43 vegetables |

|

Kisan Rail Services |

157 trains on 18 routes |

Transport perishable produce; 50% subsidy under Operation Greens |

|

Export Target (2022-23) |

USD 23.56 billion |

Agricultural & processed food sector; 40% achieved in first 4 months |

Source: IBEF

North America Market Insights

The North America agricultural films market is predicted to witness the fastest growth during the discussed timeframe. The growth of the region is highly fueled by the fact that farmers in the region are increasingly adopting innovative agricultural practices, including sustainable and precision farming techniques. Among these practices, the use of modern agricultural films is gaining traction to enhance crop quality and yield. In this context the findings from USDA official data revealed that Washington State University, supported by the USDA Specialty Crop Research Initiative (SCRI), is conducting a project from 2022 to 2026 to improve end-of-life management of polyethylene (PE) mulch in strawberry systems, with a cumulative award of USD 8.01 million. In this context, the project aims to provide sustainable solutions that maintain horticultural benefits, reduce plastic pollution, and offer strategies applicable to other specialty crops, hence making it suitable for standard market growth.

Farmers in the country are utilizing mulch, silage, and greenhouse films to boost crop productivity and improve soil management, fostering a favorable business ecosystem for the U.S. market. In addition, the expansion of horticulture and high-value crop cultivation efficiently supports strong market adoption, encouraging key pioneers to enhance their product offerings. In this context, in July 2024, Revolution Sustainable Solutions announced the acquisition of Norflex, which is one of the major producers of agricultural and industrial film products. This strategic move is expected to add Norflex’s Agriseal silage wrap and robust stretch and shrink film lines, enhancing Revolution’s ability to provide high-performance solutions. Hence, such strategic moves from players will position the U.S. as a predominant leader in eco-friendly film utilization.

Canada agricultural films market has gained enhanced exposure due to the expansion of protected agriculture in Ontario, Quebec, and British Columbia. Also, there has been an increased demand for mulch films and sustainable alternatives with a prime focus on boosting crop production. In this context Canada government report estimates show that the country’s greenhouse vegetable and mushroom operations contribute USD 3.4 billion in farm gate sales and more than USD 2.5 billion in exports in 2024. Besides, during the same year, Canada had 974 greenhouse vegetable operations producing 866,484 metric tons, which is a 5 % increase from 2023, with exports rising 17 % to USD 1.95 billion; mushrooms also saw growth in production and export, reaching 148,569 metric tons and were valued at USD 749.9 million. Hence, these trends reflect significant capital investment in technology and a prime focus on meeting growing domestic and international demand.

Canada’s Greenhouse Vegetable Imports by Commodity (Volume in Metric Tons, 2020-2024)

|

Commodity |

2020 |

2021 |

2022 |

2023 |

2024 |

2024 Share (%) |

|

Tomatoes |

66,996 |

75,306 |

77,847 |

87,047 |

91,812 |

49.6 |

|

Peppers |

49,150 |

52,738 |

61,062 |

73,526 |

72,513 |

39.2 |

|

Cucumbers |

21,105 |

25,412 |

18,360 |

21,893 |

19,229 |

10.4 |

|

Lettuce |

68 |

64 |

142 |

493 |

1,497 |

0.8 |

|

Total |

137,319 |

153,521 |

157,411 |

182,959 |

185,051 |

100.0 |

Source: Government of Canada

Number of Greenhouse Vegetable Operations in Canada by Province (2020-2024)

|

Province |

2020 |

2021 |

2022 |

2023 |

2024 |

2024 % Share |

|

Atlantic provinces |

65 |

74 |

65 |

67 |

72 |

7.4% |

|

Quebec |

230 |

236 |

212 |

250 |

260 |

26.7% |

|

Ontario |

315 |

321 |

387 |

380 |

382 |

39.2% |

|

Prairie provinces |

98 |

103 |

99 |

96 |

96 |

9.9% |

|

British Columbia |

150 |

158 |

167 |

167 |

163 |

16.7% |

|

Canada (Total) |

858 |

892 |

930 |

960 |

974 |

100.0% |

Source: Government of Canada

Europe Market Insights

Europe agricultural films market is anticipated to represent consistent growth during the discussed timeframe, owing to the funding grants, robust regulatory framework that has been constantly promoting sustainability and environmental protection. On the other hand, the heightened demand for biodegradable mulch and silage films, aligned with regional farmers’ shift toward sustainable practices, is also prompting market expansion. The CELLAGRI project, which was funded by the European Innovation Council with a €3.97 million (approximately USD 4.3 million) contribution, is developing cellulose-based mulch films with nature-inspired microfluidic water-management structures for agriculture and horticulture. Furthermore, the project is targeting TRL 5 and the project includes real field tests and scalable roll-to-roll production, aiming to provide cost-effective, bio-based, and widely adoptable sustainable agricultural films.

The advanced farming technologies and strong commitment to sustainability are the key factors driving the agricultural films market in Germany. Farmers in the country are extensively using reusable and recyclable greenhouse and silage films to enhance yields and minimize waste. On the other hand, the tightening plastic regulations spurred demand for biodegradable films, whereas significant investment in research and innovation focused on recycling agricultural films. The widespread adoption of precision farming technologies optimizes film usage and improves crop productivity in Germany. The country also benefits from government incentives and EU-funded projects, whereas the rising consumer demand for environmentally responsible produce has encouraged farmers to integrate eco-friendly films into everyday operations, hence denoting a positive market outlook.

The increasing adoption of protected agriculture and sustainable farming practices is fueling the growth of the UK agricultural films market. Growers in the country are focusing on greenhouse and mulch films to extend growing seasons and reduce labor inputs. In this context, in April 2025, the country’s Government announced a £45.6 million (USD 52 million) investment to support the development and adoption of innovative agricultural technologies, which are mainly aimed at boosting food production, farmer profits, and sustainability. It also mentioned the key measures, which were ADOPT competition, allocating £20.6 million (USD 23.5 million) to help farmers trial new technologies on their farms, bridging the gap between innovation and real-world application. Also, these efforts form part of the government’s plan for change, with a main concentration on strengthening food security, promoting sustainable practices, and supporting the rural economy in the country.